This is the first in ...

advertisement

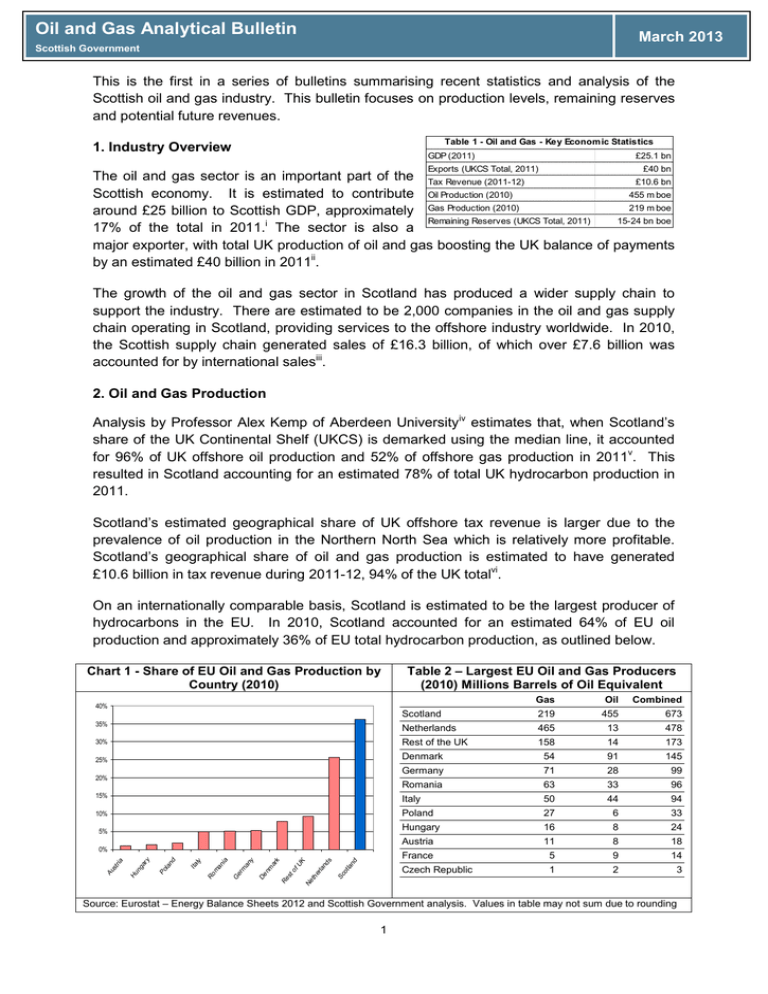

Oil and Gas Analytical Bulletin March 2013 Scottish Government This is the first in a series of bulletins summarising recent statistics and analysis of the Scottish oil and gas industry. This bulletin focuses on production levels, remaining reserves and potential future revenues. Table 1 - Oil and Gas - Key Econom ic Statistics 1. Industry Overview GDP (2011) £25.1 bn Exports (UKCS Total, 2011) £40 bn The oil and gas sector is an important part of the Tax Revenue (2011-12) £10.6 bn 455 m boe Scottish economy. It is estimated to contribute Oil Production (2010) 219 m boe around £25 billion to Scottish GDP, approximately Gas Production (2010) Remaining Reserves (UKCS Total, 2011) 15-24 bn boe i 17% of the total in 2011. The sector is also a major exporter, with total UK production of oil and gas boosting the UK balance of payments by an estimated £40 billion in 2011ii. The growth of the oil and gas sector in Scotland has produced a wider supply chain to support the industry. There are estimated to be 2,000 companies in the oil and gas supply chain operating in Scotland, providing services to the offshore industry worldwide. In 2010, the Scottish supply chain generated sales of £16.3 billion, of which over £7.6 billion was accounted for by international salesiii. 2. Oil and Gas Production Analysis by Professor Alex Kemp of Aberdeen Universityiv estimates that, when Scotland’s share of the UK Continental Shelf (UKCS) is demarked using the median line, it accounted for 96% of UK offshore oil production and 52% of offshore gas production in 2011v. This resulted in Scotland accounting for an estimated 78% of total UK hydrocarbon production in 2011. Scotland’s estimated geographical share of UK offshore tax revenue is larger due to the prevalence of oil production in the Northern North Sea which is relatively more profitable. Scotland’s geographical share of oil and gas production is estimated to have generated £10.6 billion in tax revenue during 2011-12, 94% of the UK totalvi. On an internationally comparable basis, Scotland is estimated to be the largest producer of hydrocarbons in the EU. In 2010, Scotland accounted for an estimated 64% of EU oil production and approximately 36% of EU total hydrocarbon production, as outlined below. Chart 1 - Share of EU Oil and Gas Production by Country (2010) Table 2 – Largest EU Oil and Gas Producers (2010) Millions Barrels of Oil Equivalent Gas Oil Combined Scotland 219 455 673 35% Netherlands 465 13 478 30% Rest of the UK 158 14 173 25% Denmark 54 91 145 Germany 71 28 99 Romania 63 33 96 15% Italy 50 44 94 10% Poland 27 6 33 Hungary 16 8 24 Austria 11 8 18 France 5 9 14 Czech Republic 1 2 3 40% 20% 5% Sc ot lan d ar k fU K Ne th er lan ds Re st o an y De nm Ge rm ly Ita Ro ma nia Po lan d a Au str i Hu ng ar y 0% Source: Eurostat – Energy Balance Sheets 2012 and Scottish Government analysis. Values in table may not sum due to rounding 1 Going forward, UKCS production is expected to be increasingly concentrated in northern waters, which will increase Scotland’s estimated share of UK production in future years. For example, Dana Petroleum and Statoil have announced significant investments to the east of Shetland, with Statoil’s investment in the Mariner field expected to result in thirty years of production. Furthermore, a substantial new oil discovery was recently announced by TAQA, at the Darwin oil field in the northern area of the North Sea. The latest Oil and Gas UK Activity Survey also reports growth in North Sea investment. Investment in 2012 was worth £11.4 billion, the highest level for thirty years. Investment is expected to increase to £13 billion in 2013, whilst total future investment in companies’ plans is estimated to now be worth almost £100 billionvii. These investments are expected to lead to an increase in production levels after a time lag of 2-3 years. 