PowerPoint for Chapter 23

advertisement

Financial Analysis, Planning and

Forecasting

Theory and Application

Chapter 23

Simultaneous-Equation Models for Financial Planning

By

Alice C. Lee

San Francisco State University

John C. Lee

J.P. Morgan Chase

Cheng F. Lee

Rutgers University

Outline

23.1 Introduction

23.2 Warren and Shelton model

23.3 Eastman Kodak as a case study

23.4 Francis and Rowell (FR) model

23.5 Summary

Appendix 23A. Procedure of Using Microsoft

Excel to Run FINPLAN Program

Appendix 23B. Program of FINPLAN With

An Example

23.1 Introduction

23.2 Warren and Shelton model

23.2 Warren and Shelton model

TABLE 23.1 The Warren and Shelton Model (Cont.)

III. Financing the desired level of assets

(6)CLt RCLt SALESt

(7) NFt ( At CLt PFDSKt ) ( Lt 1 LRt ) St 1 Rt 1

bt {(1 Tt )[ EBITt it 1 ( Lt 1 LRt )] PFDIVt }

(8) NFt bt (1 Tt )[ite NLt U t1 NLt ] NLt NSt

(9) Lt Lt 1 LRt NLt

(10) St St 1 NSt

(11) Ri Rt 1 bt {(1 Tt )[ EBITt it Lt U t1 NLt ] PFDIVt }

(12)it it 1 (

(13)

Lt 1 LRt

NL

) ite t

Lt

Lt

Lt

Kt

St Rt

23.2 Warren and Shelton model

TABLE 23.1 The Warren and Shelton Model (Cont.)

23.2 Warren and Shelton model

23.2 Warren and Shelton model

TABLE 23.2 List of unknowns and list of parameters provided by

management (Cont.)

23.2 Warren and Shelton model

TABLE 23.3 FINPLAN input format (Cont.)

INPUT DATA

Variable * Variable **

Number Number Data***

21

2

11,703.7

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

3

6

7

8

13

14

9

12

15

17

18

5

10

0.0726

0.1368

0.6805

0.1698

0.0

0.0

4,880.6

553.7

716.1

9,006.2

0.6054

0.3524

0.0631

GCALS t

RCA t-1

RFA t-1

RCL t-1

PFDSK t-1

PFDIV t-1

L t-1

LR t-1

S t-1

R t-1

b t-1

T t-1

i t-1

Description

The net sales (revenues) of the firm at the beginning

of the simulation. t-1= 1999

Growth rate in sales during period t .

Expected ratio of current assets (CA) to sales in t.

Expected ratio of fixed assets (FA) to sales in t.

Current Payables as a Percent of Sales

Preferred Stock

Preferred Dividends

Debt in Previous Period

Debt Repayment

Common Stock in Previous Period

Retained Earnings in Previous Period

Retention Rate

Average Tax Rate

Average Interest Rate in Previous Period

11

4

0.0631

0.1967

i et-1

REBIT t-1

Expected Interest Rate on New Debt

Operating Income as a Percentage of Sales

21

0.0631

UL

Underwriting Cost of Debt

0.1016

1.2446

461.1

23.7

E

22

19

16

20

Variable

SALE t-1

U

Kt

NUMCS t-1

mt-1

Underwriting Cost of Equity

Ratio of Debt to Equity

Number of Common Shares Outstanding in Previous Period

Price-Earnings Ratio

* Variable number as defined in Table 23-2.

** Variable number to be inputed in FinPlan computer program .

*** Data obtained from Anheuser-Busch Balance Sheets and Income Statements

Balance Sheet

23.2

Warren

and

Shelton

model

TABLE 23.3

(Cont.)

Historical or

Base-Period

input:

ANHEUSER-BUSCH COS INC

ANNUAL BALANCE SHEET

TICKER:

SIC:

GICS:

($ MILLIONS)

Dec-99

ASSETS

Cash & Equivalents

Net Receivables

Inventories

Prepaid Expenses

Other Current Assets

-----------------Total Current Assets

Dec-98

Dec-97

Dec-96

Dec-95

Dec-94

Dec-93

Dec-92

Dec-91

Dec-90

Dec-89

152.1

224.8

147.3

93.6

93.6

156.4

127.4

215

97.3

95.3

36.4

629

610.1

713.4

632.7

544.3

784.6

751.1

649.8

654.8

562.6

527.8

623.8

623.4

550.2

531.1

582.7

624.8

626.7

660.7

635.6

567.2

531.7

0

0

0

0

0

0

0

0

0

0

0

195.7

182.1

173

208.4

290

295.8

290

290.3

240

201.2

181

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------1,600.60

1,640.40

1,583.90

1,465.80

1,510.60

1,861.60

1,795.20

1,815.80

1,627.70

1,426.30 1,276.90

Gross Plant,Property & Equipment 14,379.60

13,837.70

13,227.60

12,214.70

11,319.70

12,224.10

11,727.10

11,385.10

10,589.60

10,016.70 9,187.90

Accumulated Depreciation

6,415.00

5,988.70

5,477.00

5,006.50

4,556.70

4,676.40

4,230.00

3,861.40

3,393.10

2,952.90 2,516.60

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Net Plant,Property & Equipment

