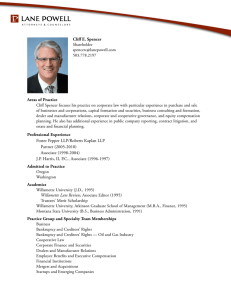

A. Jeffery Bird Areas of Practice

advertisement

A. Jeffery Bird Shareholder birdj@lanepowell.com 503.778.2173 Areas of Practice Jeff Bird has more than 25 years of experience assisting clients with complex business transactions, including mergers and acquisitions, public and private securities offerings, tender offers, proxy contests, divestitures for public and private companies, corporate finance, securities law and venture capital transactions. Jeff is a business transactional lawyer who has extensive knowledge of SEC compliance matters, and he regularly advises public companies on Dodd-Frank and Sarbanes-Oxley compliance issues, corporate governance matters and SEC periodic reporting requirements under the Securities Exchange Act of 1934. He advises and works closely with boards of directors, board committees, special committees and management. In 2008, Jeff served as interim General Counsel of Movie Gallery, Inc., a public company with more than a billion dollars in revenue. Jeff has developed a niche practice in assisting business owners plan for and execute business transitions and succession planning. In June 2012, Jeff was awarded the Certified Exit Planning Advisor credential from the Exit Planning Institute, joining approximately 400 other certified exit planning professionals worldwide. Admitted to Practice Oregon Washington District of Columbia U.S. District Court, District of Columbia U.S. Supreme Court Academics and Accreditations University of Virginia School of Law (J.D.) William Minor Lile Moot Court Competition, Finalist Washington and Lee University (B.A., cum laude, with Certificate in Commerce, Double Major in Business Administration and Philosophy) Practice Group and Specialty Team Memberships Business Corporate Finance and Securities Mergers and Acquisitions Startups and Emerging Companies Representative Matters and Clients $80 million commutation of certain trust assets subject to First and Second Lien Indentures of WMI Holdings Corp., successor to Washington Mutual, Inc. $130 million First and Second Lien Indenture of WMI Holdings Corp., successor to Washington Mutual, Inc. Retained as Special Securities Counsel to Official Committee of Equity Security Holders of Washington Mutual, Inc. in connection with emergence of WaMu from bankruptcy. Represented shareholders of Washington Mutual, Inc., in suit to force annual shareholders meeting. Represented Clear One Health Plans in $58 million going private merger transaction with Pacific Source Health Plans. Represented Clear One Health Plans in successful takeover defense against dissent shareholder. Represented Toyota Tsusho Corporation in acquisition of C.B. Equipment Co. Represented Movie Gallery, Inc., in conversion of approximately $68 million of first lien debt to equity. Represented Clear Choice Health Plans, Inc., in acquisition of third party administration company. Represented Reptron Corporation in $50 million going private merger transaction. Represented Reptron Corporation in connection with launch and completion of $30 million debt tender offer. Represented Clear Choice Health Plans, Inc., in first conversion in the State of Oregon of a health care services contractor to domestic stock insurance company and took company public. Represented Clear Choice Health Plans, Inc., in $7.5 million intrastate securities offering. Represented Assisted Living Concepts, Inc., in $130 million going private merger transaction. Represented Assisted Living Concepts, Inc., in legal defeasance of $40.25 million Senior Secured Notes and $15.25 million Junior Secured Notes. Represented Assisted Living Concepts, Inc., in sale of assets and partial redemption of $40.25 million Senior Secured Notes. Secured $50 million Term Loan and Revolver for Voicecom Systems, Inc. Represented InFocus Corporation in $5 million Series A Preferred Stock venture funding. Obtained $16 million settlement for Rentrak Corporation in connection with breach of contract and fraud suit against Hollywood Video. Represented Rentrak Corporation in $20 million spin-off transaction. Assisted client in establishing $20 million Secured Credit Facility. Represented issuer in private placement of $50 million Senior Notes. Represented Rentrak Corporation in $10 million secondary public offering of common stock. 