3. Remaining Reserves Remaining oil and gas reserves on the UKCS are substantial, suggesting that activity in the sector is likely to continue for a significant period. Oil and Gas UK estimate that between 15-24 billion barrels of oil and gas equivalent could still be recovered from the UKCS as a wholeviii. Analysis by the Scottish Government suggests that these reserves could have a potential wholesale value of up to £1.5 trillionix. This implies that, by wholesale value, more than half of the oil and gas reserves in the UKCS have still to be extracted. Wood McKenzie estimate that approximately 85% of remaining UK hydrocarbon reserves lie in Scottish watersx. The share of estimated oil reserves is thought to be higher, with in excess of 90% of UK oil reserves believed to be located in Scotland’s geographical share of the UKCS. Estimates of remaining reserves in other countries, which are directly comparable with the above projections, are not readily available. However, drawing on separate internationally comparable data sources shows that Scotland is estimated to have the largest oil reserves in the EU. As Chart 2 illustrates, Scotland is estimated to account for nearly 60% of total EU oil reserves. The major investments announced in recent months could have the potential to increase overall oil recovery rates. This could increase Scotland’s share of recoverable EU oil reserves further. Equivalent estimates of remaining gas reserves are not available due in part to the range of different methods used to quantify potential unconventional gas reserves. However, separate analysis estimates that Scotland could have the second largest volume of proven gas reserves, a sub-set of total reserves, in the EU after the Netherlandsxi. 2 Chart 2 - Share of EU Oil Reserves by Country (2010) Table 3 – EU Oil Reserves (2010) Millions Barrels of Oil Equivalent 60% Scotland 50% 40% 30% 20% 10% ly Sc ot la nd Ita Ro m an ia ar k De nm fU K Ne th er la nd s Re st o Fr an ce an y G er m Sp ai n G re ec e 0% Oil (M Barrels) Remaining 12,820 % Total EU Reserves 57% Italy 2,170 10% Romania 1,737 8% Denmark 1,261 6% Netherlands 748 3% Rest of UK 675 3% France 601 3% Germany 447 2% Spain 293 1% Greece 264 1% Cyprus 257 1% Poland 227 1% German Mineral Resources Agency (2012) - Reserves, Resources & Availability of Energy Resources 2011 and Scottish Government analysis 4. Outlook for Production A number of commentators expect production to rise in future years as a result of the recent investment in the UKCS. The latest forecasts by Oil and Gas UK suggest that production could reach 2 million boe a day by 2017xii. This would represent a 30% increase on current production levels. Analysis published by Professor Alex Kemp in November 2012 also projected that production could rise in the years to 2017 under a number of different scenariosxiii. In contrast, the Office for Budget Responsibility (OBR) forecast that production will decline by 4% between 2012-13 and 2017-18. The analysis by DECC upon which the OBR forecasts are based notes that they incorporate “very significant negative contingencies to the aggregate figures” based on DECC officials’ judgement and past forecast deviationsxiv. Such contingencies may explain some of the divergence in the forecasts of production in future years. 5. Outlook for Oil Prices Chart 3 summarises a range of recent estimates for future oil prices. There is variation between forecasters. Some, such as the OBR, expect prices to fall gradually in the coming years to approximately $92 a barrel in 2017-18. This is based upon a methodology which uses the prices implied by futures markets. Others, such as the US Energy Information Administration, predict that oil prices will fall in 2013-14 before rising again in subsequent years. Finally some organisations, such as the Department for Energy and Climate Change, predict rising oil prices. In recent years, oil prices have exceeded many initial forecasts. For example, in 2010, futures markets implied an oil price of around $85 a barrel in 2011 and 2012. Actual prices over this period averaged more than $110 a barrel. Some forecasters expect this trend to continue. For example, the IMF’s October 2012 World Economic Outlook stated that the risks to oil prices are “tilted to the upside” and “cannot be easily dismissed”xv, Most