The Liability Of Corporate Agents For Negligent Misstatement: A Critique Of The Decision In Trevor Ivory Ltd V Anderson And Recommendations For Reform In New Zealand

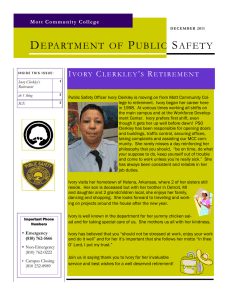

advertisement

2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 The liability of Corporate Agents for negligent misstatement: A critique of the decision in Trevor Ivory Ltd v Anderson and recommendations for reform in New Zealand Alamelu (Ala) Sonti, Barrister and Solicitor of the High Court of New Zealand ABSTRACT In the last two decades, a number of cases have come before the courts in which the personal liability of company directors has been called into question. The cases have highlighted that the courts have failed to articulate a consistent and coherent model for finding directors personally liable for their actions. As an illustration, in claims that have been brought against directors for negligent misstatement, the courts have prioritised preservation of the corporate form over ensuring third-party clients receive an adequate remedy for losses they have suffered. In this situation, clients of the company are left in the unenviable position of wearing the loss they have suffered because they are unable to recover it from the company and/or its director(s)/officers. The paper argues that strict adherence by the courts to long-established principles of company law, including the principles of limited liability and separate legal entity, have resulted in inconsistent results, which in turn has created uncertainty in the law, and needs to be addressed. The paper reviews common law developments that have taken place in other commonwealth jurisdictions and offers alternative solutions which address why directors should be held personally liable in New Zealand. This will be done by ensuring that other relevant areas of the law are systematically applied to the cause of action in question, rather than corporate theory alone. It is anticipated that this will result in a more principled approach which is likely to produce consistent and fairer results in the future. INTRODUCTION In 1993, the New Zealand (“NZ”) Court of Appeal handed down its decision in Trevor Ivory [1992] 2 NZLR 517 (“Trevor Ivory”). This controversial decision was the first case to hold that a director was not personally liable in tort for negligent advice given in the course of carrying out the business of his company. From a precedent perspective, the decision contained a number of concerning inconsistencies. The Court of Appeal misapplied the doctrine of limited liability; the ‘assumption of responsibility’ test set out in Hedley Byrne & Co Ltd v Heller & Partners [1964] AC 465 (“Hedley Byrne”) and the Tesco Supermarkets v Nattrass [1972] AC 153 (“Tesco”) doctrine. In addition to the lack of precedent authority, the court of appeal’s decision had no express mandate from the Companies Act 1993 (“The Act”). The Court therefore acted outside of the statutory framework in NZ. It is submitted that the uncertainty that currently pervades this area of law needs to be addressed for the benefit of society as a whole and for the benefit of the economy. From an economic perspective, people dealing with companies must have confidence that the law will afford them a remedy if they are financially disadvantaged in their dealings with them. Directors would also benefit by knowing what is expected of them in terms of their duties to the company, to clients, and to creditors. Greater accountability and responsibility by directors in this regard is urgently called for. In the next section, the decision in Trevor Ivory will be analysed. Trevor Ivory [1992] 2 NZLR 517 Facts The plaintiffs (Mr and Mrs Anderson) owned an orchard which included a raspberry plantation. Mr and Mrs Anderson contracted with Mr Ivory’s company, Trevor Ivory Limited, for Mr Ivory’s expert advice regarding the management of their raspberry plantation. Mr Ivory, an agricultural and horticultural advisor, recommended that they use Roundup (a powerful herbicide) to control the growth of couch grass, which was threatening their plants. However, he failed to advise the Anderson’s to protect the plants before spraying and as a result the plants absorbed the herbicide and died, with the result that they ultimately had to be dug out. The Anderson’s incurred significant losses and sued both the company and Mr Ivory personally in contract and tort. The High Court found the company liable for breach of contract and negligence and found Mr Ivory personally liable. Damages of $145,332 were awarded against both defendants. Mr Ivory appealed against the judge’s finding that he was personally liable (p. 517). June 24-26, 2007 Oxford University, UK 1 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Court of Appeal Decision Mr Anderson appealed against the finding in the High Court that Trevor Ivory was not personally liable. The Court of Appeal held that an officer or servant of a company might in the course of activities carried out on behalf of the company, come under a personal duty to a third party, breach of which, might entail personal liability. The Court decided that the test as to whether liability had been incurred was whether there had been an assumption of a duty of care, actual or imputed. In this regard, liability would depend on the particular facts of the case including the degree of implicit assumption of personal responsibility and the balancing of policy considerations. The Court noted that on the formation of his company, Mr Ivory made it plain to “all the world” that limited liability was intended and consequently, if liability was imposed on him, his object would be undermined. Furthermore, there was no just and reasonable policy consideration for imposing an additional duty of care. Mr Ivory was therefore not personally liable to the Anderson’s (pp. 519-532). Critique of the Court of Appeal’s decision In making their decision, the court of appeal made several significant errors. Long-established legal principles were given new definition either by being misapplied or extended without legal authority. Established case law doctrines were also misapplied, and finally no consideration was given to the policy reasons in favour of affording innocent third-parties a remedy. Interestingly, and from an equitable perspective, the less than honest intentions of Mr Ivory were used to exculpate him and clothe him in corporate immunity, rather than being used to find him personally liable. Misapplication of the doctrine of limited liability and the separate entity principle The doctrine of limited liability originally evolved for the benefit of a company’s shareholders. A company’s limited liability was said to arise because companies are artificial legal entities that are treated in law as entirely separate from their shareholders. The rationale behind this principle is that it encourages investment in a company by ensuring that no liability will attach to the shareholders if the company encounters financial difficulties. Consequently, shareholders are not personally liable for the company’s debts or other obligations, and cannot be sued by the company’s creditors. The principle of limited liability is therefore to protect the company’s shareholders, not the company or its officers (Grantham, 1997). In Trevor Ivory, the Court of Appeal extended the limited liability principle to protect directors from personal liability for their tortious actions. This novel extension took the principle out of its original domain of dealing with property ownership and company debts and into a new domain: to cover the tortious activities of directors. Cooke P (as he was then) was emphatic in his argument that limited liability should be available to protect directors as a matter of policy. As he stated (pp. 523-524): [I]t behoves the courts to avoid imposing on the owner of a one-man company a personal duty of care which would erode the limited liability and separate entity principles associated with the names of Salomon and Lee…the object of Mr Ivory in forming a limited liability company, an object encouraged by long-established legislative policy, would be undermined by imposing personal liability…when he formed his company, Mr Ivory made it plain to all the world that limited liability was intended. However, Cooke P’s reasoning was not supported by the decisions in Salomon v Salomon & Co Ltd [1897] AC 22 (“Salomon”) and Lee v Lee’s Air Farming Ltd [1961] AC 12 (“Lee”), which confirmed that limited liability protected shareholders only. His reasoning also lacked legislative authority. Section 97 of the Companies Act 1993 which deals with the liability of shareholders states that: [A] shareholder is not liable for an obligation of the company by reason only of being a shareholder…the liability of a shareholder to the company is limited to any amount unpaid on a share held by the shareholder. This section does not include protection for a director’s personal liability in tort. Cooke P focused on Mr Ivory’s ‘desire for protection’, but this does not mean that any such protection