| Statistical Press Release Lisboa, 21

advertisement

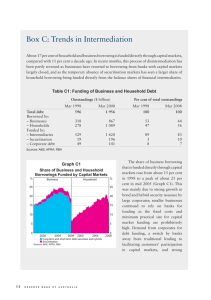

Statistical Press Release | Lisboa, 21st March 2012 | Statistics for Securitisation Funds and Companies Introductory note From now on, the statistics for Securitisation Funds and Companies published by Banco de Portugal in chapter B.8 of the Statistical Bulletin and in BPstat | Statistics Online will present further information on the breakdown by sector of securitised asset originators and debtors. The position and transaction series now published start in December 2001, the date on which the first securitisation transaction took place through a financial vehicle resident in Portugal, and were recalculated from that date in accordance with ECB regulations in this area. In Portugal, securitisations may be carried out using two kinds of vehicle: Securitisation Funds (SFs) and Securitisation Companies (SCs), both supervised by the Portuguese Securities Market Commission (CMVM). The SFs are closed entities that issue securitisation units, accounted for under the 'Capital and reserves' item, with a oneto-one correspondence between each securitisation and the respective SF, while the SCs may carry out several securitisations concurrently and issue securitised bonds under the 'Debt securities' liability item. Statistical analysis 1. Securitisations The first securitisation made through a vehicle resident in Portugal, involving mortgage credit for the sum of around EUR 1 billion, took place in December 2001 by means of an SF. In December 2011, 39 SFs were operating, with securitised assets of around EUR 26 billion. The first SC launched its activity in 2003, with four SCs operating at the end of 2011, together accounting for EUR 35 billion of securitised assets. Over this period, as shown by Chart 1, securitisations carried out through SCs were preferred over SFs. Initially, SFs offered certain tax advantages as securitisation vehicles, but when this came to an end, and given the behaviour of the international financial markets, the trend swung towards issuing bonds securitised on the national market, through the use of SCs. 1 | Statistical Press Release | Lisboa, 21st March 2012 | Chart 1 - Securitisations carried out through SFs and SCs Total amounts and change in positions at the end of the period 40,000 EUR millions 30,000 20,000 10,000 0 2001 2002 2003 2004 2005 2006 2007 2009 2008 2010 2011 -10,000 Assets securitised by SFs Assets securitised by SCs Change in Capital and Reserves Change in Securitised Bonds 2. SC and SF balance sheets The majority of assets, as may be seen in Chart 2, corresponds to the 'Securitised assets' item, which for the most part are made up of loans granted (94% in December 2011), but that also include other kinds of securitised assets, such as future revenues, tariff deficits and commercial paper. On the liabilities side, the weight of bonds has increased recently, for the reason given above, reaching 59% of total liabilities in December 2011. Chart 2 - Structure of SC and SF balance sheet Weight of Assets / Liabilities and Equity by instrument Percentages Liabilities and equity Assets EUR millions 80,000 8% 60,000 7% 40,000 6% 20,000 5% 0 4% -20,000 3% -40,000 2% -60,000 1% -80,000 0% 2001 2002 2003 2004 Deposits and other similar investments Securitised assets Debt securities Other assets 2005 2006 2007 2008 2009 2010 2011 Bonds Capital and reserves Other liabilities Weight in the financial sector (right-hand scale) It also shows the increasing weight of securitisation in the financial sector as a whole, reaching 8% at the end of 2011. Notably, the total combined assets of operations carried out by SFs and SCs more than doubled over the period from end of 2005 (around €25 billion) to December 2011 (around €62 billion). 2 | Statistical Press Release | Lisboa, 21st March 2012 | 3. Securitised assets In terms of securitised assets and originating sectors, as shown in Chart 3.1, monetary financial institutions (MFIs) have accounted for the largest share. Indeed, in December 2011, this sector represented around 96%, followed by non-financial corporations (NFCs) with 3% and non-monetary financial institutions (NMFIs) with 1%. Chart 3.2 also shows how securitised loans granted by MFIs are broken down by original debtor. In terms of debtors, the private individuals sector is the largest, continuing the trend since the start of securitisation operations. At the end of 2011, 72% of securitised loans granted by MFIs were originally credits granted to private individuals, of which 92% was mortgage credit. Currently, 30% of all mortgage loans granted by financial institutions to private individuals are securitised. Chart 3 – Securitised assets 3.1 Institutional sector of the resident originator 3.2 Assets securitised by MFI - Weight of original debtor's sector – Dec 2011 – 60,000 Other debtors; 1% EUR millions 50,000 Non-financial corporations; 26% 40,000 30,000 Nonresidents; 1% 20,000 10,000 0 2001 2002 NMFI 2003 2004 2005 GG 2006 2007 2008 NFC 2009 2010 2011 Private individuals; 72% MFI By the end of 2004, around 96% of securitised credit granted by MFIs was derecognised, meaning that in accounting terms the securitised credit was removed from the balance sheets of originating MFIs. However, from 2005, when the new International Accounting Standards were defined, this situation was reversed, and in December 2011, around 81% of securitised MFI loans were not removed from the balance sheet, and were considered non-derecognised operations. 3