organisations do not expect prices in future years to diverge significantly from current levels. However, as indicated above it is possible that prices could follow a different path, 3 with the balance of risk being on the upside. For example, analysis published by the OECD in March 2013 suggests that rising demand in East Asia and continued tight supply could result in oil prices rising above $150 by 2020xvi. The implication of such an outcome would be reflected in tax revenues over the longer term. Chart 3 – Forecasts of Future Oil Prices ($ Per Barrel) 140 130 $ per barrel 120 110 100 90 80 70 60 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 Department for Energy and Climate Change US Energy Information Administration Economist Intelligence Unit ITEM Club NIESR OBR Source: OBR – December 2012 Economic and Fiscal Outlook, Ernst & Young Eurozone Forecast Winter edition — December 2012, DECC Fossil Fuel Price Projections (October 2012), Economist Intelligence Unit – Global Forecasting Service, US Energy Information Administration - Annual Energy Outlook 2013 - Early Release 6. Outlook for North Sea Tax Revenue The latest Government Expenditure and Revenue Scotland (GERS) report estimates that oil and gas production on the Scottish portion of the UKCS generated £10.6 billion in tax revenue during 2011-12. This represents the second highest nominal level for 25 years. Based on the UK forecasts published by the OBR in December 2012, oil and gas production in the Scottish portion of the UKCS is estimated to generate £31 billion in tax revenue between 2012-13 and 2017-18. The analysis below sets out alternative forecasts for North Sea revenues, using different expectations about prices and production. Chart 4 summarises the impact of these expectations on future revenues: Scenario 2 in the chart below uses OBR production forecasts, but assumes that prices remain at $113 in cash terms in future years. This was the average price over the 24 months to 1 March 2013. Cumulative Scottish North Sea receipts under this scenario are estimated to be approximately £41 billion between 2012-13 and 201718. Assuming that prices remain constant in cash terms results in them gradually declining in real terms in the coming years. An alternative methodology would be to assume that prices remain constant in real terms, holding all else constant, this would increase the forecasts of future tax revenue. If future production followed the path projected by Oil and Gas UK this would result in production in the UKCS as a whole being approximately 2 million boe per day by 2017-18. If the additional production resulted in a similar level of tax revenue per 4 barrel as assumed in Scenario 2, it could result in North Sea production in Scottish waters generating approximately £48 billion in tax revenue between 2012-13 and 2017-18 (Scenario 3). It is possible that any additional production could be less profitable than the output already factored into the OBR’s projections as a result of rising output increasing operating costs or production focusing on relatively lower value gas fields. As a further refinement this has been factored into Scenario 4. Under this scenario total North Sea revenue is estimated to be £46 billion over the next six years (Scenario 4). As outlined in Section 5, some organisations, including DECC and the OECD, have suggested that oil prices could continue to rise in real terms in future years. Using DECC’s forecasts for oil prices outlined in Chart 4, and the production and profitability forecasts from Scenario 3, could result in oil and gas production in Scottish waters generating £57 billion in tax revenue between 2012-13 and 2017-18 (Scenario 5). Chart 4 – Scottish Cumulative North Sea Revenue Forecasts (£ Billions) (2012-13 to 2017-18) Scenario 1 = OBR Assumptions Scenario 2 = Scenario 1 + Average Price Forecasts Scenario 3 = Scenario 2 + Updated Production Estimates Scenario 4 = Scenario 3 + Lower Profitability Scenario 5 = Scenario 3 + DECC Price Forecasts £0 £10 £20 £30 £40 £50 £60 £ Billions Table 5 provides detailed estimates of North Sea revenue under the scenarios set out