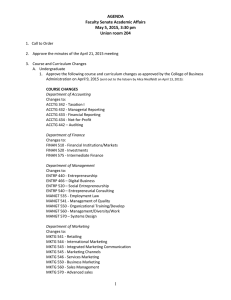

Supplemental Information Course and Curriculum items FS Academic Affairs Committee Review May 5, 2015 Meeting

advertisement

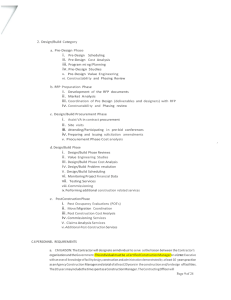

Supplemental Information Course and Curriculum items FS Academic Affairs Committee Review May 5, 2015 Meeting College of Business Administration (4‐9‐15) Pages 1‐7 College of Human Ecology (4‐12‐15) Pages 8‐12 1 College of Business Administration (4‐9‐15) Department of Accounting COURSE ACCTG 342 ‐ Taxation I ACCTG 432 ‐ Managerial Reporting ACCTG 433 ‐ Financial Reporting ACCTG 434 ‐ Not‐for‐Profit ACCTG 442 ‐ Auditing Add the following pre‐requisite to each course listed below: Enrollment in this course is limited to students who have declared a major in the college of business, or for students whose curriculum requires the relevant courses. Other students should contact the departmental office to request permission. Rationale This change will allow enforcement of the admissions requirements described in the attached proposal and processed as a separate curriculum change. Impact on Other Units This proposal would impact students from other colleges who attempt to take the influenced courses. However, the impact will only be to require permission to take those courses where pre‐requisites are met. The intent is not to restrict enrollment in the courses by bone‐fide students majoring in other areas, but only to ensure that students intending to pursue majors in business are duly admitted at the appropriate time. Effective Date Fall 2015 Department of Finance COURSE Add the following pre‐requisite to each course listed below: Enrollment in this course is limited to students who have declared a major in the college of business, or for students whose curriculum requires the relevant courses. Other students should contact the departmental office to request permission. FINAN 510 ‐ Financial Institutions/Markets 2 FINAN 520 ‐ Investments FINAN 575 ‐ Intermediate Finance Rationale This change will allow enforcement of the admissions requirements described in the attached proposal and processed as a separate curriculum change. Impact on Other Units This proposal would impact students from other colleges who attempt to take the influenced courses. However, the impact will only be to require permission to take those courses where pre‐requisites are met. The intent is not to restrict enrollment in the courses by bone‐fide students majoring in other areas, but only to ensure that students intending to pursue majors in business are duly admitted at the appropriate time. Effective Date Fall 2015 Department of Management COURSE Add the following pre‐requisite to each course listed below: Enrollment in this course is limited to students who have declared a major in the college of business, or for students whose curriculum requires the relevant courses. Other students should contact the departmental office to request permission. ENTRP 440 ‐ Entrepreneurship ENTRP 466 – Digital Business ENTRP 520 – Social Entrepreneurship ENTRP 540 – Entrepreneurial Consulting MANGT 535 ‐ Employment Law MANGT 541 ‐ Management of Quality MANGT 550 ‐ Organizational Training/Develop MANGT 560 ‐ Management/Diversity/Work MANGT 570 – Systems Design Rationale This change will allow enforcement of the admissions requirements described in the attached proposal and processed as a separate curriculum change. Impact on Other Units This proposal would impact students from other colleges who attempt to take the influenced courses. However, the impact will only be to require permission to take those courses where pre‐requisites are met. 3 The intent is not to restrict enrollment in the courses by bone‐fide students majoring in other areas, but only to ensure that students intending to pursue majors in business are duly admitted at the appropriate time. Effective Date Fall 2015 Department of Marketing COURSE Add the following pre‐requisite to each course listed below: Enrollment in this course is limited to students who have declared a major in the college of business, or for students whose curriculum requires the relevant courses. Other students should contact the departmental office to request permission. MKTG 541 ‐ Retailing MKTG 544 ‐ International Marketing MKTG 543 ‐ Integrated Marketing Communication MKTG 545 ‐ Marketing Channels MKTG 546 ‐ Services Marketing MKTG 550 ‐ Business Marketing MKTG 560 ‐ Sales Management MKTG 570 ‐ Advanced sales Rationale This change will allow enforcement of the admissions requirements described in the attached proposal and processed as a separate curriculum change. Impact on Other Units This proposal would impact students from other colleges who attempt to take the influenced courses. However, the impact will only be to require permission to take those courses where pre‐requisites are met. The intent is not to restrict enrollment in the courses by bone‐fide students majoring in other areas, but