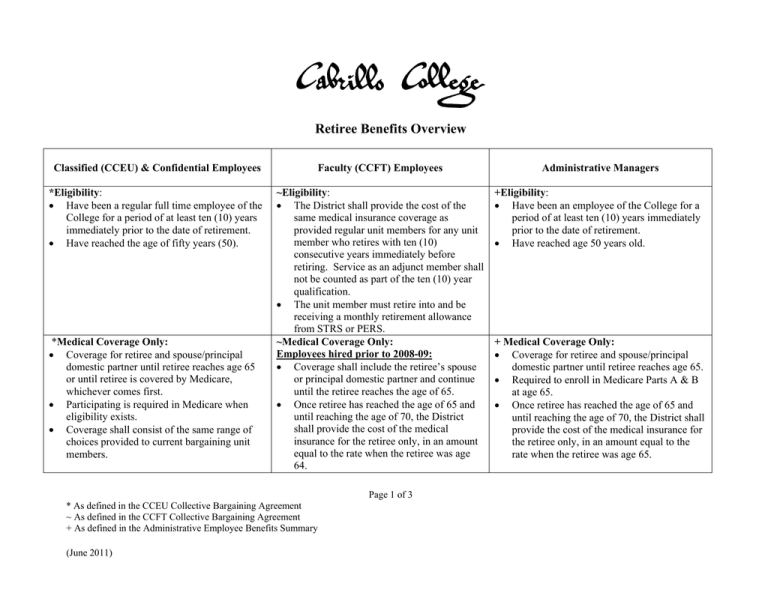

Retiree Benefits Overview

advertisement

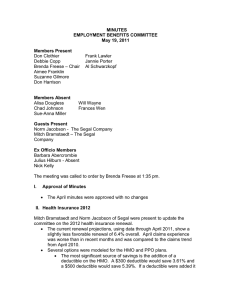

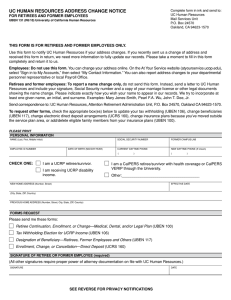

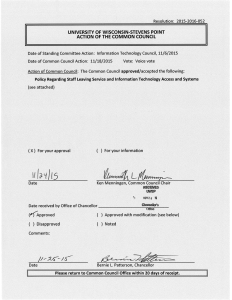

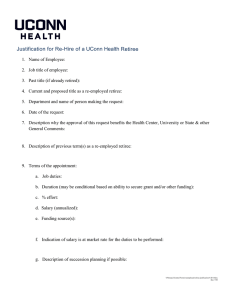

Retiree Benefits Overview Classified (CCEU) & Confidential Employees Faculty (CCFT) Employees Administrative Managers *Eligibility: Have been a regular full time employee of the College for a period of at least ten (10) years immediately prior to the date of retirement. Have reached the age of fifty years (50). ~Eligibility: The District shall provide the cost of the same medical insurance coverage as provided regular unit members for any unit member who retires with ten (10) consecutive years immediately before retiring. Service as an adjunct member shall not be counted as part of the ten (10) year qualification. The unit member must retire into and be receiving a monthly retirement allowance from STRS or PERS. ~Medical Coverage Only: Employees hired prior to 2008-09: Coverage shall include the retiree’s spouse or principal domestic partner and continue until the retiree reaches the age of 65. Once retiree has reached the age of 65 and until reaching the age of 70, the District shall provide the cost of the medical insurance for the retiree only, in an amount equal to the rate when the retiree was age 64. +Eligibility: Have been an employee of the College for a period of at least ten (10) years immediately prior to the date of retirement. Have reached age 50 years old. *Medical Coverage Only: Coverage for retiree and spouse/principal domestic partner until retiree reaches age 65 or until retiree is covered by Medicare, whichever comes first. Participating is required in Medicare when eligibility exists. Coverage shall consist of the same range of choices provided to current bargaining unit members. Page 1 of 3 * As defined in the CCEU Collective Bargaining Agreement ~ As defined in the CCFT Collective Bargaining Agreement + As defined in the Administrative Employee Benefits Summary (June 2011) + Medical Coverage Only: Coverage for retiree and spouse/principal domestic partner until retiree reaches age 65. Required to enroll in Medicare Parts A & B at age 65. Once retiree has reached the age of 65 and until reaching the age of 70, the District shall provide the cost of the medical insurance for the retiree only, in an amount equal to the rate when the retiree was age 65. Retiree Benefits Overview (continued) *Medical Coverage Only: (continued) The District shall provide the cost of the medical plan the employee was enrolled in at the time of retirement. If the retiree elects to enroll in a more expensive plan, the retiree will pay any additional costs. After age 65, the retiree