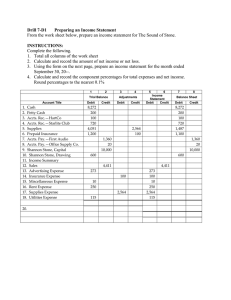

IS 3-2 note

advertisement

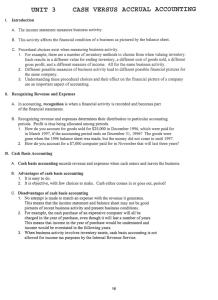

GAAP’S 1.Time Period Principle – The defining and consistent use of the same period of time for the accounting period. 2.Each company sets and defines an accounting period and consistently uses this time period when preparing financial statements 1.Matching Principle – The costs recorded in the expense accounts should be matched with the revenue they help to generate during the same accounting period 1.Accrual Basis of Accounting – this style of accounting records revenue when it is earned, whether for cash or credit, and expenses when they are incurred, whether for cash or on credit Steps in Preparing an Income Statement 1. Prepare the statement heading – 3 line heading like the balance sheet 2. Prepare the revenue section – the largest revenue item is usually listed first, the revenue is totaled and the total is placed in the right hand column 3. Prepare the expense section – they are listed in the order in which they appear in the ledger 4. Determine the net income or net loss – calculating the difference between the revenue and the expenses Facts to Remember 1.Dollar signs should be placed beside the first figure in each column, and should be placed beside the net income or the net loss figure at the bottom of the statement 2.A net loss is shown by placing the number in brackets ex ($1000)