Document 12741535

advertisement

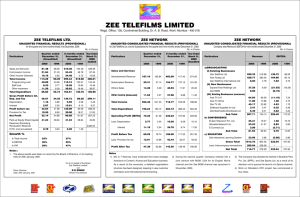

RESULT UPDATE ZEE ENTERTAINMENT Strong finish to year ENTERPRISES COMPANYNAME India Equity Research| Media Zee Entertainment Enterprises’ (ZEE) Q4FY16 revenue growth at 13.7% YoY and EBITDA growth at 52.7% YoY slightly exceeded expectations. Key positives: (i) sharp 29.1% YoY ad growth; (ii) robust 35.3% YoY growth in international subscriptions led by catch-up revenues; and (iii) EBITDA margin expansion by 690bps YoY with &TV launch expenses in base. ZEE is a quasi consumer stock and we expect it to benefit from increased ad spends by Patanjali, while other consumer companies face stiff competition. Further, consumer companies are trading at 30-34x FY18E, ZEE is trading at 27.6x FY18E. Maintain ‘BUY’. Healthy rise in ad growth; sports losses under control Ad revenue surged 29.1% YoY even though &TV was present in base for 1 month. Domestic subscription revenue grew ~12.1% YoY. Industry is still awaiting clarification on TV tariff rate by TRAI. The company closed the year with IN349mn losses (versus guidance of loss of INR1bn; INR236mn loss in Q4FY16). Key negative was depreciation jumped by 35.8% QoQ. EDELWEISS 4D RATINGS Absolute Rating BUY Rating Relative to Sector Outperform Risk Rating Relative to Sector Medium Sector Relative to Market Overweight MARKET DATA (R: ZEE.BO, B: Z IN) CMP : INR 418 Target Price : INR 499 52-week range (INR) : 441 / 300 Share in issue (mn) : 960.4 M cap (INR bn/USD mn) : 401 / 6,015 Avg. Daily Vol.BSE/NSE(‘000) : 2,430.5 SHARE HOLDING PATTERN (%) Current Q3FY16 Q2FY16 Promoters * 43.1 43.1 43.1 MF's, FI's & BK’s 4.2 4.2 3.5 FII's 47.1 47.6 48.4 ZEE expects to beat industry ad growth estimate of 15-16% YoY in FY17. The company expects mid-teen growth in domestic subscription revenues and mid single-digit growth, on dollar basis, in international subscription revenues in FY17. It expects sports losses of >INR1bn in FY17 because of the 2 key series of India, which normally entails higher costs. ZEE expects EBITDA margin upwards of 26% in FY17. The company has 26 original programming hours, which is expected to go up to 33 hours. &TV has 21 original programming hours, which is expected to gradually rise to 26 hours in FY17. Others 5.6 5.1 5.0 Outlook and valuations: Growth DNA; maintain ‘BUY’ 12 months Q4FY16 conference call: Key takeaways : * Promoters pledged shares (% of share in issue) 18.24 PRICE PERFORMANCE (%) EW Media Index Stock Nifty 1 month 7.3 4.4 3 months 10.1 9.3 7.3 34.9 (3.7) 18.1 Improvement in ad growth, monetisation of ZEE Anmol, HD channels and best play on digitisation are key positives. However, we remain guarded about loss of share to internet ads and likely doubling of investments in movie business in FY17. TV tariff rate will be a key monitorable. We estimate ZEE to log 26.8% EPS CAGR over FY16-18. At CMP, the stock trades at 34.3x and 27.6x FY17E and FY18E EPS, respectively. We maintain ’BUY/SO’ with TP of INR499 (33x FY18E EPS). Financials Year to March Revenues (INR mn) Q4FY16 Q4FY15 % change Q3FY16 % change FY16E FY17E FY17E Abneesh Roy 15,316 13,471 13.7 15,951 (4.0) 58,515 67,685 79,318 EBITDA 4,136 2,708 52.7 4,302 (3.9) 15,096 18,275 22,130 +91 22 6620 3141 abneesh.roy@edelweissfin.com Adjusted Profit 2,659 2,308 15.2 2,750 (3.3) 10,483 Rajiv Berlia Adj. diluted EPS 2.4 2.0 18.1 2.5 13,130 15,971 9.4 12.2 15.1 Diluted P/E (x) 44.4 34.3 27.6 EV/EBITDA (x) 26.7 21.9 17.8 ROAE (%) 27.3 28.6 29.0 (3.8) Edelweiss Research is also available on www.edelresearch.com, Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset. +91 22 6623 3377 rajiv.berlia@edelweissfin.com May 10, 2016 Edelweiss Securities Limited 5.9 Media Table 1: Trends at a glance Revenue break up (INR mn) Ad revenue International ad revenue Domestic ad revenue Domestic subscription International revenue Total subscription Sport business Sales Costs EBITDA EBITDA margin (%) Non-sports business Sales (non-sports) Costs (non-sports) EBITDA (non-sports) EBITDA margin (non-sports) (%) Growth rate Ad revenues Domestic subscription International revenue Total subscription revenues % of revenue Transmission & programming Employee cost EBITDA PAT Q4FY14 5,824 NA NA 3,344 1,291 4,635 Q1FY15 6,221 NA NA 3,238 1,189 4,427 Q2FY15 6,259 NA NA 3,373 872 4,245 Q3FY15 7,426 NA NA 3,455 1,007 4,462 Q4FY15 6,697 NA NA 4,175 933 5,108 Q1FY16 7,799 NA NA 3,680 945 4,625 Q2FY16 8,433 735 7,698 3,752 1,039 4,791 1,959 