A Rule-of-Thumb Approximation for Time Value of Money Calculations

advertisement

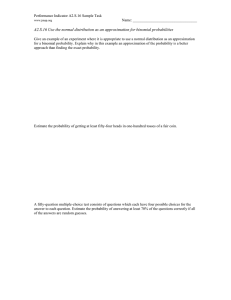

Volume 13, Issue 2 57 A Rule-of-Thumb Approximation for Time Value of Money Calculations David N. Swingler, Ph.D., Professor, Engineering Division, Saint Mary’s University, Halifax, Nova Scotia, Canada A simple rule-of-thumb is presented for the classic financial calculations centered on the present value of a series of equal future payments. It is demonstrated that it is a useful addition to the armamentaria of engineering students engaged in engineering economics and/or finance courses. Journal of Personal Finance 58 Introduction Discussion Engineers have long been associated with approximations, often codified as “rules-of-thumb” which help them deal with otherwise complex mathematical situations. These commonly find application not only at the outset of projects where ballpark estimates are useful, but also during projects as guidance while undertaking a more complete exposition of the situation, and even at the end for final “sanity checking”. The sanity-checking mechanism is also at play while reading third party reports, for instance, just to make sure that what is written makes on-going sense to the reader. The most useful, and gratifying, of these rules-of-thumb are perhaps those that are simple enough to be handled via mental arithmetic Engineering students are encouraged to use the same philosophy: nothing is more humiliating than having a nice piece of work undone by a careless use of a spreadsheet formula or mis-pressing of the buttons on a sophisticated calculator, producing a significant error which makes all the ensuing results completely useless. The proverb “spoiling the ship for a ha’porth of tar” springs to mind here. , . We begin by simply asserting that a useful approximation to b is given by , i≤0.2 . (1A) This is felt to encompass most situations of “everyday” practical , i≤0.2 . use interest but for completeness for ni > 3 we , i≤0.2 , If we compute the ,percentage error between , i≤0.2 (1B) and , i≤0.2 IfEquation we compute percentage errorand between A justification for (1A) isthe given in the appendix it might be remarked that the derivation therein requires only the mathematical skills of a first- or second-year engineering student. In passing, remark thattoin this financial $ b̂ is the Thewesolution is language, given by solving (approximate) value of any one of a stream of n equal and equi, i≤0.2 approximation of (1A) it becomes simply: spaced future payments with a present value of P = $1. an One field where rules-of-thumb play little role is that of finance The solution to this is given by solving (with the exception of the ubiquitous rule-of-72). This is almost If we compute the percentage error between b̂ and If we compute the percentage error between and viab via simply: approximation of (1A) it becomes certainly due to the notion that monetary amounts must be accu=618 . rate to the penny, which is true at the time contracts are signed but may not be true at every point in the process, as outlined above. Additionally, university courses in finance and economics =618 . are relatively new additions to the field of engineering education. And finally bankers are just not engineers and do not think like forval-i, with n The solutionthentothethis is givenresults by ofsolving representative Figure 1 ensue for various them. ues of i from 1 to 20% and n from 1 to 121 periods. We see from approximation of (1A) it becomes simply: = The purpose of this brief note is to suggest that there is a useful Figure 1 that the peak errors are not much more than very roughly “rule-of-thumb” for the classic and most common time value of ± 6% which is deemed entirely adequate for our rule-of-thumb money problem which involves dealing with the present value, P, usage, especially as the underlying = for b seems quite =618expression . of series of n equi-spaced future payments, each of value, A, with subtle over this wide range of n and i. Further we might observe an interest rate of i, via the formula that the peak negative errors of about -6% occur in the vicinity of ni=3 which makes their occurrence easily predictable (and largely A = positive = 250,000 correctable if so desired). The peak errors of about +5% /100 = occur in the vicinity of ni=1 (roughly), again useful knowledge. where the factor b is given by Zero error occurs near ni=2 (roughly). Finally we note that at = 250,000 /100 A= ni=3 where the approxima= .two parts of the piecewise continuous = 24000/ (2.4/21) =$2 . tion abut, there no discontinuity. This is aexpression felicitous effect. Weis start with the correct for given by The first payment is at the