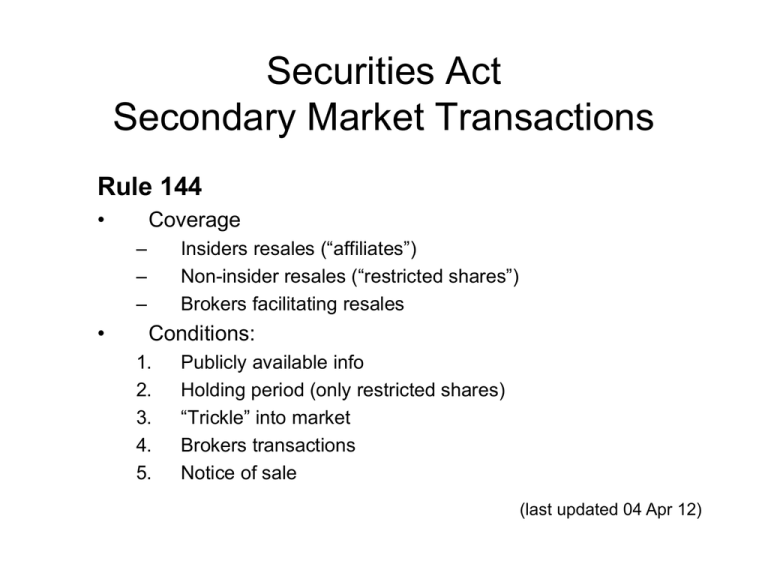

Securities Act Secondary Market Transactions Rule 144 •

advertisement

Securities Act Secondary Market Transactions Rule 144 • Coverage – – – • Insiders resales (“affiliates”) Non-insider resales (“restricted shares”) Brokers facilitating resales Conditions: 1. 2. 3. 4. 5. Publicly available info Holding period (only restricted shares) “Trickle” into market Brokers transactions Notice of sale (last updated 04 Apr 12) What is a “Rule 144A offering” …. Institutional Investor Broker Institutional Broker Investor Institutional Broker Investor Institutional Investor Broker Institutional Investor Trading market Firm-commitment underwriting Best-efforts underwriting Underwriter Underwriter Purchaser Restricted securities Issuer § 4 Exempted transactions The provisions of section 5 shall not apply to-(1) transactions by any person other than an issuer, underwriter, or dealer. (2) transactions by an issuer not involving any public offering. § 2(a)(11) Definitions The term "underwriter" means any person who has purchased from an issuer with a view to, or offers or sells for an issuer in connection with, the distribution of any security … As used in this paragraph the term "issuer" shall include, in addition to an issuer, any [control person]. Rule 144A (b) Sales by persons other than issuers or dealers. Any person, other than the issuer or a dealer, who offers or sells securities in compliance with the conditions set forth in paragraph (d) of this section shall be deemed not to be engaged in a distribution of such securities and therefore not to be an underwriter of such securities … (c) Sales by Dealers. Any dealer who offers or sells securities in compliance with the conditions set forth in paragraph (d) of this section shall be deemed not to be a participant in a distribution of such securities within the meaning of section 4(3)(C) of the Act and not to be an underwriter …, and such securities shall be deemed not to have been offered to the public within the meaning of section 4(3)(A) of the Act [statute]. Rule 144A (d) Conditions to be met. (1) securities offered/sold only to QIB or reasonably believed to be QIB (2) seller (and broker) take reasonable steps to ensure that purchaser aware relying on Rule 144A (3) securities not of same class as securities listed on US stock exchange or Nasdaq (4) for non-reporting issuer, exempt foreign issuer, or foreign government, Rule 144A holders and prospective purchasers can obtain from issuer, upon request: – “very brief” statement about issuer and business – issuer's most recent balance sheet, P&L and retained earnings statements for last 2 fiscal years Operation of Rule 144 … Trading market Broker Firm-commitment underwriting Best-efforts underwriting Underwriter Underwriter Purchaser Secondary distribution Purchaser Restricted securities Issuer Insider Rule 144 – safe harbor Non-affiliate Non-affiliate Affiliate (restricted) (restricted) (restricted) Publicly available info X Holding period > 6 mos X > 1 yr Affiliate (nonrestricted) X > 6 mos “trickle” into market X X Broker sales X X Notice of sale X X § 4 Exempted transactions The provisions of section 5 shall not apply to-(1) transactions by any person other than an issuer, underwriter, or dealer. (2) transactions by an issuer not involving any public offering. § 2(a)(11) Definitions The term "underwriter" means any person who has purchased from an issuer with a view to, or offers or sells for an issuer in connection with, the distribution of any security … As used in this paragraph the term "issuer" shall include, in addition to an issuer, any [control person]. Non-affiliate (restricted) • Reporting issuer • Non-reporting issuer Non-affiliate (reporting issuer) Rule 144 (b) Conditions to Be Met. Subject to paragraph (i) of this section, the following conditions must be met: Non-Affiliates. If the issuer [is reporting company for at least 90 days before the sale], any non-affiliate [and not affiliates during the preceding three months], who sells restricted securities of the issuer for his or her own account shall be deemed not to be an underwriter of those securities within the meaning of section 2(a)(11) of the Act if all of the conditions of paragraphs (c)(1) [current reporting company] and (d) [holding period of 6 months] of this section are met. Non-affiliate (reporting issuer) Rule 144 (b) Conditions to Be Met. Subject to paragraph (i) of this section, the following conditions must be met: Non-Affiliates. If the issuer [is reporting company for at least 90 days before the sale], any non-affiliate [and not affiliates during the preceding three months], who sells restricted securities of the issuer for his or her own account shall be deemed not to be an underwriter of those securities