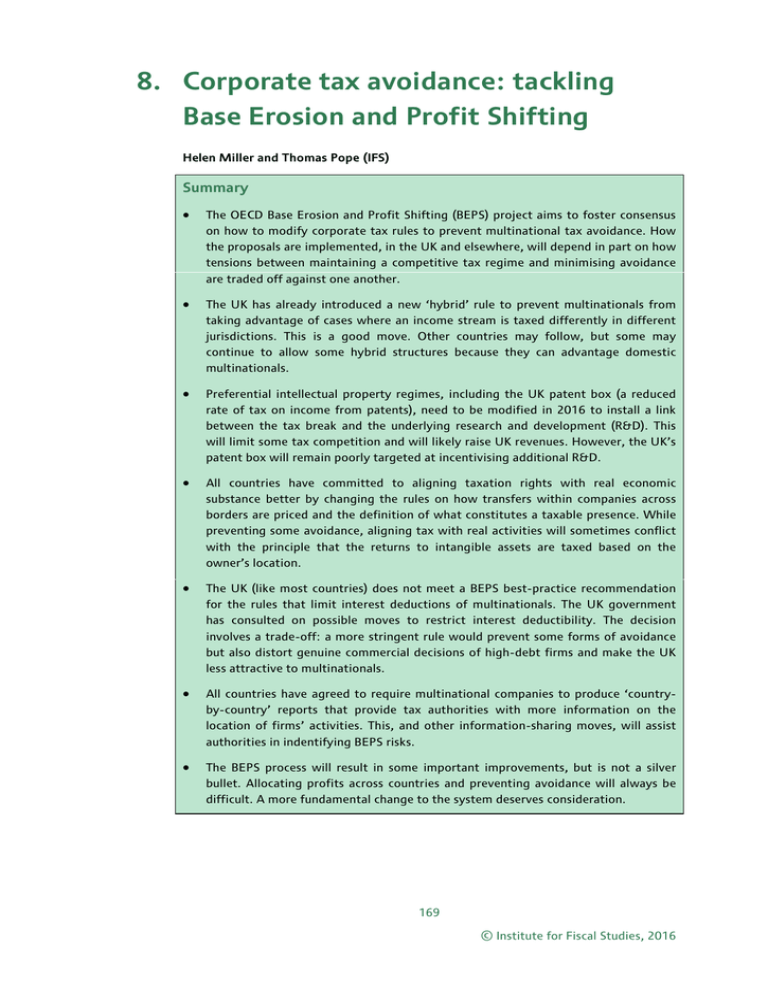

8. Corporate tax avoidance: tackling Base Erosion and Profit Shifting Summary •

advertisement