FOR INTERNAL USE ONLY Rev. 9/21/15 (Replaces 6/1/15)

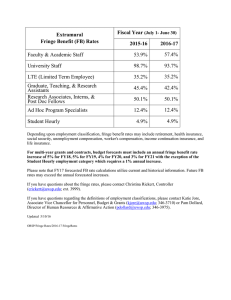

advertisement

FOR INTERNAL USE ONLY Rev. 9/21/15 (Replaces 6/1/15) THE UNIVERSITY OF MONTANA Employer-Paid Fringe Benefits Rates are subject to change without prior notice. (Figures expressed are percentages) This form is being supplied to assist you in computing fringe benefit rates to be used on budgets for external funding. These are the actual and anticipated rates at this time, incorporating known changes. This information is subject to change without notice, so please call to verify ALL rates before building involved, multi-year budgets. It may be helpful to use ORSP's Internal budget template; contact ORSP. PLEASE NOTE: The fringe benefit rates listed are for employees working in Montana. For employees working In another state, contact Shelley Hiniker at x6634 to find out the rates for workers' compensation and unemployment, because the rates payable in another state may be higher than the rates listed below. The account paying such salaries is responsible for paying the appropriate benefits. Faculty / Contract Professionals CLASSIFIED & Letters of Appointment & PERM. P/T TEMP. & P/T (not to exceed 90 days) STUDENTS (Taking at least 6 credits) STUDENTS (Taking <6 credits and/or summer FY AY Summer employment) NOTE: Retirement is manadatory if working at least 1.0 FTE for one semester or working at least .50 FTE for two semesters. PERS 8.4 Mandatory if scheduled to work 960 hours in a fiscal year; optional for fewer hours 8.4 # TIAA-CREF / TRS 11.0 11.0 11.0 TIAA-CREF is 9.7 and projected to increase 1% in FY17 TRS rates are 11.05; if one is higher, it is used when estimating budgets. Salaries for individual who are/were covered under TRS/PERS will be so assessed. Unemployment 0.25 0.25 0.25 0.25 0.25 Workers' Comp. (Low rate quoted) 0.67 0.67 0.67 0.67 3.77 * 7.65 7.65 7.65 7.65 11.5 0 FICA -- OASDI -- 6.2% 7.65 MCRE -- 1.45% FICA Taxable wage base = $117,000 for CY 2014 SL / AL / Term. Assessment 11.5 5.0 5.0 Applies to all non-student salaries paid from an external funding source. Actual Totals For budgeting purposes, use the following fringe rates: 0.25 3.77 * 3.77 * 7.65 31.07 24.57 24.57 28.44 20.07 3.77 11.67 31.5% 25.0% 25.0% 29.0% 21.0% 4.0% 12.0% For budgeting purposes on multi-year proposals, include annual increases (unless otherewise specified by sponsor) as of July 1: salary - 3%; tuition - 10%; and health insurance (increase June 1) - 10%. For cost sharing on an externally funded project, use 18% fringe for all personnel except students. Cost share fringe does not include health insurance. Use rates listed above for student personnel. $887 / mo. $887 / mo. Health Insurance as of 6/1/14 Increase to Increase to 100% paid for .5 (or greater) FTE $1054/mo $1054/mo as of 6/1/16 as of 6/1/16 $887 / mo. ** Increase to $1054/mo as of 6/1/16 *** Students pay own Students pay own insurance insurance Health insurance is allocated in proportion to an employee's monthly salaries & wages, not FTE. Ex: State base = $1,000; Research base = $2,000, thus 1/3 of health insurance applied to state base and 2/3 to research base. * Because non-faculty and non-clerical employees are likely subject to the high rate (3.77%) for workers' comp., they are budgeted as such. ** On a fully state-supported AY faculty member, there is no insurance fee assessed to an externally funded project in the summer. *** Temporary help must be employed at least .50 FTE for a minimum of 6 months to be enrolled in the health insurance plan. (An employee is not health insurance eligible if it is even one day less than 6 months.) An employee meeting these requirements is mandated into the program -- it is not optional. # Temporary employees can elect to join the retirement system. Therefore, retirement MAY be a cost for any temporary employee and DEFINITELY calculated when hiring a teacher. G:\ORSP Information\Fringe Benefits\Fringe BenefitsFY15 9.20.15