Linear Programming

advertisement

Linear Programming

Topics

• General optimization model

• LP model and assumptions

• Manufacturing example

• Characteristics of solutions

• Sensitivity analysis

• Excel add-ins

Deterministic OR Models

Most of the deterministic OR models can be formulated as

mathematical programs.

"Program" in this context, has to do with a “plan” and not a

computer program.

Mathematical Program

Maximize / Minimize z = f (x1,x2,…,xn)

Subject to

gi(x1,x2,…,xn)

{}

=

xj ≥ 0, j = 1,…,n

bi , i =1,…,m

Model Components

• xj are called decision variables. These are things

that you control

• gi(x1,x2,…,xn)

{}

=

bi are called structural

(or functional or technological) constraints

• xj ≥ 0 are nonnegativity constraints

• f (x1,x2,…,xn) is the objective function

Feasibility and Optimality

( )

x1

• A feasible solution x =

.

.

.

satisfies all the

xn

constraints (both structural and nonnegativity)

• The objective function ranks the feasible solutions;

call them x1, x2, . . . , xk. The optimal solution is the

best among these. For a minimization objective, we

have z* = min{ f (x1), f (x2), . . . , f (xk) }.

Linear Programming

A linear program is a special case of a mathematical

program where f(x) and g1(x) ,…, gm(x) are linear

functions

Linear Program:

Maximize/Minimize z = c1x1 + c2x2 + • • • + cnxn

Subject to ai1x1 + ai2x2 + • • • + ainxn

xj uj, j = 1,…,n

xj 0, j = 1,…,n

{}

=

bi , i = 1,…,m

LP Model Components

xj uj are called simple bound constraints

x = decision vector = "activity levels"

aij , cj , bi , uj are all known data

goal is to find x = (x1,x2,…,xn)T

(the symbol “ T ” means)

Linear Programming Assumptions

(i) proportionality

(ii) additivity

(iii) divisibility

(iv) certainty

linearity

Explanation of LP Assumptions

(i) activity j’s contribution to objective function is cjxj

and usage in constraint i is aijxj

both are proportional to the level of activity j

(volume discounts, set-up charges, and nonlinear

efficiencies are potential sources of violation)

(ii) no “cross terms” such as 12 x1x5 may not

appear in the objective or constraints.

Explanation of LP Assumptions (cont’d)

(iii) Fractional values for decision variables are permitted

(iv) Data elements aij , cj , bi , uj are known with

certainty

• Nonlinear or integer programming models should be

used when some subset of assumptions (i), (ii) and

(iii) are not satisfied.

• Stochastic models should be used when a problem

has significant uncertainties in the data that must be

explicitly taken into account [a relaxation of

assumption (iv)].

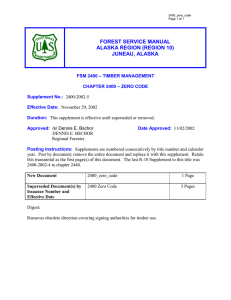

Product Structure for

Manufacturing Example

Machines A,B,C,D

Available time:

2400 min/week

Operating expenses:

$6000/week

P

Revenue:

$90/unit

Max sales:

100 units/week

Purchased

part:

$5/unit

Q

Revenue:

$100/unit

Max sales:

40 units/week

D

15 min/unit

D

10 min/unit

R

Revenue:

$70/unit

Max sales:

60 units/week

C

16 min/unit

C

9 min/unit

C

6 min/unit

B

16 min/unit

A

20 min/unit

B

12 min/unit

A

10 min/unit

RM1

$20/unit

RM2

$20/unit

RM3

$20/unit

Component 1

Component 2

Component 3

Data for Manufacturing Example

Machine data

Machine \ Product

A

B

C

D

Total processing time

Unit processing times

(min)

P

Q

20

10

12

28

15

6

10

15

57

59

Availability

(min)

R

10

16

16

0

42

2400

2400

2400

2400

Product data

Revenue per unit

Material cost per unit

Profit per unit

Maximum sales

P

Q

R

$90

$45

$45

100

100

$40

$60

40

$70

$20

$50

60

Data Summary

Selling price/unit

Raw Material cost/unit

Maximum sales

Minutes/unit on A

B

C

D

P

Q

R

90

45

100

20

12

15

10

100

40

40

10

28

6

15

70

20

60

10

16

16

0

Machine Availability: 2400 min/wk

Structural

coefficients

Operating Expenses = $6,000/wk (fixed cost)