7,964.60

7,849.00

7,750.60

7,208.20

6,763.00

7,547.70

7,497.10

7,523.70

7,196.50

7,063.80 6,671.30

Investments at Equity

Other Investments

Intangibles

Deferred Charges

Other Assets

-----------------TOTAL ASSETS

2,012.50

1,880.60

1,296.80

741.2

178.2

177.5

136.1

171.6

116.9

100.8

87.4

119

116.4

128.1

129.3

618.6

634.9

645.3

164.8

159.9

151.4

141.1

425

442.2

451.9

435.8

443.8

483.4

495.9

505.7

519.9

533.6

536.8

518.7

555.7

515.8

483.3

312.7

340.3

310.7

0

0

0

0

764

0

0

356.3

365.6

358.4

312.2

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------12,640.40

12,484.30

11,727.10

10,463.60

10,590.90

11,045.40

10,880.30

10,537.90

9,986.50

9,634.30 9,025.70

LIABILITIES

Notes Payable

Accounts Payable

Taxes Payable

Accrued Expenses

Other Current Liabilities

-----------------Total Current Liabilities

242.3

0

0

0

0

0

0

0

0

0

0

932.6

905.7

791.8

726.8

682.8

850.9

812.5

737.4

709.8

711.2

608

164.2

193.6

183.9

233

0

0

91

38.8

45.2

79.2

40

263

256.3

224.3

227.6

333.3

448.9

609.7

426.7

392.7

391.1

337.6

385.1

374.7

300.7

243.5

225.9

369.2

302.4

256.9

255.1

230.4

213

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------1,987.20

1,730.30

1,500.70

1,430.90

1,242.00

1,669.00

1,815.60

1,459.80

1,402.80

1,411.90 1,302.60

Long Term Debt

Deferred Taxes

Investment Tax Credit

Minority Interest

Other Liabilities

-----------------TOTAL LIABILITIES

4,880.60

4,718.60

4,365.60

3,270.90

3,270.10

3,078.40

3,031.70

2,642.50

2,644.90

3,147.10 3,307.30

1,344.70

1,303.60

1,293.60

1,208.10

1,132.80

1,258.20

1,170.40

1,276.90

1,500.70

1,396.20 1,315.90

0

0

0

0

0

0

0

0

0

0

0

@IF

@IF

@IF

0

0

0

0

0

0

0

0

506.4

515.8

525.4

524.6

512.1

624.3

607.1

538.3

0

0

0

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------8,718.90

8,268.30

7,685.30

6,434.50

6,157.00

6,629.90

6,624.80

5,917.50

5,548.40

5,955.20 5,925.80

23.2

Warren and Shelton model

TABLE 23.3 (Cont.) Historical or Base-Period input:

Balance Sheet

ANHEUSER-BUSCH COS INC

ANNUAL BALANCE SHEET

TICKER:

SIC:

GICS:

($ MILLIONS)

Dec-99

Dec-98

Dec-97

Dec-96

Dec-95

Dec-94

Dec-93

Dec-92

Dec-91

Dec-90

Dec-89

EQUITY

Preferred Stock - Redeemable

0

0

0

0

0

0

0

0

0

0

0

Preferred Stock - Nonredeemable

0

0

0

0

0

0

0

0

0

0

0

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Total Preferred Stock

0

0

0

0

0

0

0

0

0

0

0

Common Stock

716.1

712.7

709.3

705.8

347.3

343.8

342.5

341.3

338.5

335.7

333.9

Capital Surplus

1,030.50

870.3

734.9

613.8

665.1

479.4

402.2

328.5

193.3

73.9

7.2

Retained Earnings

9,006.20

8,115.10

7,390.90

6,915.70

6,857.50

6,634.90

5,990.40

5,793.50

5,230.50

4,592.60 3,995.60

Less: Treasury Stock

6,831.30

5,482.10

4,793.30

4,206.20

3,436.00

3,042.60

2,479.60

1,842.90

1,324.20

1,323.10 1,236.80

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Common Equity

3,921.50

4,216.00

4,041.80

4,029.10

4,433.90

4,415.50

4,255.50

4,620.40

4,438.10

3,679.10 3,099.90

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------TOTAL EQUITY

3,921.50

4,216.00

4,041.80

4,029.10

4,433.90

4,415.50

4,255.50

4,620.40

4,438.10

3,679.10 3,099.90

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------TOTAL LIABILITIES & EQUITY 12,640.40

12,484.30

11,727.10

10,463.60

10,590.90

11,045.40

10,880.30

10,537.90

9,986.50

9,634.30 9,025.70

COMMON SHARES OUTSTANDING 461.1

476.6

487.02

497.357

507.952

514.58

534.074

556.804

570.104

564.612

565.974

Income Statement

ANHEUSER-BUSCH COS INC

ANNUAL INCOME STATEMENT

23.2

Warren

and

Shelton

model

TABLE 23.3

(Cont.)

Historical

or BasePeriod

input:

($ MILLIONS, EXCEPT PER SHARE)

Dec-99

Dec-98

Dec-97

Dec-96

Dec-95

Dec-94

Dec-93

Dec-92

Dec-91

Dec-90

Dec-89

Sales

11,703.70 11,245.80 11,066.20 10,883.70 10,340.50 12,053.80 11,505.30 11,393.70 10,996.30 10,743.60 9,481.30

Cost of Goods Sold

6,477.40 6,424.10 6,413.20 6,370.70 6,225.40 7,156.90 6,825.60 6,756.30 6,628.80 6,612.00 5,869.40

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Gross Profit

5,226.30 4,821.70 4,653.00 4,513.00 4,115.10 4,896.90 4,679.70 4,637.40 4,367.50 4,131.60 3,611.90

Selling, General, &

Administrative Expense

2,147.00 1,958.00 1,916.30 1,890.00 1,756.60 2,370.30 2,308.70 2,308.90 2,126.10 2,051.10 1,876.80

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Operating Income Before Deprec.

3,079.30 2,863.70 2,736.70 2,623.00 2,358.50 2,526.60 2,371.00 2,328.50 2,241.40 2,080.50 1,735.10

Depreciation, Depletion, &

Amortization

777

738.4

683.7

593.9

565.6

627.5

594.1

552.8

519.9

481.5

406.4

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Operating Profit

2,302.30 2,125.30 2,053.00 2,029.10 1,792.90 1,899.10 1,776.90 1,775.70 1,721.50 1,599.00 1,328.70

Interest Expense

307.8

291.5

261.2

232.8

225.9

221.4

207.8

199.6

238.5

283

177.9

Non-Operating Income/Expense

170.6

103.8

91

41.9

54.7

29.4

46.3

39.1

37.6

36.1

75.9

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Pretax Income

2,165.10 1,937.60 1,882.80 1,892.90 1,461.70 1,707.10 1,050.40 1,615.20 1,520.60 1,352.10 1,226.70

Total Income Taxes

762.9

704.3

703.6

736.8

575.1

675

455.9

621

580.8

509.7

459.5

Minority Interest

@IF

@IF

@IF

0

0

0

0

0

0

0

0

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Income Before Extraordinary

Items & Discontinued Operations

1,402.20 1,233.30 1,179.20 1,156.10

886.6 1,032.10

594.5

994.2

939.8

842.4

767.2

Preferred Dividends

0

0

0

0

0

0

0

0

0

0

0

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Available for Common

1,402.20 1,233.30 1,179.20 1,156.10

886.6 1,032.10

594.5

994.2

939.8

842.4

767.2

Savings Due to Common

Stock Equivalents

0

0

0

0

0

0

0

0

0

0

0

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Adjusted Available for Common

1,402.20 1,233.30 1,179.20 1,156.10

886.6 1,032.10

594.5

994.2

939.8

842.4

767.2

Extraordinary Items

0

0

-10

0

0

0

0

-76.7

0

0

0

Discontinued Operations

0

0

0

33.8

-244.3

0

0

0

0

0

0

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Adjusted Net Income

1,402.20 1,233.30 1,169.20 1,189.90

642.3 1,032.10

594.5

917.5

939.8

842.4

767.2

23.2

Warren and Shelton model

TABLE 23.3 (Cont.) Historical or Base-Period input:

Income Statement

ANHEUSER-BUSCH COS INC

ANNUAL INCOME STATEMENT

($ MILLIONS, EXCEPT PER SHARE)

PER SHARE DATA

Earnings Per Share Basic Excluding Extra Items & Disc Op

Dec-99 Dec-98 Dec-97 Dec-96 Dec-95 Dec-94 Dec-93 Dec-92 Dec-91 Dec-90 Dec-89

2.99

2.56

2.39

2.28

1.72

1.96

1.09

1.74

1.63

1.48

1.34

Earnings Per Share Basic Including Extra Items & Disc Op

2.99

2.56

2.37

2.35

1.25

1.96

1.09

1.61

1.63

1.48

1.34

Earnings Per Share DilutedExcluding Extra Items & Disc Op

2.94

2.53

2.36

2.27

1.71

1.94

1.09

1.73

1.63

1.48

1.34

Earning Per Share Diluted Including Extra Items & Disc Op

2.94

2.53

2.34

2.34

1.25

1.94

1.09

1.6

1.63

1.48

1.34

EPS Basic from Operations

2.99

2.57

2.39

2.15

1.91

1.96

1.72

1.74

1.63

1.48

1.34

EPS Diluted from Ops

2.94

2.54

@NA

@NA

@NA

@NA

@NA

@NA

@NA

@NA

@NA

Dividends Per Share

1.16

1.08

1

0.92

0.84

0.76

0.68

0.6

0.53

0.47

0.4

Com Shares for Basic Eps

469.5

482.1

492.6

505.8

515.8

528.2

548.6

571.6

575.8

569.2

572.4

Com Shares for Diluted EPS

476.8

487.5

499.7

510.6

524.4

538

558.6

581.6

585.8

579.4

@NA

Statement of Cash Flows

ANHEUSER-BUSCH COS INC

ANNUAL STATEMENT OF CASH FLOWS

TICKER:

SIC:

GICS:

23.2

Warren

and

Shelton

model

TABLE 23.3

(Cont.)

BUD

2082

30201010

($ MILLIONS)

Dec-99

Dec-98

Dec-97

Dec-96

Dec-95

1,402.20

777

0

40.3

-155.5

1,233.30

738.4

0

34.5

-53.7

1,179.20

683.7

0

91.4

-49.9

1,156.10

593.9

52

93.8

886.6

565.6

-11

51.3

0

38.6

-18.9

-0.4

33.6

-29.4

-3.2

2,084.30

0

-27.1

103.3

-73.2

145.9

9.7

64.9

2,176.00

0

-93.2

-80.7

-19.1

61.7

-49.1

92.6

1,816.60

-33.4

-75.2

-88.4

51.6

24.6

146.7

99.2

2,020.90

0

184.4

54.2

-51.9

-126.2

-138.1

1,414.90

0

0

0

865.3

7

59.6

-812.7

0

0

0

817.5

566.5

0

-1,384.00

0

0

0

1,199.30

683.3

0

-1,882.60

0

0

0

1,084.60

135.7

116.6

-1,103.70

0

0

0

952.5

82.9

0

-1,035.40

129.9

1,349.20

544.7

973.4

553.7

0

-1,344.30

0

107.4

688.8

521

451.5

63.6

0

-714.5

0

95.1

587.1

492.6

1,245.90

141.6

0

119.7

0

113.4

770.2

458.9

773.6

575.1

0

-917.2

0

159

393.4

429.5

597.6

363.6

0

-429.9

0

Cash and Equivalents - Change

-72.7

77.5

53.7

0

-50.4

DIRECT OPERATING ACTIVITIES

Interest Paid - Net

Income Taxes Paid

286.9

706.2

263.3

644.3

205.1

609.5

208

533.6

198

546.6

INDIRECT OPERATING ACTIVITIES

Income Before Extraordinary Items

Depreciation and Amortization

Extraordinary Items and Disc. Operations

Deferred Taxes

Equity in Net Loss (Earnings)

Sale of Property, Plant, and Equipment

and Sale of Investments - Loss (Gain)

Funds from Operations - Other

Receivables - Decrease (Increase)

Inventory - Decrease (Increase)

Accounts Payable and Accrued Liabs - Inc (Dec)

Income Taxes - Accrued - Increase (Decrease)

Other Assets and Liabilities - Net Change

Operating Activities - Net Cash Flow

INVESTING ACTIVITIES

Investments - Increase

Sale of Investments

Short-Term Investments - Change

Capital Expenditures

Acquisitions

Investing Activities - Other

Investing Activities - Net Cash Flow

FINANCING ACTIVITIES

Sale of Common and Preferred Stock

Purchase of Common and Preferred Stock

Cash Dividends

Long-Term Debt - Issuance

Long-Term Debt - Reduction

Financing Activities - Other

Financing Activities - Net Cash Flow

Exchange Rate Effect

Retained Earnings Statement

23.2

Warren

and

Shelton

model

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS EQUITY

Anheuser-Busch Companies and Subsidiaries

YEAR ENDED DECEMBER 31 (in millions, except per share)

1999

COMMON STOCK

Balance, beginning of period

Shares issued under stock plans

Balance, end of period

1998

$712.7

3.4

$716.1

$709.3

3.4

TABLE 23.3

(Cont.)

RETAINED EARNINGS

Balance, beginning of period

Net income

$1,241.0

$1,017.0

100.5

$8,320.7

1,402.2

$9,181.2

$929.2

87.8

$1,117.5

$1,017.0

=============================================

$7,604.9

1,233.3

Common dividend paid (per share: 1999 - $1.16;

1998 - $1.08; 1997 - $1.00)

(544.7)

Shares issued under stock plans

3.0

Balance, end of period

$705.8

3.5

$712.7

$709.3

=============================================

CAPITAL IN EXCESS OF PAR VALUE

Balance, beginning of period

$1,117.5

Shares issued under stock plans

123.5

Balance, end of period

1997

3.0

(521.0)

3.53.5

$6,924.5

1,169.2

(492.6)

3.8 3.8

$8,320.7

$7,604.9

=============================================

Retained Earnings Statement

23.2

Warren

and

Shelton

model

YEAR ENDED DECEMBER 31 (in millions, except per share)

TREASURY STOCK

Balance, beginning of period

Treasuru stock acquired

Balance, end of period

ESOP DEBT GUARANTEE

Balance, beginning of period

Annual debt service

Balance, end of period

TABLE 23.3

(Cont.)

