PLC - Material adverse change event established and appropriation not... Material adverse change event established and appropriation

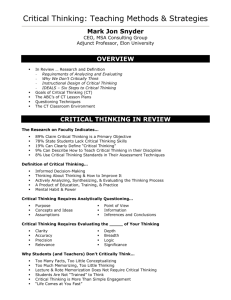

advertisement

PLC - Material adverse change event established and appropriation not i... Page 1 of 9

Material adverse change event established and appropriation

not invalid but relief from forfeiture available (Privy Council)

Resource type: Legal update: case report

Status: Published on 14-Feb-2013

Jurisdictions: England, Wales

In Cukurova Finance International Limited and Cul<urova Holding AS v Alfa Telecom Turl<ey Ltd

[2013] UKPC 2 (30 January 2013), the Privy Council examined whether the material adverse

change event of default in a facility agreement had been established, whether the exercise of the

remedy of appropriation had been vitiated by bad faith or improper purpose and whether the

equitable remedy of relief from forfeiture was available.

Jonathan Lawrence of K&L Gates LLP has commented on the decision for PLC Finance.

PLC Finance

Speed read

The Privy Council has agreed with the decision of the Court of Appeal of the Eastern Caribbean

Supreme Court that the material adverse change event of default had been established by Alfa

Telecom and that Alfa Telecom had not exercised the remedy of appropriation in bad faith and for

an improper purpose. The Privy Council also decided that relief from forfeiture should be available

to Cukurova but invited further submissions as to the basis and terms on which it should be granted

{Cukurova Finance International Limited and Cukurova Holding AS v Alfa Telecom Turkey Ltd

[2013] UKPC 2).

Jonathan Lawrence of K&L Gates LLP has commented on the decision for PLC Finance.

Background

Material adverse change event of default

A material adverse change (MAC) event of default (www.practicallaw.com/9-107-6565)

usually

refers to any event or circumstance that may materially and adversely affect the following:

3 A borrower and its group.

a The ability of a borrower and its group to perform its or their obligations under the finance

documents.

3 The security granted in connection with a facility agreement.

This clause is a "sweep-up" event of default. It allows a lender to capture unforseeable events or

circumstances that perhaps do not give rise to an event of default under one of the other events of

default drafted to catch specific concerns that the lender was able to identify when the facility

http://finance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 2 of 9

agreement in question was signed.

The vagueness of this event of default means its effectiveness is highly disputed and wrongful use

could give rise to lender liability risks.

For more information on a MAC event of default, see Practice note, Material adverse cliange

(MAC) clauses in finance documents: MAC event of default (www.practicallaw.com/5-384-7022).

Financial Collateral Arrangements (No.2) Regulations 2003

The Financial Collateral Arrangements (No.2) Regulations 2003 {SI 2003/3226) (FCA Regulations)

implement Directive 2002/47/EC of the European Parliament and of the Council of 6 June 2002 on

financial collateral arrangements {OJ 2002 L168/43) (Directive) in the United Kingdom. The aim of

the Directive is to simplify the process of taking financial collateral across the EU by introducing

minimum uniform arrangements.

The FCA Regulations apply to "financial collateral arrangements" which includes "security financial

collateral arrangements" between two parties (both of whom must be non-natural persons) in which

a security interest in the financial collateral is given by the collateral-provider to the collateral-taker

coupled with the financial collateral being in the possession or under the control of the collateraltaker or a person acting on its behalf.

"Financial collateral" is defined by the FCA Regulations as cash or financial instruments, such as

company shares or equivalent securities, bonds or other tradeable capital markets debt instruments.

For more information on the FCA Regulations, see Practice note, Financial collateral

arrangements (www.practicallaw.com/8-212-1954).

Appropriation

Regulation 17 of the FCA Regulations provides that:

"Where a legal or equitable mortgage is the security interest created or arising under a security

financial collateral arrangement on terms that include a power for the collateral-taker to appropriate

the collateral, the collateral-taker may exercise that power in accordance with the terms of the

security financial collateral arrangement, without any order for foreclosure from the courts."