1,608 351 17.9 976 964 12 1.2 1,181 1,431 (250) (21.2) 2,476 2,746 (270) (10.9) 1,680 1,438 242 14.4 1,519 1,504 15 1.0 1,278 1,256 22 1.7 9,629 6,864 2,765 28.7 9,575 6,495 3,080 32.2 9,997 6,543 3,455 34.6 11,791 9,325 2,466 20.9 11,880 8,783 3,097 26.1 12,571 9,047 3,524 28.0 14,037 9,585 4,452 31.7 13,715 9,344 4,372 31.9 21.5 (0.9) 10.2 2.0 17.4 2.2 10.8 4.4 7.3 0.7 (29.2) (7.3) 8.5 4.0 (19.0) (2.3) 15.0 24.9 (27.7) 10.2 25.4 13.7 (20.5) 4.5 34.7 11.2 19.2 12.9 26.8 21.2 2.3 16.9 29.1 12.1 35.3 16.4 47.0 8.6 26.9 18.7 38.2 10.6 29.3 19.9 42.1 9.7 28.7 20.3 47.3 8.0 25.9 22.5 46.0 9.0 20.1 16.9 45.6 10.3 23.2 18.1 43.6 9.1 25.6 19.4 44.0 8.1 27.0 17.2 44.9 8.5 27.0 17.4 11,161 7,358 3,803 34.1 Q3FY16 9,419 812 8,607 4,188 1,030 5,218 Q4FY16 8,645 1,120 7,525 4,682 1,262 5,944 1,914 2,064 (150) (7.8) 1,601 1,837 (236) (14.7) Source: Edelweiss research Inflation linked hikes for TV tariffs: slightly negative for broadcasters Our view: Press release by TRAI dated May 9, 2016 concluded that inflation linked rate hike for TV services are not required at present (initially, it ordered 27.5% hike). Though deals are done on a lump sum amount for Phase 3 and 4 markets for broadcasters, bargaining power shifts to distributors and hence we believe this is slightly negative for broadcasters like ZEE. 2 TRAI issued tariff orders dated March 31, 2014 (eleventh tariff order) and December 31, 2014 (Thirteenth tariff order) providing for inflation linked hike applicable to rates of TV services at wholesale level in the non CAS and addressable DAS markets The effective inflation linked hike permitted by TRAI was 27.5% The first installment of 15% was made effective from April, 2014 while the second installment of 12.5% was made effective from January 2015 These tariff orders were set aside by TDSAT on April 28, 2015. After then broadcaster approached Supreme Court however Supreme Court uphold the TDSAT order. TDSAT had requested TRAI to consider other inflation indices such as GDP deflator in the calculation of inflation linked hikes. Edelweiss Securities Limited Zee Entertainment Enterprises After doing the analysis as mentioned by TDSAT, TRAI concluded that inflation linked hike is not required at present. ZEE: Other key developments At the advent of third week of January, Patanjali became one of the largest FMCG advertisers on TV. The company even surged ahead of established brands like Cadbury, Parle, Horlicks and Pond’s. As per media reports, Patanjali has set aside ~INR3bn for advertising and promotions ZEEL has already launched two Bollywood channels in the APAC region, namely Zee Bioskop in Indonesia and Zee Nung in Thailand. It becomes the first Indian company to foray into the Philippines market. Zee Entertainment Enterprises Limited (ZEEL) is expanding internationally at a frenetic pace. Soon after entering the Philippines market, it is gearing up to launch a free-to-air (FTA) channel in Germany by July. After Star India launching HD feed of its regional channels Star Jalsha and Star Pravah and Viacom’s Colors too planning to launch high definition feed for its Marathi channel, ZEE plans to launch Zee Marathi HD. Zee is also the most trusted brand in the Hindi GEC category as per the report. Zee’s ranking among the top 1,000 trusted brands in India has improved by 15 places to 176 all India in BTR-2016 from 191 in BTR-2015. India will tour West Indies for a four-match Test series in July-August this year, putting an end to the long impasse between the Board of Control for Cricket in India (BCCI) and the West Indies Cricket Board (WICB). Taj was getting 14% commission fee from ZMCL for distributing the latter’s channels. With ZEEL subsuming the distribution business by moving it from Taj TV, the ZMCL board has also accorded in-principle approval for entering into a new agreement for distribution of television channels. Other Broadcasters | Key developments Star India is launching HD versions of its Bengali GEC Star Jalsha and movie channel Jalsha Movies. Last year it launched an HD version of its Malayalam GEC Asianet. It recently received the licence to launch Star Vijay HD, which is a Tamil GEC. Star Jalsha HD and Jalsha Movies HD will most likely be launched on 14 April, the Bengali New Year. Both the channels have been priced at INR30 on a la carte basis. Viacom18 is looking to expand its regional channels portfolio, especially in southern languages. Currently it has 5 regional channels – Colors Marathi, Colors Bangla, Colors Kannada, Colors Gujarati and Colors Oriya. Viacom18 is planning to launch HD variants of its regional GECs—Colors Marathi, Colors Bangla and Colors Kannada. TV18 all set to rebrand its English news channel CNN‐IBN as CNN News18. IBN, which stands for Indian Broadcasting Network, will be dropped from the logo. The new brand name and logo are most likely to come into effect from 18 April. TV18 has expanded its 3 Edelweiss Securities Limited Media regional channel bouquet with the soft launch of News18 Assam/North East, News18 Tamil Nadu and News18 Kerala. The channels will be formally launched one after the other in June. Sony Pictures Networks India has signed letter of intent to acquire 9X Media, the company that runs a clutch of music channels including 9XM, for INR2200mn. 9X media is backed by private equity fund New Silk Route, which owns close to 80% stake in the company. 9X Media operates three music channels in Hindi, 9XM, 9X Jalwa and 9X Bajao, one in English (9XO), Marathi (9X Jhakaas) and Punjabi (9X Tashan) each. Star India is planning to launch an FTA Hindi movie channel under the name Star Utsav Movies. The channel is most likely to launch in May–June. The licence was earlier under Star Gold Romance, but recently the company got MIB clearance to change the name to Star Utsav Movies. Colors Marathi has taken 3 rate hike in last fiscal driven by strong viewership growth. The rate increase has been between 60 and 110% for existing clients while new clients are coming at new rates. ZEE Q4FY16 Conference Call | Key Takeaways Ad growth: Industry ad growth is expected in 15-16% YoY range in FY17. ZEE is expected to beat the industry estimate. The company reported ad growth of 29.1% YoY in Q4FY16. LTL ad growth for ZEE is not significantly less than 29.1% YoY in Q4FY16. International ad growth: New market launches are driving growth. It also contains sports ad revenues (Asia Cup - T20). Segment-wise ad performance: FMCG is expected to be steady over next 6 months. Ecommerce is doing fine and has not fallen off the cliff. The company saw slight pickup in auto segment and 4G will push ad growth from telecoms. &TV: The channel recorded 25% YoY growth in urban viewership in Q4FY16. It is expected to do well going forward. Domestic subscriptions: Keeping NSPL’s judgement and TV tariff expected in July 30, 2016 therefore the company expects mid-teen growth in domestic subscription revenues in FY17. It reported low mid-digit growth in Q4FY16 as some of the deals got shifted following the NSPL judgement. International subscription: Good in Q4FY16 due to catch up revenue. Zee expects mid single-digit growth, on dollar basis, in FY17. Sports losses: Zee expects losses upwards of INR1bn in FY17 as two series of India are normally of higher cost. Movie business investments: The company expects to invest INR1,000-1,500mn in FY17 across regional and Hindi movies. It invested INR700-800mn in the film business in FY16. Content cost: Ex-sports, content cost per hour basis is expected to increase by inflation rate. EBITDA margin: Better than 26% YoY in FY17. 4 Edelweiss Securities Limited Zee Entertainment Enterprises Original programming hours: The company has 26 hours original programming hours, which is expected to go up to 33 hours. &TV has 21 original programming hours, which is expected to go up to 26 hours. ZEE and &TV content buying: The company buys over 2,000 hours content in a year. Growth: International, digital and movie businesses will drive growth. FTA ad market size: Currently, the FTA ad market size is INR8-10bn and expected to grow; 48-49% of the population is in the FTA market. HD channels: Doing well for industry. Zee is waiting for licences to get approved to launch regional HD channels. The company also looks at HD penetration. TV tariff order: The company expects to benefit from both broadcasters and MSOs. New deals have to be executed with new RIO when TRAI issues the tariff order. OTT platform: The person who has best content in OTT will win the OTT platform. Netflix’s content largely builds on broadcaster content. OTT play will be second screen to start with due to broadband issues. Ditto TV: Zee has 3mn subscribers. Gross ARPU is ~INR20 per month. Revenue is predominantly from India. Dispute with Doordarshan: The company has been in dispute with Doordarshan for long regards sports revenue (INR400mn dispute). The latest update is that the