($5,482.1)

1,349.2

TOTAL SHAREHOLDERS EQUITY

COMPREHENSIVE INCOME

Net income

Foreign currency translation adjustment

($4,206.2)

587.1

($6,831.3)

($5,482.1)

($4,793.3)

=====================================================

($247.2)

36.7

($282.1)

34.9

($315.4)

33.3

($210.5)

($247.2)

($282.1)

=====================================================

ACCUMULATED OTHER COMPREHENSIVE INCOME

Balance, beginning of period

($205.6)

Foreign currency translation adjustment

30.6

Balance, end of period

($4,793.3)

688.8

($214.0)

8.4

($8.8)

(205.2)

($175.0)

($205.6)

($214.0)

=====================================================

$3,921.5

$4,216.0

$4,041.8

=====================================================

$1,402.2

30.6

$1,233.3

8.4

$1,169.2

(205.2)

TOTAL COMPREHENSIVE INCOME $1,432.8

$1,241.7

$964.0

=====================================================

The above data of financial statements is downloaded from the COMPUSTAT dataset. @NA represents data is not available.

23.3 Eastman Kodak as a case study

Data

sources and

parameter estimations

Procedure

for

calculating WS model

The Data Description

23.3 Eastman

Kodak as a case

study

Variable Description

SALE t-1 Sales in previous period

GCALS t Growth in Sales

RCA t-1

Current Assets as a Percent of Sales

RFA t-1

Fixed Assets as a Percent of Sales

RCL t-1

Current Payables as a Percent of Sales

PFDSKt-1 Preferred Stock

PFDIV t-1 Preferred Dividends

L t-1

Debt in Previous Period

LR t-1

Debt Repayment

S t-1

Common Stock in Previous Period

R t-1

Retained Earnings in Previous Period

b t-1

Retention Rate

T t-1

Average Tax Rate

i t-1

Average Interest Rate in Previous Period

i e t-1

Expected Interest Rate on New Debt

REBIT t-1 Operating Income as a Percentage of Sales

U

1

U

s

t

Underwriting Cost of Debt

t

Underwriting Cost of Equity

Kt

Ratio of Debt to Equity

NUMCS t-1Number of Common Shares Outstanding in Previous Period

m t-1

Price-Earnings Ratio

23.3 Eastman Kodak as a case study

Procedure for Calculating WS Model

By using the data above, we are able to calculate the unknown variables below:

(1) Salest = Salest-1 (1 + GCALSt)

= 11,703.7 1.0726

= 12,553.38

(2) EBITt = REBITt-1 Salest

= 0.1967 12,553.38

= 2,469.25

(3) CAt = RCAt-1 Salest

= 0.1368 12,553.38

= 1,717.30

23.3 Eastman Kodak as a case study

(4) FAt = RFAt-1 Salest

= 0.6805 12,553.38

= 8,542.58

(5) At = CAt + FAt

= 1,717.30 + 8,542.58

= 10,259.88

(6) CLt = RCLt-1 Salest

= 0.1698 12,553.38

= 2,131.56

(7) NFt = (At – CLt – PFDSKt) – (Lt-1 – LRt) – St-1 – Rt-1 – bt{(1 – Tt)[EBITt –

it-1(Lt-1 – LRt)] – PFDIVt}

= (10,259.88 – 2,131.56 – 0) - (4,880.60 – 553.70) – 716.1 – 9,006.20 –

0.6054{(1-0.3524)(2,469.25 - 0.0631(4,880.60 – 553.70) – 0}

= -6,781.92

23.3 Eastman Kodak as a case study

(12) itLt = i0(L0 – LRt) + ietNLt

= 0.0631(4,880.60 – 553.70) + 0.0631NLt

= 273.03 + 0.0631NLt

(8) NFt + bt(1-T)[iNLt + ULtNLt] = NLt + NSt

-6,781.92 + 0.6054(1 - 0.3524)(0.0631NLt + 0.03NLt) = NLt + NSt

-6,781.92 + 0.0365NLt = NLt + NSt

(a) NSt +0.9635NLt = -6,781.92

(9) Lt = Lt-1 – LRt + NLt

(b) Lt = 4,880.60 – 553.70 + NLt

Lt – NLt = 4,326.90

(10) St = St-1 + NSt

(c) -NSt + St = 716.1

(11) Rt = Rt-1 + bt{(1 – Tt)[EBITt – itLt – ULtNLt] – PFDIVt}

= 9,006.20 + 0.6054{0.6476[2,469.25 – itLt - 0.03NLt]}

23.3 Eastman Kodak as a case study

Substitute (12) into (11)

Rt = 9,006.20 + 0.6054{0.6476[2,469.25 – (273.027 + 0.0631NLt) - 0.03NLt]}

= 9,006.20 + 861.04 - 0.0357NLt

(d) Rt = 9,867.24 - 0.0357NLt

(13) Lt = (St + Rt)Kt

Lt = 1.2446St + 1.2446Rt

(e) Lt – 1.2446St – 1.2446Rt = 0

(b) – (e) = (f)

0 = (Lt – NLt – 4,326.90) – (Lt - 1.2446St - 1.2446Rt)

4,326.90= 1.2446St + 1.2446Rt – NLt

(f) – 1.2446(c) = (g)

4,326.9-4,880.7= (1.2446St - 1.2446Rt – NLt ) – 1.2446(-NSt + St )

3,435.64= 1.2446NSt - NLt + 1.2446Rt

23.3 Eastman Kodak as a case study

(g) – 1.2446(d) = (h)

3,435.64 - 12,280.77

= (1.2446NSt – NLt + 1.2446Rt ) – 1.2446(.0494NLt + Rt )

- 8,845.13 = 1.2446NSt – 1.06148NLt

(h) – 1.2446(a) = (i)

1.2446NSt – 1.06148NLt – 1.2446(NSt + 0.9505NLt )

= - 8,845.13 + 8,440.78

NLt = 180.15

Substitute NLt in (a)

NSt + 0.9635(180.15) = -6,781.92

NSt = -6,955.49

23.3 Eastman Kodak as a case study

Substitute NLt in (b)

Lt = 4,880.60 – 553.70 + 180.15

= 4,507.05

Substitute NSt in (c)

10,159.65 + St = 716.10

St = -6,239.39

Substitute NLt in (d)

Rt = 9,867.24 - 0.0357(180.15)

Rt = 9,860.81

Substitute NLtLt in (12)…

it(4,505.76) = 273.027 +0.0357(180.15)

it =0.0631

23.3 Eastman Kodak as a case study

(14) EAFCDt = (1 – Tt)(EBITt – itLt – ULtNLt)- PFDIVt

= 0.6476[2,469.25 – (0.0631)(4,505.76) - 0.0631(178.86)]

= 1,407.55

(15) CMDIVt = (1 – bt)EAFCDt

= 0.3946(1,407.55)

= 555.42

(16) NUMCSt = X1 = NUMCSt-1 + NEWCSt

X1 = 461.10 + NEWCSt

(17) NEWCSt = X2 = NSt / (1 – Ust) Pt

X2 = - 6,955.49 / (1 - 0.1016)Pt

(18) Pt = X3 = mtEPSt

X3 = 23.70(EPSt)