This was the wording of regulation 17 as it applied to the facts of this case, but regulation 17 has

since been amended. For information on the amendments made to regulation 17, see Practice

note, Financial collateral arrangements: Changes introduced by the FCA Amendment Regulations

2010 (www. practicalla w. com/8-212-1954).

Appropriation is not defined in the Directive or the FCA Regulations. The Concise Oxford English

Dictionary (Oxford University Press, 11th ed., 2006) defines "appropriate" as including "take for

one's own use without permission".

For more information on the right of appropriation, see Practice note, Financial collateral

arrangements: Right of appropriation (www.practicallaw.com/8-212-1954).

Relief f r o m f o r f e i t u r e

http://finance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 3 of 9

The jurisdiction of a court to allow relief from forfeiture is equitable. It was first established in

relation to leases of land and most commonly arises in that context. However, this relief may also

be available in relation to other types of property where the forfeiture is of proprietary or possessory

rights rather than mere contractual rights {BICCPLCyBum^^^^

Facts

Corporate structure and background

The appellants, Cukurova Finance International Limited (CFI) and Cukurova Holding AS (CH), are

members of the Cukurova Group of companies. Before September 2005, CH owned 52.91 % of

Turkcell Holding AS (TCH), the remaining shares in TCH being held by Telia Sonera Finland OYJ

(Sonera). TCH held 51 of the 100 issued shares in Turkcell lletisim Hizmetleri AS (Turkcell), a

Turkish mobile phone network provider whose shares are traded on the Istanbul and New York

stock exchanges.

In 2003 and 2004, the Cukurova Group was under considerable cash flow pressures and it entered

into discussions with the Alfa Group with a view to alleviating those pressures.

While discussions with the Alfa Group continued, Sonera contended that CH was obliged to

transfer its shares in TCH to Sonera pursuant to an alleged pre-emption agreement. It became

clear in the discussions with the Alfa Group that the shares in Turkcell and TCH might be important

in any agreement reached between the Cukurova Group and the Alfa Group. Therefore, to defeat

Sonera's claim to CH's shares in TCH, CH transferred those shares to a newly incorporated BVI

company, Cukurova Telecom Holdings Limited (CTH). CTH was wholly owned by CFI.

Documentation and proceedings

On 1 June 2005, CH and CFI entered into a subscription agreement (Subscription Agreement) with

Alfa Telecom Turkey Limited (ATT) under which:

a In return for a subscription price of US$1.6 billion from ATT, CFI had to procure that CTH

issued convertible bonds to ATT which, when exercised, would give ATT 49% of the issued

shares in CTH, leaving CFI with the remaining 51%.

3 ATT would enter into a facility agreement (Facility Agreement) under which it would grant CFI a

secured facility (Secured Loan) of US$1.352 billion (secured by charges over CFI's shares in

CTH and CH's shares in CFI), and an unsecured facility of US$355 million.

a The parties agreed to enter into a shareholders agreement.

On 17 June 2005, Sonera began arbitration proceedings against CFI in Geneva, claiming specific

performance of the pre-emption agreement.

On 28 September 2005, ATT and CFI entered into the Facility Agreement. The Facility Agreement

contained various events of default, including a material adverse change (MAC) event of default at

http://finance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 4 of 9

clause 17.16 on the following terms:

"Any event or circumstance which in the opinion of [ATT] has had or is reasonably

likely to have a material adverse effect on the financial condition, assets or business

of [CFI]."

Also on 28 September 2005, CFI granted to ATT a share charge governed by English law over its

51% shareholding in CTH.

On 25 November 2005, ATT made the advances contemplated by the Subscription Agreement and

the Facility Agreement, including the Secured Loan.

Also on 25 November 2005, CH granted to ATT a share charge governed by English law over its

100% shareholding in CFI.

The terms of the share charges granted by CFI and CH (Share Charges) were identical in all

material respects and included a clause which provided that ATT had the right to appropriate the

charged shares in satisfaction of the liabilities owed to it.

On 24 November 2006, CFI made the interest payments required under the Facility Agreement,

despite the fact that ATT had blocked the payment of dividends to CTH with a view to preventing

CFI from paying that interest.