is available in law (Wishart, 1993a). June 24-26, 2007 Oxford University, UK 2 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 A similar criticism can be made of the Court of Appeal’s application of the separate entity principle. In Trevor Ivory, the Court spoke of Mr Ivory’s actions as if they were those of the company itself. As Hardie Boys J noted: “the problem that has vexed the common law courts in this area is that of respecting the doctrine of separate legal personality on the one hand and of allowing an adequate remedy on the other.” (p. 525). Phrased in this way, Hardie Boys J inferred that because of the separate legal personality of a company, this somehow precludes the existence of personal liability for directors (Anderson, 2004). In fact several academic commentators have criticised this ‘fusing’ of the two entities: namely the company and its directors and have labeled this is as anthropomorphism that somehow reifies the company. In Trevor Ivory the court held that Mr Ivory was not liable because he was acting ‘as the company’. That is, in certain circumstances a director’s actions are in fact the actions of the company. While there is no doubt that a company is a ‘legal person’ and to that extent it can do things that natural legal person’s can do, like borrow money and purchase property; it is still an artificial legal entity which has no physical presence (Grantham & Rickett, 2002). It is unable to do any of these things without authorised personnel entering into contracts on its behalf. This is typically why the management of a company’s affairs must be vested in natural persons, typically its directors. The central question that must therefore be asked is who has vested in them the right and power to activate the company to perform juristic acts? (Grantham et al., 2002). As we know, shareholders are typically only concerned with ownership and investment issues, whereas directors have full decision-making power. Therefore, there is a clear divorce between ownership and control, which in turn explains why limited liability only extends to the shareholders of the company. Although it is acknowledged that the law has developed theories to attribute human behaviour to the company (such as the attribution and identification theories), this has been done in a way that fuses the human actor to the company, instead of separating out the guilty human being from the company, in order to isolate the guilty actor. In tort and crimes actions, there must be an identifying human being to take an action against. There are no good reasons why this should be any different in a corporate context. The decision in Trevor Ivory therefore white-washes individual liability by fusing it with the corporate form (Borrowdale, Rowe, & Taylor, (2002). By contrast, the proper use of agency and tort principles separates out the individual to pin liability on, and is discussed later in the paper. Misapplication of the Identification Theory The identification theory was first developed in Tesco Supermarkets Ltd v Nattrass [1972] AC 153 (“Tesco”). The theory identifies the acts and knowledge of those in control of the company as those of the company. On this basis, only the company will be liable (Wishart, 2003b). To this extent it differs from the law of agency in that it effectively merges, for legal purposes, the individual and the company into one entity (Wishart, 2003b). In Tesco, the company sought to distance itself from the store manager by arguing that it was his acts that led to a breach of the Trade Descriptions Act 1968. The House of Lords decided that the intention of the company was not in fact the intention of the store manager because he was not sufficiently senior, unlike a managing director for example, who carries out the functions of management and speaks and acts for the company. The Act provided a defence if a defendant company could show that the offence was due to the act of “another person” and the defendant had taken all reasonable precautions. The House of Lords held that the defence was open to the company because the employee was “another person” and not the “directing mind and will” of the company. Therefore, it is the mind of the controlling individual which is the mind of the company. However, in Trevor Ivory the Court of Appeal reversed the identification theory by holding that Mr Ivory’s negligent advice was the in fact the company’s negligent advice and on this basis he was exempt from personal liability. That is, the Court of Appeal declined to hold Mr Ivory personally responsible because he was in fact ‘identified’ with his company, therefore only the company could be held liable to the Anderson’s. A case which illustrates the absurdity of the Tesco doctrine is Nordick Industries Ltd v Regional Controller of Inland Revenue [1976] 1 NZLR 194 (“Nordick”). Cooke J (as he was then) applied the Tesco doctrine and accepted that the director’s actions of making a false return to the Inland Revenue should be treated as the actions of the company, even though the director was acting fraudulently. This logic was strongly criticized in subsequent cases such as Director of Public Prosecutions v Gomez [1993] AC 442 (“Gomez”). In Gomez, Lord Browne-Wilkinson suggested that such a contention was illogical because if the individual was senior enough to be identified with the company, the company must have consented to the director’s actions. Such an action is not however in the best interests of the company and as a legal person, the company would not authorise (or have its senior management or directors authorise such acts). The ruling in Nordick surely cannot be correct especially where fraud or dishonesty are involved. Similarly in Ivory, the ‘one-person’ company as a legal person would never have consented to Mr Ivory’s negligent advice, which he gave as an employee of the June 24-26, 2007 Oxford University, UK 3 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 company. Also, his admission that he formed the company to avoid liability showed his dishonest intentions. A director should not be allowed to argue that his actions were those of the company. This would effectively preclude any action being taken against the individual and runs counter to long-established equitable principles. For these reasons, it is submitted that doctrines which merge an individuals actions with those of the company for the purposes of avoiding individual liability, are wrong in principle. This encourages dishonesty on the part of senior management and ultimately leads to the spread of losses onto third parties who contract with the company. In fact in the Privy Council1 decision of Meridian Global Funds Management Asia Ltd v Securities Commission [1995] 3 NZLR 7 (“Meridian”), Lord Hoffman stated that the identification doctrine used in Trevor Ivory was a ‘last resort’ rule of attribution, which should only be used by the courts if general principles of agency were insufficient in giving meaning to a substantive rule of law in relation to a legal person (p. 12). The liability of Mr Ivory could have easily been determined using the law of agency. There was therefore no need for the Court of Appeal to resort to the Tesco Identification doctrine. In the sections that follow, consideration is given to the role of equitable doctrines in situations where the ‘corporate personality’ is used for improper purposes. Section 133 of the Companies Act 1993 will also be examined because it expressly states that “directors must exercise their powers for a proper purpose”. In addition to this, section 131 states that “directors must act in good faith when exercising powers or performing duties”. Lifting the Corporate Veil The concept of the separate legal entity of a company and the resulting limitation of liability is statutorily enshrined in section 15 of the Companies Act 1993. Section 15 states that “a company is a legal entity in its own right separate from its shareholders and continues in existence until it is removed from the New Zealand register.” As a general rule, as long as the company has been established for legitimate reasons, the courts will not lift the veil which is said to ‘hang’ between the shareholders and the company. However, the courts will not allow the corporate form to be used as a device to evade contractual or other legal obligations 2 or for the purposes of fraud or improper conduct. In Gilford Motor Co Ltd v Horne [1933] 1 Ch 935 (“Gilford”) and Jones v Lipman [1962] 1 WLR 832 (“Jones”), the English courts held that the ‘fraud exception’ which allows a court to lift the corporate veil would be invoked if the defendant had the intention to use the corporate structure in such a way as to deny the plaintiff some pre-existing legal right. In Gilford for example, Mr Horne, an ex employee of Gilford Motor Company Ltd (“GMC”) incorporated a limited liability company in the name of his wife, in order to circumvent a clause in his employment contract, which prevented him from setting up in competition with GMC following the termination of his contract. The court held that the company