23.3 Eastman Kodak as a case study

(19) EPSt = X4 = EAFCDt / NUMCSt

X4 = 1,407.55 / NUMCSt

(20) DPSt = X5 = CMDIVt/ NUMCSt

X5 = 555.42 / NUMCSt

(A) = For (18) and (19) we obtain X3 = 23.70(1,407.55) / NUMCSt

=33,452.55/X1

Substitute (A) into Equation (17) to calculate (B)

(B) = -6,955.49 / (1-0.1016)(23.70)(1,407.55) / X1

(B) = 0.2321X1

23.3 Eastman Kodak as a case study

Substitute (B) into Equation (16) to calculate (C)

(C) = X1 = 461.10 - 0.2321X1

(C) = X1 = 374.24

Substitute (C) into (B)…

(B) = 0.3231X1

(B) = 116.92

From Equation (19) and (20) we obtain X4, X5 and X3

X4 = 1,411.5 / 374.24 = 3.76

X5 = 555.42 / 344.24 = 1.48

X3 = 23.70(3.76) = 89.11

23.3 Eastman Kodak as a case study

The results of the above calculations allow us to forecast the following information

regarding Anheuser-Busch in the 2000 fiscal year ($ in thousands, except for per

share data):

Sales = $12,553.38

Current Assets = $1,717.30

Fixed Assets = $8,542.58

Total Assets = $10,259.88

Current Payables = $2,131.56

Needed Funds = ($6,781.92)

Earnings Before Interest and Taxes = $2,469.25

New Debt = $180.15

New Stock = ($6,955.49)

Total Debt = $4,507.05

Common Stock = ($6,239.39)

Retained Earnings $9,858.34

Interest Rate on Debt = 6.31%

Earnings Available for Common Dividends = $1,407.55

Common Dividends = $555.42

Number of Common Shares Outstanding = 374.24

New Common Shares Issued = 86.86

Price per Share = $89.11

Earnings per Share = $3.76

Dividends per Share = $1.48

23.3 Eastman Kodak as a case study

TABLE 23.4 The Comparison of Financial Forecast of Anheuser-Busch Companies,

Inc.: Hand Calculation and FinPlan Forecasting.

Category

INCOME STATEMENT

Sales

Operating Income

Interest Expense

Income before taxes

Taxes

Net Income

Common Dividends

Debt Repayments

BALANCE SHEET

Assets

Current Assets

Fixed Assets

Total Assets

Manual

Calculation

Financial Plan

Model

Variance

(|(A - F)/A|)

12,553.38

2,469.25

284.39

2,173.49

765.94

1,407.55

555.42

553.70

12,553.39

2,469.25

284.39

2,173.49

765.94

1,407.55

555.42

553.70

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

1,717.30

8,542.58

10,259.88

1,717.30

8,542.58

10,259.88

0.0%

0.0%

0.0%

23.3 Eastman Kodak as a case study

TABLE 23.4 The Comparison of Financial Forecast of Anheuser-Busch Companies,

Inc.: Hand Calculation and FinPlan Forecasting. (Cont.)

Category

LIABILITIES AND NET WORTH

Current Payables

Total Debt

Common Stock

Retained Earnings

Total Liabilities and Net Worth

PER SHARE DATA

Price per Share

Earnings per Share (EPS)

Dividends per Share (DPS)

Manual

Calculation

Financial Plan

Model

Variance

(|(A - F)/A|)

