Self-Supporting Budget Request Instructions

BUDGET POLICY

FISCAL YEAR SELF-SUPPORTING BUDGET REQUEST

INSTRUCTIONS

Board of Regents policy requires that all self-supporting accounts exceeding $25,000 of projected annual expenditure activity (excluding voluntary transfers (VT or MT), recharge credits

(39 or 29) and ending account balance/reserves (79, 97 or 98)) be included in the annual budget process using the long-form budget template. Sponsored Projects (fund 132x-137x) and plant, loan, endowment and scholarships funds (funds 1312, 18xx-19xx and agencies 130 to

136) are excluded.

If projected expenditures in a self-supporting account are less than $25,000, a short-form budget must be submitted in the following instances:

1. Any salary or wages will be paid from the account (Position Control requirement)

2. There will be activity in the account and the fund (the first four digits of the account number) is one of the following: 1201,1202,1204,1206,1208,1210,1211, 1212, 1213,

1300,1317,1318,1319,1407,1504,1505,1506, 1700, 1701, 1702, 1703, 1704, 1705,

1708, 1709,1711,1712

GENERAL INFORMATION

Please input information in white or gray cells only. Go to the Review menu tab, Changes,

Unprotect sheet if you need to override formulas or make changes (such as adjusting column width) to the form itself. You must note on the form if you have changed any formula.

Before performing any work in the opened template, click file “save as” and save on your server or hard drive. Make sure you are working from the template on your computer and not the budget website before proceeding.

This excel file (in .xlsx format) includes the following forms:

1. Form No.1 has two tabs: Part 1 summarizes all major sources of funds and Part 2 summarizes all major uses of funds. Data input into other forms will automatically update the shaded cells in Form 1, Part 2.

2. Form Nos. 2, 3A and 3B provide details of operating expenses (standard or specialized)

3. Form No. 4 provides space to explain any significant changes which have occurred between the current fiscal year and the year being budgeted on Forms 1 to 3

Please submit ONLY a hard copy of each budget with proper signature (e.g. the Dean, VP, or the Dean/VP ’s designated fiscal officer) to PBA (MS118) on or before May 1,

The UNRHR professional PAF’s generated in July will again be based on the data entered between March and May 15 in the web based CBE (Contract & Budget Entry) application which also feeds the final comprehensive position lists (CPL) available for your review in

CAIS/HR/Look Up Information/Comprehensive Position Listing. To avoid rejected Personnel

Action Forms (PAFs), it is crucial that a budget revision be sent to PBA for changes you make to July 1 PAFs after the CBE closes if the change causes a net increase in total professional salary dollars paid from a specific account. Note: Budget revisions for Sponsored Project accounts should be submitted to Sponsored Projects. For classified personnel, if you plan in the CBE/CPL to pay an individual from different accounts, at a different FTE, or with a different salary split than in the June 1-15th pay period please prepare and submit to BCN-HR during

May a new PAF effective June 16th.

1

2012 NEW PAYDATE SHIFT: Please remember June 1 – June 30 salaries for non-hourly professionals and graduates will post to accounts in early July FY2016. Hourly and classified salaries from June 16-30 will also post in July rather than Period 13. You must align the PAF’s for this period with the budgets you establish for FY16.

HELPFUL HINTS

1. Each form includes fields indicating, to the right of the budget column, ‘explanatory note requeste d’ when amounts have changed by 25% and $6,250. When this note appears, please enter an alphanumeric reference in the gray cell next to the ‘current year actual’ column then go to Form 4 and enter, next to the appropriate reference, an explanation of the change. See example below:

11. Equipment A

A new projection system for planetarium theatre

3,000 26,000 explanatory note requested

2. Endowment income for the following year is available each spring for funds 1311/

1300/1301. The budget office is able to provide this information if you do not have it.

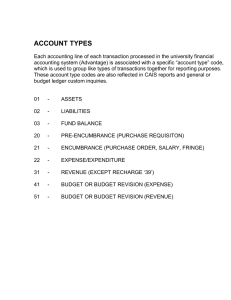

3. Useful CAIS/Financial Reports: i. Look up Info/Organization – shows function (under activity), whether or not an account is host authorized (under project) & signature authority ii. Look up Info/Expense Document Images – enter the account number you are budgeting and the month the transaction in question posted iii. Standard Reports/Organization Summary by Object/Subobject/No roll up iv. Custom Inquiries/General Ledger: this may help you identify the source account number for all VT In or Out – you may need to look up the transaction number using ‘Documents’ to find the source account number

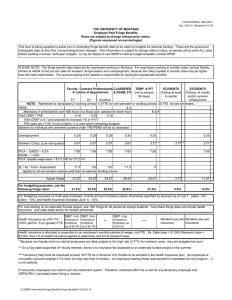

4. REGIA – Retired Employees Group Insurance Assessment – is charged to all non sponsored project accounts based on ‘retirement eligible’ gross salaries. This is assessed as a percentage of retirement eligible salaries. For budgeting purposes, this is included in the fringe calculation in the CBE/Comprehensive Position Lists.

