2Q 15 1Q 15 2Q 14 May 2,

advertisement

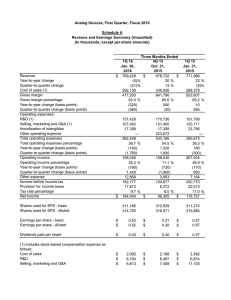

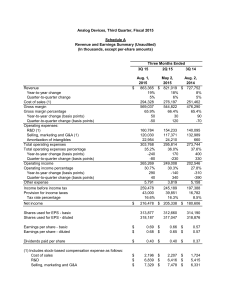

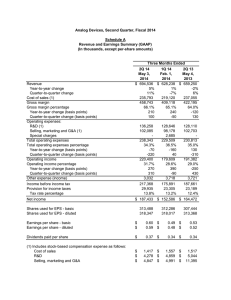

Analog Devices, Second Quarter, Fiscal 2015 Schedule A Revenue and Earnings Summary (Unaudited) (In thousands, except per-share amounts) Three Months Ended 2Q 15 Revenue Year-to-year change Quarter-to-quarter change Cost of sales (1) Gross margin Gross margin percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating expenses: R&D (1) Selling, marketing and G&A (1) Amortization of intangibles Total operating expenses Total operating expenses percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating income Operating income percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Other expense 2Q 14 May 2, Jan. 31, May 3, 2015 2015 2014 $ 821,019 $ 771,986 $ 694,536 18% 23% 5% 6% -5% 11% 276,197 268,379 235,793 544,822 503,607 458,743 66.4% 65.2% 66.1% 30 10 210 120 550 100 Income before income tax Provision for income taxes Tax rate percentage Net income 1Q 15 $ Shares used for EPS - basic Shares used for EPS - diluted 154,233 117,371 24,210 295,814 36.0% 170 -230 249,008 30.3% -140 340 3,819 151,706 120,171 23,796 295,673 38.3% 180 -300 207,934 26.9% -170 850 7,164 136,203 102,085 55 238,343 34.3% -70 -220 220,400 31.7% 270 310 3,032 245,189 39,851 16.3% 200,770 22,013 11.0% 217,368 29,935 13.8% 205,338 $ 178,757 $ 187,433 312,660 317,047 311,274 315,684 313,488 318,347 Earnings per share - basic Earnings per share - diluted $ $ 0.66 0.65 $ $ 0.57 0.57 $ $ 0.60 0.59 Dividends paid per share $ 0.40 $ 0.37 $ 0.37 (1) Includes stock-based compensation expense as follows: Cost of sales R&D Selling, marketing and G&A $ $ $ 2,207 6,416 7,478 $ $ $ 2,392 6,874 11,105 $ $ $ 1,417 4,278 4,847 Analog Devices, Second Quarter, Fiscal 2015 Schedule B Selected Balance Sheet Information (Unaudited) (In thousands) Cash & short-term investments Accounts receivable, net Inventories (1) Other current assets Total current assets PP&E, net Investments Goodwill Intangible assets, net Other Total assets Deferred income on shipments to distributors, net Other current liabilities Long-term debt, current Long-term debt, non-current Non-current liabilities Shareholders' equity Total liabilities & equity 2Q 15 May 2, 2015 $ 3,074,778 408,510 394,494 167,979 4,045,761 629,665 39,687 1,643,614 621,277 68,471 $ 7,048,475 1Q 15 Jan. 31, 2015 $ 2,873,281 402,350 367,238 160,168 3,803,037 612,472 34,989 1,641,793 646,400 82,465 $ 6,821,156 2Q 14 May 3, 2014 $ 4,807,225 360,847 298,432 171,528 5,638,032 545,485 30,080 287,341 28,442 65,571 $ 6,594,951 $ $ $ 295,428 398,127 374,664 498,399 517,649 4,964,208 $ 7,048,475 278,228 354,681 872,926 509,111 4,806,210 $ 6,821,156 (1) Includes $3,066, $3,176, and $1,982 related to stock-based compensation in 2Q15, 1Q15, and 2Q14, respectively. 267,933 303,269 872,515 219,711 4,931,523 $ 6,594,951 Analog Devices, Second Quarter, Fiscal 2015 Schedule C Cash Flow Statement (Unaudited) (In thousands) 2Q 15 May 2, 2015 Cash flows from operating activities: Net Income Adjustments to reconcile net income to net cash provided by operations: Depreciation Amortization of intangibles Stock-based compensation expense Other non-cash activity Excess tax benefit - stock options Deferred income taxes Changes in operating assets and liabilities Total adjustments Net cash provided by operating activities Percent of total revenue $ Cash flows from investing activities: Purchases of short-term available-for-sale investments Maturities of short-term available-for-sale investments Sales of short-term available-for-sale investments Additions to property, plant and equipment Payments for acquisitions, net of cash acquired Change in other assets Net cash (used for) provided by investing activities Cash flows from