On 26 January 2007, Sonera issued a press release announcing that the Geneva arbitration had

resulted in an award (Award) that concluded that there was a binding obligation on CH to transfer

its 52.91% holding in TCH to Sonera for US$3.1m, and ordered specific performance of that

obligation.

On 16 April 2007, in a letter signed by the sole director of ATT sent by its solicitors to CFI (with a

copy to CH), ATT:

3 Alleged that a number of events of default had occurred under the Facility Agreement which

were incapable of remedy, and demanded immediate repayment of the Secured Loan

(repayment proceedings). Amongst other things, ATT stated that the Award as described in

Sonera's press release was an event that triggered the MAC event of default. This was on the

basis that CH would be unable to comply with the order for specific performance under the

Award which would, therefore, be replaced by a significant damages award that would have a

material adverse effect on the financial condition of CH and/or other members of the Cukurova

Group.

a Formally requested to be registered as the owner of the charged shares in CTH and CFI

(enforcement proceedings).

Also on 16 April 2007, ATT issued two claims in the BVI courts as follows:

a First, for a declaration that ATT was entitled to accelerate repayment of the Secured Loan, and

demanding its immediate repayment, together with contractual and default interest (repayment

proceedings).

http://finance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 5 of 9

a Secondly, for an order compelling CFI and CH to comply with ATT's request to be registered as

the owner of the charged shares.

On 17 April 2007, CFI challenged ATT's right to accelerate the Secured Loan but provided no

arguments in support of this challenge.

On 27 April 2007, ATT gave notice to CH and CFI that it had appropriated the charged shares in

exercise of its rights under the Share Charges, shortly after which CFI obtained an interim

injunction restraining ATT from proceeding with the appropriation, if it had not already been

completed.

On 17 May 2007, CFI gave ATT formal notice that it intended to repay the Secured Loan in full,

together with contractual interest and default interest and formally tendered that amount to ATT

eight days later. However, ATT refused to accept the amount tendered on the ground it was made

too late because ATT had exercised its right to accelerate the Secured Loan and as such was

entitled to appropriate the charged shares which it had, therefore, done.

On 25 May 2007, CFI and CH began proceedings (tender proceedings) seeking an order requiring

ATT to accept the amount tendered and to redeem the security.

High Court

Before the enforcement, repayment and tender proceedings could proceed, the preliminary point of

whether ATT's actions on 27 April 2007 were sufficient to appropriate the charged shares had to be

decided. This issue was resolved by the Privy Council on 5 May 2009 which decided that ATT's

action had been sufficient, provided that ATT in due course established that it was entitled to

enforce its security {Cukuroya Finance International

Ltd&AnqrvM

Virgin Islands) [2^^

For more information on this decision, see Legal update,

Appropriation of financial collateral: Privy Council decision (www.practicallaw.com/3-385-9105).

The High Court then had to decide on three issues as follows:

a Whether any event of default had occurred under the Facility Agreement so entitling ATT to

accelerate the Secured Loan.

a If an event of default had occurred, whether ATT was entitled to enforce its security by

appropriating the charged shares.

3 Whether, if they failed on the first two issues, CFI and CH were entitled to relief from forfeiture.

On 20 May 2010, the High Court held that ATT had not established any event of default, in

particular the MAC event of default had not been established because there was no evidence ATT

had formed the requisite opinion that the Award was an event that would trigger the MAC event of

default. This meant that the Court did not need to decide the other two issues but the Court did,

however, reject the argument raised by CFI and CH that ATT was not justified in appropriating the

charged shares because it had done so in bad faith and for an improper motive (namely with the

intention of obtaining control of the shares in Turkcell).

http://finance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 6 of 9

The High Court directed that, if CFI tendered the appropriate amount outstanding, ATT would be

obliged to permit CFI to redeem the charged shares.

ATT appealed to the Court of Appeal of the Eastern Caribbean Supreme Court.

Court of Appeal

On 20 July 2011, the Court of Appeal held, disagreeing with the High Court, that ATT had

established three events of default. The Court of Appeal also held, this time in agreement with the

High Court, that CH and CFI could not rely on the bad faith or improper purpose arguments. They

allowed the appeal and held that ATT had properly accelerated the Secured Loan and had properly

appropriated the charged shares. While two judges did not consider the claim for relief from

forfeiture, Kawaley JA effectively held that that claim could not succeed because the argument

based on bad faith and improper purpose had failed.

