– The March Solvency II Towards Economic Capital Models

advertisement

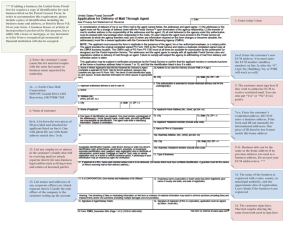

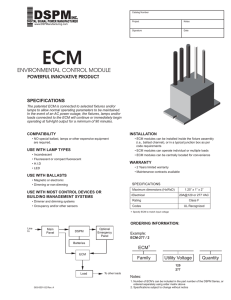

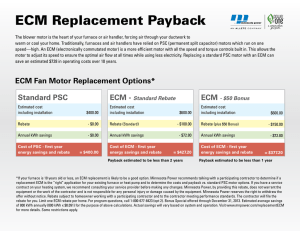

CAS Spring Meeting – June 19, 2007 Solvency II – The March Towards Economic Capital Models David Lightfoot Guy Carpenter - Instrat Discussion What is an Internal or Economic Capital Model (ECM)? Why are EU Regulators and Companies Supporting Use of ECMs? ECM Results as Full or Partial Replacement of the SCR Standard Formula – How to Use – Regulatory Approval 2 Economic Capital Modeling Definition of Economic Capital Estimate of capital needed to support the enterprise given the possibility of decreasing assets, increasing liabilities or unexpected net losses resulting from the risks undertaken or inherent in the business Capital Assets Capital Net Losses Assets Liabilities Liabilities 3 Review of ECM Components Capital Need for Non-Life Insurance Company Quantitative Methods • Factor / Scenario Based Insurance Hazard Underwriting Accumulation / Cat Financial (Asset) Credit Market Operational & Strategic People / Processes / Systems External Events • Simulation Based Quantitative Challenges • Data Availability / Resolution • Correlation • Treatment of Uncertainty • Non-modeled Perils Reserving Liquidity Business Strategy • Operational Risk 4 Why Growing Support for this Development? Regulators – Principal regulatory objectives Better risk management Encouragement of innovation in risk management methodology Improved risk sensitivity in capital requirements – Other stated benefits Higher competitiveness through lower cost of capital Better modeling of non-standard contracts Better, more informed and more consistent discussion with regulators and rating agencies Companies – Integral to ERM virtuous circle of risk identification, measurement, and management – Organizational, reputation and operational benefits 5 ECM Results as Full or Partial Replacement of the SCR Standard Formula How to Use Full Internal Model (long term goal) – Model and simulate all important aspects of the business – Take correlation between risks into account – Calculate Net Operating Income for each simulation – SCR = 1 in 200 year negative result Partial Internal Model (valuable starting point) – Model and measure risk using Partial Internal Models – Clearly identify which componets of the SCR standard formula are affected by the use of the ECM – Aggregate capital requirements to total capital requirement Correlation needs to be considered 6 ECM Results as Full or Partial Replacement of the SCR Standard Formula Regulatory Approval Test 2: Use Test 1: Statistical Quality Internal Risk Management Actuarial Model Regulatory Capital Requirement Test 3: Calibration 7 Key Message The movement is well under way in Europe for better, transparent risk management supported by a clearer measurement of risk and ultimately how risk relates to capital 8