amount has been deposited with the court and the company expects to recover it. Cash and equivalents: INR20.46bn. Receivable days: 83 days in FY16. Advertising receivables slightly low compared to subscription receivables. Gross debt: INR9mn. Inventory days: 11% YoY increase. Working capital: North of INR4,000mn. Recurring capex: Generally below INR1bn. 5 Edelweiss Securities Limited Media ZEE Q3FY16 Conference Call | Key Takeaways Ad revenue: Ad revenue grew 26.8% YoY in Q3FY16. Excluding &TV, LTL ad growth was ahead of TV ad industry growth rate of ~15% YoY. TV ad industry: TV ad industry growth in Q3FY16 was 14-15% YoY. TV ad industry seems optimistic given the visibility the company has over the next 2-3 quarters. Original programming hours: The company has 34 hours’ original programming hours (up by 6 hours YoY). Star Plus has original programming hours of more than 40 hours. &TV original programming hour is 22 hours. For Bangla and Marathi, original programming increased by half an hour YoY. Sector wise ad industry: FMCG is growing at a healthy pace. Further, FMCG contribution also remains intact (100bps point change QoQ). Internet & ecommerce is growing very high. Telecom & auto have not fired in a big way as yet. FTA channels: After BARC ratings, accurate measurement of the rural part has commenced. It will help broadcasters and advertisers. The company will look to monetise FTA channels (rural audience). BARC: Advertisers have not started trading on BARC currency. It will become trading currency in next 3-4 months. OTT investments: As of today, ZEE is one of the few OTT players who have done well given subscription model. The company will keep evaluating strategies. OTT players will face stiff competition from each other. However, in the broadcaster business, not a large threat due to infrastructure constraints in the short term. &TV progress: The company is happy with the traction. EBITDA will not necessarily improve if investments continue in &TV. The company’s objective is to build traction. Sports series in FY17: A few cricket matches in FY17 are India-Zimbabwe, India-West Indies, Pakistan-West Indies, etc. Sports business: With the digitisation progression on Phase III, subscription monetisation will improve in 3-4 years. This will change dynamic of the sports business. Phase III digitisation: The government has maintained the deadline. Stay orders have come from various states High Courts. Switch-off of analogue signals will happen over a period of time. Web portal: The company to induct investors in web portal. India Webportal (IWPL) is a 51% subsidiary of ZEE, whereby IWPL will issue convertible preference shares to the said investor, which may result in potential dilution of the company’s shareholding in the said subsidiary below 51%. Subscription revenue: Subscription revenue increased due to catch up revenue in Q3FY16. ZEE anticipates traction in subscription revenue and has guided for double digit growth in FY16. 6 Edelweiss Securities Limited Zee Entertainment Enterprises International strategy: ZEE will offer content to various audiences in Thailand, Middle East and Africa, which will help the international business. Sports loss: The company continues to maintain sports losses guidance of lower than INR1,000mn. With no India-Pakistan series, loss is expected to be lower. However, syndication of sports has some cost associated with it. Hence, the sport loss guidance remains intact. Content cost: In Q3FY16, ZEE produced 2 movies and premiered 3 movies. Domestic content cost increased in line with inflation. Marketing spends: In past 2 years, 4 channels were launched. Hence, marketing spends grew in past 2 years. The company expects no big launches. Hence, marketing growth will increase in line with inflation rate. EBITDA margin guidance: ZEE maintains flattish EBITDA margin guidance for FY16. Other income: Exchange loss impacted other income. Redemption of preference shares: The board has approved redemption of 22.2mn unlisted redeemable preference shares. Cash and equivalents: INR18.34bn. 7 Edelweiss Securities Limited Media Outlook and valuations: Growth DNA; maintain ‘BUY’ Improving ad outlook due to stable government, best play on digitisation, product innovations and net cash are key positives in favour of ZEE. We believe, irrespective of higher subscriber additions by DTH or cable operators, broadcasters like ZEE will be one of the safest and most attractive plays on