CH and CFI appealed the decision.

Decision

The Privy Council upheld the decision of the Court of Appeal of the Eastern Caribbean Supreme

Court that:

3 The MAC event of default had been established by ATT.

3 ATT's exercise of its remedy of appropriation was not vitiated by bad faith or improper purpose.

The Privy Council also held that relief from forfeiture should be available to Cukurova.

MAC e v e n t o f default e s t a b l i s h e d

The wording of the MAC event of default in clause 17.16 of the Facility Agreement meant that it

was common ground between the parties that for that clause to be satisfied an event did not need

objectively to have an adverse effect. All that was required was for ATT as lender to believe that an

event had such an effect and for that belief to be both honest and rational.

The Privy Council upheld the Court of Appeal's ruling that ATT had provided evidence that it had

formed the requisite opinion that an event that was likely to have a material adverse effect on the

financial condition of CFI had occurred, and that that opinion was honest and rational. ATT's letter

of 16 April 2007 in which it alleged that a number of events of default had occurred was signed by

the sole director of ATT (who had also signed the Facility Agreement on behalf of ATT), making it

clear that ATT had formed the requisite opinion.

Appropriation not invalid by reason of bad faith or improper purpose

The Privy Council upheld both the High Court and Court of Appeal decisions that the appropriation

of the shares by ATT was effective and not invalid because ATT had exercised its rights in bad faith

http://finance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 7 of 9

and for improper purpose. ATT had a contractual right to accelerate the Secured Loan and was

entitled under the Share Charges to appropriate the charged assets in satisfaction of the liabilities

owed to it by CFI. The acquisition of control of Turkcell by ATT as a result of ATT appropriating the

shares was a necessary incident of a permitted mode of enforcement by ATT to satisfy the debt

owed to it. The fact that it was an incident that was highly attractive to ATT did not mean that ATT

had exercised its right to appropriate in bad faith.

The Privy Council went on to comment that if a security taker is enforcing its security to satisfy the

debt owed to it, the fact that it may have additional reasons, however significant, for enforcing that

security cannot vitiate its enforcement of the security otherwise the right to enforce security for its

proper purpose would be indefinitely impeded as a result of other aspects of the security taker's

state of mind which were irrelevant.

Relief from forfeiture available

The Privy Council held that relief from forfeiture should be available to CFI and CH. It concluded

that the jurisdiction to grant relief from forfeiture is not limited to real property and it is available in

principle where what is in question is forfeiture of proprietary or possessory rights (as opposed to

merely contractual rights), regardless of the type of property concerned.

ATT had submitted that relief from forfeiture was excluded, expressly or by necessary implication,

by the FCA Regulations. However, the Privy Council found that nothing in the FCA Regulations

precludes the availability of relief against forfeiture and that, in principle, it remains available

following ATT's appropriation of the charged shares.

Various factors should be taken into account in deciding whether relief from forfeiture was available

to a party, for example, the conduct of the party seeking relief (whether his default was wilful, the

gravity of the breach and the disparity between the value of the property of which forfeiture is

claimed compared with the damage cause by the breach), the ability and extent to which the

breaches have been, or could be, remedied and the need for commercial certainty. The Privy

Council took the view that relief from forfeiture should be available in this case on appropriate

conditions, and asked for further submissions as to the basis and terms upon which it should be

granted.

Comment

This decision is of interest because it provides useful guidance on what evidence may be used to

establish a belief that a MAC event of default, often hard to establish, has occurred. The comments

made by the Privy Council on the enforcement of security being motivated by bad faith, or for a

purpose other than satisfying the liabilities owed, are interesting and help to clarify whether a

security taker's enforcing of its security may be vitiated by an improper or collateral reason.

This case is also interesting with regard to the FCA Regulations as it shows that, in certain

scenarios, the remedy of appropriation available to a security taker under the FCA Regulations can

be challenged and a security provider granted relief from forfeiture. More generally, it reiterates that

the equitable remedy of relief from forfeiture is available in relation to assets other than real

property.

http://fmance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 8 of 9

PLC Finance is grateful to Jonattian Lawrence of K&L Gates LLP for providing his comments below

on the decision.