2,131.56

4,507.05

-6,237.07

9,858.34

10,259.88

2,131.57

4,507.04

-6,237.06

9,858.33

10,259.88

0.0%

0.0%

0.0%

0.0%

0.0%

89.11

3.76

1.48

88.61

3.74

1.48

0.6%

0.6%

0.3%

FINPLAN input

YEAR=1999

23.3

Eastman

Kodak as

a case

study

TABLE 23.5

FINPLAN

input

Variable Number for

Beginning

Value of Data

FinPlan Computer Program Period

11703.7

2

0

716.1

15

0

9006.2

17

0

0.0631

10

0

461.1

16

0

4

1

0

4880.6

9

0

0.0726

3

1

0.1368

6

1

0.6805

7

1

0.1698

8

1

0.1967

4

1

553.7

12

1

0.6054

18

1

1.2446

19

1

23.7

20

1

0.3524

5

1

0.0631

11

1

0.03

21

1

0.06

22

1

Last

Period

0

0

0

0

0

0

0

4

4

4

4

4

4

4

4

4

4

4

4

4

23.3 Eastman Kodak as a case study

TABLE 23.6

Pro forma balance sheet of Anheuser-Busch Companies, Inc.: 2000-2003

Item/ Year

Assets

Current assets

Fixed assets

Total assets

Liabilities and net worth

Current liabilities

Long term debt

Preferred stock

Common stock

Retained earnings

Total liabilities and net worth

Computed DBT/EQ

Int. rate on total debt

Per share data

Earnings

Dividends

Price

2000

2001

2002

2003

1,717.30 1,841.98 1,975.71 2,119.14

8,542.58 9,162.77 9,827.99 10,541.50

10,259.88 11,004.75 11,803.70 12,660.65

2,131.57 2,286.32 2,452.30 2,630.34

4,507.04 4,834.25 5,185.22 5,561.67

0.00

0.00

0.00

0.00

-6,237.05 -6,871.13 -7,552.24 -8,283.79

9,858.33 10,755.32 11,718.42 12,752.43

10,259.88 11,004.75 11,803.70 12,660.65

1.24

1.24

1.24

1.24

0.06

0.06

0.06

0.06

3.74

1.48

88.61

4.01

1.58

95.09

4.39

1.73

104.08

4.81

1.90

113.93

23.3 Eastman Kodak as a case study

TABLE 23.7

Pro forma income statement of Anheuser-Busch Companies, Inc.: 2000-2003

Item/ Year

Sales

Operating income

Interest expense

Underwriting commission -- debt

Income before taxes

Taxes

Net income

Preferred dividends

Available for common dividends

Common dividends

Debt repayments

Actual funds needed for investment

2000

2001

2002

2003

12,553.39 13,464.76 14,442.31 15,490.82

2,469.25 2,648.52 2,840.80 3,047.04

284.39

305.04

327.19

350.94

11.37

55.59

57.08

58.69

2,173.49 2,287.89 2,456.53 2,637.41

765.94

806.25

865.68

929.42

1,407.55 1,481.64 1,590.85 1,707.99

0.00

0.00

0.00

0.00

1,407.55 1,481.64 1,590.85 1,707.99

555.42

584.65

627.75

673.97

553.70

553.70

553.70

553.70

-6,773.01

246.83

223.56

198.60

23.3

Eastman

Kodak as

a case

study

TABLE 23.8

Results of sensitivity analysis

Year

g=

0.073

EPS =

DPS =

PPS =

g=

0.03

EPS =

DPS =

PPS =

g=

0.09

EPS =

DPS =

PPS =

g=

0.078

EPS =

DPS =

PPS =

g=

0.078

EPS =

DPS =

PPS =

g=

0.078

EPS =

DPS =

PPS =

g=

0.078

EPS =

DPS =

PPS =

2000

2001

2002

2003

b=

k=

0.6054 1.245

3.74

1.48

88.61

4.01

1.58

95.09

4.39

1.73

104.08

4.81

1.90

113.93

3.64

1.44

86.36

3.77

1.49

89.28

3.98

1.57

94.22

4.20

1.66

99.43

3.78

1.49

89.52

4.11

1.62

97.51

4.57

1.80

108.30

5.07

2.00

120.27

3.72

1.86

88.26

3.98

1.99

94.27

4.33

2.17

102.70

4.72

2.36

111.89

3.75

1.13

88.92

4.04

1.21

95.82

4.44

1.33

105.33

4.89

1.47

115.78

3.73

1.47

88.38

4.01

1.58

95.09

4.39

1.73

104.00

4.80

1.89

113.74

3.71

1.46

87.87

4.02

1.59

95.31

4.41

1.74

104.41

4.83

1.90

114.37

b=

k=

0.6054 1.245

b=

k=

0.6054 1.245

b=

k=

0.5 1.245

b=

0.7

k=

1.245

b=

k=

0.6054

1

b=

k=

0.6054

1.5

23.4 Francis and Rowell (FR) model

The

FR model specification

A brief

discussion of FR’s

empirical results

23.4 Francis and Rowell (FR) model

TABLE 23.9 List of variables for FR model.

23.4 Francis and Rowell (FR) model

TABLE 23.9 List of variables for FR model. (Cont.)

23.4 Francis and Rowell (FR) model

TABLE 23.9 List of variables for FR model. (Cont.)

23.4 Francis and Rowell (FR) model

TABLE 23.9 List of variables for FR model. (Cont.)

23.4 Francis and Rowell (FR) model

TABLE 23.10 List of equations for FR Model.

23.4 Francis and Rowell (FR) model

TABLE 23.10 List of equations for FR Model. (Cont.)

23.4 Francis and Rowell (FR) model

TABLE 23.11 Sector interdependence

1

Explained

Sector

1

2

3

4

5

6

7

8

9

10

2

Earning Sector

3

4

5

6

7

8

9

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

10

23.4 Francis and Rowell (FR) model

TABLE 23.12 Variable interdependence within sector seven

23.4 Francis and

Rowell (FR)

model

TABLE 23.13

Transformation of

industry sales

moments to company

NIAT and EBIY moments

23.4 Francis and

Rowell (FR)

model

TABLE 23.13

Transformation of

industry sales

moments to company

NIAT and EBIY moments

(Cont.)

23.4 Francis and Rowell (FR) model

TABLE 23.13 Transformation of industry sales moments to company NIAT

and EBIY moments (Cont.)

(Cont.)

23.4 Francis and Rowell (FR) model

TABLE 23.13 Transformation of industry sales moments to company NIAT

and EBIY moments (Cont.)

(Cont.)

23.4 Francis and Rowell (FR) model

TABLE 23.13 Transformation of industry sales moments to company NIAT

and EBIY moments (Cont.)

(Cont.)

23.4 Francis and Rowell (FR) model

Share price

Cash dividend per year

(Equity capitaliza tion rate, its ) - (Growth rate, g ta )

23.5 Summary

Two simultaneous-equation financial planning models are

discussed in detail in this chapter. There are 20 equations

and 20 unknowns in the WS model. Annual financial data

from Anheuser-Busch Co. are used to show how the WS

model can be used to perform financial analysis and

planning. A computer program of the WS model is

presented in Appendix B.

The FR model is a generalized WS financial-planning

model. There are 36 equation and 36 unknown in the FR

model. The two simultaneous-equation financial-planning

models discussed in this chapter are an alternative to

Carleton's linear-programming model, to perform financial

analysis, planning, and forecasting.

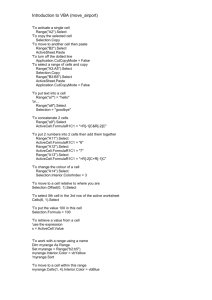

Appendix 23A. Appendix 23A. Procedure of Using

Microsoft Excel to Run FINPLAN Program

Appendix 23A. Appendix 23A. Procedure of Using

Microsoft Excel to Run FINPLAN Program

Appendix 23A. Appendix 23A. Procedure of Using

Microsoft Excel to Run FINPLAN Program

The program of FinPlan is available on the Website: http://www.pegasus.rutgers.edu/~wpt

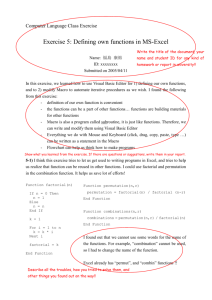

Appendix 23B. Program of FINPLAN

With An Example

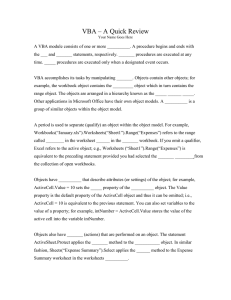

This program is composed under Visual Basic Application (VBA) environment.

Option Explicit

Sub FinPlan()

Dim i As Integer

Dim bNYEARFound As Boolean

Dim NDATE As Integer

Dim NUMVR As Integer

Dim NYEAR() As Integer

Dim

Dim

Dim

Dim

Dim

Dim

Dim

Dim

Dim

Dim

N As Integer

SALES() As Double

GSALS() As Double

ORATE() As Double

T() As Double

CARAT() As Double

FARAT() As Double

CLRAT() As Double

ZL() As Double

ZI() As Double

'Looping control variable

'Check if Year Being Simulated is found

'Year immediately preceeding the first forecasted year

'Variable code number

'Year being simulated

'1 The number of years to be simulated

'2 Sales in the simulation year

'3 Growth rate of sales

'4 Operating income rate (EBIT/SALES)