only to ensure that students intending to pursue majors in business are duly admitted at the appropriate time. Effective Date Fall 2015 4 NON‐EXPEDITED UNDERGRADUATE CURRICULUM CHANGE Bachelor of Science in Business Administration Bachelor of Science in Business Administration From: To: Business administration pre‐professions Business administration pre‐professions Students entering college for the first time and eligible Students entering college for the first time and eligible for admission to K‐State must enroll in the business for admission to K‐State must enroll in the business administration pre‐professions program (BAPP). administration pre‐professions program (BAPP). Students must achieve a 2.5 K‐State GPA by the time Students must achieve a 2.5 K‐State GPA by the time they complete 30 credit hours to remain in good they complete 30 credit hours to remain in good standing. standing. Students with previous academic work (either at K‐ Students with previous academic work (either at K‐ State or elsewhere) requesting transfer to the College State or elsewhere) requesting transfer to the College of Business Administration must have a 2.5 or higher of Business Administration must have a 2.5 or higher grade point average and enroll in the BAPP curriculum. grade point average and enroll in the BAPP curriculum. Transfer students, entering with 45 or more credit Transfer students, entering with 45 or more credit hours, must achieve a K‐State GPA of 2.5 or higher on hours, must achieve a K‐State GPA of 2.5 or higher on the first 15 or more hours of K‐State course work to be the first 15 or more hours of K‐State course work to be able to continue in the College of Business able to continue in the College of Business Administration. For purposes of admission, grade Administration. For purposes of admission, grade point averages will be based on all courses attempted point averages will be based on all courses attempted at colleges or universities. at colleges or universities. The BAPP is expressly designed as a non‐degree program; students with 60 or more credit hours will The BAPP is expressly designed as a non‐degree not be allowed to enroll in BAPP unless they are first‐ program; students with 60 or more credit hours will semester transfer students. Students remain in BAPP not be allowed to enroll in BAPP unless they are first‐ until they meet the requirements for their intended semester transfer students. degree plan and complete an Application to Degree Admission to a degree plan (major) in accounting, Plan. entrepreneurship, finance, management, Admission to a degree plan (major) in accounting, management information systems, or marketing is entrepreneurship, finance, management, necessary for graduation. In order to be admitted to a management information systems, or marketing is major, students must complete the application necessary for graduation. Applicants for admission to process and be accepted. Deadlines for consideration one of the degree plans, other than accounting will be for admission will be February 15 for the Summer and accepted upon completion of a minimum of 45 credit Fall semester and September 15 for the Spring hours with a K‐State grade point average of 2.5 or semester. The application process includes (1) A above. For accounting the grade point average for checklist related to preparatory requirements admission to the degree plan is 3.0 K‐State GPA. described below (2) development of a long‐range Transfer students must meet the above requirements academic plan for their major and (3) a written and complete at least 12 graded hours at K‐State statement of career objectives. before they can be admitted into a degree plan. The exact sequence of the courses to be taken is worked out between student and advisor. There is 5 some flexibility in scheduling. To enroll in any course, students must have prerequisites as stated in the catalog. Applications for a degree plan (major) may be made by the semester during which the student will have completed at least 45 credit hours of the pre‐ professional requirements. Degree plan applications must be filed by the time students complete 60 credit hours. Transfer Coursework All transfer coursework approved by the K‐State Admissions Office, with a grade of C or better, will be reviewed by the CBA Office of Student Services for equivalency within the business curriculum and is subject to final approval. (Transfer coursework carrying a grade of D will not be accepted toward a student’s business degree requirements.) Final approval of transfer courses for use within an individual’s business degree plan is determined by the 1) Must have at least and overall cumulative GPA of 2.5 for all KSU credits completed to be considered, with a 3.0 to major in accounting. 