the digitisation theme. Amongst listed players, the company is the best placed to benefit due to its huge brand and bouquet of 33 domestic and 36 international channels. Also, it is underpinned by sturdy free cash flow, a secular growth story and stable dividend policy. Key concerns are (1) loss of ad share to internet and (2) flattish viewership of new channels like &TV and Zindagi. Also, we remain guarded about loss of share to internet ads and likely doubling of investments in movie business in FY17. TV tariff rate will be a key monitorable. We have factored in the possible loss of &TV in our numbers; we believe it could clock loss of INR7-10bn over the next 3-5 years (akin to other mainstream Hindi GECs) and break even only thereon. We maintain our target multiple of 33x to arrive at a target price of INR499. We maintain ‘BUY/Sector Outperformer’. Chart 1: ZEE’s 1-year forward PE band 500 40x 35x 400 30x 25x (INR) 300 20x 200 15x 100 May-16 Nov-15 May-15 Nov-14 May-14 Nov-13 May-13 Nov-12 May-12 Nov-11 May-11 Nov-10 May-10 Nov-09 May-09 Nov-08 May-08 0 Source: Bloomberg, Edelweiss research Chart 2: Overall ad revenues 50.0 35.0 (%) 20.0 5.0 Q4FY16 Q3FY16 Q2FY16 Q1FY16 Q4FY15 Q3FY15 Q2FY15 Q1FY15 Q4FY14 Q3FY14 Q2FY14 Q1FY14 Q4FY13 Q3FY13 Q2FY13 Q1FY13 Q4FY12 Q3FY12 Q2FY12 (25.0) Q1 FY12 (10.0) Source: Company, Edelweiss research 8 Edelweiss Securities Limited Zee Entertainment Enterprises Chart 3: Costs (as a % of revenue) 60.0 48.0 (%) 36.0 24.0 Transmission & programming Employee expenses Q4FY16 Q3FY16 Q2FY16 Q1FY16 Q4FY15 Q3FY15 Q2FY15 Q1FY15 Q4FY14 Q3FY14 Q2FY14 Q1FY14 Q4FY13 Q3FY13 Q2FY13 Q1FY13 Q4FY12 Q3FY12 Q2FY12 0.0 Q1 FY12 12.0 S G &A expenses Chart 4: Sports business reported EBITDA 2,880 (INR mn) 1,920 960 0 (960) Sports revenues Q4FY16 Sports EBITDA Chart 5: Operational performance (ex-sports) 5,000 45.0 40.0 3,000 35.0 2,000 30.0 1,000 25.0 0 20.0 (%) 4,000 Q1 FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16 Q4FY16 (INR mn) Q3FY16 Q2FY16 Q1FY16 Q4FY15 Q3FY15 Q2FY15 Q1FY15 Q4FY14 Q3FY14 Q2FY14 Q1FY14 Q4FY13 Q3FY13 Q2FY13 Q1FY13 Q4FY12 Q3FY12 Q2FY12 (1,920) EBITDA (ex sports) EBITDA Margin (ex sports) Source: Company, Edelweiss research 9 Edelweiss Securities Limited Media Table 2: Sports business (INR mn) Sales Costs EBITDA EBITDA margin (%) Q4FY14 1,959 1,608 351 17.9 Table 3: EBITDA margin (non-sports) (INR mn) Q4FY14 Sales (non-sports) 9,629 Costs (non-sports) 6,864 EBITDA (non-sports) 2,765 EBITDA margin (non-sports) (%) 28.7 Q1FY15 976 964 12 1.2 Q2FY15 1,181 1,431 (250) (21.2) Q3FY15 2,476 2,746 (270) (10.9) Q4FY15 1,680 1,438 242 14.4 Q1FY16 1,519 1,504 15 1.0 Q2FY16 1,278 1,256 22 1.7 Q3FY16 1,914 2,064 (150) (7.8) Q4FY16 1,601 1,837 (236) (14.7) Q1FY15 9,575 6,495 3,080 32.2 Q2FY15 9,997 6,543 3,455 34.6 Q3FY15 11,161 7,358 3,803 34.1 Q4FY15 11,791 9,325 2,466 20.9 Q1FY16 11,880 8,783 3,097 26.1 Q2FY16 12,571 9,047 3,524 28.0 Q3FY16 14,037 9,585 4,452 31.7 Q4FY16 13,715 9,344 4,372 31.9 Table 4: Sports business – Annual performance (INR mn) FY11 FY12 Revenues 4,411 3,934 Costs 6,489 5,414 EBITDA (2,078) (1,480) EBITDA Margin (%) (47.1) (37.6) FY13 4,960 5,830 (870) (17.5) FY14 6,591 7,567 (976) (14.8) FY15 6,313 6,579 (266) (4.2) FY16E 6,500 7,100 (600) (9.2) FY17E 6,400 7,500 (1,100) (17.2) FY18E 6,600 7,200 (600) (9.1) Source: Company, Edelweiss research Table 5: ZEE’s sports schedule Sport Country/ Tournament Cricket South Africa West Indies Sri Lanka Zimbabwe Pakistan Tenure of rights CY12-20 CY13-19 CY13-20 CY12-19 CY15-19 Entire Tenure - Overall 281 258 202 153 54 60 Tennis US Open CY13-16 Football UEFA Champions League UEFA Europa League French Football League The League Cup The Football League CY15-18 CY15-18 CY12-15 CY12-15 CY12-15 Wrestling WWE CY15-19 Golf European Tour Asian Tour CY13-18 CY13-18 Entire Tenure - India specific 37 47 22 16 9 Source: Company, Edelweiss research 10 Edelweiss Securities Limited Zee Entertainment Enterprises Table 6: Pakistan Cricket Board sports schedule Sport Country/ Tournament Start date Against Oct-15 England Total number of matches 9 Dec-15 India Cricket Pakistan 10 Oct-16 West Indies 9 Oct-17 Sri Lanka 9 Oct-18 Australia 6 Oct-18 New Zealand 9 Mar-19 Australia 3 Source: Company, Edelweiss research Table 7: Consolidated balance sheet (all values are in INR mn) Shareholders funds Share capital (including preference) Reserves & surplus Minority Interest Share application money Total non-current liabilities Long-term