'5 Federal income tax rate

'6 Ratio of current assets to sales

'7 Ratio of fixed assets to sales

'8 Ratio of current liabilities to sales

'9 Long term debt

'10 Interest rate on total debt

Appendix 23B. Program of FINPLAN

With An Example

Dim ZIE() As Double

Dim ZLR() As Double

Dim PFDSK() As Double

Dim PFDIV() As Double

Dim S() As Double

Dim ZNUMC() As Double

Dim R() As Double

Dim B() As Double

Dim ZK() As Double

Dim PERAT() As Double

Dim UL() As Double

Dim US() As Double

'11 Interest rate on new debt

'12 Debt repayments

'13 Preferred stock

'14 Preferred dividends

'15 Common stock

'16 Cummulative number of common stock shares outstanding

'17 Retained earnings

'18 Retention rate

'19 Desired debt to equity ratio

'20 Price / Earnings ratio

'21 Underwriting commission of new debt

'22 Underwriting commission of new stock

Appendix 23B. Program of FINPLAN

With An Example

Dim O() As Double

Dim CA() As Double

Dim FA() As Double

Dim A() As Double

Dim CL() As Double

Dim ZNF() As Double

Dim ZNL() As Double

Dim EXINT() As Double

Dim DBTUC() As Double

Dim EAIBT() As Double

Dim TAX() As Double

Dim EAIAT() As Double

'Operating income

'Current assets

'Fixed assets

'Total assets

'Current liabilities

'Estimated needed funds

'Value of new debt issued

'Interest expense

'Debt underwriting commission

'Earnings after interest and before tax

'Federal income taxes

'Earnings after interest and after tax

Appendix 23B. Program of FINPLAN

With An Example

Dim EAFCD() As Double

'Earnings available for common dividends

Dim

Dim

Dim

Dim

Dim

Dim

Dim

Dim

Dim

'Common stock dividends

'Value of new common stock issued

'Total liabilities and net worth

'Computed debt to equity

'Actual needed funds

'Per share market price of common stock

'Value of new common stock shares issued

'Common stock earnings per share

'Common stock dividends per share

COMDV() As Double

ZNS() As Double

TLANW() As Double

COMPK() As Double

ANF() As Double

P() As Double

ZNEW() As Double

EPS() As Double

DPS() As Double

Appendix 23B. Program of FINPLAN

With An Example

On Error GoTo ErrorHandler

Columns("a").ColumnWidth = 29

'Set default column A width

Range("a2").Select

NDATE = ActiveCell.Value

'Get the year being simulated from cell A2

Range("b5").Select

NUMVR = ActiveCell.Value

'Get the variable code number from cell B5

bNYEARFound = False

While NUMVR <> Empty And Not bNYEARFound

If NUMVR = 1 Then

'If the number of years to be simulated is found

N = ActiveCell.Previous.Value + 1

bNYEARFound = True

End If

ActiveCell.Offset(1, 0).Activate

NUMVR = ActiveCell.Value

Wend

Appendix 23B. Program of FINPLAN

With An Example

If Not bNYEARFound Then N = 5

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

NYEAR(N)

SALES(N)

GSALS(N)

ORATE(N)

T(N)

CARAT(N)

FARAT(N)

CLRAT(N)

ZL(N)

ZI(N)

ZIE(N)

ZLR(N)

PFDSK(N)

PFDIV(N)

S(N)

ZNUMC(N)

R(N)

B(N)

ZK(N)

PERAT(N)

UL(N)

US(N)

'If the number of years to be simulated is not found

'then set the default of N as 5

Appendix 23B. Program of FINPLAN

With An Example

NYEAR(1) = NDATE

For i = 2 To N

NYEAR(i) = NYEAR(i - 1) + 1

Next

Range("b5").Select

NUMVR = ActiveCell.Value

While NUMVR <> Empty

Select Case NUMVR

Case 2

SALES(1) = ActiveCell.Previous.Value

Case 3

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

GSALS(i) = ActiveCell.Previous.Value

Next

Appendix 23B. Program of FINPLAN

With An Example

Case 4

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

ORATE(i) = ActiveCell.Previous.Value

Next

Case 5

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

T(i) = ActiveCell.Previous.Value

Next

Case 6

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

CARAT(i) = ActiveCell.Previous.Value

Next

Case 7

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

FARAT(i) = ActiveCell.Previous.Value

Next

Appendix 23B. Program of FINPLAN

With An Example

Case 8

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

CLRAT(i) = ActiveCell.Previous.Value

Next

Case 9

ZL(1) = ActiveCell.Previous.Value

Case 10

ZI(1) = ActiveCell.Previous.Value

Case 11

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

ZIE(i) = ActiveCell.Previous.Value

Next

Case 12

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

ZLR(i) = ActiveCell.Previous.Value

Next

Appendix 23B. Program of FINPLAN

With An Example

Case 13

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

PFDSK(i) = ActiveCell.Previous.Value

Next

Case 14

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

PFDIV(i) = ActiveCell.Previous.Value

Next

Case 15

S(1) = ActiveCell.Previous.Value

Case 16

ZNUMC(1) = ActiveCell.Previous.Value

Case 17

R(1) = ActiveCell.Previous.Value

Case 18

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

B(i) = ActiveCell.Previous.Value

Next

Appendix 23B. Program of FINPLAN

With An Example

Case 19

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

ZK(i) = ActiveCell.Previous.Value

Next

Case 20

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

PERAT(i) = ActiveCell.Previous.Value

Next

Case 21

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

UL(i) = ActiveCell.Previous.Value

Next

Case 22

For i = ActiveCell.Next.Value + 1 To ActiveCell.Next.Next.Value + 1

US(i) = ActiveCell.Previous.Value

Next

End Select

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

NUMVR = ActiveCell.Value

Wend

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

ReDim

O(N)

CA(N)

FA(N)

A(N)

CL(N)

ZNF(N)

ZNL(N)

EXINT(N)

DBTUC(N)

EAIBT(N)

TAX(N)

EAIAT(N)

EAFCD(N)

COMDV(N)

ZNS(N)

TLANW(N)

COMPK(N)

ANF(N)

P(N)

ZNEW(N)

EPS(N)

DPS(N)

Appendix 23B. Program of FINPLAN

With An Example

For i = 2 To N

'Solve simultaneous equations for N periods

SALES(i) = SALES(i - 1) * (1 + GSALS(i))

O(i) = ORATE(i) * SALES(i)

CA(i) = CARAT(i) * SALES(i)

FA(i) = FARAT(i) * SALES(i)

A(i) = CA(i) + FA(i)

CL(i) = CLRAT(i) * SALES(i)

ZNF(i) = (A(i) - CL(i) - PFDSK(i)) - (ZL(i - 1) - ZLR(i)) - S(i - 1) - R(i - 1) _

- B(i) * ((1 - T(i)) * (O(i) - ZI(i - 1) * (ZL(i - 1) - ZLR(i))) - PFDIV(i))

ZNL(i) = (ZK(i) / (1 + ZK(i))) * (A(i) - CL(i) - PFDSK(i)) - (ZL(i - 1) - ZLR(i))