may continue coverage at his/her own expense A surviving spouse or principal domestic partner may remain enrolled in the medical plan at their own expense. ~Medical Coverage Only: (continued) As soon as any retiree qualifies for Medicare, the District shall not be responsible for providing private medical coverage but shall provide the “Carve Out” plan for the retiree to age 70. After age 70, the retiree may continue coverage at his/her own expense. A surviving spouse or principal domestic partner may remain enrolled in the medical plan at their own expense. Employee hired during or after 2008/09 academic year: The District shall provide the retiree with a stipend equal to the rate of the least cost HMO medical plan for single or employee plus one to age 65. The retiree may elect to purchase a higher level of medical coverage at his/her own expense. Once a retiree qualifies for Medicare and until reaching the age of 70, the District shall provide a stipend amount equal to the cost of the lowest HMO “Carve Out” plan. After age 70, the retiree may continue coverage at his/her own expense. Page 2 of 3 * As defined in the CCEU Collective Bargaining Agreement ~ As defined in the CCFT Collective Bargaining Agreement + As defined in the Administrative Employee Benefits Summary (June 2011) +Medical Coverage Only: (continued) Retiree can elect to pay for spouse’s (or domestic partner’s) medical coverage at this time. After age 70, the retiree may continue coverage at his/her own expense. Survivors of deceased retired administrators have the option of remaining on the district medical plan until the retiree would have reached the age of 65 (as long as the survivor was on the medical plan at the time the retiree retired). After which, the survivor may continue medical coverage at his/her expense. Retiree Benefits Overview (continued) District Liability 2010/11: Total: $430,924 40 retirees PPO: 30 retirees HMO: 10 retirees Estimated District Liability 2011/12: Total: $514,403 45 retirees PPO: 34 retirees HMO: 11 retirees Annual Stipend Amounts 2010/11 (active employees: Employee only: $8,773.68 2-Person: $16,971.00 Family: $23,363.28 District Liability 2010/11: Total: $447,690 62 retirees PPO: 51 retirees HMO: 10 retirees Ind. Ret Plan: 1 retiree Estimated District Liability 2011/12: Total: $460,091 56 retirees PPO: 43 retirees HMO: 12 retirees Ind. Ret Plan: 1 retiree Annual Stipend Amounts 2010/11 (active employees): Employee only: $8,773.68 2-Person: $16,971.00 Family: $23,363.28 Total District Liability for 2010-11: $990,087 Total District Liability for 2011-12: $1,102,930 (June 2011) Page 3 of 3 * As defined in the CCEU Collective Bargaining Agreement ~ As defined in the CCFT Collective Bargaining Agreement + As defined in the Administrative