financing activities: Dividend payments to shareholders Repurchase of common stock Proceeds from employee stock plans Excess tax benefit - stock options Change in other financing activities Net cash used for financing activities Effect of exchange rate changes on cash Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period $ Three Months Ended 1Q 15 2Q 14 Jan. 31, May 3, 2015 2014 205,338 $ 178,757 $ 187,433 32,036 25,154 16,101 1,832 (11,142) (6,481) 81,193 138,693 344,031 41.9% 31,773 24,739 20,371 3,743 (4,635) (2,915) (83,180) (10,104) 168,653 21.8% 27,459 55 10,542 1,400 (4,423) 1,068 14,824 50,925 238,358 34.3% (1,661,176) 1,154,412 291,900 (49,229) (4,468) (268,561) (1,211,021) 701,149 583,750 (23,760) (118) (3,729) 46,271 (2,275,241) 1,966,158 189,267 (44,058) (6,076) (169,950) (124,882) (24,275) 52,090 11,142 (3,563) (89,488) 32 (115,084) (59,636) 42,793 4,635 (3,988) (131,280) (2,675) (115,795) (22,614) 62,936 4,423 (11,284) (82,334) (511) 80,969 569,233 650,202 (14,437) 417,227 402,790 (13,986) 650,202 636,216 $ $ Analog Devices, Second Quarter, Fiscal 2015 Schedule D Revenue Trends by End Market (Unaudited) The categorization of revenue by end market is determined using a variety of data points including the technical characteristics of the product, the “sold to” customer information, the "ship to" customer information and the end customer product or application into which our product will be incorporated. As data systems for capturing and tracking this data evolve and improve, the categorization of products by end market can vary over time. When this occurs we reclassify revenue by end market for prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each end market. The results below are inclusive of the Hittite acquisition from the acquisition date, July 22, 2014. Three Months Ended Industrial Automotive Consumer Communications Total Revenue Revenue $ 390,712 139,707 109,032 181,568 $ 821,019 May 2, 2015 % Q/Q % 48% 11% 17% 13% 13% 15% 22% -10% 100% 6% Y/Y % 20% 3% 40% 17% 18% Jan. 31, 2015 Revenue $ 351,703 124,040 95,109 201,134 $ 771,986 May 3, 2014 Revenue $ 325,950 135,998 77,644 154,944 $ 694,536 Analog Devices, Second Quarter, Fiscal 2015 Schedule E Reconciliation from GAAP to Non-GAAP Data (In thousands, except per-share amounts) (Unaudited) See "Non-GAAP Financial Information" in this press release for a description of the items excluded from our non-GAAP measures. GAAP Gross Margin 2Q 15 Three Months Ended 1Q 15 2Q 14 May 2, 2015 Jan. 31, 2015 May 3, 2014 $544,822 Gross Margin Percentage $503,607 $458,743 66.4% 65.2% 66.1% 1,520 2,973 - $ 546,342 113 $ 506,693 $ 458,743 Gross Margin Percentage 66.5% 65.6% 66.1% GAAP Operating Expenses $ 295,814 $ 295,673 $ 238,343 36.0% 38.3% 34.3% (24,435) (24,132) - (1,820) (3,057) - Acquisition-Related Expenses Stock-Based Compensation Expense Non-GAAP Gross Margin Percent of Revenue Acquisition-Related Expenses Acquisition-Related Transaction Costs Stock-Based Compensation Expense Non-GAAP Operating Expenses $ 269,559 (4,164) $ 264,320 $ 238,343 32.8% 34.2% 34.3% $ 249,008 $ 207,934 $ 220,400 30.3% 26.9% 31.7% 25,955 27,105 - 1,820 3,057 - $ 276,783 4,277 $ 242,373 $ 220,400 33.7% 31.4% 31.7% Percent of Revenue GAAP Operating Income/Margin Percent of Revenue Acquisition-Related Expenses Acquisition-Related Transaction Costs Stock-Based Compensation Expense Non-GAAP Operating Income/Margin Percent of Revenue GAAP Diluted EPS $ 0.65 $ 0.57 $ 0.59 Acquisition-Related Expenses 0.08 0.08 - Acquisition-Related Transaction Costs Acquisition-Related Tax Impact 0.01 0.01 - (0.01) (0.01) - 0.01 - Stock-Based Compensation Expense Impact of the Reinstatement of the R&D Tax Credit Non-GAAP Diluted EPS (1) $ 0.73 (1) The sum of the individual per share amounts may not equal the total due to rounding $ (0.02) 0.63 $ 0.59