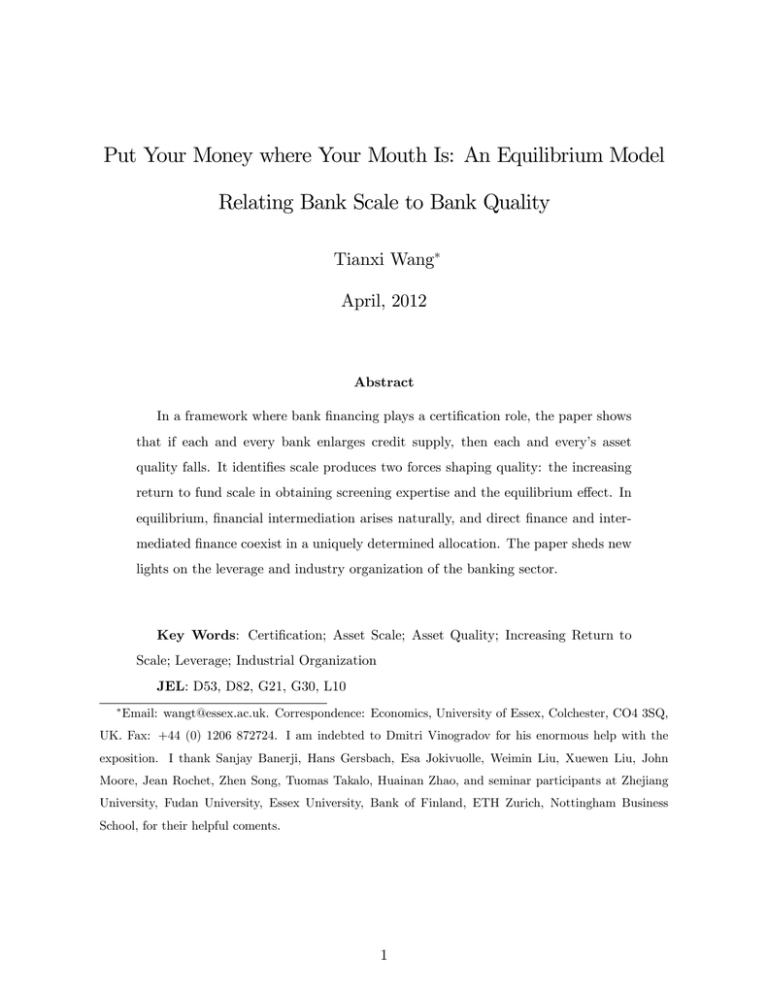

Put Your Money where Your Mouth Is: An Equilibrium Model

advertisement