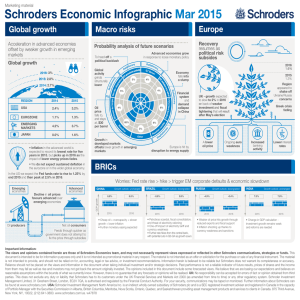

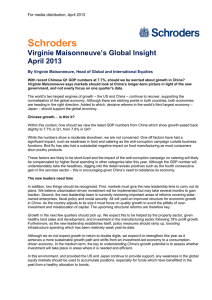

The `square root` recovery Looking for a global locomotive A pay

advertisement

√ Schroders Economic Infographic July 2015 The ‘square root’ recovery 4.6% The recovery in growth after the global financial crisis resembles the square root sign Following the initial collapse & rebound, global growth has flattened at a steady, albeit sub-par rate, of 2.5% UK labour shortages 3.3% 2.5% 2.2% 08 2.6% 2.6% UK is running out of spare capacity 2.9% Indicators point to a shortage of labour + early signs of wage inflation -1.3% 09 10 11 2012 - 2015 12 Year 13 14 15 Firms may have to compete to recruit + retain staff 1 16 2 3 2016 This should result in accelerated wage growth However, we expect a continued recovery in Europe + Japan, as well as steady growth in the US. Global slowdown is largely accounted for by weaker demand in the West for emerging market exports % 2.9% global growth in 2016 2016 = EM exports BoE relaxed: expected productivity recovery = no need to hike interest rates We believe the first interest rates hikes will appear in February 2016 Looking for a global locomotive US no longer the global locomotive it once was: The economy is not in a position to continue as a driver of global growth Just escaping deflation Relying on currency devaluation to reflate activity Too small, represent 10 % of global activity India as global driver is slightly optimistic It is difficult to see who may take responsibility The absence of a global locomotive means that we are unlikely to break with the square root recovery • Subdued growth • Ageing workforce • Inflationary pressure • Interest rates rise A pay-as-you-go bailout Eurozone leaders have reached an agreement over a third Greek bailout September GREXIT Going forward, there will be a series of reforms to avoid a grexit 2015 An agreement will hopefully be reached by September 2015 Source: Schroders as at July 2015. Important Information: Schroders has expressed its own views in this document and these may change. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get back the amount originally invested. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA, which is authorised and regulated by the Financial Conduct Authority. For your security, communications may be taped or monitored. Visit Schroders Talking Point for market news and expert views http://www.schroders.com/talkingpoint