was formed as a device in order to mask the effective carrying on of the business of Mr Horne. Similarly in the Jones case, Mr Lipman had agreed to sell a property to the Jones,’ however prior to its completion he set up a company and sold the house to the company, which was in his absolute control. The intention was to deny the plaintiffs the remedy of specific performance. The court held that the company was a mask, which Mr Lipman held before his face in an attempt to avoid recognition by the eye of equity. If the courts prevent limited liability companies from evading their legal obligations, then it is submitted that the Court of Appeal in Trevor Ivory should have viewed Mr Ivory’s intentions with regard to forming his company as suspicious. Mr Ivory openly stated that he formed the company in order to avoid personal liability. This clearly amounts to an improper use of the corporate structure, the purpose of which is to evade legal obligations and is not a legitimate reason to form a company. The corporate veil existed between Mr Ivory as the principal shareholder and Trevor Ivory Limited. The only significant difference between the abovementioned cases and Trevor Ivory is that the companies were formed after the fraudulent acts in question. By contrast, in Trevor Ivory, Mr Ivory formed his company first and then used it to avoid personal liability. In principle, it should make little difference whether the improper intentions existed before the company was formed or after it was formed. New Zealand’s most authoritative case to date. The Courts will also lift the veil in agency situations – where the company is nothing more than an agent for the majority shareholder such as in Trevor Ivory. 1 2 June 24-26, 2007 Oxford University, UK 4 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 The view taken by the NZ courts regarding when the corporate veil will be lifted is extremely mindful not to affect the principle enshrined in section 15 of the Act. In Chen & Anor v Butterfield & Another (1996) 7 NZCLC 261,086 (“Chen”), Tipping J (as he was then) stated that the corporate veil should only be lifted if it creates a substantial injustice which the courts simply cannot countenance (p. 261,090). In declining to lift the corporate veil in Chen he noted that (p. 261,092) “corporate structures and separate legal personality are legitimate facets of commerce, which are deeply engrained into our commercial life.” Tipping J did not think that the use of a shell company to rent premises in order to avoid personal liability was a sham. In his view, the defendant made his intentions clear to the lessor (p. 261,092). This seems rather surprising and is evidence of the fact that the courts will not challenge the principles of incorporation unless the reasons are very compelling. It is submitted that this reasoning is absurd given that lifting the corporate veil is an equitable remedy. Furthermore, in cases like Trevor Ivory, strict adherence to the section 15 principle does create a substantial injustice especially where innocent third-party clients are involved. While there is nothing dubious about a oneperson company, if the company is set up in order to avoid subsequent liabilities to third-parties, then the commercial reasons behind the incorporation are far from genuine. The company in Trevor Ivory was clearly set up to take advantage of the section 15 provision and to avoid liability. As sole shareholder and director, Mr Ivory used the corporate shell to evade his liabilities to clients. In such a scenario, clients should have a strong case in favour of lifting the corporate veil. In fact when considering whether limited liability is justifiable, it is submitted that the courts should ask whether they would allow directors like Mr Ivory to avoid liability in the absence of his limited liability company. In such a case it is unlikely that Mr Ivory could escape liability, therefore absent genuine commercial reasons, he should not be allowed to avoid liability while trading as a company. Otherwise, he takes all the benefits of trading in the corporate form without incurring any responsibilities to clients. This is clearly open to abuse and it encourages irresponsible actions by directors and the use of a ‘shell’ company with nominal assets. The Court of Appeal in Trevor Ivory alluded to the fact that Mr Ivory ‘had made it plain to all the world that limited liability was intended’. However, from an equitable point of view and based on sections 131 and 133 of the Act, Mr Ivory was not acting in ‘good faith’ by trying to distance himself from liability when no such exemption existed in law, or under the Act. Similarly, in performing his role as a director of Trevor Ivory Limited, he did not use his powers for a ‘proper purpose’ by taking advantage of the unique features of a oneperson company, including the fact that he would automatically be regarded as a ‘senior employee,’ which identified him with the company and assured him of his much desired immunity from liability (see Ivory p. 524) where Cooke P noted that Mr Ivory was identifying himself with his company, as if Mr Ivory had read the decision in Tesco. Equity One of equity’s maxims is that ‘equity will not allow a statute to be used as an instrument of fraud’. Equity would not therefore permit Mr Ivory to cloak himself in the clothing of a company in order to avoid personal liability. If the assertion of a statutory right cloaks a fraud, equity will intervene under this maxim (Dal Pont, & Chalmers, 2000). It is submitted that the Court of Appeal’s reasoning in Trevor Ivory runs counter to equitable principles. By accepting Mr Ivory’s evidence that he incorporated in order to avoid personal liability, the Court of Appeal endorsed Mr Ivory’s use of the corporate structure in order to accomplish a fraud. Given that equity looks to intent rather than to form (Dal Pont et al., 2000), Mr Ivory’s desire to avoid liability would have stripped him of his ‘corporate’ protection. In fact under the principles of equity and agency, directors owe fiduciary duties to the company. 3 Mr Ivory would have been required to work in the best interests of the company and within his express authority. Therefore by negligently advising the Anderson’s to use Round-up on their raspberry plants, he was in breach of his fiduciary duty to the company, and he acted outside of his authority as an agent. From an equitable point of view, the company per se could have argued that Mr Ivory failed to act in the best interests of the company as its employee, and should have been entitled to monetary compensation from Mr Ivory.4 From an agency point of view, the Court of Appeal should have found that Mr Ivory was personally liable to the Anderson’s for his negligent advice as an employee of Trevor Ivory Limited. Mr Ivory’s personal liability as an agent should have been determined on the basis of established agency and tort principles discussed in the next section. 3 In addition to sections 131-138 of the Act. This argument is theoretical only with a one-person company: i.e. where the same person is the director, employee, and sole shareholder, but is valid in companies with two or more actors. 4 June 24-26, 2007 Oxford University, UK 5 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Tort Liability and Mr Ivory The application of ordinary principles of liability in tort to the conduct of agents acting on behalf of another is not usually seen as posing any special difficulty (Todd, 1998a). An agent like Mr Ivory acting on behalf of Trevor Ivory Limited, should therefore have been found liable for his negligent misstatement, which induced a contract between the representee (Mr Anderson) and the principal (Trevor Ivory Limited). However, in Trevor Ivory the court held that in the case of a limited liability company, special circumstances must first be found before it can be said that the owner of a ‘one-person company’ is personally liable (p. 532). The court held that the director must have ‘assumed responsibility’ in order to be personally responsible and that the test for finding that a director had assumed responsibility would be determined by factors such as the degree of control of the particular director, the prominence of the director, and whether his involvement was in routine performance of the company’s affairs (p. 527). At the outset it should be noted that this is not the established test for determining an ‘assumption of responsibility.’ The original test set out in Hedley Byrne stated that (pp. 486 & 502-503): A reasonable man, knowing that he was being trusted or that his skill and judgment were being relied on, would, I think have three courses open to him. He could keep silent or decline to give the information or advice sought: or he could give an answer with a clear qualification that he accepted no responsibility for it: or he could simply answer without any such qualification. If he chooses to adopt the last course he must, I think, be held to have accepted some responsibility for his answer being given carefully, or to have accepted a relationship with the inquirer which requires him to exercise such care as the circumstances require…if someone possessed of a skill undertakes, quite irrespective of contract, to apply that skill for the assistance of another person who relies on such skill, a duty of care will arise. The fact that the service is given by means of words can make no difference. Therefore, a person is under no general duty to act, but by voluntarily taking on a task that person is then obliged to perform the task with care (Todd, 2003b). By undertaking to speak or inducing reliance in some way, responsibility is assumed and the basis for a duty of care comes into existence (Todd, 2003b). A person owes a duty of care in tort because the law imposes the duty on the basis of what he or she has said or done or assumed to do, not because that person somehow decides to assume legal responsibility (Todd, 2003b). Given that negligent advisors like Mr Ivory will never agree to ‘assume responsibility’ in a Hedley Byrne action, the courts simply impose responsibility on them where their negligent words are relied on by a sufficiently proximate plaintiff, like the Anderson’s (Todd, 2003c). If the correct test had been applied, there would be no doubt that Mr Ivory assumed responsibility for the advice he gave the Anderson’s and therefore owed them a duty of care. He assumed the task of advising the Anderson’s to use Roundup to get rid of weeds around their raspberry plantation. A duty of care therefore existed because there was a sufficiently close relationship between Mr Ivory and the Anderson’s, i.e. proximity was established. However, the court tinkered with the test in such a way that they created an unrealistically high evidential burden for the Anderson’s to establish. In doing so, they misapplied the original Hedley Byrne test and made certain that company directors will rarely, if ever, be held personally liable. The court’s blatant disregard for established legal principles was geared towards the wider policy implications of their decision: preserving the principles of limited liability and the company form as a means of doing business in NZ, no matter what the cost. Unfortunately, third party clients of NZ companies were not factored into the equation at all. The end result being that they will rarely if ever, be successful in holding a director personally responsible for his/her negligent advice or actions. In fact as the original Hedley Byrne test stated, a disclaimer of liability would serve as notice to subsequent clients that the defendant does not assume liability. The court of appeal in Trevor Ivory seemed to believe that a disclaimer somehow included trading in the corporate form (p. 524), where Cooke P noted that by Mr Ivory “making it plain to all the world that limited liability was intended,” this effectively was his June 24-26, 2007 Oxford University, UK 6 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 disclaimer. However, this in not what the House of Lords contemplated by a disclaimer in Hedley Byrne. What they were referring to, was if for example, an accountant prepares financial accounts for a client and states in the accounts that they do not accept liability for the information contained therein, then that would be taken as a disclaimer of liability to anyone who subsequently relied on the accounts. Looking at the ‘revised’ Trevor Ivory ‘assumption of responsibility’ test, it could be argued that Mr Ivory had assumed responsibility to the Anderson’s. He clearly had all the control: he was the managing director, sole shareholder, and employee of Trevor Ivory Limited. He was therefore in such a position of control that he had effectively assumed personal responsibility for the advices he gave. Mr Ivory was also ‘highly prominent’ and his company ‘barely visible,’ which resulted in a focus ‘predominantly on the man himself.’ (p. 532). Lastly, Mr Ivory’s involvement was in the routine performance of the affairs of Trevor Ivory Limited. The company was set up to provide expert horticultural advice. Mr Ivory provided that advice to the Anderson’s in his capacity as an employee of Trevor Ivory Limited. However, the Court of Appeal concluded that Mr Ivory had made it clear that he did not assume personal responsibility, and furthermore the contract between the Anderson’s and Trevor Ivory Limited was on company letterhead but referred to Mr Ivory’s personal attendances. It was suggested by Mr Anderson that invoicing through the company was a tax devices and that the real contact was with Mr Ivory personally (p.525). It is submitted that these factors that supposedly weigh against an assumption of personal responsibility, are nothing more than customary business practice (as indicated by Mr Anderson, they are used predominantly for tax purposes). Unfortunately, subsequent cases have considered the same factors and applied the same reasoning (see Livingston v Bonifant (1995) 7 NZCLC 260,657; Banfield v Johnson (1994) 7 NZCLC 260,497). Putting aside the various ‘tests’ and focussing on the intentions of the Anderson’s in choosing to use Mr Ivory’s services, it is patently obvious that there is a reality gap between the law and customary business practice. To this extent it, could be argued that the law as judges are applying it is out of touch with the way in which people do business. In Trevor Ivory for example, McGechan J noted that the Anderson’s were anxious to receive the personal involvement of Mr Ivory (p.531). In fact it was his personal involvement which appealed to them (p. 531). As the Court noted this was not surprising in an advisory-type relationship (p.531). Mr Ivory’s name was known to the Anderson’s as being well recognised in the horticultural advisory field, and when the Anderson’s agreed, it was on the basis that Mr Ivory would be the ‘man on the ground’. Accordingly, it should not be overlooked that business clients will be highly influenced (during pre-contractual negotiations) by an advisors’ personal reputation or expertise in their particular field, or by their initial contact with the advisor. Pre-contractual negotiations are material when considering why the client was induced to enter into contractual relations with the company in the first place. From the client’s perspective, it is the person in front of the company that they seek to employ. The courts should therefore examine whether, during the precontractual negotiations, the advisor held out or represented to the client that he or she would be the person they would be dealing with, or that they would somehow assume a special duty or an obligation to the client or act in their personal capacity. After all, it would seem absurd that an advisor can induce clients to contract with their companies on the basis of their personal involvement, and then after something goes wrong, they can turn around and argue that they were merely passing on the advice on behalf of their company. One point that the Court of Appeal overlooked is the fact that the NZ approach to the tort of negligent misstatement is derived from the decision in Anns v Merton London Borough Council [1978] AC 728 (“Anns”). One must therefore ask whether: 1. There was a sufficient relationship of proximity or neighbourhood between the alleged wrongdoer and the person who suffered damage, that, in the reasonable contemplation of the former, carelessness on their part may cause damage to the latter, in which case a prima facie duty of care arises; and 2. (if the first question is answered in the affirmative) is it necessary to consider whether there are any considerations which ought to negative, reduce, or limit the scope of the duty or the class of persons to whom it is owed, or the damages to which a breach of it may give rise to (pp. 751-752). Under the Anns test, the Hedley Byrne criteria were treated as nothing more than policy reasons that might negate a prima facie duty of care. Modifications to the Anns test have since been made by the NZ Court of Appeal (see South Pacific Manufacturing Co Ltd v NZ Security Consultants and Investigations Ltd [1992] 2 NZLR 282), however these do not differ in substance and a detailed discussion of them is beyond the scope of this paper. Interestingly, if the Anns test had been applied, a duty of care would have arisen in Trevor Ivory. June 24-26, 2007 Oxford University, UK 7 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Agency Relationship between Directors and the Company Corporations are artificial legal entities which can only act through their officers and employees (Watson, 2004). If the concept of agency did not exist there would be no corporations (Watson, 2004). The concept of agency is therefore indispensable to trade and commerce in a modern society (Watson, 2004). Where directors are concerned, the extent to which a director of a company may enter into transactions on behalf of their company will depend on the precise scope of their authority (see sections 107 and 180(1) of the Act, which explains how transactions are formalised and agents are subsequently given their authority). Generally, a company (the principal) is