end of the first period. As an aside, we note that Hawawini and Vora [1, p. (v)] have indicated that the , i≤0.2 and problem of calculating i from known A, P and n is non-trivial , i≤0.2 has a very long history. , , i≤0.2 , We start with the correct expression for A= = 250,000 and let /100 = 250,000 so that the above becomes and let so that the above becomes , i≤0.2We start with the correct expression for given by If we compute the percentage error between compute the percentage error between and via and via ©2014, IARFC. All rights of reproduction in any form reserved. and let so that the above becomes given b /100 Volume 13, Issue 2 59 . , i≤0.2 , , i≤0.2 If we compute the percentage error between . and via Figure 1. Errors in the approximation of Equation (1). Examples , i≤0.2 The solution to this is given by solving approximation of (1A) it becomes simply: for i, with n=9. With our We take our second example from a worked example in the We now present simple examples of the utility of the rule-ofcourse text Contemporary Engineering Economics by Park et al thumb of Equation (1A). It might be of interest to note that these , , i≤0.2 =618 . [2, p.78]. Paraphrasing it states: A lottery winner is expecting 21 were literally the first examples that came to the hand of the annual payments of $24,000 (after tax) which he wants to use author as he thought about this topic. We start with one ofIfthe we compute the percentage error between and via against a bank loan at 10% interest. How much can he borrow earliest examples of interest calculations, taken from [1, p. 1] from the bank? Here we have A =$24k, n=21, i=0.1 and we use A 16th century Italian university was loaned 2814 ducats and = = 24000/ (2.4/21) =$210,000 repaid it in nine annual installments of 618 ducats beginning at the end of the first year. What was the effective interest rate? The solution to this is given by solving for i, with n=9. With our (Recall that interest rate calculations, accurate ones anyway, are which is also (just about) manageable by mental arithmetic alone. approximation of (1A) it becomes simply: regarded as mathematically non-trivial.) The correct answer is $207,569 but the book’s authors offer the interesting caveat that the whether the bank would loan that =618 . /100 = 250,000 The solution to this is given by solving 2814b = 618 for i, with amount A = depends = 250,000 /100 on the applicant’s creditworthiness, suggestn=9. With our approximation of (1A) it becomes simply: ing that our $210k figure would nicely suffice for this ballpark estimate. 1 2 2814 + i =618 . We start with the correct expression for given by Our last problem is taken from another worked example in the 9 3 same text=[2, p.76]. Here a company has borrowed $250,000 for = 24000/ (2.4/21) =$210,000 equipment. The loan carries an interest rate of 8% and is to be It is convenient to mentally rearrange this as (1 + 6i) = 9 * 618 / 2814 repaid in annual installments over the next six years. What is the and if we observe that the right-hand side is almost exactly two amount annual installment? Here we have then an approximate answer immediately falls out as i =16⅔%by and let so that of thethe above becomes mental arithmetic only. (Given that the numbers involved strongly suggest that the amount repaid was exactly twice that A= = 250,000 /100 = 250,000 /100 loaned, one wonders whether there is an ancient typographical error in the data as given here). With the data as actually given, or A = 22% of $250,000 = $55,000, again via mental arithmetic our approximation yields i =16.3% which is the correct answer We start with the correct expression for given by only. Note the efficacy of turning b̂ into a percentage figure. to three significant digits. The fact that the rule-of-thumb is this The correct answer is $54,079 but requires access to (and correct accurate lies in the fortuitous positioning of this problem on the application of) significant computational resources. left in Figure 1 in the vicinity of n=9, i=16% where the approximation error is small. and let so that the above becomes Journal of Personal Finance 60 Students will of course complain that Equation (1A) is just another formula to memorize. To this end is useful to refer to it via the mnemonic “the one ’n two-thirds formula” and to indicate that, as it deals with loan repayments, it is natural for the quantity to reduce with n, hence n appears as a denominator, but increase with i so i appears as a numerator term. It should also be stressed this is not a replacement for the “correct” results, but simply an auxiliary tool. A= = 250,000 /100 = 250,0 Appendix I : Derivation of the approximation We start with the correct expression for given by