Employee Benefits Summary (June 2011) District Liability 2010/11: Total: $111,473 13 retirees PPO: 10 retirees HMO: 3 retirees Estimated District Liability 2011/12: Total: $128,436 14 retirees PPO: 11 retirees HMO: 3 retirees Annual Stipend Amounts 2010/11 (active employees): Employee only: $8,773.68 2-Person: $16,971.00 Family: $23,363.28 Headcount Information by Employer Group 2010-11 Updated 05/11/11 Blue Shield HMO Blue Shield PPO Totals % of Total Kaiser Permanente (Retiree Plan) Low $25 co-pay Classified Employees Employee Employee + 1 Family 19 7 10 63 36 37 20 9 0 4 3 2 8 0 2 114 55 51 17.6% 8.5% 7.9% Academic Employees Employee Employee + 1 Family 36 23 47 7 8 17 1 28 16 10 2 8 4 6 0 1 79 55 79 12.2% 8.5% 12.2% Adjunct Employees Employee Employee + 1 Family 4 0 0 22 0 0 3 0 0 4 0 0 5 0 0 38 0 0 5.9% 0.0% 0.0% Confidential Employees Employee Employee + 1 Family 0 0 0 7 0 5 0 0 0 0 0 0 0 0 1 7 0 6 1.1% 0.0% 0.9% Admin/Mgrs Employee Employee + 1 Family 2 0 5 4 4 4 3 4 3 1 1 1 0 2 0 10 11 13 1.5% 1.7% 2.0% Retirees (District Paid) Employee Employee + 1 Family 3 0 0 2 2 0 31 2 0 2 0 0 0 0 0 1 0 0 0 0 0 39 4 0 6.0% 0.6% 0.0% Retirees (self-pay) Employee Employee + 1 Family 3 0 0 0 0 0 12 4 0 0 0 0 0 0 0 6 2 0 1 0 0 22 6 0 3.4% 0.9% 0.0% Early Retirees (under 65) Employee Employee + 1 Family 4 5 1 2 4 0 22 17 0 2 0 0 0 1 0 30 27 1 4.6% 4.2% 0.2% 169 225 184 34 26 9 1 26.1% 34.8% 28.4% 5.3% 4.0% 1.4% 0.2% Totals: % of Total High $300 Ded Med $500 Ded Low $2,500 Ded Companion Care (Retiree Plan) High $10 Co-pay 647 2010-11 Open Enrollment - Related Medical Plan Information Blue Shield HMO High 2010/11 Blue Shield HMO Low 2009/10 Difference Blue Shield PPO High Blue Shield PPO Medium 2010/11 2009/10 Difference 2010/11 2009/10 2010/11 2009/10 4 3 1 3 2 1 1 1 0 6 0 1 6 1 1 0 -1 0 112 61 44 121 61 41 17.6% 9.6% 6.9% 18.9% 9.5% 6.4% 1 -1 -1 2 8 4 5 8 4 -3 0 0 5 0 1 5 1 1 0 -1 0 82 54 77 87 56 75 12.9% 8.5% 12.1% 13.6% 8.8% 11.7% 3 0 0 0 0 0 4 0 0 4 0 0 0 0 0 5 0 0 2 0 0 3 0 0 38 0 0 33 1 0 6.0% 0.0% 0.0% 5.2% 0.2% 0.0% 0 1 0 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 7 1 4 6 2 3 1.1% 0.2% 0.6% 0.9% 0.3% 0.5% 0 1 1 3 5 2 3 5 2 0 0 0 0 2 1 0 0 2 0 2 -1 0 1 1 0 1 0 0 0 1 8 12 14 8 10 13 1.3% 1.9% 2.2% 1.3% 1.6% 2.0% 3 0 0 0 0 0 27 7 0 33 5 0 -6 2 0 1 0 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 34 7 0 38 6 0 5.4% 1.1% 0.0% 5.9% 0.9% 0.0% 0 0 0 0 0 0 0 0 0 12 1 0 13 0 0 -1 1 0 0 0 0 0 0 0 0 0 0 0 1 0 0 1 0 0 0 0 15 2 0 16 1 0 2.4% 0.3% 0.0% 2.5% 0.2% 0.0% 2 5 0 0 5 0 2 0 0 24 21 0 25 20 0 -1 1 0 3 0 0 2 0 0 1 0 0 0 1 0 0 2 0 0 -1 0 33 29 1 32 28 1 5.2% 4.6% 0.2% 5.0% 4.4% 0.2% 294 285 9 192 197 -5 2 22 21 1 635 639 46.3% 44.9% 30.2% 31.0% 3.5% 3.3% 24 13 8 -2 -5 1 61 38 33 68 34 31 -7 4 2 19 12 0 20 11 0 -1 