bound by the contracts of a director (the agent) acting within the scope of their express, implied or apparent (ostensible) authority (Farrar, 2003). The use of agency concepts to describe corporate action means that individuals will be held responsible for their actions (Grantham, 1997). As far as the personal liability of a director is concerned, agency principles provide that a director who acts outside his authority (absent either ratification by the principal or a situation of necessity) will be personally liable for his/her actions. If the agent is negligent, he will be liable in tort to the victim (Watson, 2004). Similarly, a principal (company) will be vicariously liable for its agents’ acts if the principal has expressly or impliedly authorised the agent (director/employee) to commit the tort. The mere fact that the agent committed the tort while conducting the principal’s business does not relieve them of liability (Watson, 2004). Since it is standard practice for decision-making to be left to company directors (see s 128 of the Act, which vests the board of directors with management and decision-making power), it is logical that they should be accountable for the consequences of their advice, especially since they are in the best position to ensure that the loss does not occur. In fact, as many commentators have argued it is hard to understand why in cases like Trevor Ivory, directors should be treated any more kindly than ordinary employees (Todd, 2003b). Surely a person’s status as a senior manager/director within a company and the fact that they have considerable autonomy to make decisions goes hand in hand with the fact they should shoulder more responsibility than junior employees. Otherwise we have the paradoxical situation where a director is not liable, yet a lower level employee is (see C Evans & Sons Ltd v Spritebrand Ltd [1985] 1 WLR 317,330 where Slade LJ makes the comment that to treat company directors any more kindly than the junior employees would offend common sense). The fact that a director operates a one-person company does not provide an excuse for the general rule that attributes liability to an employee. In fact landmark cases like Salomon and Lee set down foundational principles confirming the separate legal personality of the company and its human actor(s). Lee confirmed that one person could be an employee, shareholder, and managing director at the same time. Therefore when Mr Lee appointed himself as a pilot (employee), he did so as an agent for his company. On this basis, the Privy Council granted his widow an insurance payout when the plane he was flying crashed. That is, when Mr Lee died he was carrying out his role as an employee of the company and not as a director. By this same reasoning therefore, when Mr Ivory gave advice to the Anderson’s regarding what herbicide to use, he was acting as an employee of Trevor Ivory Limited and on that basis the Court should have found him personally liable for the losses suffered by the Anderson’s. Instead, the Court of Appeal found that Mr Ivory wasn’t liable because he was acting as the company (p.524). The decision was decided quite differently from Lee, which might well have been decided based on the Court’s desire to see justice done to Mr Lee’s widow. By comparing these two cases, it is clear that the Courts are pre-figuring the outcome they want and then applying the law in a way that achieves that outcome. Such an approach is resulting in concerning inconsistencies. Policy Considerations Cooke P was not in favour of imposing personal liability on directors because in doing so it might undermine the principle of limited liability (p. 524). However entrepreneurial activity can be carried on quite satisfactorily without torts being committed (Todd, 1993c). As already discussed, the principal of limited liability applies only to shareholders in order that they might invest in the company without being concerned with the company’s debts. The justification for limited liability of shareholders is that without it, shareholders would be deterred from investing in companies and this would adversely affect commerce in general. A director’s presumption of immunity therefore has its genesis in public policy – namely, the protection of commerce, the encouragement of investment and the creation of wealth (Seagar, & Eric, 2006). However, the fact that companies are generally formed with limited share capital is of importance in the consideration of policy reasons regarding why directors should be made liable for their torts. Given that the majority of closely-held companies are formed with nominal share capital, the law as it currently stands does not June 24-26, 2007 Oxford University, UK 8 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 deter directors from acting negligently. Instead, the law should ensure that directors are held accountable for their actions. Otherwise, sole traders would also be encouraged to incorporate and trade with nominal share capital. This way they can avoid liability to their clients because the corporate immunity that they are clothed in blocks out effective individual wrongdoing, and it undercuts deterrence and the effective distribution of loss (Borrowdale et al., 2002). Unfortunately, no consideration was given by the Courts to the inefficient allocation of losses onto third-party clients. There are no convincing reasons why these losses should be borne by innocent clients. From an economic and social perspective, this is not an effective way to spread a company’s debts. It is both economically and socially inefficient because in Trevor Ivory-type situations, the cost incurred is greater than the gain. Viewed aggregately over the whole economy, this produces an enormous externality on consumers. These costs should therefore be borne internally by the company and/or its directors. Recovery options against the company are unlikely to be fruitful because companies with limited share capital will be unable to pay in the event of a successful negligence suit. The only option for the client would be to wind up the company. In fact if clients commence proceedings against companies who are unable to pay, they will be burdened with the legal costs of doing so, and ultimately ranked as an unsecured creditor. The end result being that they are likely to receive a very nominal payout, if anything at all. This is clearly an unattractive option. It is therefore imperative that the law relating to the personal liability of directors be reviewed to ensure that innocent clients have recourse to compensation. This would in turn create greater certainty in the market because any perceived risks in engaging the services of a company would be reduced significantly. If the wheels of commerce are to turn effectively, there must be this minimum level of certainty for clients that contract with companies. In fact in bank lending, this situation is commonly encountered and is why banks routinely take guarantees from company directors, supported by a mortgage over their family homes or commercial property. It is a well known fact that in the event of a default on the companies’ loan facilities, banks will not recover their debts from the company itself.5 From a cost perspective, it is less expensive and more efficient to pursue the directors’ personally: that is to call up the guarantees, commence mortgagee-sale proceedings and if necessary, bankrupt the directors for any shortfall outstanding. This scenario is illustrative of a common commercial situation where the concept of limited liability is rendered meaningless. Practicality and efficiency require this, otherwise banks would not lend to companies unless they had considerable assets. Since NZ is predominantly a nation of small and medium sized enterprises (SMEs)6 banks will more often than not take personal guarantees from the directors. If they didn’t, banks would not lend to companies because of the risks involved. This would mean that companies would be unable to trade for the practical reasons that they typically need a working overdraft facility in place, in order to operate on a day-to-day basis. The implications of this on the NZ economy is that economic growth would be stifled. It is therefore submitted that if voluntary creditors like banks can “contract out” of the limited liability rule, involuntary creditors like the Anderson’s should be afforded mandatory protection by the law. Involuntary creditors are far more vulnerable than banks, and are far less able to wear the loss. They also have no forewarning when they enter into contracts with companies. Unfortunately, the Court of Appeal gave no consideration to the unattractive position that clients of NZ companies would be left in if they are placed in the same situation as the Anderson’s. Given that one-person or small closely-held companies are commonplace in NZ;7 this factor should have been taken into account by the Courts before deciding against holding directors personally liable. Policy arguments in favour of preserving the limited liability status of a company therefore strongly influenced the reformulation of a new assumption of responsibility test in Trevor Ivory. In tort cases, the courts are mindful to ensure a balancing of both principle and policy before a duty of care is said to arise. 