2 Assisted TRW, Inc., with $500 million self-tender offer. Represented issuer in $10 million private placement. Publications “Letting Go: As Baby Boomers Sell Their Businesses, Too Many Forget the All-Important Succession Plan,” Oregon Business magazine, Quoted (April 2015) “Exit Planning and the Changing of the Guard: A Value Proposition,” Oregon Business magazine, Interviewed (March 2015) “Transition Planning: Key Steps for a Successful Exit From a Closely Held Business,” Seattle Business magazine (December 2013) “Transition Plans Allow for Smoother Exits,” Portland Business Journal (February 22, 2013) “Q&A, Jeffery Bird on Corporate Governance,” Portland Business Journal (September 9, 2011) “Dodd-Frank Bill will Force Greater Scrutiny of CEO Salaries,” Portland Business Journal (September 3, 2010) “Controversial SEC Rules Favor Shareholder Activists,” Portland Business Journal (August 21, 2009) “Corporate Buy-Sell Agreements,” Advising Oregon Businesses, Supplement to Chapter 23, Oregon State Bar, Co-author (2007) “Proposed SEC Rules Expand Private Placement Opportunities,” Portland Business Journal (September 14, 2007) Speaking Engagements “The Unique Challenges of Governing Small-Cap Companies,” National Association of Corporate Directors Event, Moderator (February 25, 2015) “Cyber Threats: Emerging Practice to Frame and Manage Risk,” Moderator (September 24, 2014) “Current Trends in Mergers and Acquisitions,” Washington State Bar Association’s 34th Annual Northwest Securities Institute, Panelist (May 2, 2014) “Shareholder Engagement: Communication Strategies That Work,” NACD NW Chapter - Portland (January 15, 2014) “Governance Failures in the Headlines: Lessons Learned,” National Association of Corporate Directors Northwest Chapter - Portland, Panelist and Co-chair (September 2013) “Nonprofit Boards: Best Practices and Leading Through Changing Governance and Disclosure,” National Association of Corporate Directors Northwest Chapter - Portland, Moderator and Co-chair (May 2012) “Changes and Challenges Driving the Audit Committee Agenda,” KPMG Audit Committee Roundtable, Panelist (June 2011) “Ebitdda Schmebitda: 10 Things you Must do to Build Your Business Value and Prepare for the Inevitable,” U.S. Trust Seminar (May 2011) 3 “Selling in the Sweet Zone: Why You Should Plan Now For Your Future Business Transition Event,” Panelist (January 2011) “The Board’s Role in Corporate Strategy,” National Association of Corporate Directors Northwest Chapter - Portland, Co-chair (October, 2010) “Developments in Disclosure Regulation,” Willamette Securities Regulation Conference, Panelist (2009) “The Business Owner’s Guide to Litigation,” Moderator, 2009 “Developments in Disclosure Regulation,” Willamette Securities Regulation Conference, Panelist (2008) “Audit Committee Effectiveness Post SOX: Looking Back, Thinking Ahead,” KPMG Audit Committee Roundtable, Panelist (December 2007) “Exploring the Audit Committee’s Role in IT Governance,” KPMG Audit Committee Roundtable, Panelist (June 2007) Awards and Honors Named as one of The Best Lawyers in America®, Mergers and Acquisitions (2013-2016) Named as an “Oregon Super Lawyer,” Super Lawyers® magazine, Mergers and Acquisitions (2009-2016) Recognized for his work in Mergers, Acquisitions and Buyouts by The Legal 500 (United States, Northwest Category) Certified Exit Planning Advisor through the Exit Planning Institute (2012-present) Professional and Community Activities National Association for Corporate Directors Northwest Chapter Vice President-Portland (2013-Present) Board Member (2011-Present) Chairman, Advisory Board of Northwest Chapter of National Association of Corporate Directors - Portland (2009-Present) Oregon State Bar Chair, Securities Regulation Section (2013) Secretary, Treasurer and Chair-Elect, Securities Regulation Section (2010-2012) Executive Committee (2009-2014) Member, Corporate Counsel Section Member, International Law Section Member, Business Law Section Steering Committee, 32nd Annual Northwest Securities Institute (2012) Member, The Arlington Club Board Member and Former Chair, Business for Culture and the Arts (2011-Present) Board Member, Oregon Wildlife Heritage Foundation (2011-Present) 4