within the meaning of section 2(a)(11) of the Act if all of the conditions of paragraphs (c)(1) [current reporting company] and (d) [holding period of 6 months] of this section are met. Non-affiliate (non-reporting issuer) Rule 144 (b) Conditions to Be Met. Subject to paragraph (i) of this section, the following conditions must be met: Non-Affiliates. The requirements of paragraph (c)(1) of this section [current reporting company] shall not apply to restricted securities sold for the account of a person who is not an affiliate of the issuer at the time of the sale and has not been an affiliate during the preceding three months, provided a period of one year has elapsed since the later of the date the securities were acquired from the issuer or from an affiliate of the issuer. If the issuer [is not a reporting company], any non-affiliate … who sells restricted securities of the issuer for his or her own account shall be deemed not to be an underwriter of those securities within the meaning of section 2(a)(11) of the Act if the condition of paragraph (d) [12 month holding period] of this section is met. Affiliate • Restricted securities • Non-restricted securities Affiliate (restricted / non-restricted) Rule 144 (b) Conditions to Be Met. Subject to paragraph (i) of this section, the following conditions must be met: Affiliates or persons selling on behalf of affiliates. Any affiliate of the issuer, or any person who was an affiliate at any time during the 90 days immediately before the sale, who sells restricted securities, or any person who sells restricted or any other securities for the account of an affiliate of the issuer of such securities, or any person who sells restricted or any other securities for the account of a person who was an affiliate at any time during the 90 days immediately before the sale, shall be deemed not to be an underwriter of those securities within the meaning of section 2(a)(11) of the Act if all of the conditions of this section are met. Affiliate (restricted / non-restricted) Rule 144 (b) Conditions to Be Met. Subject to paragraph (i) of this section, the following conditions must be met: Affiliates or persons selling on behalf of affiliates. Any affiliate of the issuer [who sells restricted securities], or any person who was an affiliate at any time during the 90 days immediately before the sale, who sells restricted securities, or any person who sells restricted or any other securities for the account of an affiliate of the issuer of such securities, any person who sells restricted or any other securities for the account of a person who was an affiliate at any time during the 90 days immediately before the sale, shall be deemed not to be an underwriter of those securities within the meaning of section 2(a)(11) of the Act if all of the conditions of this section are met. Conditions: (c) (d) (e) (f) (h) (i) Current public information Holding period for restricted securities Trickle into market Broker's transactions [defined in (g)] Notice to SEC Must engage in bona-fide sale Some hypotheticals … (12 hypotheticals) Hypothetical #1-6 Island Tours is a reporting company. Four months ago Island Tours sold $2 million in common stock in a Reg D private placement. Skipper (the company’s CEO) purchased 100,000 shares at $10/share. Mary Ann, an unaffiliated outside investor, purchased another 100,000 shares. Hypothetical #1 Mary Ann wants to sell her holdings on Nasdaq, just 3 months after she bought in the Reg D offering. Can she under Rule 144? A. No. She must wait at least 6 months, maybe 12 months. B. No. Reg D offerings require investment intent. C. Yes. She is not a control person. D. Yes. Mary Ann always gets her way. Dawn Wells Actress, Author, Journalist, Motivational Speaker, Businesswoman, Entreprenuer Hypothetical #2 Mary Ann wants to sell her holdings on Nasdaq, now nine months after she bought in the Reg D offering. Assume Island Tours is late in its latest 10-K. Nasdaq sell Can she under Rule 144? A. No. She must wait 12 months, given IT not current. B. No. Reg D offerings require 12month holding. C. Yes. Non-affiliates of public companies must wait 6 mos. D. Yes. Reg D offerings have no holding periods. Not current -- ’34 Act filings Mary Ann Reg D Island Tours Hypothetical #3 Mary Ann wants to sell her holdings on Nasdaq, now 13 months after she bought in the Reg D offering. Assume Island Tours is still late in filing its 10Qs and 10-Ks. Nasdaq sell Can she under Rule 144? A. No. She must wait until IT becomes current. B. No. Reg D offerings require 24month holding. C. Yes. Non-affiliates must wait 12 mos. D. Yes. Reg D offerings have no holding periods. Not current -- ’34 Act filings Mary Ann Reg D Island Tours Hypothetical #4 Mary Ann bought in the Reg D private placement