8 5 Based on my knowledge of dealing with these situations during the course of my employment with a bank. While some larger companies have assets to support the borrowings, banks still typically take additional security from the directors’ personally. 6 The Ministry of Economic Development (2005) confirmed that SMEs accounted for 96.8% of all enterprises in NZ. 7 Statistics New Zealand has confirmed that 52% of the total businesses in NZ in February 2006 were incorporated companies. 8 Refer to the Anns’ decision. June 24-26, 2007 Oxford University, UK 9 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 However, in Trevor Ivory, policy dictated the Court’s desired outcome and legal principles were creatively re-worked to fit in with that outcome. As Cooke P stated (p. 523): …it behoves the court to avoid imposing on the owner of a one-man company a personal duty of care which would erode the limited liability and separate identity principles associated with the names of Salomon and Lee. Viewing the issue as one of the assumption of a duty of care… I cannot think it reasonable to say that Mr Ivory assumed a duty of care to the plaintiffs as if he were carrying on business on his own account and not through a company. The main concern of the Court was that limited liability would be eroded if directors were held personally liable. However, as I have argued these two competing policy objectives have nothing to do with each other. Consequently, the policy arguments put forward by Cooke P can readily be dismissed. This leaves the policy objective of affording a remedy to third parties to be considered. Since there is no reason why the principles of agency and tort law cannot be invoked to pin liability on the individual director/employee, and the company vicariously, these principles should apply in the corporate context. Comparison with other Jurisdictions In the next section, I will compare and contrast the approaches taken by the courts in the United Kingdom (“UK”) and Australia, when dealing with the tort of negligent misstatement in a corporate context. Since it is beyond the scope of this paper to examine the historical development of tort law in these jurisdictions, my analysis will be confined to recent case-law and a discussion paper produced by the Australian Government. While there has been a significant parallel in the approach and ambit of duty of care in both of these jurisdictions (Katter, 2002), each one has followed a different test for establishing personal liability in a corporate context. United Kingdom The most authoritative case to date in the UK is the House of Lords decision in Williams v Natural Health Foods Ltd (1998) 2 All ER 577 (“Williams”), which in most respects upheld the decision in Trevor Ivory. In this case, Mr Williams had approached Natural Health Foods Limited (“NHFL”) to obtain a franchise for a health food shop. Brochures issued by the company emphasised the experience and expertise of Mr Mistlin, the managing director. Amongst other things, the brochures detailed future projections and profitability of the franchise in question. Mr Mistlin played a prominent role in the production of the projections, which Mr Williams relied on in deciding to take up the franchise. Unfortunately, the turnover proved to be substantially less than what was stated in the brochure and the franchise was subsequently wound up. Mr Williams argued that Mr Mistlin was personally liable for the negligent misstatements in the brochure. The House of Lords held that in order to fix a director with personal liability for the loss suffered by a client of the company, it had to be shown that: 1. 2. Mr Mistlin (the director) had assumed personal responsibility for the advice; and Mr Williams had relied upon the assumption of responsibility (pp.584-585). Lord Steyn delivered the leading judgment. His lordship concluded that in determining whether a director had assumed personal responsibility, an objective test applied (p. 582). The primary focus was on things said or done by the director or on his or her behalf in dealings with the plaintiff (p. 582). The question to be asked was whether the director or anyone on his/her behalf conveyed directly or indirectly to the plaintiff that the director has assumed personal responsibility towards the plaintiff? Lord Steyn held that in respect of reliance by the plaintiff, the test is not simply reliance in fact (p. 583). The test is whether the plaintiff could reasonably rely on an assumption of personal responsibility (p. 583). The House of Lords held that there were no exchanges or conduct which could have conveyed to the plaintiffs that Mr Mistlin was willing to assume personal responsibility (p.584); nor was there anything in the evidence that suggested the plaintiffs had believed Mr Mistlin was undertaking personal liability towards them (p. 584). The House of Lords therefore concluded that Mr Mistlin was not personally liable. June 24-26, 2007 Oxford University, UK 10 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Comparison with Trevor Ivory While the House of Lords upheld the Trevor Ivory decision, Lord Steyn’s reasoning differed in a number of crucial respects. Lord Steyn accepted that a director as an agent, owned primary liability for his own acts, therefore when a director acted on behalf of a company he might incur personal liability in tort and the company in turn could be vicariously liable as principal (p. 582). As far as assumption of responsibility (under Hedley Byrne) was concerned, Lord Steyn concluded that this was relevant because it was part and parcel of the tort itself (pp. 581-582). However in Trevor Ivory, assumption of responsibility was no more than a superadded element required only where the tort applied to company directors (Grantham et al., 2002). Another difference was the issue of the immunity of company directors. In Trevor Ivory the immunity arose from the internal workings of company law, in particular the rules of authority and attribution, and the determination that company law rules should prevail over those of tort law (Grantham et al., 2002). Lord Steyn however, treated the matter as entirely within the law of torts: directors do not incur personal liability for negligent advice given in the course of the routine conduct of the company’s business, not because they occupy a unique position or because the rules of company law protect them, but simply because the crucial elements of the relevant tort have not been made out (Grantham et al., 2002). The outcome in Williams is still hard to digest. The fact that an assumption of responsibility by the director still has to be proved by the plaintiff creates an unrealistically high evidential burden for the plaintiff, just like it did in Trevor Ivory. Mr Williams should have been able to prove that the managing director had assumed responsibility, using agency and tort principles. The director assumed the task of preparing the financial information, therefore he owed the purchaser a duty of care – there was a sufficiently close relationship between Mr Williams and Mr Mistlin, and he knew the brochure would be given to prospective clients – that’s why it was made. He would have known that the brochure would be relied on by prospective clients when deciding whether or not to purchase a franchise. If fact, making the brochure was part of the usual business practice of his company, therefore when he made it he was acting as an employee, not in his ‘other’ role as managing director. It therefore should not have mattered that he did not personally advise Mr Williams or hand him the brochure in person. Despite this, Lord Steyn insisted that there were no personal dealings between the two parties or exchanges of conduct, which conveyed to Mr Williams that Mr Mistlin was prepared to assume personal responsibility (p.585). While this might be true, there were those very dealings with a junior employee who had sent them the financial projections. Clearly, Mr Mistlin was liable under the principles of agency and tort. It makes no sense to say that Mr Mistlin was not liable because he did not meet the clients and advise them personally, and to also say that the junior employee was not liable because he did not prepare the projections himself. Mr Mistlin as senior employee should have been personally liable as agent for his company (and for tasks which he delegated to his junior employee) and his company should have been vicariously liable for authorising his acts. Australia The Corporations Act 2001 is the principal legislation regulating companies in Australia. In terms of directors’ duties, the Act is virtually identical to the NZ Act. With regard to case-law, Australia has relatively few cases which look at the issue of whether directors are personally liable for their tortious conduct while acting for the company (Anderson, 2004). Australia’s case-law draws heavily on precedents from other commonwealth jurisdictions. The most popular test is the ‘direct or procure’ test 9, which has frequently been used for establishing personal liability in a corporate context. Under this test, a director will be found liable if it is shown that he/she expressly directed or procured the act or omission in question. This is the test most likely to lead to liability, particularly in the case of small or one-person proprietary companies (Anderson, 2004). When applying the test, the Courts pay no regard to the separate entity principle (Anderson, 2004). The test is therefore weighed in favour of the third-party plaintiff. The test has been applied in a number of Australian cases involving the torts of negligence, breach of copyright, nuisance, deceit, and conversion (see for example the decisions in Australasian Performing Right Association Ltd v Valamo Pty Ltd (1990) 18 IPR 216; Kalamazoo (Aust) Pty Ltd v Compact Business Systems Pty Ltd (1985) 84 FLR 101,127; Martin Engineering Co v Nicaro Holdings Pty Ltd (1991) 100 ALR 358; and more recently in Microsoft Corporation v Auschina Polaris Pty Ltd [1996-7] 142 ALR 111). 