5. Graduate student health insurance premiums will not be final until August so you may need to revise your budget for fringe during the year.

Graduate tuition needs to be budgeted in object 44.

6. You will need to access the CAIS/Human Resources/Look Up Information/

Comprehensive Position Listing report in order to complete the salary budget information required on Form 1, Part 2. The Budget office will validate all positions are linked to the account numbers shown in the comprehensive position lists. Links for non-pooled positions and non-sponsored project accounts will NOT roll. With these exceptions, links will be established only for those position/account pairings indicated in the comprehensive position list data for the coming fiscal year.

a. There is a fringe and classified salary calculator template on the budget website.

This can be used for making salary projections in strategic plans, grant applications and self-supporting budgets where positions were not in the CPL.

7. Host – object 25 – should only be budgeted on host authorized accounts. If you have a participant paid hosting expense use obj/subobj. 30 PP and attach documentation of the participant payment (flyer, etc.) to the payment request sent to the Controller’s office.

8. SP

– State Personnel Division assessment – is charged to all non-sponsored project accounts as a percentage of retirement eligible classified salaries (14 01). This is included in operating sub object SP.

2

SOURCE OF FUNDS SUMMARY

Form 1, Part 1

ACCOUNT INFORMATION

Account Number

Appropriation

Function

College/Admin Unit

Department

Account Title

Signature Authority

Contact Person, Mail Stop

& Phone

Enter the eleven digit account number, in the form:

FUND – AGENCY – ORGANIZATION (xxxx-xxx-xxxx)

Enter the Appropriation Area assigned - most are UNR (107 is

ICA; 151 is Coop Ext; 152/153 is Ag Exp. Station )

Enter the accounting function assigned by the Controller’s Office

(CAIS Financial/Look up Info/Organization – Activity column).

Note: You can only change this function for a new year – if a function change is needed, please contact Jane Patterson.

Enter College or Administrative Unit assigned.

Enter the Department assignment (This should correspond to an active Human Resources Department name).

Enter the account title as reported in CAIS/Advantage for the current fiscal year. If the official account title is an acronym or an abbreviation, please document the full name. If a correction is required, please work with Jane Patterson (

Controller’s Office) to make the change using the request to modify account form.

Enter the last names of the people with signature authority for the account (see CAIS ‘Look up Info’ – Organization).

Enter the name, phone number and mail stop of the person the budget office should contact with questions about the account.

Enter a brief description as to why the account is being utilized. Account Purpose

RESOURCE SUMMARY

1. Opening Account

Balance (object 97)

3.

Revenue

2. Total Revenue

Transfer(s) In (object

VT)

Total Transfers

The opening balance for the projected actual column is the

Current Appropriation amount in CAIS or the Current Modified

APPR on the APP2 table in Advantage. This field will automatically complete for the budget request column.

Fund

1311: leave this cell blank. For funds 1318/1319: Use the current budgeted opening account balance in proj. actual.

All major sources of revenue are to be listed. Please refer to the codes listed on the CAIS Organization Summary

(The current year Projected Actual Revenue can be calculated by annualizing the revenues year to date. Annualize means divide the year to date number by the number of the fiscal period shown in the CAIS report header (ex. 2010/ 09 = March) and multiply the result by 12) Fund 1311: Complete Form 1, Part 1 row 2.i. last – enter the amount from line 19 of Form 1, Part 2

NOTE: recharges are entered only on Form 1, Part 2 line 21

A calculation of the sum of the total revenue.

All transfers from other accounts are to be listed by account number and amount in the space provided under Transfer(s) In.

Note: In general, this object should not be used for accounts budgeting recharge credits or foundation accounts.

A calculation of the sum of the total Transfer(s) In.

3

4. TOTAL REVENUE

BUDGET

A calculation of the sum of lines 1, 2, and 3 to determine the total resources available to be budgeted.

