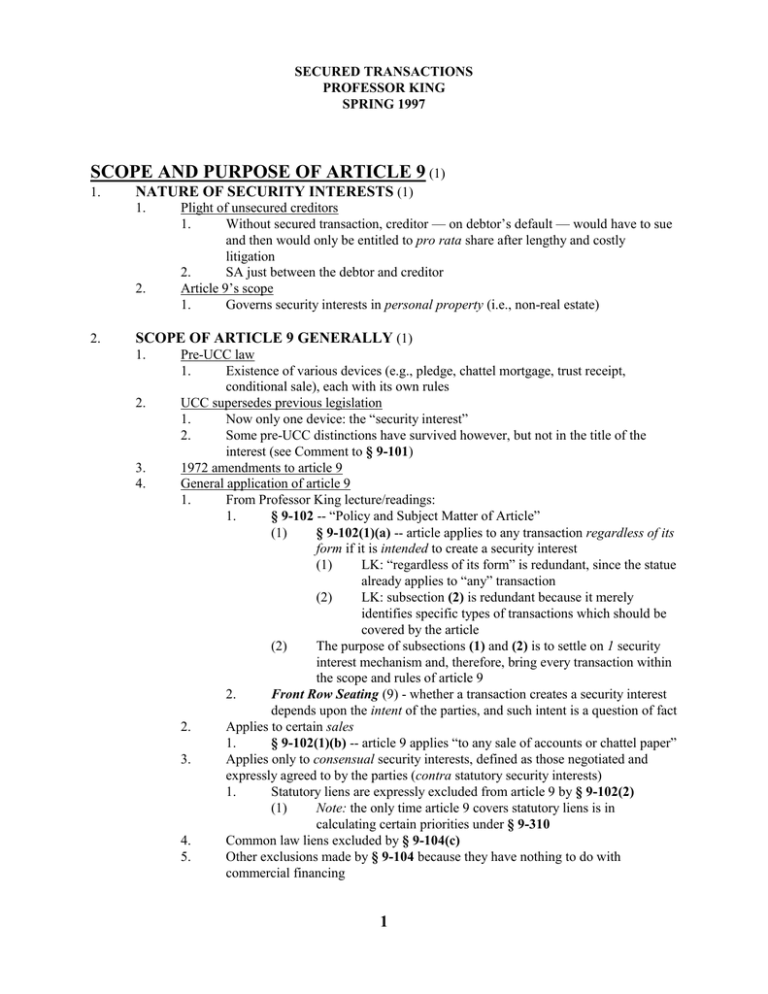

SCOPE AND PURPOSE OF ARTICLE 9 NATURE OF SECURITY INTERESTS

advertisement