9 Used in various Commonwealth Countries. June 24-26, 2007 Oxford University, UK 11 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 In the more recent case of Microsoft, a company was involved with the importation and sale of unlicensed reproductions of computer software. Lindgren J. held that the director who alone negotiated the purchase, importation and sale was personally liable under the ‘direct or procure’ test. The ‘direct or procure’ test focuses attention on the relationship between the director's intention and the particular corporate conduct, which the law characterises as tortious (p. 111). What seems to underlie this test is the notion that companies can engage in tortious conduct only through human beings, and at least ordinarily, where a particular human being is involved and responsible, he or she should, as a matter of policy, be liable (p. 111). After all, even if the aggrieved party did not sue the director personally, apparently the director would be liable to indemnify the company in respect of its liability to the aggrieved party (p. 111). The rationale behind this test could easily apply in NZ. Section 137 of the Companies Act 1993 expressly states that “A director of a company when exercising powers or performing duties as a director, must exercise the care, diligence, and skill that a reasonable director would exercise in the same circumstances.” Therefore by negligently advising a client, it could be argued that a director has breached s 137 and should therefore indemnify the company for the loss he or she has caused the company. The company in turn could then fully indemnify the client. It is submitted that the ‘direct or procure’ test is a good test for determining the personal liability of any company employee. The fact that it doesn’t take into account the corporate form is not, it is submitted, prejudicial in determining liability for negligence. Tort and agency principles are applicable in any situation where an employee has negligently advised a client. A duty of care exists in such a situation, therefore no distinction should be made when establishing if the defendant (managing director) owes the plaintiff a duty of care, even though his company contracted with the plaintiff. Like NZ, the Australian market is made up of predominantly SMEs, which comprise 99.5% of total operating businesses (Jensen & Webster, 2004). These proprietary companies (where shareholders stand behind the company) make up the majority of total companies. Statistics show that there are about 1,232,150 registered companies out of which 1,213,400 are proprietary companies. Interestingly, in an empirical study (by Ramsay & Noakes in 2001) where the courts pierced the corporate veil in Australia, it was noted that the number of shareholders in a company makes a significant difference to the piercing rate. Where a company has only one shareholder the piercing rate is 50% (Ramsay et al., 2001). This declines as the number of shareholders increases. It was also noted that the courts are more prepared to lift the veil of a proprietary company (42.4%) than a public company (22%), and also piercing was more likely in contract rather than in a tort context (Ramsay et al., 2001). Does this mean that the courts’ view proprietary companies as somehow different from public companies? The most obvious difference between the two is that with proprietary companies, there is no clear separation between management and control on the one-hand, and ownership on the other. Thus it is quite common for one person to be both the sole director and shareholder. As I have already indicated, the incentive for a sole trader to incorporate and then hide behind the corporate veil in their dealings with third-parties would be far greater in a one-person company than in a large publicly held company. As far as further research is concerned, the Australian Corporations and Advisory Committee produced a discussion paper in 2005, which examines the current law relating to the personal liability for corporate fault. Whilst the paper focuses primarily on the criminal liability of directors, a number of points were raised on civil liability also. The discussion paper examines direct and derivative liability, which apply more to criminal liability, however it notes that in all cases of personal liability: namely civil and criminal, compliance is essential with the relevant legislation concerned, i.e. not only the Corporations Act 2001. In this regard it is submitted that the decision in Trevor Ivory highlights the fact that compliance with all relevant legislation is not taken seriously enough, and is essential for effective corporate governance in NZ. Another option for New Zealand: A review of section 9 of the Fair Trading Act 1986 The Fair Trading Act 1986 is a piece of consumer legislation. The Act is therefore geared towards protecting consumers’ interests. With this object in mind it is useful to examine the workings of section 9 of the Act, which deals with misleading and deceptive conduct generally. Section 9 states: that ‘no person shall, in trade, engage in conduct that is misleading or deceptive or is likely to mislead or deceive.’ Under this provision, directors have been held personally liable (see Specialised Livestock Import Limited v Borrie, Unreported, Court of Appeal 28 March 2001; Jagwar Holdings Ltd v Julian (1992) 6 NZCLC 68, 0404; Hill Country Beef New Zealand Ltd v Sharplin & Donovan, Unreported, CP 5/95, 28 March 1996). June 24-26, 2007 Oxford University, UK 12 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Cases decided under the Act provide an interesting contrast to the decisions in Trevor Ivory and Williams. The Act recognises that corporations will be liable for their agents and the agents will also be personally liable. The case of Kinsman v Cornfields unreported, Court of Appeal, 13 December 2001 (“Kinsman”) provides an interesting contrast. This case had very similar facts to Williams yet it produced an entirely different result. In the next section, I intend to explore section 9 of the Act and examine why, when we are presented with similar fact scenarios, the NZ Courts are turning out such different decisions. Kinsman Facts Mr Kinsman sold his franchise to the Cornfields. He made representations as to turnover; however they were out of date and overstated. The question for the Court of Appeal was whether Mr Kinsman was personally liable rather than his company. Mr Kinsman argued that he was merely a conduit of his company: that is, he did not make the representations himself, he merely passed them on. The Court of Appeal held that it would be a rare case that a director who took a role in negotiations could avoid liability under the Act on this basis. The Court concluded that the director was clearly the alter ego of the company and could not fairly say he was just passing on another party’s words: i.e. the company he worked for. Importantly, intention is not required under section 9: that is, it does not need to be shown that the director or employee in question intended to mislead or deceive. Also under section 9, the statement made by the defendant must be material and a nexus must be established between the misleading statement and the loss suffered. On the whole, the section 9 test is much wider in scope than the Trevor Ivory and Williams’ tests. In fact if these cases were decided under section 9, both Mr Ivory and Mr Mistlin would have been caught under the Act, the result being that they both would have been personally liable for the misleading advice they gave. Both cases established a clear connection between the misleading advice in question and the loss suffered. Furthermore, it does not matter whether the representation is fact or opinion and includes future projections of income. In Jagwar Holdings Ltd v Julian (1992) 6 NZCLC 68,040, two directors were held liable under section 9 for forecasting inflated future