Financial Regulations 2014

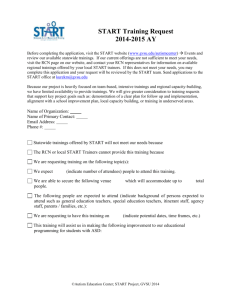

advertisement