Decision Variables

xP = # of units of product P to produce per week

xQ = # of units of product Q to produce per week

xR = # of units of product R to produce per week

LP Formulation

max z = 45 xP + 60 xQ + 50 xR – 6000

s.t. 20 xP + 10 xQ + 10 xR 2400

12 xP + 28 xQ + 16 xR 2400

15 xP + 6 xQ + 16 xR 2400

10 xP + 15 xQ + 0 xR 2400

xP 100, xQ 40, xR 60

Are we done?

xP 0, xQ 0, xR 0

Objective Function

Structural

constraints

demand

nonnegativity

Are the LP assumptions

valid for this problem?

= 81.82, x *Q = 16.36, x *R = 60

Optimal solution x *

P

Discussion of Results for

Manufacturing Example

• Optimal objective value is $7,664 but when we

subtract the weekly operating expenses of

$6,000 we obtain a weekly profit of $1,664.

• Machines A & B are being used at maximum

level and are bottlenecks.

• There is slack production capacity in

Machines C & D.

How would we solve model using

Excel Add-ins ?

Solution to Manufacturing Example

Linear Model

TRUE

FALSE

TRUE

FALSE

FALSE

100

100

0

60

0

Ph. 1 Iter.

Solver: Jensen LP/IP

Name: PQR

4

Total Iter.

Type: Linear

Type: LP1

Comp. Time 00:00

Sens.: Yes

Goal: Max

Change

Status Optimal

Side: No

Objective: 7663.6

Solve Select the Relink Buttons command from the OR_MM menu before clicking a button.

3

2

1

Variables

R

Q

P

Name:

Change Relation

60

81.818 16.364

Values:

0

0

0

Lower Bounds:

60

40

100

Upper Bounds:

Linear Obj. Coef.:

Constraints

Num. Name

MachA

1

MachB

2

MachC

3

MachD

4

Linear Model

Value

2400

2400

2285.5

1063.6

Rel.

<=

<=

<=

<=

Name:

RHS

2400

2400

2400

2400

PQR

45

60

50

Linear Constraint Coefficients

10

10

20

16

28

12

16

6

15

0

15

10

Solver: Jensen LP/IP

Ph. 1 Iter.

8

Characteristics of Solutions to LPs

A Graphical Solution Procedure (LPs with 2 decision variables

can be solved/viewed this way.)

1. Plot each constraint as an equation and then decide which

side of the line is feasible (if it’s an inequality).

2. Find the feasible region.

3. Plot two iso-profit (or iso-cost) lines.

4. Imagine sliding the iso-profit line in the improving direction.

The “last point touched” as the iso-profit line leaves the

feasible region region is optimal.

Two-Dimensional Machine

Scheduling Problem -- let xR = 60

max z = 45 xP + 60 xQ + 3000

s.t.

20

12

15

10

xP

xP

xP

xP

+

+

+

+

10 xQ

28 xQ

6 xQ

15 xQ

1800

1440

2040

2400

xP 100, xQ 40

xP 0, xQ 0

Objective Function

Structural

constraints

demand

nonnegativity

Feasible Region for Manufacturing

Example

P

240

Max Q

200

D

160

120

Max P

80

A

40

0

C

B

0

40

80 120

160

200 240 280 320

360

Q

Iso-Profit Lines and Optimal Solution for

Example

P

Optimal solution = (16.36, 81.82)

120

Max Q

100

80

A

60

40

Z = $4664

20

Z = $3600

B

0

0

10

20

30

40

50

60

Q

Possible Outcomes of an LP

1. Unique Optimal Solution

2. Multiple optimal solutions : Max 3x1 + 3x2

s.t. x1+ x2 1

x1, x2 0

3. Infeasible :

feasible region is empty; e.g., if the

constraints include

x1+ x2 6 and x1+ x2 7

4. Unbounded :

Max 15x1+ 7x2

s.t. x1 + x2 1

x1, x2 0

(no finite optimal

solution)

Note: multiple optimal solutions occur in many practical (real-world) LPs.