Jonathan Lawrence, K&L Gates LLP

The Privy Council's decision explores several pertinent issues of direct relevance to lenders and

borrowers both when entering into finance documentation and seeking to enforce it.

3 Most importantly, this is the first case in which the exercise of an appropriation provision has

been challenged and successfully overturned by a borrower. There are equitable safeguards

available to borrowers who give security. In addition, the case contains an in depth discussion

of the origin of the FCA Regulations and its interplay with the Directive. This is of significance

as many English law security documents now contain an appropriation provision introduced by

the FCA Regulations. Parties should bear in mind that, in certain circumstances, the

appropriation by the lender will not be final and, if called upon, a court may exercise its

jurisdiction to grant relief from forfeiture to allow a borrower the opportunity to redeem its

security after the lender has purported to enforce it.

3 The Privy Council has yet to determine the precise conditions upon which Cukurova can

recover its shares in this case. Significantly, the Privy Council's judgment has raised several

questions concerning how much a borrower, who is granted relief from forfeiture, will be

required to pay by way of compensation to the lender for having been deprived of its

repayment from the date of appropriation to the eventual redemption date. Each party is

making further submissions on this point. The Privy Council has asked the parties to consider

the different views that may be taken as to the conceptual basis of relief against forfeiture, for

example, that it:

-3 restores a borrower's property in shares charged, upon terms imposed by the court to

compensate the lender appropriately; or

3 also retrospectively recreates and requires performance of all contractual obligations which

would otherwise have existed, but for the appropriation.

A further judgment is expected later in the year.

3 Additionally, the case is of interest to those considering how courts view the "controlling minds"

of companies when they call an event of default, such as a MAC. At first instance, the judge

found that the only director of ATT, who was based in Luxembourg, did not appear to have

been in any real sense a directing mind or will of ATT. The first instance judge dismissed as

unsatisfactory evidence that the management of ATT had been delegated to another company.

The Court of Appeal disagreed saying that if the ATT sole director only acted upon instructions

of other individuals who were the true directing minds of ATT then the 16 April 2007 letter could

only have been sent upon those individuals' instructions and, therefore, the test was satisfied.

The Privy Council pointed to further supporting evidence. The lesson being that, when issuing

a default notice, the issuing party must be able to show its decision making process. If that

decision involved other parties then the relationships between the parties must be readily

http://finance.practicallaw.com/4-524-0432

14/02/2013

PLC - Material adverse change event established and appropriation not i... Page 9 of 9

explainable to the court.

3 The MAC clause was triggered on the basis of the press release about the award rather than

the official award itself. The Privy Council found that the press release may have been

premature but it represented a classic case of a substantial contingent liability and therefore

unquestionably triggered the event of default. A lender needs to be aware of not acting

prematurely in calling a default but a borrower needs to consider publicity about its condition as

potentially triggering a MAC clause.

Case

Cukurova Finance International Ltd & Anor v Alfa Telecom Turkey Ltd (British Virgin Islands) [2013]

UKPC 2 (30 January 2013)

Resource information

Resource ID: 4-524-0432

Published: 14-Feb-2013

Products: PLC UK Finance

Related content

Topics

Lending: General (http://finance.practicallaw.com/1-103-2033)

Security and Quasi Security (http://finance.practicallaw.com/6-103-1106)

Practice notes

Financial collateral arrangements (http://finance.practicallaw.com/topic8-212-1954)

Material adverse change (MAC) clauses in finance documents (http://finance.practicallaw.com/topic5-384-7022)

Legal update: case report

Appropriation of financial collateral: Privy Council decision (http://finance.practicallaw.com/topic3-385-9105)

Case page

Cukurova Finance International Ltd & Anor v Alfa Telecom Turkey Ltd (British Virgin Islands) [2013] UKPC 2 (30

January 2013) (http://finance.practicallaw.com/topicD-016-0434)

http://finance.practicallaw.com/4-524-0432

14/02/2013