Texas A&M Forest Service Timesheet Instructions

advertisement

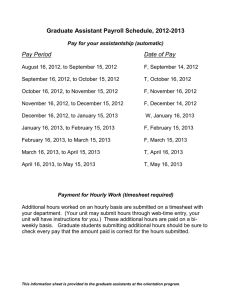

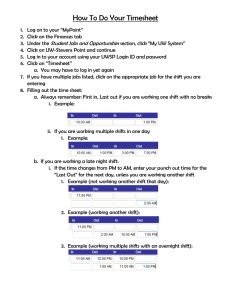

Rev 10/21/04 Texas A&M Forest Service Timesheet Instructions I. Payday Information Paychecks are normally calculated and printed two (2) days before the actual pay date shown on the check and/or check stub. It is mailed out the same day it is printed. This gives two days mail time to get to the employee. The check is not valid before the pay date on the check. II. Paycheck Delivery We are able to put all employees on Direct Deposit and we highly recommend it to all of our employees. This does away with the problem of a lost check in the mail. It is now possible for an employee to get his/her check stub information emailed to them by HR Connect. This then removes the mail system from all steps of the payroll distribution. We highly recommend this also. III. TFS Payroll Work Period The FLSA Law states that a payroll period is made up of seven (7) days assigned by the Employer. Our period begins on Thursdays at 12:01 a.m. and ends on Wednesday night at 11:59 p.m. IV. Completing the Timesheet - Instructions 1. The timesheet file consists of three worksheets: (1) Budgeted Biweekly Employees, (2) Seasonal Employees, and (3) Salaried Employees Emergency Response. Each group is treated differently in computing the hours worked. Please list each employee on his or her applicable worksheet. 2. Preparer Box - This is located at the top left corner. - Enter the preparer’s name that completed the timesheet. 3. Date Prepared Box - This is also located at the top left corner. - Enter the date the timesheet was prepared. 1 Rev 10/21/04 4. Phone # if Questions Box - This is located at the top left corner. - Enter the phone number where the preparer may be reached if any questions arise. 5. Submission Data Box - Choose an X from the drop down box under the action column to clearly state what is being sent in. Failure to label the timesheet may cause the Payroll Office to pay people twice. a. Payroll Submitted – submitting for the first time (original timesheet) b. Payroll Submitted with Estimated Time – submitting time with estimated days c. Correction Affecting Pay – changes to the hours worked or coded, affecting pay, from the original timesheet d. Correction Not Affecting Pay – changes to the hours worked or coded, not affecting pay, from the original timesheet 6. Signature Copy - Place a handwritten X in this box when submitting a copy of the signature copy of the timesheet. 1. The original signed timesheet should always be kept with the timekeeper’s records. The timekeeper is the official repository for the time sheet records for the employees he or she reports. 2. The signature copy of the timesheet gives proof that the employee’s reported time has been approved by his or her supervisor and is eligible for pay. 7. Pay Period Dates Box - Enter the start and end date of the pay period. 8. Work Week Box - Defaults to 5 Eight Hour Days (change if different) 9. Normal Working Hours Box - Defaults to 8am to 5pm (change if different) 10. Administrative Unit Box - Enter the department and/or location, whichever is appropriate. 11. Date on Each Weekday Column - Above the listed day of the week, enter the date for the pay period. 2 Rev 10/21/04 12. Employee Name Column - List each employee’s name in alphabetical order by his or her last name on the appropriate worksheet. - Do not leave names on the timesheet that have no hours to report. - Skip a line in between each employee listed. Do not skip a line between different lines for same employee. 1. For seasonal/student worker employees, please include each account number and hours worked on a separate line by the employee’s name. Do not skip a line between these lines. 2. For employees that work on incidents, please include each incident number and hours worked on a separate line under the employee’s name. Do not skip a line between these lines. Also, please make sure you use the assigned incident number from TICC which will be the number set up in FAMIS for expenses. 13. Weekday Columns - Enter the number of hours worked or the number of hours on leave for each day. - Enter as whole hours or quarters of an hour. If you enter 8 it will automatically enter 8.00. If partial hours are worked, use quarter hours. Fifteen minutes would be entered as 0.25 hours, 30 minutes would be entered as 0.50 hours, and 45 minutes would be entered as 0.75 hours. - If you enter an incorrect number of hours, be sure to hit delete to take out the incorrect number or type the new number of hours over the incorrect number. Blanking it out by hitting the space bar will cause an error in the total column. - If an employee has more than one leave type, account number, or incident number, then use as many lines as needed for the number of hours worked on the above. 3 Rev 10/21/04 14. Code Columns - This column is only used when there are hours of coded leave. Do not use this column for the daily activity code. - Only the codes listed at the bottom left corner of the timesheet may be entered in this column. See Part V for code definitions. a. If you enter an incorrect code, a message will pop up for you to retry. 1. Click retry and enter the correct code or hit delete to eliminate a code. 2. Click cancel and the incorrect code will disappear. b. If an employee has more than one type of hours in one day then use as many lines as needed for the employee. - For example, on Tuesday, an employee worked 4 hours and took vacation the remaining 4 hours. Therefore on the first line of hours for Tuesday you will enter 4 and on the second line you will enter 4 and a V in the code column. 