typical PPSA schemes

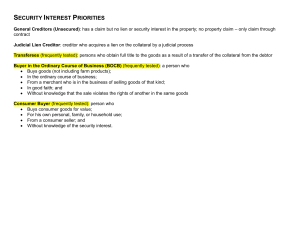

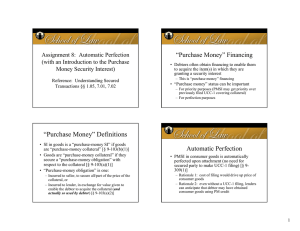

advertisement

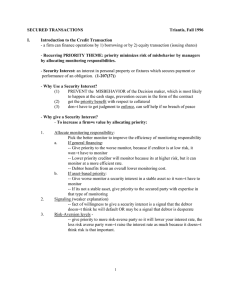

OUTLINE OF A TYPICAL PPSA SCHEME Professor Hugh Beale GENERAL COVERAGE Creation (aspects) and attachment Perfection registration, also possession, control of financial collateral Priority vs other SIs, other purchasers Rights and duties before default Remedies on default Private International law provisions Not only traditional securities Quasi-securities RoT devices Deemed SIs Outright sales of trade receivables Operating leases, commercial consignments SCOPE OF APPLICATION Any device with a security purpose, created by any party company, sole trader/partners, consumer Traditional securities Pledge, mortgage or charge, contractual lien Fixed and floating charges not distinguished SI may authorise debtor to dispose of some or all collateral Debtor has power to dispose of cash, inventory and other items usually sold QUASI-SECURITY • Conditional sales, Hire-purchase agreements, Finance leases • Consignments (and sometimes other…) • Retention of title clauses for inventory – Priority and perfection rules apply • PMSI super-priority – On D’s default, treated as security only • any surplus to D • SP must resell in reasonable fashion • No need to distinguish • “single security interest” REGISTRATION OF SIMILAR -LOOKING TRANSACTIONS • Operating leases, commercial consignments (e.g. floor plans with sale-or-return) • “Deemed SIs” • UCC: outside scheme - but if in doubt file! • Canada, NZ: Operating leases > 1 year, commercial consignments – file or lose effectiveness and priority – rights on D’s default not affected OUTRIGHT SALES OF RECEIVABLES Perfection and priority rules apply Surplus rules do not Even if on recourse basis Financier may collect in full “NOTICE FILING” • SP (or agent) may file to perfect SI • Filing before or after security agreement • Multiple transactions with same debtor • Voluntary, but unfiled non-possessory SI – ineffective in debtor’s insolvency – loss of priority against other SPs – ineffective against buyers who don’t know of SI NOTICE FILING • No submission of charge document • Financing statement – Borrower’s (‘debtor’s) name and address – Creditor’s (‘secured party’s’) name and address – brief details of property (‘collateral’) • On-line registration • On-line searching METHODS OF PERFECTION • Filing a financing statement • Possession (by SP or 3rd person holding for SP) • Automatic perfection (i.e. when SI attaches) • Temporary perfection – ‘Continuous perfection’ when method changes • Control (investment securities, bank accounts) PRIORITY VS SECURITY INTERESTS • Date of filing (or perfection by possession) • SP with control has priority • SP who provided finance to buy the collateral has priority over previously perfected SIs (PMSI ‘super-priority’) – ‘purchase-money security interest’ (PMSI) – whether supplies collateral or finances purchase – ‘cross-collateralisation’ – Provided registration and notice PROCEEDS SI normally attaches to proceeds With same priority Proceeds Proceeds of sale Fruits Products (commingled goods, accessions, new goods) Thus RoT supplier’s PMSI priority continues into new goods, proceeds But as against receivables financier, by date of registration PRIORITY AGAINST BUYERS • Unperfected (unfiled) SI ineffective against buyer who doesn’t have actual knowledge of it • Perfected SI effective against buyer, unless – buys from D in ordinary course of D’s business – small value for private purposes MOTOR VEHICLES • File and search by VIN • If FS omits VIN, SI ineffective against buyer unless has actual knowledge of SI • If filed, SI effective against any buyer except – sales by dealer in ordinary course of business, where B takes free of SI created by the dealer [(but not by a previous owner)] NON-SERIAL NUMBER EQUIPMENT Greater publicity If search at each stage, existing SIs will be revealed Otherwise, check at each stage of provenance REMEDIES • Scheme for distribution of surplus and payment of deficit • n/a ‘deemed’ SIs • Remedies • Some mandatory • Surplus rules • Notice of sale • Good faith provision on manner of sale REMEDIES Collection of receivables by SP Possession on default (anticipated?) Disposal by sale in reasonable manner Notice before sale unless ready market Effect of disposition Account of distribution Retention (foreclosure) Redemption