We start with the correct expression for b given by and let so that the above becomes and let ni = p so that the above becomes Escalating payment streams It should be observed that approximation of equation (1A) can be readily extended to a stream of escalating payments. Rather than digress here, this material is adumbrated in Appendix II. We begin the by lettingn be nbylarge. beletting large. a cla We approximation begin the approximation nFollowing be alarge. Follo We begin the approximation by letting Following We begin the approximation by letting n be large. Fo L’hopital’s rule for the bracketed term in the denominator, we arrive a We begin the approximation by letting n be large. Following a classic application of L’hopital’s rule for the bracketed term in the denominator, classic application of L’hopital’s rule for the bracketed term in the L’hopital’s rule for the bracketed term in the denominato We begin the approximation by letting n be large. Following a classic application of L’hopital’s rule for the bracketed term in the denominator, arrive at the approximation denominator, we arrive at thewe approximation Conclusion L’hopital’s rule for the bracketed term in the denominator, we arrive at the approximation . . We have presented a useful rule-of-thumb for time value of . money problems, of benefit to students in engineering econom. ics and finance classes and perhaps even to their professor, idly . musing, while exam invigilating, what the payments might be It transpires,It not altogether that is reasonably linea transpires, notintuitively, altogether intuitively, that is reaso on the $300,000 mortgage she’d need to take out on that new It transpires, not altogether intuitively, that isthat reasonIt transpires, not altogether intuitively, is rea is reasonably linear for and transpires, not altogether intuitively, that house she is interested in, It with, say, an amortization of 25 years ably for and it is this unitymight whereuse p=0. this use is reasonably linear for andFor It transpires, not altogether that answer: (100/25 and an interest rate of 6%. intuitively, [Her approximate + unity Swingler paper it is where p=0. For this reason we ≈reaan itlinear is unity where p=0. reason we For might 2/3 * 6)% of $300,000 = 8% of $300,000 = $24,000pa or about itmight is unity where p=0. For this reason we might use ≈ and with a little it is unity where p=0. For this reasonsonwewemight use use and with a little numerical $2000pm]. regression it is unity where p=0. For this reason we might use ≈ numerical and with a little analysis on the interval 0 p 3 , m is regression analysis on the interval 0 ≤ p ≤ 3, m is found to be immediately leads to the final result about 0.67. This immediately leads to the final result ≈ or = = ≈ = or or or for ni ≤ 3. or or for ni ≤ 3. . ≈ ≈= == p / n 1 ≈2 1 2 = =b ≈ 1 p = i = b̂ 1 e p n 3 n 3 = = for ni ≤ 3. for ni ≤ 3. 1 2 3. ni ≤ 3. bˆ i for ni ≤ for n 3 Notwithstanding the constraints in this analysis, the main body of Notwithstanding thethat constraints in this analysis, the main body of this note demonstrates the approximation works well down approximation works downfortothe as special low ascase n=1offor i<0.2 (altho to as low as n=1 for i<0.2well (although n=1, . where where just1+i, 1+i,ofof course). completeness, ni>3,wei<0.2, we bb isisjust course). For For completeness, ni>3,. i<0.2, . simply. use bˆˆ=i i. b . Appendix II: Escalating Payment Streams Escalating payment streams can be readily handled by simple m In particular, if the payment amounts increase by e% each period we have and where the nth is where n(i-e)≤2, i≤0.25, e≤i i≤0.25, Again, then gives (approximately) the n(i-e)≤2, e≤i Again gives (approxi where i≤0.25, e≤i Again gives where n(i-e)≤2, i≤0.25, e≤i asymptotically Again givesn(i-e)≤2, (approximately) the first payment. It is (appro correct as (i-e)→0 has utility, for utility, example, asymptotically correct asand (i-e)→0 and has forinex 1 2 where n(i-e)≤2, i≤0.25, e≤iasymptotically Again gives (approximately) the first payment. It is asymptotically correct asin(i-e)→0 and the has utility, for paymentand ofpayment ahas stream escalating retirement from a princi correct as (i-e)→0 utility, example, first ofofafor stream escalating retirement payouts fro bˆ of i estimating e . payouts n 3 payment of a stream of escalating retirement payouts asymptotically correct as (i-e)→0 and has utility, for example, in estimating the first portfolio yield is i and the inflation rate is e. It has a sweet spot nf payment of a stream of escalating retirement principal of Prate where portfoliopayouts yield isfrom i anda the inflation is e. the It has a sw portfolio yield is i and the inflation rate is e. It