15. Pay Columns - These columns automatically sum for you. The formula in each column totals the hours for all of the days worked and then subtracts hours that you enter in the Comp Time column. The result should be that the total of all hours worked for the seven-day period should equal the hours to be paid and the hours entered in the comp time column. - If an alpha character is entered in the day columns, then the pay columns will show numeric symbols (####) and will not total. 16. Comp Time Columns - You must account for all hours worked, even if they are to be banked as comp time. - When comp time is earned, place the hours in this column. No letter is used beside the comp time hours earned. - This column is to show the hours earned as comp in that time period to be taken off at a later date. The column is not to be used to show comp hours taken off. Hours taken off as comp time should be coded with a “c” in the code column. - The pay column and the comp column must equal the total hours showing for the 7-day period. - For example, if an employee works 45 hours in a workweek and the additional 5 hours will be comp time, the daily amounts should add across to a total of 45 hours. You would show 40 in that week’s pay column and 5 in that week’s comp column. 4 Rev 10/21/04 17. Total Hours to be Paid this Period Column - This column will also automatically sum for you. 18. Signature, Title, and Date Line - Complete with Proper Approval V. Submitting the Timesheet Timesheets are due by noon on the due date assigned. Please make every attempt in meeting this deadline. However, please do not send in partial timesheets. This causes much confusion and makes it very difficult for us to work the timesheets. Please submit the timesheet when you have accounted for all of your employees’ time. It is imperative that you let your group of employees know what the deadline is. It is the employee and supervisor’s responsibility to submit their time to the timekeeper in a timely fashion so the timekeeper may submit it to the Payroll Office by the deadline. If an employee does not submit his time by the required deadlines, then he will receive pay for his scheduled 80 hours. Any overtime earned will be paid on a future payroll. If a seasonal worker does not get his time in by the assigned deadline, he will receive his pay on the next scheduled payroll. Again, it is his responsibility to know the due date to submit his hours worked. Please email or fax the completed timesheet to the Payroll Office by the deadline. To insure that all in the Payroll Office will receive your timesheet, please use this email address payroll@tfs.tamu.edu. If you are faxing the timesheet, please make sure it is completely legible, especially if sending a reduced size fax, to reduce the chance of errors. VI. Submitting Timesheets with Estimated Time When submitting estimated time, please follow these guidelines. 1. Do not estimate overtime for budgeted biweekly, seasonals, or salaried employees. 2. Do not estimate time to an emergency incident for budgeted biweekly, seasonals, or salaried employees. For budgeted biweekly, always estimate the time to the employee’s regular budgeted account. 3. Do not estimate time for seasonals unless they work on a set schedule. For seasonals that work on an as needed basis, do not estimate time. For seasonals that work a set schedule, you may estimate time. If for some reason the seasonal with the set schedule did not work the hours estimated and owes TFS hours back, the Payroll Office requests your help to retrieve those hours back. 4. Do not estimate time for student workers. Their schedules may change due to their school schedule. 5 Rev 10/21/04 5. Do not use a code to specify an estimated day. If an employee is on an approved paid leave status, the proper leave codes may be used for the estimated days. When submitting a timesheet with estimated days, place an X in the submission data box next to payroll submitted with estimated time. VII. Submitting Corrections When submitting corrected time, please follow the guidelines below. 1. Please check the appropriate Submission Data Box on the timesheet. Remember if the change involves coded time and more than 40 hours were originally reported for that workweek, it will affect the pay of the employee. 2. Please use a timesheet with the same dates as the original timesheet being corrected in the exact same format. 3. To make sure the proper hours are paid, uniformity must be used throughout the Agency by all timekeepers. To achieve this we ask that the following method be used to report all payroll corrections. a. When time needs to be corrected for normal changes as well as estimated days, turn in a corrected time sheet for the entire work week. Please include all the hours in the entire week, not just the days being affected. The Payroll Office will subtract out the previous hours paid. Do not turn in additions only. Example: John Doe has 8 hours for each day of a workweek. Later he turns in his time and has Thursday as 10 hours. The proper method to use is to submit a timesheet with the correct submission data box checked. You would show 10 hours on his regular line for Thursday and then show the 8 hours for all the other days. If the extra two hours were to be booked as comp time, you would enter 2 in the Comp column. The formula would then pick up the 8 in the Pay column. If the extra two hours were for an emergency response to an incident number you would list the regular line with 8 hours and on the second line you would list the incident number and 2 hours. If all 10 hours were to the incident number you would show the incident number and 10 hours for the Thursday. All the other days would remain on the regular line. 6 Rev 10/21/04 b. Please turn in as few timesheets as possible. When doing corrections for normal or estimated days, please turn in one timesheet for each group (Biweekly, Seasonal, and Salaried Emergency Response) of your employees. Do not turn in one timesheet for one biweekly employee and one timesheet for another biweekly employee, etc. VIII. Leave Codes 1. Comp Time (C) Comp time should be scheduled in advance by the employee and should have the prior approval of the supervisor. Comp time is subject to rescheduling by the supervisor if an unreasonable burden would result. The supervisor has the right and should request that an employee use his/her comp time before using annual leave. This helps to manage the amount of comp time an employee has acquired. 