borrowings Long term provisions Other non current liabilities Current liabilties Short term borrowings Trade payables Other current liabilties Short-term provisions Total equity and liabilities Non-current assets Fixed assets Goodwill on consolidation Non-current invesments Deferred tax assets (net) Long-term loans and advances Other non-current assets Current assets Current investments Inventories Trade receivables Cash and cash equivalents Short-term loans and advances Other current assets Total assets 31.03.2016 62,314 21,130 41,184 85 863 9 550 304 15,678 5,194 6,355 4,129 78,941 25,071 5,810 9,150 3,048 556 5,913 594 53,870 7,391 13,160 13,245 9,733 8,810 1,532 78,941 31.03.2015 55,498 21,152 34,346 4 780 12 480 288 13,775 4,204 4,979 4,592 70,058 20,340 4,368 7,887 1,464 531 5,710 380 49,718 8,291 11,878 10,692 7,365 10,167 1,325 70,058 % change 12.3 (0.1) 19.9 1825.0 10.6 (23.6) 14.8 5.3 13.8 NM 23.6 27.6 (10.1) 12.7 23.3 33.0 16.0 108.2 4.6 3.5 56.6 8.4 (10.9) 10.8 23.9 32.1 (13.3) 15.6 12.7 Source: Edelweiss research 11 Edelweiss Securities Limited Media Financial snapshot Year to March Advertisement Subscription Others Net revenues Total revenues Transmission and prog Staff costs SG&A Total expenditure EBITDA Depreciation EBIT Other income Interest Add: Prior period items Add: Exceptional items Profit before tax Provision for taxes Minority interest Associate profit share Reported net profit Adjusted Profit Diluted shares (mn) Adjusted Diluted EPS Diluted P/E (x) EV/EBITDA (x) ROAE (%) Tax Rate As % of net revenues Transmission and Prog Employee cost SG&A EBITDA Reported net profit Q4FY16 8,645 5,944 727 15,316 15,316 6,881 1,297 3,002 11,181 4,136 273 3,862 458 42 Q4FY15 6,697 5,108 1,666 13,471 13,471 6,201 1,209 3,353 10,763 2,708 174 2,534 564 30 % change 29.1 16.4 (56.4) 13.7 13.7 11.0 7.3 (10.5) 3.9 52.7 57.1 52.5 (18.9) 41.3 Q3FY16 9,419 5,218 1,314 15,951 15,951 7,023 1,288 3,337 11,649 4,302 201 4,101 290 45 % change (8.2) 13.9 (44.7) (4.0) (4.0) (2.0) 0.7 (10.0) (4.0) (3.9) 35.8 (5.8) 57.9 (4.7) 4,278 1,618 - 39.4 116.2 (100.0) (100.0) 15.2 15.2 4,346 1,602 (6) (1.6) 1.0 (100.0) 2,659 2,659 960 2.4 37.8 3,068 749 (25) (37) 2,308 2,308 960 2.0 24.4 2,750 2,750 960 2.5 36.9 (3.3) (3.3) 44.9 8.5 19.6 27.0 17.4 46.0 9.0 24.9 20.1 16.9 12 44.0 8.1 20.9 27.0 17.2 FY16 34,296 20,579 3,640 58,515 58,515 26,049 5,232 12,139 43,419 15,096 840 14,255 2,016 123 (331) 15,818 5,528 18 (4) 10,268 10,483 960 9.4 44.4 26.7 27.3 35.0 44.5 8.9 20.7 25.8 17.9 FY17E 40,470 23,216 4,000 67,685 67,685 29,917 5,956 13,537 49,410 18,275 918 17,357 2,263 105 (INR mn) FY18E 47,754 27,564 4,000 79,318 79,318 34,900 6,821 15,467 57,188 22,130 1,015 21,115 2,733 100 19,515 6,440 (55) 23,747 7,837 (60) 13,130 13,130 960 12.2 34.3 21.9 28.6 33.0 15,971 15,971 960 15.1 27.6 17.8 29.0 33.0 44.2 8.8 20.0 27.0 19.3 44.0 8.6 19.5 27.9 20.1 Edelweiss Securities Limited Zee Entertainment Enterprises Company Description ZEE Entertainment Enterprises (ZEE) is one of the largest media companies in India. It owns and operates Zee TV and Zee Cinema, both leading channels in the Hindi GEC and movies segments, respectively. Besides these two, the company has an attractive bouquet of several other channels including Ten Sports, Ten Cricket, Ten Action, &pictures, &TV, Anmol, Zindagi, Zing, Zee Classic, Zee Action, Zee Café and Zee Studios. With the likes of Zee Marathi, Zee Bangla, Zee Telugu, and Zee Kannada, the company has an impressive bouquet of regional channels. Investment Theme GDP recovery, improvement in its market share in regional and movies genres and new launches will aid ad revenue growth. Higher penetration of DTH and the digitisation process augur well for faster growth in subscription revenue over the long term. We believe ZEE is well poised to benefit from this favourable environment. Key Risks Delay in monetisation benefit from digitisation. Rise in new investments may pressurise margins longer than expected. Slowdown in ad spends due to lower than expected GDP growth. Increased sports losses. 