Securitisation in Ireland Clive Jackson

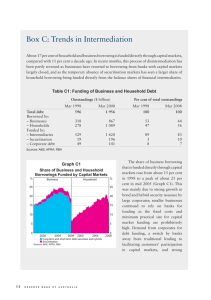

advertisement

Securitisation in Ireland Clive Jackson OECD Working Party on Financial Statistics, 2 November 2009 Securitisation in Ireland: Two themes •Growth in ‘originate and distribute’ model ... Irish banks’ securitisation activities •... replaced by ‘internal’ securitisations phenomenon •Monthly data collected since 1996 •Important for understanding credit developments Wider population of securitisation vehicles: “Financial Vehicle Corporations” •Common location for vehicles of euro-area banks •Also varied activities by other types of vehicles •Limited data collected on this sector •But statistical requirements from Q4 2009 First theme: Securitisation carried out by Irish resident banks Securitisation by Irish banks • • First securitisation: IR£200 million in 1996 Outstanding amount of securitised mortgages now c. €38 billion € billion 160 Securitised mortgages 140 120 100 80 60 40 20 0 Mortgages, excluding securitised volumes Statistical treatment of securitisation • Most commonly in Ireland, loans are purchased by a bankruptcy-remote vehicle created for this purpose (so-called SPV / SPE / FVC) – – Loans are moved off balance sheets, giving a sharp fall in credit reported Securitised residential mortgages must be added back in to correct for this when analysing volumes and growth rates: 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% -15% Annual change in residential mortgage lending, adjusted for securitisations Annual change in residential mortgage lending, unadjusted for securitisations Recent developments • • Securitisation activity accelerated despite freezing of market post-crisis “Internal securitisations” used to create eligible assets for refinancing operations • • Notes purchased by securitisation vehicles purchased by bank to use as collateral Mortgages on balance sheets are replaced by debt securities holdings Post-crisis growth: internal securisations € billion 45 30% Securitised mortgages (LHS scale) 40 Securitised mortgages as percentage of total mortgages (RHS scale) 25% 35 30 25 First period of growth Second period of growth: originate and distribute 20% 15% 20 15 10% 10 5% 5 0 0% Issuance of Asset Covered Securities • It is possible for a bank to set up a “covered bond” bank – – Enabled by 2001 legislation, first carried out in 2004 Loans may be transferred to a designated “mortgage bank” under the 2001 legislation, which may then issue “Asset Covered Securities” Issuance fell sharply in 2007, but rose in 2008 – • Statistical treatment – – The mortgage bank is a credit institution covered by statistical reporting requirements Loans on its balance sheet are captured – no adjustments are necessary € billion Issuance of mortgage-backed covered bonds in Ireland 25 Outstanding 20 New issuance 15 10 5 0 2004 2005 Source: European Covered Bond Council. 2008 data are provisional. 2006 2007 2008 Second theme: Other securitisation vehicles resident in Ireland Wider population of securitisation vehicles • New ECB statistical regulation for Financial Vehicle Corporations passed Governing Council in December 2008 in order to: – – – – • Ireland is one of the primary locations for FVCs in the euro-area – – – • contribute to analysis of monetary aggregates harmonise treatment of securitised lending across the euro-area provide information on alternatives to bank finance examine wider issue of credit risk transfer Structures enabled by Section 110 of the Taxes Consolidation Act 1997, as amended by Section 48 of the Finance Act 2003 2003 legislation allows “Section 110s” to register with the Revenue Commissioners They may then utilise certain treatments to ensure tax neutrality (e.g. with respect to paying interest or income to CDO investors) New Regulation requires a national register of resident FVCs – – – First time such an exercise has been done – 900 vehicles currently FVC definition is wider than what is traditionally thought of as securitisation (i.e. vanilla securitisations of banks’ mortgage books covered in banking statistics) Some issues around the margins in determining whether some vehicles are inside or outside the FVC definition FVC Regulation ECB/2008/30 • First collection of data from all resident FVCs with respect to Q4 2009 – – • Derogation on some securitised loans data on FVC balance sheets – – • Central Bank deadline T+19 days Transmission to ECB T+28 days where loans are originated & serviced by an MFI in the euro-area, customer/geographic/ maturity of loans will be supplied directly to the respective National Central Bank This data will be exchanged between Central Banks through the ECB Derogation for smaller vehicles < €180 million – – – Only quarterly total assets/liabilities collected for small FVCs The derogation may be applied so long as total assets of all derogated FVCs does not exceed 5% of population assets Subject to annual review What will be collected? Assets Liabilities • Deposits & loan claims • Loans & deposits received • Securitised loans • Debt securities issued • Other securitised assets (e.g. trade or tax receivables) • Capital & reserves • Debt securities held (ISINby-ISIN data) • Remaining liabilities • Shares & other equity • Financial derivatives • Fixed assets • Remaining assets • Financial derivatives Flows • Financial transactions in assets and liabilities categories • Write-downs & write-offs of securitised loans Summary of key breakdowns Geographic • Domestic, Other Monetary Union Member State and Rest of World for securitised loans from euro-area banks and debt securities held • Unallocated for most other asset and liability categories • No geographic data on holders of issued securities Sector • MFI/Non-MFI on deposits & loan claims and debt securities held. • Securitised loans from euroarea banks broken down by customer: government; OFI; insurance & pension fund; household; nonfinancial corporations. • To net out multi-FVC securitisation transactions, ‘of which FVC’ positions are requested for some items. • Unallocated for most asset and liability categories Maturity • Of securitised loans from banks to NFCs • Of debt securities held • Of debt securities issued What type of vehicles are in Ireland? • 900 vehicles are currently on register of FVCs, total assets c. €500bn – • • Compare to €38 billion securitised by Irish banks Residential and Commercial MBS make up one third of vehicles CDOs (including CLOs, CBOs) make up 40% Nature of securitisation (by number) Other / Not yet specified 33% Types of securitisation vehicles (by number) True-sale 47% Synthetic 20% Source: Central Bank's list of Irish resident FVCs. [Note: Data on this slide are preliminary estimates in advance of the first full collection of data in December.] Thank Thank you you