REVENUE DETAIL Write a detailed explanation of the revenue. (e.g. $50 lab fee X

30 students x 3 classes = $4,500).

4

USE OF FUNDS SUMMARY

Form 1, Part 2

The Current Year Projected Actual expenditures can normally be determined by 1) referring to the pr ior year’s organization summary by object/subobject report and 2) annualizing ( Annualize means divide the year to date number by the number of the fiscal period shown in the

CAIS report header (ex. 2010 /09 = March) and multiply the result by 12) the year to date expense information. These can also be used as a basis for estimating the following year's expenditures.

1. Letter of Appointment with or without

Benefits (object 10)

Enter the Pooled Position number for your department LAC (letter of appt. without benefits)/LBC (letter of appt. with benefits). NO

FTE is associated with LAC’s. Enter the combined annualized

FTE (e.g. 1.82) for all LBC’s to be paid from this account.

2a. Professional Salaries

(object 11)

Go to CAIS/Human Resources/Look Up Info/Comprehensive

Position Listing and lookup for the coming fiscal year the account you are budgeting. You will need to export the report to excel and create sums by employee type to obtain the total professional FTE, salaries and fringe to be paid from this account. Enter the total FTE and salaries on line 2a and enter the professional fringe on row 7a. For the current year projected actual, go to the organization summary report (or the position control report) for this account and enter the sum of the

2b. Professional Overload

3.

(object 11)

Graduate Assistant

Salaries (object 12)

4a. Classified Salaries

(object 14) encumbrances + expenditures year to date.

Enter the amount you expect to pay in overloads from this account. Make sure to note the position numbers on Form 4 (add a letter reference in the grey column) if the positions which will receive overloads are different from those being paid salaries otherwise no ‘position/account link’ will be established.

Graduate Assistant salaries should be calculated and entered on line 3. A pooled position number must also be entered in the box to the left.

Go to CAIS/Human Resources/Look Up Info/Comprehensive

Position Listing and lookup for the coming fiscal year the account you are budgeting. You will need to export the report to excel and create sums by employee type to obtain the total classified FTE, salaries and fringe to be paid from this account.

Enter the total FTE and salaries on line 4a and enter the classified fringe on row 7e. For the current year projected actual,

4b. Classified Overtime

5.

(object 14)

Student Wages (object

15) go to the organization summary report (or the position control report) for this account and enter the sum of the encumbrances + expenditures year to date.

Enter the amount of overtime you expect to pay from this account. Make sure to note the position numbers on Form 4 (add a letter reference in the grey column) if the positions which will receive overtime are different from those being paid salaries otherwise no ‘position/account link’ will be established.

Enter the annualized hourly wages paid for college student help.

Enter pooled position number in the shaded box to the left.

5

6. Temporary Labor

(object 15)

7a. Professional Fringe

7b. Overload Fringe

Temp Labor earnings are the hourly wages paid for temporary employment categories. Enter the estimated wages by year on line 6. A pooled position number (45xxx) must be entered in the box to the left.

Go to CAIS/Human Resources/Look Up Info/Comprehensive

Position Listing and lookup the account you are budgeting. Enter the total professional fringe on line 7a.

An auto calculation (in the budget year only) of the amount on 2b.

7c. Letter of Appt. Fringe A % of the amount on line 1 plus the FTE (which may be greater than 1.0 if there are multiple LOB’s paid from this account) multiplied by the cost of health insurance. This amount is inferred by formula in the budget year only and is the average

7d. Graduate Fringe fringe rate (both FICA alternative and FICA eligible).

Graduate Assistant Fringe is calculated at 1.5% of the total

Graduate Assistant salaries (line 3) plus a special health insurance benefit inferred by formula . As grad students don’t

7e. Classified Fringe carry FTE, the number of students budgeted is based on the total salary dollars divided by $14,000 (the min. stipend). The actual charge will be split - fall (September) and spring/summer

(February). The annual contract for grad health insurance does not occur until August of each year so it is possible that a budget revision to increase fringe may be needed.

Go to CAIS/Human Resources/Look Up Info/Comprehensive

Position Listing and lookup the account you are budgeting. Enter

7f. Classified Overtime

Fringe the total classified fringe on line 7e.

An auto calculation (in the budget year only) of 3.15% of the amount on line 4b.

7g. Student Wage Fringe Fringe Benefits for the Student Wage category are calculated at

1.5% of the total Student Wages (line 5) and are inferred by formula. If your students have worked as a temp/casual laborer during the calendar year, the fringe rate is higher so enter the dollars in the casual labor line.