13 Edelweiss Securities Limited Media Financial Statements Key Assumptions Year to March Income statement FY15 FY16 FY17E FY18E Macro GDP(Y-o-Y %) Inflation (Avg) 7.2 5.9 7.4 4.8 7.9 5.0 8.3 5.2 Repo rate (exit rate) 7.5 6.8 6.0 6.0 61.1 65.0 67.5 67.0 USD/INR (Avg) Sector Year to March Net revenue Direct costs Employee costs FY16 FY17E FY18E 58,515 26,049 67,685 29,917 79,318 34,900 4,498 5,232 5,956 6,821 10,408 12,139 13,537 15,467 EBITDA 12,537 15,096 18,275 22,130 673 840 918 1,015 11,864 14,255 17,357 21,115 2,278 2,016 2,263 2,733 103 123 105 100 - (331) - - 14,039 15,818 19,515 23,747 Depreciation 10.0 15.0 15.0 15.0 EBIT TV industry sub. gr (%) 10.0 14.0 20.0 20.0 Add: Other income Company Less: Interest Expense Sales assumptions Add: Exceptional items Domestic sub rev gr (%) FY15 48,837 21,393 Total SG&A expenses TV industry ad gr (%) Ad revenue growth (%) (INR mn) 11.8 28.9 18.0 18.0 Profit Before Tax 8.0 14.5 15.0 22.0 Less: Provision for Tax 4,284 5,528 6,440 7,837 Internat sub rev gr (%) (17.3) 6.9 4.5 5.0 Less: Minority Interest (57) 18 (55) (60) Sports revenues (INR mn) 6,313 6,500 6,400 6,600 Associate profit share (37) (4) - - 8.8 6.2 5.9 5.0 9,775 10,268 13,130 15,971 43.8 44.5 44.2 44.0 Adjusted Profit Othr oper inc (% of rev) Cost assumptions Trans costs (% of rev) Reported Profit Exceptional Items - (222) - - 9,775 10,489 13,130 15,971 Shares o /s (mn) 960 960 960 960 Diluted shares o/s (mn) 960 960 960 960 8.7 9.4 12.2 15.1 Personnel cost(% of rev) 9.2 8.9 8.8 8.6 Sell & Adm exp(% of rev) 21.3 20.7 20.0 19.5 6.1 5.5 4.7 4.0 Adjusted Diluted EPS Ad & pub exp(% of rev) Promotion exp (% of rev) Sports losses (INR mn) 4.5 4.1 3.5 3.0 Dividend per share (DPS) 2.3 2.4 3.0 3.7 (266) (600) (1,100) (600) Dividend Payout Ratio(%) 26.6 27.1 26.5 26.5 Year to March FY15 FY16 FY17E FY18E 21.3 43.8 20.7 44.5 20.0 44.2 19.5 44.0 Financial assumptions Common size metrics Tax rate (%) 30.5 35.0 33.0 33.0 Capex (INR mn) 636 1,424 1,400 1,500 78 80 80 80 201 200 200 200 S G & A expenses Direct Cost EBITDA margins 25.7 25.8 27.0 27.9 Net Profit margins 19.9 18.0 19.3 20.1 Year to March FY15 FY16 FY17E FY18E Revenues EBITDA 10.4 4.1 19.8 20.4 15.7 21.1 17.2 21.1 9.6 7.3 25.2 21.6 (6.7) 8.6 29.2 24.3 Debtor days Inventory days Payable days 58 60 60 60 Cash conversion cycle 222 220 220 220 Int rate on debt (%) 5.6 5.6 5.6 5.6 Dep. (% gross block) 10.3 11.4 11.4 11.4 Growth ratios (%) Adjusted Profit EPS 14 Edelweiss Securities Limited Zee Entertainment Enterprises Balance sheet (INR mn) Cash flow metrics FY15 FY16 FY17E FY18E FY15 FY16 FY17E FY18E Share capital Reserves & Surplus 960 34,346 960 40,582 960 48,832 960 59,174 Operating cash flow Investing cash flow 6,809 (3,661) 7,483 (1,133) 10,555 (1,400) 12,525 (1,501) Shareholders' funds 35,306 41,542 49,792 60,134 Financing cash flow (9,723) 4 22 (33) (93) Short term borrowings 10 10 10 10 Long term borrowings 20,204 20,204 20,204 16,170 Total Borrowings 20,214 20,214 20,214 16,180 As on 31st March Minority Interest Long Term Liabilities Year to March (3,427) (4,235) (4,936) Net cash Flow (279) 2,115 4,219 1,301 Capex (636) (1,424) (1,400) (1,500) (2,601) (2,783) (3,483) (4,237) Year to March FY15 FY16 FY17E FY18E ROAE (%) ROACE (%) 31.1 27.4 27.3 27.7 28.6 29.7 29.0 32.6 Inventory Days Dividend paid Profitability and efficiency ratios 768 768 768 768 (531) (531) (531) (531) 55,761 62,015 70,210 76,458 5,853 3,213 6,553 3,165 7,353 3,125 8,153 2,994 201 200 200 200 878 850 850 850 Debtors Days 78 80 80 80 Intangible Assets 8,163 8,823 9,345 9,961 Payable Days 58 60 60 60 Total Fixed Assets 12,254 12,838 13,319 13,804 Cash Conversion Cycle 222 220 220 220 1,464 1,464 1,464 1,464 Current Ratio 4.1 4.3 4.7 4.8 Cash and Equivalents 15,656 17,480 21,699 23,002 Gross Debt/EBITDA 1.6 1.3 1.1 0.7 Inventories 11,878 14,273 16,393 19,123 Gross Debt/Equity 0.6 0.5 0.4 0.3 Sundry Debtors 10,692 12,825 14,835 17,385 Adjusted Debt/Equity 1.1 0.9 0.8 0.6 Loans & Advances 15,877 15,877 15,877 15,877 Net Debt/Equity 115.6 115.9 165.3 211.1 Def. Tax Liability (net) Sources of funds Gross Block Net Block Capital work in progress Non current investments Other Current Assets 1,706 1,706 1,706 1,706 40,153 44,681 48,811 54,091 Trade payable 4,204 4,886 5,522 6,341 Year to March FY15 FY16 FY17E FY18E Other Current Liab 9,562 9,562 9,562 9,562 Total Current Liab 13,766 14,448 15,084 15,903 Total Asset Turnover Fixed Asset Turnover 0.9 4.4 1.0 5.0 1.0 5.5 1.1 6.2 Net Curr Assets-ex cash 26,387 30,233 33,727 38,188 Equity Turnover 1.6 1.5 1.5 1.4 Uses of funds 55,761 62,015 70,210 76,458 36.8 43.3 51.9 62.6 Year to March FY15 FY16 FY17E FY18E Adj. Diluted EPS (INR) Y-o-Y growth (%) 8.7 (6.7) 9.4 8.6 12.2 29.2 15.1 24.3 Adjusted Cash EPS (INR) 10.9 11.8 14.6 17.7 Diluted P/E (x) 48.2 44.4 34.3 27.6 P/B (x) 11.4 9.7 8.1 6.7 8.3 6.9 5.9 5.0 32.3 0.5 26.7 0.6 21.9 0.7 