2) Must have completed the following courses ‐ ENGL 100/200, COMM 105 (speech), MATH 205 (Calculus), ECON 110, ECON 120, and GENBA 110 3) Must have taken at least 12 credit hours of courses from the Communications, Quantitative and Business Core areas from K‐ State 4) Must have completed the required Professional Advantage Certification Requirements for the first year 5) Must have completed the IT Proficiency Exams ‐ GENBA 166 Students requesting admissions will be considered and notified of admission/denial 30 days following the application deadline. Meeting the requirements above does not guarantee admission. Admission is based on capacity available within the College of Business Administration and is determined based on the materials above, as well as an evaluation of the overall academic record by the admissions committee. The exact sequence of the courses to be taken is worked out between student and advisor. There is some flexibility in scheduling. To enroll in any course, students must have prerequisites as stated in the catalog. Transfer Coursework All transfer coursework approved by the K‐State Admissions Office, with a grade of C or better, will be reviewed by the CBA Office of Student Services for equivalency within the business curriculum and is subject to final approval. (Transfer coursework carrying a grade of D will not be accepted toward a student’s business degree requirements.) Final approval of transfer courses for use within an individual’s business degree plan is determined by the appropriate department head, in conjunction with the 6 appropriate department head, in conjunction with the CBA Office of Student Services and the Associate Dean and Director of Undergraduate Studies. In general, upper‐level (300+) business* courses will only be considered for approval if the coursework has been completed at an AACSB‐accredited institution. *Business courses are defined as those carrying a prefix of ACCTG, FINAN, GENBA, MANGT, or MKTG. Degree Requirements Candidates for the bachelor of science in business administration must complete at least 9 credit hours of resident instruction in upper‐division business courses after acceptance and enrollment in a degree plan program in the college. Additional residency requirements may apply. A student will become eligible for graduation with a bachelor of science in business administration degree upon fulfilling the above requirements and completing 126 credit hours of coursework. Fifty‐four of these hours must be in the BAPP program, 30 hours in the business core, and the remaining 42 hours must be earned as specified by the student’s major. Students must earn a minimum 2.5 grade point average in the business core courses in order to graduate. CBA Office of Student Services and the Associate Dean and Director of Undergraduate Studies. In general, upper‐level (300+) business* courses will only be considered for approval if the coursework has been completed at an AACSB‐accredited institution. *Business courses are defined as those carrying a prefix of ACCTG, FINAN, GENBA, MANGT, or MKTG. Degree Requirements Candidates for the bachelor of science in business administration must complete at least 9 credit hours of resident instruction in upper‐division business courses after acceptance and enrollment in a degree plan program in the college. Additional residency requirements may apply. A student will become eligible for graduation with a bachelor of science in business administration degree upon fulfilling the above requirements and completing 126 credit hours of coursework. Fifty‐four of these hours must be in the BAPP program, 30 hours in the business core, and the remaining 42 hours must be earned as specified by the student’s major. To be eligible for graduation, the student’s GPA on courses from the Business Core must be at least 2.5. Rationale The change in the College of Business Administration Admissions Process will add the pre‐requisite requirement to the courses listed in the expedited course list. This note: “enrollment in this course is limited to students who have declared a major in the college of business, or for students whose curriculum requires the relevant courses. Other students should contact the departmental office to request permission” needs to be added to the pre‐requisite. This change will allow enforcement of the admissions requirements described in the attached proposal and processed as a separate curriculum change. Impact On Other Units This proposal would impact students from other colleges who attempt to take the influenced courses. However, the impact will only be to require permission to take those courses where pre‐requisites are met. The intent is not to restrict enrollment in the courses by bona fide students majoring in other areas, but only to ensure that students intending to pursue majors in business are duly admitted at the appropriate time. Effective Date Fall 2016 7 College of Human Ecology (4‐12‐15) Non-expedited Undergraduate Course Change Proposals 599 and below School of Family Studies and Human Services Early Childhood Education Course Add: ECED 300 Problems in Early