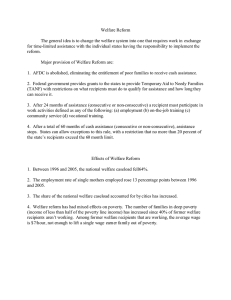

Welfare Reform and Family Expenditures: Work Regime?

advertisement