Universal Credit: winners and losers © Institute for Fiscal Studies

Universal Credit: winners and losers

© Institute for Fiscal Studies

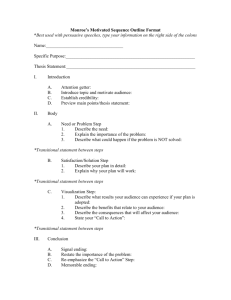

Estimating the cost and impact on families

•

Compare families’ disposable incomes under Universal Credit with those under the existing system in 2014-15

• Cover ‘working-age’ families in Great Britain only

• exclude those with persons aged 60 or over, containing any students, or having no one aged 18 or over

• Assuming full take-up, no behavioural responses

• Maximum entitlement for Universal Credit matches current outof-work benefits, and “income” defined as in current meanstested benefits

• Some simplifications

• ignore SSMG, cold weather payments, in-kind benefits, support for childcare and for mortgage interest

• Impact analysis with and without transitional protection

© Institute for Fiscal Studies

Aggregate results

• 2.5 million working-age families will gain

• 1.4 million will lose out in the long run

• 2.5 million will receive as much payment as they do under the existing system

• Cost (given our assumptions)

• Total gain of the winners is £3.6 billion per year

• Total loss of the losers is £1.9 billion per year (ignoring transitional protection)

•

Long-run cost of £1.7 billion per year

•

Short-run cost depends on how families are moved across and nature of transitional protection

© Institute for Fiscal Studies

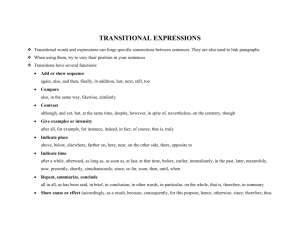

Winners and losers from Universal Credit

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0% the poorest

2 3 4 5 6 income decile group

7 8 9 the richest loser (ignoring transitional protection) not affected because UC entitlement matches current entitlement to MTBs and TCs not affected and currently not receiving any means-tested benefits or tax credits winner

Notes: Income decile groups are based on equivalised family income using the McClements equivalence scale.

Source: Authors’ calculations using the IFS tax and benefit microsimulation model, TAXBEN, run on uprated data from the 2008

–09 Family Resources Survey.

© Institute for Fiscal Studies

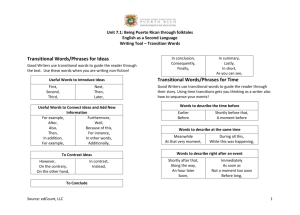

Change in income by income decile group

£ change

£10.00

% change

10%

£8.00

£6.00

£4.00

£4.20

£4.58

£5.43

£3.64

8%

6%

4%

£2.00

£1.40

£0.73

£0.00

income decile group -£0.23

-£0.55

-£0.48

-£2.00

the poorest

2 3 4 5 6 7 8

£ change without transitional protection (LHS axis)

£ change with transitional protection (LHS axis)

% change without transitional protection (RHS axis)

% change with transitional protection (RHS axis)

9

Notes: Income decile groups are based on equivalised family income using the McClements equivalence scale.

Source: Authors’ calculations using the IFS tax and benefit microsimulation model, TAXBEN, run on uprated data from the 2008

–09 Family Resources Survey.

© Institute for Fiscal Studies

-£0.18

the richest

2%

0%

-2%

Winners and losers by family type

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Single adult

Couple without children

Couple with children

Lone parent

All families winner not affected and currently not receiving any meanstested benefits or tax credits not affected because UC entitlement matches current entitlement to

MTBs and TCs loser (ignoring transitional protection)

© Institute for Fiscal Studies

Change in income by family type

£2

£1

£0

-£1

-£2

£5

£4

£3

£ change

£8

£7

£6 without transititional protection

Single adult Couple without children with transitional protection

Couple with children

Lone parent

© Institute for Fiscal Studies

Change in income by family type and employment status (without transitional protection)

Family type single adults couples without children couples with children lone parents

Number of adults in work

1

Fraction of that family type

Change in income, %

73% 0.1

0

27% 0.4

2

76% <0.1

1

19% 1.0

0

6% 0.5

2

61% <0.1

1

33% 1.7

0

6% -0.9

1

56% 0.1

0

44% -1.0

•

Personal amount under UC >

WTC

•

Gain from earnings disregards

Unearned income to be treated more harshly under UC than under CTC

© Institute for Fiscal Studies

Summary: impact on family incomes

• 2.5 million winners, 1.4 million losers, and 2.5 million not affected

• Cost £1.7 bn a year in the long run (or without transitional arrangements)

• Across the income distribution

– Bottom six-tenths will, on average, be better off, with a progressive pattern.

The richer ones will lose slightly on average.

• Different family types

– Couples will fare better than single people

• Lone parents will lose, on average, in the long run;

• Couples with children have the highest average gain

– But substantial differences in impact within each family type

• No simple explanation for pattern; reflects parameters chosen by government for Universal Credit

© Institute for Fiscal Studies