Economics of Personal Airplane Operation O3c RO

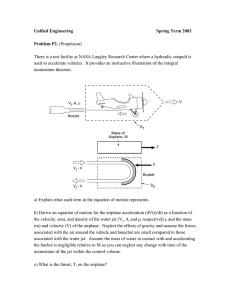

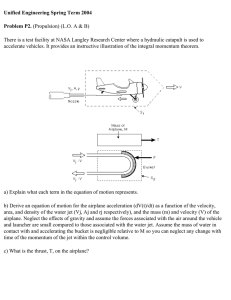

advertisement