nine months ago. Five months after the purchase she pledged her shares to Howell Bank. Mary Ann defaults and Howell Bank wants to sell the pledged shares on Nasdaq. Assume Island Tours is current in all its Exchange Act filings. Can she under Rule 144? A. No. No tacking allowed. B. Yes. Tacking allowed always. C. Yes. Tacking allowed if bona fide and pledged w/ recourse. Nasdaq sell Howell Bank Current -- ’34 Act filings pledge Mary Ann Reg D Island Tours Hypothetical #5 Skipper (Island Tour’s CEO) wants to sell 16 months after the Reg D offering. He will use Sparrow Securities. Island Tours has not filed its latest Form 10-K. Can he under Rule 144? A. No. He must wait 12 months, given IT not current. B. No. Affiliates are subject to current-filings condition. C. Yes. Affiliates, like non-affiliates, must wait 12 months. D. Yes. Reg D offerings have no holding periods. Hypothetical #6 Skipper wants to sell some of his Island Tour stock that he bought on Nasdaq last week. Assume Island Tours is still late in filing its 10Qs and 10-Ks. Can he under Rule 144? A. No. He must wait 12 months, given IT not current. B. No. He must wait until IT is current. C. Yes. Affiliates selling nonrestricted need not wait. D. Yes. Affiliates can always sell non-restricted shares. Nasdaq Sell (one week later) buy Not current -- ’34 Act filings Skipper Reg D Island Tours Hypothetical #7-10 Island Tours went public 3 years ago and has 10 million shares outstanding – some from its recent Reg D offering. The average weekly trading volume of Island Tours has been around 125,000 shares – at about $10/share. Hypothetical #7 Eight months after the Red D offering, Mary Ann decides to sell the 250,000 shares she purchased in the private placement. This is more than 1% outstanding shares and the weekly trading volume. Can she under Rule 144? A. No. She is subject to trickle condition. B. No. She is subject to 12-month holding condition. C. Yes. Non-affiliates of public companies must wait 6 mos. D. Yes. Non-affiliates can sell 1% every month. Dawn Wells - Actress, Author, Journalist, Motivational Speaker, Businesswoman, Entreprenuer Hypothetical #8 Eight months after the Red D offering, Mary Ann decides to sell her 250,000 shares that she purchased in the private placement. At the same time, two other unaffiliated investors in the Reg D offering (professor and Mrs. Howell) also decide to sell 100,000 shares each. Can they under Rule 144? A. No. The trickle condition is cumulative. B. Yes. The trickle condition is not cumulative. C. Yes. Assuming Mrs. Howell is not an affiliate through Mr. Howell. Hypothetical #9 Skipper holds 200,000 shares – 100,000 he received in the Reg D private placement and another 100,000 that he bought on the open market. He wants to sell all 200,000 shares. Can he under Rule 144? A. No. All his shares are subject to trickle condition. B. Yes. Only his restricted shares are subject to trickle. C. Yes. Restricted are less than 1%; open-market are w/in weekly avg. Hypothetical #10 This time Skipper decides to resell only his 100,000 restricted shares through unsolicited brokers’ transactions on the Nasdaq. At about the same time, he resells the 100,000 unrestricted shares to Mr. Howell, a highly sophisticated investor. The sale of the unrestricted shares is negotiated and solicited, with the assistance of Sparrow Securities. Can he under Rule 144? A. No. Resales are cumulated; and trickle not met. B. Yes. The sale to Mr. Howell is exempt under 4(1-1/2). Hypothetical #11-12 You are a broker working for Sparrow Securities. You receive a large flow of orders from many different investors. You receive an order from Skipper, the CEO of Island Tours, to sell unregistered securities previously sold through Island Tours’ private placement of thirteen months ago. The securities all bear a Rule 502(d) legend indicating their restricted status. Hypothetical #11 As the broker, how do you go about making the various inquiries as required by Rule 144(g)? See Form 144 – www.sec.gov/about/forms/secforms .htm#1933forms [click here] Which inquiry is not necessary? A. Whether the seller is using nonpublic information. B. Whether the seller acquired the securities more than 6 mos ago. C. What other sales the seller has made in the last 3 mos. D. Whether the seller is related has family members who are selling. Hypothetical #12 Sparrow Securities maintains a list of customers that have recently indicated a desire to purchase the stock of “high growth-high risk startup companies.” As the broker receiving the sale order from Skipper, can you contact the customers on the list and sell them the Island Tours restricted securities? Can they under Rule 144? A. No. Only if asked about IT in last 10 days. B. Yes. This is not a general solicitation. The end