Childhood Education Credits Variable: (1‐9) Independent or small group study of early childhood development and education. When Offered: As needed and upon sufficient demand K‐State 8: None Pre‐Requisites: Consent of Instructor Rationale: Given the rapidly changing field of early childhood development and education, the need for a special topics course in Early Childhood Education was identified by the faculty. Note: The variable credits were changed to 1‐9 from 1‐18 to reflect a more reasonable number of credits for this experience. IMPACT: NONE. Effective: Fall 2015 Personal Financial Planning Course Add: PFP 300 Problems in Personal Financial Planning Credits Variable: (0‐3) Relevant topics in personal financial planning will be explored in a small group setting. When Offered: As needed and upon sufficient demand K‐State 8: None Pre‐Requisites: None Rationale: Given the rapidly changing field of financial planning, the need for a special topics course in Personal Financial Planning was identified by the faculty. IMPACT: NONE. Effective: Fall 2015 8 Course Add: PFP 456 Financial Counseling and Communication Credits: (3) This course provides an introduction to the interactive process between the client and the practitioner, including communication techniques, motivation and esteem building, the counseling environment, ethics, and methods of data intake, verification, and analysis. Other topics include legal issues, compensation, uses of technology to identify resources, information management, and current or emerging issues. When Offered: Fall K‐State 8: None Pre‐Requisites: KSU cumulative GPA of 2.5 or higher Rationale: Financial Counseling has previously operated as course number FSHS 756. To delineate the difference in the undergraduate level and graduate level course, a new course number and name is being proposed at the undergraduate level. IMPACT: This course is an option for the College of Business Admission’s thematic sequence. The advising unit was notified on 2‐ 26‐15 of the proposal. (Ashley Croisant, Academic Advisor, College of Business Administration indicates they will adjust their thematic sequence documents.) Effective: Fall 2015 Course Add: PFP 460 Retirement Planning Concepts Credits: (3) This course surveys various types of retirement plans, ethical considerations in providing retirement planning services, assessing and forecasting financial needs in retirement, and integration of retirement plans with government benefits. When Offered: Fall K‐State 8: None Pre‐Requisites: PFP 305 or FINAN 450 with a grade of “B” or better and KSU cumulative GPA of 2.5 or higher Rationale: Retirement Planning Concepts has previously operated as course number FSHS 760. To delineate the difference in the undergraduate level and graduate level course, a new course number and name is being proposed at the undergraduate level. IMPACT: This course is an option for the College of Business Admission’s thematic sequence. The advising unit was notified on 2‐ 26‐15 of the proposal. (Ashley Croisant, Academic Advisor, College of Business Administration indicates they will adjust their thematic sequence documents.) Eric Higgins, Department of Finance von Waaden Chair of Investment Management responded on 9/12/14 that they agree with the proposal to include FINAN 450 as a pre‐requisite as long as enrollment does not increase. FINAN 450 is already required in the curriculum. Adding it as a pre‐requisite will sequence the course appropriately. Effective: Fall 2015 9 Course Add: PFP 462 Personal Investment Concepts I Credits: (3) An in‐depth study of investment options for clients, this course will include common stocks, fixed income securities, convertible securities, and related choices. Relationships between investment options and employee/employer benefit plan choice will be studied. Current and emerging issues, and ethics will be an integral part of the course.. When Offered: Fall K‐State 8: None Pre‐Requisites: PFP 305 or FINAN 450 with a grade of “B” or better and KSU cumulative GPA of 2.5 or higher Rationale: Personal Investment Concepts I has previously operated as course number FSHS 762. To delineate the difference in the undergraduate level and graduate level course, a new course number and name is being proposed at the undergraduate level. As a part of our accreditation with the CFP® Board, our courses must cover a number of core standards that are critical to professional competence. For the materials related to investments, the number of relevant competencies is difficult to cover in a single semester, and a number of comparable programs around the country break the investments curriculum into two separate courses as we are proposing to do here. FSHS 462 would remain as investments I, with the newly developed FSHS 482 serving as a second course in investments. IMPACT: Eric Higgins, Department of Finance von Waaden Chair of Investment Management responded on 9/12/14 that they agree with