ZL(i) = (ZL(i - 1) - ZLR(i)) + ZNL(i)

ZI(i) = ZI(i - 1) * ((ZL(i - 1) - ZLR(i)) / ZL(i)) + ZIE(i) * (ZNL(i) / ZL(i))

If ZNL(i) <= 0 Then ZI(i) = ZI(i - 1)

EXINT(i) = ZI(i) * ZL(i)

DBTUC(i) = Abs(UL(i) * ZNL(i))

EAIBT(i) = O(i) - EXINT(i) - DBTUC(i)

TAX(i) = T(i) * EAIBT(i)

Appendix 23B. Program of FINPLAN

With An Example

EAIAT(i) = EAIBT(i) - TAX(i)

EAFCD(i) = EAIAT(i) - PFDIV(i)

COMDV(i) = (1 - B(i)) * EAFCD(i)

R(i) = R(i - 1) + B(i) * ((1 - T(i)) * (O(i) - ZI(i) * ZL(i) - UL(i) * _

ZNL(i)) - PFDIV(i))

S(i) = ZL(i) / ZK(i) - R(i)

ZNS(i) = S(i) - S(i - 1)

TLANW(i) = CL(i) + PFDSK(i) + ZL(i) + S(i) + R(i)

COMPK(i) = ZL(i) / (S(i) + R(i))

ANF(i) = ZNF(i) + B(i) * (1 - T(i)) * (ZI(i) * ZL(i) + UL(i) * _

ZNL(i) - ZI(i - 1) * (ZL(i - 1) - ZLR(i)))

P(i) = (PERAT(i) * EAFCD(i) - ZNS(i) / (1 - US(i))) / ZNUMC(i - 1)

ZNEW(i) = ZNS(i) / ((1 - US(i)) * P(i))

ZNUMC(i) = ZNUMC(i - 1) + ZNEW(i)

EPS(i) = EAFCD(i) / ZNUMC(i)

DPS(i) = COMDV(i) / ZNUMC(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

Range(ActiveCell.Offset(0, -1), ActiveCell.Offset(70, N)).Clear 'Clear the report area

ActiveCell.Offset(6, 0).Activate

'Select the Income Statemet Starting Cell

With ActiveCell.Font

.Bold = True

.Size = 11

End With

ActiveCell.Value = "Pro forma Income Statement"

ActiveCell.Offset(2, -1).Activate

For i = 1 To N

ActiveCell.Offset(0, i).Value = NYEAR(i)

Next

'Generate Income Statement

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(2, 0).Activate

Range(ActiveCell, ActiveCell.Offset(15, N)).NumberFormat = "###0.00"

ActiveCell.Value = "Sales"

For i = 1 To N

ActiveCell.Offset(0, i).Value = SALES(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Operating income"

For i = 1 To N

ActiveCell.Offset(0, i).Value = O(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Interest expense"

For i = 1 To N

ActiveCell.Offset(0, i).Value = EXINT(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Underwriting commission -- debt"

For i = 1 To N

ActiveCell.Offset(0, i).Value = DBTUC(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Income before taxes"

For i = 1 To N

ActiveCell.Offset(0, i).Value = EAIBT(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Taxes"

For i = 1 To N

ActiveCell.Offset(0, i).Value = TAX(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Net income"

For i = 1 To N

ActiveCell.Offset(0, i).Value = EAIAT(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Preferred dividends"

For i = 1 To N

ActiveCell.Offset(0, i).Value = PFDIV(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Available for common dividends"

For i = 1 To N

ActiveCell.Offset(0, i).Value = EAFCD(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Common dividends"

For i = 1 To N

ActiveCell.Offset(0, i).Value = COMDV(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Debt repayments"

For i = 1 To N

ActiveCell.Offset(0, i).Value = ZLR(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Actl funds needed for investment"

For i = 1 To N

ActiveCell.Offset(0, i).Value = ANF(i)

Next

ActiveCell.Offset(5, 1).Activate

With ActiveCell.Font

.Bold = True

.Size = 11

End With

'Generate Balance Sheet

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Value = "Pro forma Balance Sheet"

ActiveCell.Offset(2, -1).Activate

For i = 1 To N

ActiveCell.Offset(0, i).Value = NYEAR(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Font.Bold = True

ActiveCell.Value = "Assets"

ActiveCell.Offset(1, 0).Activate

Range(ActiveCell, ActiveCell.Offset(9, N)).NumberFormat = "###0.00"

Range(ActiveCell.Offset(10, 0), ActiveCell.Offset(15, N)).NumberFormat = "###0.0000"

ActiveCell.Value = "Current assets"

For i = 1 To N

ActiveCell.Offset(0, i).Value = CA(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Fixed assets"

For i = 1 To N

ActiveCell.Offset(0, i).Value = FA(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Total assets"

For i = 1 To N

ActiveCell.Offset(0, i).Value = A(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Font.Bold = True

ActiveCell.Value = "Liabilities and net worth"

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Current liabilities"

For i = 1 To N

ActiveCell.Offset(0, i).Value = CL(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Long term debt"

For i = 1 To N

ActiveCell.Offset(0, i).Value = ZL(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Preferred stock"

For i = 1 To N

ActiveCell.Offset(0, i).Value = PFDSK(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Common stock"

For i = 1 To N

ActiveCell.Offset(0, i).Value = S(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Retained earnings"

For i = 1 To N

ActiveCell.Offset(0, i).Value = R(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Total liabilities and net worth"

For i = 1 To N

ActiveCell.Offset(0, i).Value = TLANW(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Computed DBT/EQ"

For i = 1 To N

ActiveCell.Offset(0, i).Value = COMPK(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Int. rate on total debt"

For i = 1 To N

ActiveCell.Offset(0, i).Value = ZI(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Per share data"

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Earnings"

For i = 1 To N

ActiveCell.Offset(0, i).Value = EPS(i)

Next

Appendix 23B. Program of FINPLAN

With An Example

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Dividends"

For i = 1 To N

ActiveCell.Offset(0, i).Value = DPS(i)

Next

ActiveCell.Offset(1, 0).Activate

ActiveCell.Value = "Price"

For i = 1 To N

ActiveCell.Offset(0, i).Value = P(i)

Next

Exit Sub

' Exit to avoid ErrorHandler.

ErrorHandler: ' Error-handling routine.

Select Case Err.Number ' Evaluate error number.

Case 9

MsgBox "'The number of years to be simulated' does not match your " & _

"'Last Period' input.", vbExclamation

Case 11

MsgBox Str$(Err.Number) & ", " & Err.Description & Chr$(10) & _

"'The number of years to be simulated' does not match your " & _

"'Last Period' input.", vbExclamation

Case Else

MsgBox Str$(Err.Number) & ", " & Err.Description

End Select

End Sub