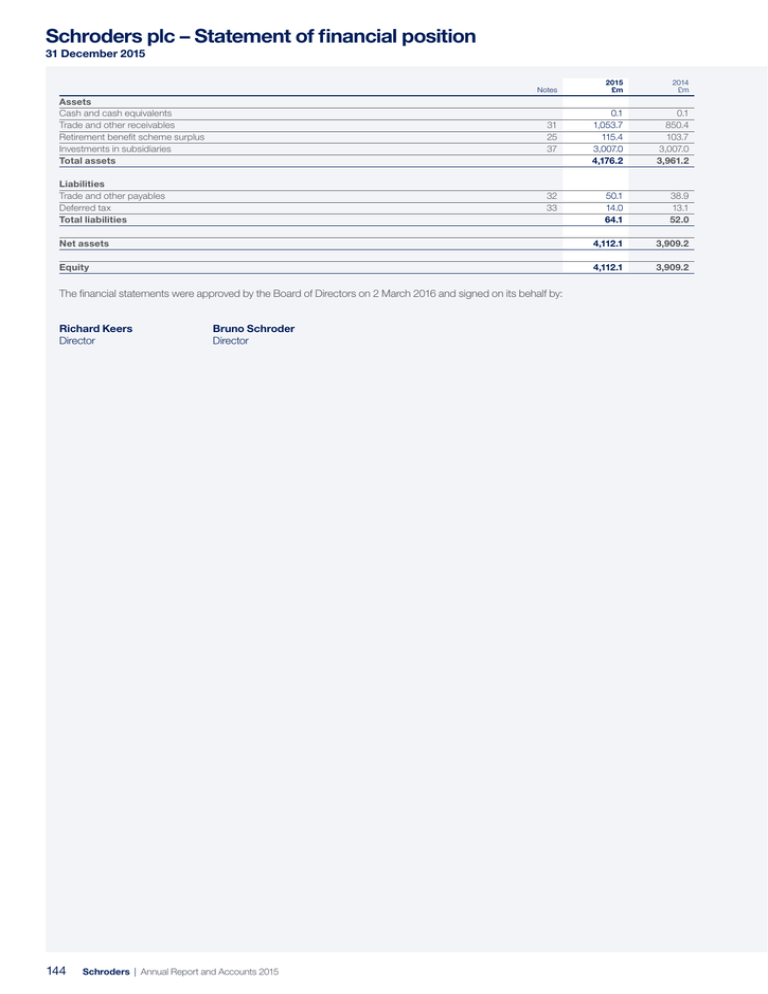

Schroders plc – Statement of financial position 31 December 2015

advertisement

Schroders plc – Statement of financial position 31 December 2015 2015 £m 2014 £m 0.1 1,053.7 115.4 3,007.0 4,176.2 0.1 850.4 103.7 3,007.0 3,961.2 50.1 14.0 64.1 38.9 13.1 52.0 Net assets 4,112.1 3,909.2 Equity 4,112.1 3,909.2 Notes Assets Cash and cash equivalents Trade and other receivables Retirement benefit scheme surplus Investments in subsidiaries Total assets 31 25 37 Liabilities Trade and other payables Deferred tax Total liabilities 32 33 The financial statements were approved by the Board of Directors on 2 March 2016 and signed on its behalf by: Richard Keers Director 144 Bruno Schroder Director Schroders | Annual Report and Accounts 2015 Schroders plc – Statement of changes in equity Financial report Year ended 31 December 2015 Share capital £m Share premium £m Own shares £m Profit and loss reserve £m Total £m 282.5 119.4 (135.2) 3,642.5 3,909.2 – – – 415.7 415.7 – – – 8.0 8.0 – – – – – – (2.3) 5.7 (2.3) 5.7 – – – – – – – – – – – – – (49.9) (49.9) 57.0 0.7 (226.3) – (168.6) 57.0 0.7 (226.3) (49.9) (218.5) Transfers At 31 December 2015 – 282.5 – 119.4 48.0 (137.1) (48.0) 3,847.3 – 4,112.1 Year ended 31 December 2014 Share capital £m Share premium £m Own shares £m Profit and loss reserve £m Total £m 282.7 119.4 (138.6) 3,495.9 3,759.4 – – – 299.6 299.6 – – – 38.7 38.7 – – – – – – (7.7) 31.0 (7.7) 31.0 (0.2) – – – – (0.2) – – – – – – – – – – (58.9) (58.9) 0.2 55.4 0.4 (177.7) – (121.7) – 55.4 0.4 (177.7) (58.9) (180.8) – 282.5 – 119.4 62.3 (135.2) (62.3) 3,642.5 – 3,909.2 Year ended 31 December 2015 Notes At 1 January 2015 Profit for the year Items not to be reclassified to the income statement: Actuarial gains on defined benefit pension schemes Tax on items taken directly to other comprehensive income Other comprehensive income Share-based payments Tax credit in respect of share schemes Dividends Own shares purchased Transactions with shareholders 8 35 Notes At 1 January 2014 Profit for the year Items not to be reclassified to the income statement: Actuarial gains on defined benefit pension schemes Tax on items taken directly to other comprehensive income Other comprehensive income Shares cancelled Share-based payments Tax credit in respect of share schemes Dividends Own shares purchased Transactions with shareholders Transfers At 31 December 2014 21 8 35 The distributable profits of Schroders plc are £2.3 billion (2014: £2.1 billion) and comprise retained profits of £2.4 billion (2014: £2.2 billion), included within the ‘Profit and loss reserve’, less amounts held within the own shares reserve. The Group’s ability to pay dividends is however restricted by the need to hold regulatory capital and to maintain sufficient other operating capital to support its ongoing business activities. In addition, the Group invests in its own funds as seed capital for the purposes of supporting new investment strategies. An analysis of the Group’s capital position is provided in the financial review. Schroders | Annual Report and Accounts 2015 145 Schroders plc – Cash flow statement for the year ended 31 December 2015 2015 £m 2014 £m Profit before tax 406.7 292.8 Adjustments for: Increase in trade and other receivables (Decrease)/increase in trade and other payables Net credit taken in respect of the defined benefit pension schemes Share-based payments expensed Amounts received in respect of Group tax relief Interest paid Interest received Net cash from operating activities (200.5) (1.9) (3.7) 57.0 6.6 (0.4) (0.1) 263.7 (115.5) 0.3 (2.8) 55.4 6.4 – – 236.6 Cash flows from financing activities Loan received from a Group company Acquisition of own shares Dividends paid Net cash used in financing activities 12.5 (49.9) (226.3) (263.7) – (58.9) (177.7) (236.6) – – 0.1 – 0.1 0.1 – 0.1 Net movement in cash and cash equivalents Opening cash and cash equivalents Net movement in cash and cash equivalents Closing cash and cash equivalents 146 Schroders | Annual Report and Accounts 2015