the proposal to include FINAN 450 as a pre‐requisite as long as enrollment does not increase. FINAN 450 is already required in the curriculum. Adding it as a pre‐requisite will sequence the course appropriately. Effective: Fall 2015 Course Add: PFP 464 Estate Planning Concepts Credits: (3) This course provides an introduction to fundamentals of the estate planning process. Includes property transfer, tax consequences, probate avoidance, powers of appointment, and various tools/techniques used in implementing an effective estate plan. When Offered: Spring K‐State 8: None Pre‐Requisites: PFP 305 or FINAN 450 with a grade of “B” or better and KSU cumulative GPA of 2.5 or higher 10 Rationale: Estate Planning Concepts has previously operated as course number FSHS 764. To delineate the difference in the undergraduate level and graduate level course, a new course number and name is being proposed at the undergraduate level. IMPACT: This course is an option for the College of Business Admission’s thematic sequence. The advising unit was notified on 2‐ 26‐15 of the proposal. (Ashley Croisant, Academic Advisor, College of Business Administration indicates they will adjust their thematic sequence documents.) Eric Higgins, Department of Finance von Waaden Chair of Investment Management responded on 9/12/14 that they agree with the proposal to include FINAN 450 as a pre‐requisite as long as enrollment does not increase. FINAN 450 is already required in the curriculum. Adding it as a pre‐requisite will sequence the course appropriately. Effective: Fall 2015 Course Add: PFP 466 Personal Risk Management and Insurance Planning Credits: (3) This course provides an analysis of risk management concepts, tools, and strategies for individuals and families, including: life insurance; property and casualty insurance; liability insurance; accident, disability, health, and long‐term care insurance; and government‐subsidized programs. Current and emerging issues, as well as ethical considerations, relative to risk management will be discussed. Case studies will provide experience in selecting insurance products suitable for individuals and families. When Offered: Spring K‐State 8: None Pre‐Requisites: PFP 305 or FINAN 450 with a grade of “B” or better and KSU cumulative GPA of 2.5 or higher Rationale: Personal Risk Management and Insurance Planning has previously operated as course number FSHS 766. To delineate the difference in the undergraduate level and graduate level course, a new course number and name is being proposed at the undergraduate level. IMPACT: Eric Higgins, Department of Finance von Waaden Chair of Investment Management responded on 9/12/14 that they agree with the proposal to include FINAN 450 as a pre‐requisite as long as enrollment does not increase. FINAN 450 is already required in the curriculum. Adding it as a pre‐requisite will sequence the course appropriately. Effective: Fall 2015 Course Add: PFP 472 Personal Income Tax Concepts Credits: (3) This course provides an introduction to personal income tax practices and procedures including tax regulations, tax return preparation, the tax audit process, the appeals process, preparation for an administrative or judicial forum, and ethical considerations of taxation. New and emerging issues related to taxation will be covered. Family/individual case studies provide practice in applying and analyzing tax information and recommending appropriate tax strategies. When Offered: Fall 11 K‐State 8: None Pre‐Requisites: KSU cumulative GPA of 2.5 or higher Co‐Requisite: PFP 305 Rationale: Personal Income Tax Concepts has previously operated as course number FSHS 772. To delineate the difference in the undergraduate level and graduate level course, a new course number and name is being proposed at the undergraduate level. IMPACT: None Effective: Fall 2015 Course Add: PFP 482 Personal Investment Concepts II Credits: (3) This course is designed to build off of PFP 462 (Pers Inv Con I) and to help students develop a better understanding of the available tools and procedures of investment planning for family and individual goal attainment. Lectures, readings, case studies, and problem sets are designed to help students in preparing for the Investment Planning section of the Certified Financial PlannerTM examination. When Offered: Spring K‐State 8: None Pre‐Requisites: PFP 462 and KSU cumulative GPA of 2.5 or higher Rationale: As a part of our accreditation with the CFP® Board, our courses must cover a number of core standards that are critical to professional competence. For the materials related to investments, the number of relevant competencies is difficult to cover in a single semester, and a number of comparable programs around the country break the investments curriculum into two separate courses as we are proposing to do here. PFP 462 would remain as Investments I, with PFP 482 serving as a second investments course. IMPACT: None Effective: Fall 2015 12