profits to potential investors. The profits turned out to be untrue and were therefore classified as misleading. Section 9 of the Act is very liberal in its interpretation and it is therefore very easy for plaintiffs to meet its requirements in order to find directors liable. Clients of companies in a similar situation to the Anderson’s and Williams’ have a very effective remedy under section 9 of the Act. Monetary compensation will be granted for damages (the tort measure of damages will apply in most cases (the actual loss suffered); however expectation losses (loss of profits) may also be granted (see Cox & Coxon Ltd v Leipst [1999] 2 NZLR 15. The Act offers an effective way to make directors or employees personally liable when speaking or acting on behalf of their company or employer. Clients of NZ companies must be made aware of the widened liability under the Act because it may not be immediately obvious that they have a case which comes within the scope of the Act. Importantly, the Act represents a significant limitation to the concept of limited liability. Furthermore, under the s 45(2) (a) and s 45(2) (b) of the Act: Any conduct engaged in on behalf of a body corporate by a director, servant, or agent of the body corporate, acting within the scope of that person’s actual or apparent authority; or by any other person at the direction or with the consent or agreement (whether express or implied) of a director, servant, or agent of the body corporate, given within the scope of the actual or apparent authority of the director, servant or agent shall be deemed for the purposes of this Act, to have been engaged in also by the body corporate. The Act therefore clearly separates a director or employee from the company itself. June 24-26, 2007 Oxford University, UK 13 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 Conclusion The current law in NZ relating to the personal liability of company directors for negligent misstatements made to innocent clients is far from satisfactory. The Court of Appeal in Trevor Ivory granted a very generous immunity and protection to NZ directors on the basis that the principles of limited liability and separate entity should not be eroded by imposing liability on directors. As the paper has highlighted, these principles would not be affected by imposing liability on directors for torts committed in the course of business. Unfortunately, the Court gave no consideration to the equally important policy reasons in favour of ensuring innocent third party clients’ receive protection from the careless actions of directors. Further consideration should have also been given to the policy reasons in favour of imposing liability on negligent directors, especially in light of the large amount of SMEs in the NZ business environment, and the fact that innocent thirdparty clients are likely to be left wearing the loss resulting from negligent advice. From a practical viewpoint, criticism has been made of the judiciary’s reluctance to ensure that company law keeps apace with the realities in commerce and business practice in NZ. The decision in Trevor Ivory is therefore criticised for being based entirely on orthodox and outdated company law principles, which have no practical effect. While these principles are important because they establish that a corporation is a separate legal entity, separate from its members. In practice these principles have had to undergo significant development in order to keep up with the demands of business in a civilised society. As I have highlighted, in many business situations, limited liability is often more illusory than real. Therefore commercial practice has dictated that orthodox principles have limited practical applicability. It is submitted that the NZ Law Commission thoroughly review the law in this area. The lack of a satisfactory judicial response to date and the inconsistencies between legislation, which are resulting in entirely different outcomes, must be addressed. A new provision that incorporates the principles in sections 9 and 45(2) (a) and (b) of the Fair Trading Act 1986 should be inserted in the Companies Act 1993 to ensure consistency between both pieces of legislation. For situations not captured by the new provision, application of longestablished principles of agency and tort law can easily remedy a Trevor Ivory type-situation. By doing so, this would provide consistent results to all employees, without threatening the very existence of the company per se. June 24-26, 2007 Oxford University, UK 14 2007 Oxford Business & Economics Conference ISBN : 978-0-9742114-7-3 REFERENCES Anderson, H. (2004). The theory of the corporation and its relevance to directors’ tortious liability to creditors. Australian Journal of Corporate Law, 16, 1-15. Anns v Merton London Borough Council [1978] AC 728. Australasian Performing Right Association Ltd v Valamo Pty Ltd (1990) 18 IPR 216. Australian Government Corporations and Markets Advisory Committee. (2005). Personal liability for Corporate Fault: Discussion Paper. Sydney. Banfield v Johnson (1994) 7 NZCLC 260,497. Borrowdale, A Rowe, D & Taylor, L. (2002). Company Law Writings: A New Zealand Collection. Centre for Commercial & Corporate Law Inc: University of Canterbury New Zealand. Chen v Butterfield (1996) 7 NZCLC 261,086. Cox & Coxon Ltd v Leipst [1999] 2 NZLR 15. C Evans & Sons Ltd v Spritebrand Ltd [1985] 1 WLR 317. Companies Act 1993. Corporations Act 2001. Dal Pont, G.E & Chalmers, D.R.C. (2000). Equity and Trusts in Australia and New Zealand (2nd ed.) Brookers: New Zealand. Director of Public Prosecutions v Gomez [1993] AC 442. Fair Trading Act 1986. Farrar, J. (2003). Corporate Governance in Australia and New Zealand. Oxford University Press: Oxford. Farrar, J. (2005). Corporate Governance Theories, Principles and Practice (2nd ed.). Oxford University Press: Oxford. Gilford Motor Co Ltd v Horne [1933] 1 Ch 935. Grantham, R & Rickett, C. (2002). Company and Securities Law: Commentary and Materials. Brookers: New Zealand. Grantham, R. (1997). Company directors and tortious liability. Cambridge Law Journal, 259-262. Hedley Byrne & Co Ltd v Heller & Partners [1964] AC 465. Hill Country Beef New Zealand Ltd v Sharplin & Donovan, Unreported, CP 5/95, 28 March 1996. Jagwar Holdings Ltd v Julian (1992) 6 NZCLC 68, 0404. Jensen, P.H., &Webster, E. (2004). SMEs and Their Use of Intellectual Property Rights in Australia. Retrieved 5 March 2007 from the World Wide Web: www.melbourneinstitute.com/wp/wp2004n17.pdf Jones v Lipman [1962] 1 WLR 832. Kalamazoo (Aust) Pty Ltd v Compact Business Systems Pty Ltd (1985) 84 FLR 101,127. Katter, N.A. (2002). The ambit of duty of care for negligent misstatement in the United Kingdom and Australia. Professional Negligence, 18, 82. Kinsman v Cornfields Unreported, Court of Appeal, 13 December 2001. Lee v Lee’s Air Farming Ltd [1961] AC. Livingston v Bonifant (1995) 7 NZCLC 260,657. Martin Engineering Co v Nicaro Holdings Pty Ltd (1991) 100 ALR 358. Meridian Global Funds Management Asia Ltd v Securities Commission [1995] 3 NZLR 7. Microsoft Corporation v Auschina Polaris Pty Ltd [1996-7] 142 ALR 111. Ministry of Economic Development. (2005). SMEs in New Zealand: structure and dynamics.. Wellington. Nordick Industries Ltd v Regional Controller of Inland Revenue [1976] 1 NZLR 194. Payne, J. (1997). Lifting the Corporate Veil: A reassessment of the fraud exception. Cambridge Law Journal, 56, 284. Ramsay, I.M., & Noakes, D.B. (2001). Piercing the Corporate Veil in Australia. Company & Security Law Journal, 19, 1-39. Re South Pacific Shipping Ltd (In Liq) Unreported, High Court, 2004. Salomon v Salomon & Co Ltd [1897] AC 22. Seagar, G., & Eric, C. (2006). Affirmation and clarification of Trevor Ivory. New Zealand Law Journal, 268-271. South Pacific Manufacturing Co Ltd v NZ Security Consultants and Investigations Ltd [1992] 2 NZLR 282. Specialised Livestock Import Limited v Borrie, Unreported, Court of Appeal 28 March 2001. Standard Chartered Bank v Pakistan National Shipping Corp [2002] UKHL 43. Statistics New Zealand. (2006). New Zealand Business Demography Statistics. Retrieved from the World Wide Web:http://www.stats.govt.nz/NR/rdonlyres/29E85B4D-6CA6-4047-AA92-8DAECE1620BE/0/businessdemography06hotp.pdf Tesco Supermarkets v Nattrass [1972] AC 153. Todd, S. (1998). Liability of agents in tort. Professional Negligence,14, 136-142. Todd, S. (2003). Assuming Responsibility for Torts. Law Quarterly Review, 119, 199-204. Todd, S. (1993). Duties of care: the New Zealand jurisprudence Part 2: Particular duty problems. Professional Negligence, 9, 54. Trevor Ivory Ltd v Anderson [1992] 2 NZLR 517. Trade Descriptions Act 1968. Watson, S. (2004). The Law of Business Organisations (4th ed.). Auckland: Palatine Press. Williams v Natural Life Foods (1998) 2 All ER 577. Wishart, D.A. (1993). Anthromorphism rampant: rounding up executive directors’ liability. New Zealand Law Journal, 175-176. Wishart, D. (2003). Corporate Criminal Liability – The Move Towards Recognising Genuine Corporate Fault. Columbia Law Review, 9, 151. June 24-26, 2007 Oxford University, UK 15