1 0 Academic Employees Employee Employee + 1 Family 8 8 16 12 9 15 -4 -1 1 38 22 46 37 21 44 1 1 2 29 16 10 28 17 11 Adjunct Employees Employee Employee + 1 Family 4 0 0 4 0 0 0 0 0 22 0 0 20 1 0 2 -1 0 3 0 0 Confidential Employees Employee Employee + 1 Family 0 0 0 0 0 0 0 0 0 7 0 4 6 1 3 1 -1 1 Admin/Mgrs Employee Employee + 1 Family 1 0 5 1 1 5 0 -1 0 4 4 5 4 3 4 Retirees - over age 65 (District Paid) Employee Employee + 1 Family 3 0 0 2 1 0 1 -1 0 3 0 0 Retirees - over age 65 (self-pay) Employee Employee + 1 Family 3 0 0 3 0 0 0 0 0 Early Retirees (under 65) Employee Employee + 1 Family 4 2 1 5 1 1 -1 1 0 94 105 -11 14.8% 16.5% 33 31 5.2% 4.9% 2010/11 2009/10 2010/11 2009/10 Individual Retiree Medical Plans (over age 65 only) CompanionCare 2010/11 Health Net Seniority Plus* 2009/10 Difference 2010/11 2009/10 Kaiser Permanente 2009/10 Difference 2010/11 Totals % of Totals Retirees (District Paid) Employee Employee + 1 Family 1 0 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 n/a n/a n/a 0 0 0 1 0 0 0 0 0 9.1% 0.0% 0.0% 0.0% 0.0% 0.0% Retirees (self-pay) Employee Employee + 1 Family 7 2 0 6 2 0 1 0 0 1 0 0 1 0 0 0 0 0 n/a n/a n/a 2 0 0 8 2 0 9 2 0 72.7% 18.2% 0.0% 81.8% 18.2% 0.0% 10 1.6% 8 1.3% 2 1 0.2% 1 0.2% 0 0 0.0% 2 0.3% 11 11 Totals: % of Total *Health Net Seniority Plus is no longer offered by SISC as of 10/01/10 Updated 10/13/2010 % of Totals Difference 2009/10 Difference 2010/11 2009/10 Difference 2010/11 22 8 9 Totals: Totals 2009/10 2010/11 Classified Employees Employee Employee + 1 Family % of Total Blue Shield PPO Low RETIREE RATES 2011-12 Rates Effective 10/01/11 BLUE SHIELD PPO High Option Plan (90%) 520.00 single with Medicare A & B 853.00 single - no Medicare 1040.00 2-person with Medicare A & B 1,514.00 2-person - no Medicare BLUE SHIELD PPO Medium Option Plan (80%) 516.00 single with Medicare A & B 774.00 single - no Medicare 1032.00 2-person with Medicare A & B 1,373.00 2-person - no Medicare BLUE SHIELD PPO Low Option Plan (high deductible) 497.00 single with Medicare A & B 577.00 single - no Medicare 994.00 2-person with Medicare A & B 1030.00 2-person - no Medicare BLUE SHIELD HMO Medical Plans BLUE SHIELD HMO High Option Plan (10-0) 522.00 single with Medicare A & B 780.00 single - no Medicare 1044.00 2-person with Medicare A & B 1,559.00 2-person - no Medicare BLUE SHIELD HMO Low Option Plan (25-500) 483.00 single with Medicare A & B 654.00 single - no Medicare 967.00 2-person with Medicare A & B 1,305.00 2-person - no Medicare COMPANIONCARE 427.00 single with Medicare A & B 854.00 2-Person with Medicare A & B KAISER PERMANENTE SENIOR ADVANTAGE MEDICARE PLAN 324.00 single with Medicare A & B 648.00 2-Person with Medicare A & B DELTA DENTAL 63.76 single 115.48 2-person 166.07 family (June 2011)