has a payment of a stream of escalating payouts from amakes principal ofIt Pfor where theforspot itisideal retirement income streams. Forstreams. instanc portfolio retirement yield is i and the which inflation rate e.makes has aideal sweet n≈30, (i-e)≤0.6 which itsuch suchnear retirement income ˆmakes gives (approximately) the first payment which is Here which it ideal for such retirement income stream A Pn≈30, bform portfolio yield is i and thewhich inflation rateitisideal e. Itfor hasrights aprincipal sweet spot near (i-e)≤0.6 ofprincipal $500,000 and his portfolio has a yield of i=7% and ©2014, IARFC. All ofretirement reproduction inany reserved. makes such income streams. For instance if retiree has a of $500,000 and his portfolio has a yield of s principal of $500,000 and his portfolio has a yield which makes it ideal for such retirement income streams. instance ifaerror awith retiree aover period. The distribution is of now but there peak with e=3% over ahas period years then theareapprox principal of $500,000 and inflation his For portfolio has yield of i=7% hecomplex, wants match inflation e=3% a n=30 period of to n=30 years theno . Volume 13, Issue 2 61 It transpires, not altogether≈intuitively, that = = is reasonably linear for Escalating Payment Streams it is unityAppendix where p=0.II:For this reason we might use or Escalating payment streams can forbenireadily ≤ 3. handled by simple modification(s) to equation (1A). In particular, if the payment amounts increase by e% each period such that the first payment is A and the nth is A*(1 + e) ^ (n – 1), then we have ≈ = = . or for ni ≤ 3. Here A = P bˆ gives (approximately) the first payment which is subsequently indexed by e% per period. The error distribution is now complex, but there are peak errors of about ±10% for ni≤3, i≤0.1, e≤i so again it covers a wide range of “everyday” situations. The errors generally are worst as (i-e)→0. ≈ and and with a Acknowledgement little The author would like to acknowledge the helpful comments of Prof. Moshe Milevsky, York University, Toronto on an early draft of this document. References [1] G. A. Hawawini and A. Vora, The History of Interest Approximations, Arno Press, USA, 1980, ISBN 0-405-13480-0 [2] C. S. Park, R. Pelot, K. C. Porteous, M. J. Zuo, Contemporary Engineering Economics, Addison Wesley Longman, Toronto, 2001, ISBN 0-201-61390-5 . To avoid this problem perhaps a more useful approximation is for gives (approximately) the first payment. It is where n(i-e)≤2, i≤0.25, e≤i Again an escalating immediate payment stream similar to the above but asymptotically (i-e)→0 and of hastheutility, for Inexample, in estimating the first where the firstcorrect paymentas is at the beginning first period. this case have peak of aboutretirement ±10% for thispayouts formula: from a principal of P where the payment of we a stream oferrors escalating portfolio yield is i and the inflation rate is e. It has a sweet spot near n≈30, (i-e)≤0.6 which makes it ideal for such retirement income streams. For instance if a retiree has a principal of $500,000 and his portfolio has a yield of i=7% and he wants to match inflation with e=3% over a period of n=30 years then the approximate first annual payment isn(i-e)≤2, abouti≤0.25, $26,700. The true isgives about $27,400k. The difference is a wholly where n(i-e)≤2, e≤iAgain Again (approximately) the first payment. It is where i≤0.25, e≤i (approxiA =value P bˆ gives acceptable mately)-2.6%. the first payment. is asymptotically correct as (i-e)→0 asymptotically correct as It(i-e)→0 and has utility, for example, in estimating the first and has utility, for example, in estimating the first payment of from a principal of P where the payment of a stream of escalating retirement payouts a stream of escalating retirement payouts from a principal of P portfolio yield is i and the inflation rate is e. It has a sweet spot near n≈30, (i-e)≤0.6 where the portfolio yield is i and the inflation rate is e. It has a which makes it ideal such which retirement For instance if a retiree has a sweet spot near n≈30,for (i-e)≤0.6 makes itincome ideal forstreams. such principal of $500,000 and his portfolio has a yield of i=7% and he wants to match retirement income streams. For instance if a retiree has a prininflation e=3% a period n=30 years then the approximate first annual cipal ofwith $500,000 and over his portfolio has a of yield of i=7% and he wants is to match withThe e=3% overvalue a period of n=30$27,400k. years payment aboutinflation $26,700. true is about The difference is a wholly then the approximate first annual payment is about $26,700. The acceptable -2.6%. true value is about $27,400k. The difference is a wholly acceptable -2.6%.