Fringe Benefits for Temp. Labor inferred by formula. 7h. Temporary Labor

Fringe

TOTAL FRINGE

(object 16)

In the projected actual year, enter the sum of the total encumbrance and year to date expense columns from the

CAIS/Financial/Standard Reports/Organization Summary Report.

In the budget year, this is a calculation of the sum of lines 7a

8.

9.

Travel (object 20)

Host (object 25) through 7h. Note: Formulas have been set to round all cents up to the next whole dollar. Reference the fringe rates on the budget web page for specific rate information.

Enter the amount of in-state, out-of-state and foreign travel here.

If the account is host authorized (Project Code ‘H’ on CAIS ‘Look up Info’ – Organization), list amount to be budgeted for these expenditures here. Budget participant paid expenses in 30 PP.

10. Operating (object 30) Complete Form 2. Totals are inferred from Form 2.

11. Specialized Operating Totals for operating object codes 31-38 are inferred - Form 3A.

6

12. Specialized Operating Totals for operating object codes 47-49 are inferred - Form 3B.

13. Miscellaneous Enter the title of the object code and the expense object code

(not sub object but a separate object not listed in the other rows)

14. Tuition (object 44) before entering the projected actual and budgeted amounts.

Example would be Interest – IN for an interest payment.

Enter the amount of tuition paid on behalf of students.

15. Equipment

16. Mandatory Transfer

All equipment purchased (individual components must be valued at $5,000 or more AND a useful life in excess of 12 months).

This may include high end printers, microscopes, laboratory apparatus, etc.

This is mandatory bond payments made to third parties after collection in a central account by the controller’s office (primarily used by parking and housing)

17. Negative Reserves

18. Miscellaneous

19. TOTAL

EXPENDITURES

20. Transfer(s) Out

TOTAL VT OUT

21. Sales & Service

22. ENDING ACCOUNT

BALANCE

23. TOTAL

EXPENDITURE

BUDGET

–

Recharge Credits

For all payroll clearing accounts, enter negative reserves (obj.

98) – the value should be negative and equal total expenditures so that the amount on line 23 is zero.

Enter the title of the object code and the expense object code

(not sub object but a separate object not listed in the other rows) before entering the projected actual and budgeted amounts.

Example would be Interest – IN for an interest payment.

A calculation of the sum of all expenditure categories, excluding transfers out.

All subsidies to other accounts are to be listed by account number and amount in the space provided under line 20. If more than three transfers will occur, attach a separate sheet listing all transfers and enter the total transfers here. Note: In general, this object should not be used for accounts budgeting recharge credits and foundation accounts.

A calculation of the sum of lines 20a-20c.

Enter amount, as a negative, for interdepartmental sales of goods and services that are credited to object code 39.

The ending account balance is the difference between estimated total sources of funds available (Form 1, Part 1, Line 4), total estimated expenditures, and transfers out (Form 1, Part 2, Lines

19, 20 & 21). Note: This will always be zero on a 1311 account budget.

Calculated sum of total estimated expenditures, transfer(s) out and ending account balance. This total must agree to the total revenue budget found on line 4 on Form 1, Part 1.

7

OPERATING EXPENDITURE DETAIL

Form 2

This form is designed to collect current and budget year operating expenditure detail for object code 30. Enter expenditures by object/subobject code (e.g. 3012). All valid object codes will infer the description. Form totals are calculated and inferred to Form 1, Part 2 line 10.

You need to project actual expenditures by major operating category. These can normally be determined by 1) referring to the prior year’s organization summary by object/subobject report and 2) annualizing ( Annualize means divide the year to date number by the number of the fiscal period shown in the CAIS report header (ex. 2010/09 = March) and multiply the result by 12) the year to date expense information. These can also be used as a basis for estimating the following year's expenditures. Enter cost estimates in the spaces provided.

Estimate next fiscal year’s budget expenditures in the same manner.

SPECIALIZED OPERATING EXPENDITURE DETAIL

Forms 3A and 3B

These forms have been designed to collect current and budget year

‘specialized operating’ expenditure detail for object codes 31-38 (Form 3A) and 47-49 (Form 3B). Complete the appropriate form by entering expenditure information by object code (format xxxx). As long as you have entered the specific two digit object code relating to your budget in cell G7, all valid object codes entered in column A will infer the description. Totals are calculated and inferred to

Form 1, Part 2, lines 11 and 12. See detailed instructions for Form 2 above, as this form captures the same information, only for specialized operating codes.

8