2. Emergency Leave (E) Approval for emergency leave is specifically limited to the Director. A copy of the approved document needs to be sent in with the payroll. Emergency leave will be granted upon request because of death of the employee's spouse, or the employee's or spouse's child, parent, brother, sister, grandparent, or grandchild. The Director can also grant emergency leave when it is determined by the Agency that there are unsafe travel conditions or hazardous working conditions. 3. Holiday Leave (H) The Texas State Legislature sets the number of holidays. The holiday schedule is set by TAMUS and/or the TFS. Employees should always take the scheduled day off if possible. Any alteration from the assigned day must have prior supervisor approval unless emergency response is required. 4. Jury Duty (J) The TFS grants leaves of absence with pay for jury duty service. This is not required and should not be abused. If an employee is released from jury duty, he/she is expected to return to work if practicable. If the employee receives payment for their service, they are not required to report this to us. 7 Rev 10/21/04 5. Leave Without Pay (X) Even though there is no pay, it still must be approved by the appropriate personnel and cannot arbitrarily be taken. Do not enter any hours when an employee is on this status. Either leave the weekday column blank or enter zero, but remember to fill in the code column with an X. 6. Military Leave (M) Several types of military duty are eligible for paid status. The Director must give prior approval for any military duty. 7. Nonscheduled Paid Leave (L) This is paid leave designated by the Chancellor of TAMUS or the Director of the TFS. The Director’s Office or the Payroll Office, if instructed by the Director, will notify you of this type of leave. 8. Sick Leave (S) Sick leave with pay may be taken and sick leave without pay may be requested when sickness, injury, or pregnancy and confinement prevent the employee's performance of duty, or when the employee is needed to care for and assist a member of the employee's immediate family who is actually ill. Immediate family is defined as those individuals living in the same household and related by kinship, adoption or marriage, or foster children certified by the Texas Department of Protective and Regulatory Services. An employee’s minor child is considered immediate family even if the child does not live in the employee’s household. Pregnancy and confinement means temporary disabilities caused by or contributed to pregnancy, miscarriage, abortion, childbirth, and recovery therefrom. (See also System Regulation 31.03.05.) An employee's use of sick leave with or without pay for family members not residing in that employee's household is strictly limited to the time necessary to provide care and assistance to a child, spouse, or parent (but not parent-in-law) of the employee who needs such care and assistance as a direct result of a documented medical condition. An employee may use up to eight hours of sick leave with pay each calendar year to attend parent-teacher conferences for the employee’s children in prekindergarten through 12th grade. The employee must provide reasonable advance notice of need for this leave. Malingering and other abuses of sick leave with or without pay will constitute grounds for dismissal. 8 Rev 10/21/04 9. Sick Leave Pool (P) Sick leave pool is designed to aid employees who have suffered a catastrophic illness or injury to himself or immediate family member. To receive hours from the sick leave pool, an employee must contact the TFS Human Resource Office to apply. Each case is reviewed and decisions are made on a caseby-case basis. The employee may be eligible for up to 90 days (720 hours). If eligible for sick leave pool, it is usually given in 180-hour blocks. Each block request is reviewed for its merit and must be approved in advance by the Administrator. Timekeepers should always make sure the employee has furnished them with an approved copy of the request before coding time to this code. 10. Vacation or Annual Leave (V) An employee should always try to schedule annual leave in advance and must have supervisor’s approval. While it is not necessarily the norm, a supervisor does have the right to instruct an employee to reschedule his/her annual leave if, by granting leave in the requested time period, it would place an unreasonable burden on the Agency’s ability to provide the quality and quantity of services that the Agency is expected to provide. 11. Weekend / R&R (W) An employee takes a normal workday as a weekend during an incident. 12. Administrative Leave (A) Administrative leave is limited in its use. You will be instructed on a caseby-case situation if this leave is to be used. Approval for administrative leave is specifically limited to the Director. A copy of the approved document needs to be sent in with the payroll. 9