Example with Multiple Optimal

Solutions

x2

z1

z2

z3

Maximize z = 3x1 – x2

4

subject to 15x1 – 5x2 30

3

10x1 + 30x2 120

2

1

x1 0, x2 0

0

0

1

2

3

4

x1

Bounded Objective Function with

Unbound Feasible Region

z3

x2

z2

Maximize z = –x1 + x2

z1

4

subject to

3

–x1 + 4x2 10

–3x1 + 2x2 2

2

1

x1 0, x2 0

0

0

1

2

3

4

x1

Inconsistent constraint system

x2

Maximize z = x1 + x2

4

subject to

3

3x1 + x2 6

3x1 + x2 3

2

1

0

0

1

2

3

4

x1 0, x2 0

x1

Constraint system allowing only

nonpositive values for x1 and x2

x1

–4

–3

–2

–1

0

0

–1

–2

–3

–4

x2

Maximize z = x1 + x2

subject to

x1 – 2x2 0

–x1

+x2 1

x1 0, x2 0

Sensitivity Analysis

Shadow Price (dual variable) on Constraint i

Amount object function changes with unit increase

in RHS, all other coefficients held constant

Objective Function Coefficient Ranging

Allowable increase & decrease for which

current optimal solution is valid

RHS Ranging

Allowable increase & decrease for which

shadow prices remain valid

Solution to Manufacturing Example

Linear Model

TRUE

FALSE

TRUE

FALSE

FALSE

100

100

0

60

Name: PQR

Solver: Jensen LP/IP

Ph. 1 Iter.

0

Type: LP1

Type: Linear

Total Iter.

4

Change

Goal: Max

Sens.: Yes

Comp. Time 00:00

Objective: 7663.6

Side: No

Status Optimal

Solve Select the Relink Buttons command from the OR_MM menu before clicking a button.

Variables

1

2

3

Change Relation

Name:

P

Q

R

Values:

81.818 16.364

60

Lower Bounds:

0

0

0

Upper Bounds:

100

40

60

Linear Obj. Coef.:

Constraints

Num. Name

1

MachA

2

MachB

3

MachC

4

MachD

Linear Model

Value

2400

2400

2285.5

1063.6

Rel.

<=

<=

<=

<=

Name:

RHS

2400

2400

2400

2400

PQR

45

60

50

Linear Constraint Coefficients

20

10

10

12

28

16

15

6

16

10

15

0

Solver: Jensen LP/IP

Ph. 1 Iter.

8

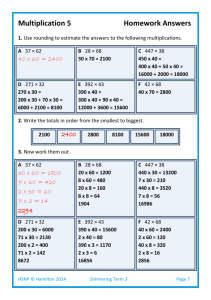

Sensitivity Analysis with Add-ins

Microsoft Excel 9.0 Sensitivity Report

Worksheet: [ch02.xls]PQR_S

Report Created: 5/5/2002 8:08:50 PM

Adjustable Cells

Cell

$H$8

$I$8

$J$8

Name

Values: P

Values: Q

Values: R

Final

Reduced

Objective

Allowable

Allowable

Value

Cost

Coefficient

Increase

Decrease

81.81818182

0

45 38.33333333 19.28571429

16.36363636

0

60

23

37.5

60 10.45454545

50

1E+30 10.45454545

Constraints

Cell

$D$15

$D$16

$D$17

$D$18

Name

MachA Value

MachB Value

MachC Value

MachD Value

Final

Shadow

Constraint

Allowable

Allowable

Value

Price

R.H. Side

Increase

Decrease

2400 1.227272727

2400 144.8275862 866.6666667

2400 1.704545455

2400

520

360

2285.454545

0

2400

1E+30 114.5454545

1063.636364

0

2400

1E+30 1336.363636

What You Should Know

About Linear Programming

•

•

•

•

What the components of a problem are.

How to formulate a problem.

What the assumptions are underlying an LP.

How to find a solution to a 2-dimensional

problem graphically.

• Possible solutions.

• How to solve an LP with the Excel add-in.