in Chart 4. Table 5 - Illustrative Projections for Scottish North Sea Tax Revenue (£ Billions) 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 £6.7 £6.9 £6.9 £6.9 £7.2 £6.2 £7.1 £7.5 £7.4 £8.3 £5.5 £7.1 £8.0 £7.7 £9.4 £4.5 £6.6 £7.9 £7.5 £9.7 £4.2 £6.8 £8.5 £7.9 £10.7 £4.1 £7.0 £9.2 £8.5 £11.8 Total (2012-13 to 2017-18) £31.3 £41.5 £48.1 £45.9 £57.1 Irrespective of the specific assumptions used, Scottish oil and gas production is expected to remain a significant source of tax revenue in future years. Based on the OBR’s methodology, production in Scottish waters could generate approximately £31 billion in tax revenue over the six years to 2017-18. Taking into account recent trends in investment and prices, and the methodologies outlined above, suggests that the industry could instead generate between £41 and £57 billion in tax revenue over this period. Taking the average of these new scenarios suggests that oil and gas production in Scottish waters could generate 5 approximately £48 billion in tax revenue between 2012-13 and 2017-18. This is not dissimilar to the tax revenue estimated to have been generated in Scottish waters over the previous six years. 7. Summary This is the first in a series of bulletins summarising recent trends in the Scottish oil and gas industry. Further updates will be published in due course. The oil and gas sector is an important part of the Scottish economy, contributing an estimated £25 billion to Scottish GDP in 2011 (17% of the total). Analysis of remaining reserves shows that Scotland will continue to be a major oil and gas producer for a number of decades, with up to 24 billion recoverable boe estimated to remain on the UKCS. Analysis by the Scottish Government suggests that such reserves could have a potential wholesale value of up to £1.5 trillion. This implies that, by wholesale value, more than half of the reserves on the UKCS have still to be extracted. Separate internationally comparable analysis by the Scottish Government suggests that Scotland accounts for approximately 60% of remaining EU oil reserves. Over the past year there have been a number of major investments in the North Sea, with further significant investment planned. The additional production coming on-stream as a result of such investment, and a general expectation of current oil prices being sustained in cash terms, means that North Sea revenues are expected to remain significant in the years ahead. Any future rise in prices, as suggested by the OECD, would increase tax revenues further towards the end of the forecast period. Scottish Government March 2013 i Scottish Government analysis based on SNAP: http://www.scotland.gov.uk/Topics/Statistics/Browse/Economy/SNAP Employment and export figures in table 1 are taken from the Oil and Gas UK 2012 Economic Outlook Scottish Enterprise (2011) - Survey of International Activity in the Oil and Gas Sector 2010-11 iv Professor Alex Kemp is the Director of the Aberdeen Centre for Research in Energy Economics and Finance and the author of the official history of the north sea oil and gas industry v For a further discussion of this issue please see Chapter 4 of Government Expenditure and Revenue Scotland vi Scottish Government (2013) – Government Expenditure and Revenue Scotland 2011-12 vii Oil and Gas UK – Activity Survey 2013 viii Oil and Gas UK (2012) – Economic Report ix For further information on this calculation see the answer to Scottish Parliament question S4W-06988 x Wood McKenzie (2012) - Scottish Independence and the Oil & Gas Industry Key Considerations xi Scottish Government analysis based on the BP Statistical Review of World Energy 2012. xii Oil and Gas UK (2013) – Activity Survey 2013, Page 4 xiii Professor Alexander G. Kemp and Linda Stephen (November 2012) - Prospects for Activity in the UK Continental Shelf after Recent Tax Changes: the 2012 Perspective, Page 38 xiv DECC (February 2013) – UKCS Oil and Gas Production Projections xv IMF (2012) – World Economic Outlook October 2012, Pages 39 and 40. xvi OECD Economics Department Working Paper No. 1031 - The Price of Oil - Will It Start Rising Again? – Page 6 ii iii 6