17.8 0.9 Current Assets (ex cash) BVPS (INR) Free cash flow (INR mn) Year to March FY15 FY16 FY17E FY18E Reported Profit Add: Depreciation 9,775 673 10,268 840 13,130 918 15,971 1,015 71 82 70 67 (1,474) 139 (70) (67) Less: Changes in WC 2,236 3,846 3,494 4,461 Operating cash flow 6,809 7,483 10,555 12,525 636 1,424 1,400 1,500 6,173 6,059 9,155 11,025 Interest (Net of Tax) Others Less: Capex Free Cash Flow Operating ratios Valuation parameters EV / Sales (x) EV / EBITDA (x) Dividend Yield (%) Peer comparison valuation Market cap (USD mn) Name Zee Entertainment Enterprises DB Corp DEN Networks Dish TV India Hathway Cable & Datacom Sun TV Network Diluted P/E (X) FY17E FY18E EV / EBITDA (X) FY17E FY18E ROAE (%) FY17E FY18E 6,015 909 34.3 15.6 27.6 14.1 21.9 8.5 17.8 7.4 28.6 25.6 29.0 25.2 (0.1) 234 (34.5) (66.4) 6.8 5.7 (1.4) 1,458 30.0 26.6 8.8 7.2 NM NM 456 NM NM 10.6 10.0 (12.2) (17.0) 2,132 13.1 11.2 6.0 5.0 28.2 29.8 Source: Edelweiss research 15 Edelweiss Securities Limited Media Additional Data Directors Data Subhash Chandra Lord Gulam K. Noon Prof. Sunil Sharma Subodh Kumar Non-Executive Chairman Independent Director Independent Director Executive Vice Chairman Ashok Kurien Punit Goenka Prof. (Mrs.) Neharika Vohra Manish Chokhani Non-Executive Director Managing Director & CEO Independent Director Independent Director Auditors - M/S MGB & Co *as per last annual report Holding - Top10 Perc. Holding Perc. Holding Oppenheimer Funds Inc 9.94 Vanguard Group Inc 3.10 Schroder Investment Mgmt Group 1.97 Blackrock Fund Advisors 1.72 Gic Private Limited 1.67 Columbia Wanger Asset Management 1.49 Birla Sun Life Asset Management 1.33 Goldman Sachs Asia Llc 1.17 Icici Prudential Life Insurance 0.72 Nordea Inv Management Ab 0.60 *as per last available data Bulk Deals Data Acquired / Seller B/S Qty Traded Price No Data Available *in last one year Insider Trades Reporting Data Acquired / Seller B/S Qty Traded No Data Available *in last one year 16 Edelweiss Securities Limited RATING & INTERPRETATION Company Absolute Relative Relative reco reco risk Company Absolute Relative Relative reco reco DB Corp BUY SO M DEN Networks Risk HOLD SP Dish TV India BUY SO M H Hathway Cable & Datacom BUY SP M Jagran Prakashan BUY SP Sun TV Network BUY SP M PVR BUY SO M H Zee Entertainment Enterprises BUY SO M ABSOLUTE RATING Ratings Expected absolute returns over 12 months Buy More than 15% Hold Between 15% and - 5% Reduce Less than -5% RELATIVE RETURNS RATING Ratings Criteria Sector Outperformer (SO) Stock return > 1.25 x Sector return Sector Performer (SP) Stock return > 0.75 x Sector return Stock return < 1.25 x Sector return Sector Underperformer (SU) Stock return < 0.75 x Sector return Sector return is market cap weighted average return for the coverage universe within the sector RELATIVE RISK RATING Ratings Criteria Low (L) Bottom 1/3rd percentile in the sector Medium (M) Middle 1/3rd percentile in the sector High (H) Top 1/3rd percentile in the sector Risk ratings are based on Edelweiss risk model SECTOR RATING Ratings Criteria Overweight (OW) Sector return > 1.25 x Nifty return Equalweight (EW) Sector return > 0.75 x Nifty return Sector return < 1.25 x Nifty return Underweight (UW) Sector return < 0.75 x Nifty return 17 Edelweiss Securities Limited Media Edelweiss Securities Limited, Edelweiss House, off C.S.T. Road, Kalina, Mumbai – 400 098. Board: (91-22) 4009 4400, Email: research@edelweissfin.com Nirav Sheth Head Research nirav.sheth@edelweissfin.com Coverage group(s) of stocks by primary analyst(s): Media DB Corp, DEN Networks, Dish TV India, Hathway Cable & Datacom, Jagran Prakashan, PVR, Sun TV Network, Zee Entertainment Enterprises Recent Research Date Company Title Price (INR) Recos 25-Apr-16 Jagran Prakashan Focused on multi-pronged growth; Visit Note 167 Buy 22-Apr-16 Den Networks Shedding flab, core competency to the fore; Visit Note 89 Hold 20-Apr-16 DB Corp Ad growth to revive; Visit Note 324 Buy Distribution of Ratings / Market Cap Rating Interpretation Edelweiss Research Coverage Universe Rating Distribution* * 3 stocks under review Buy Hold 153 63 > 50bn 743 Market Cap (INR) Reduce 11 227 Between 10bn and 50 bn < 10bn 158 Rating Total 62 7 Expected to Buy appreciate more than 15% over a 12-month period Hold appreciate up to 15% over a 12-month period Reduce depreciate more than 5% over a 12-month period One year price chart 446 450 297 400 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jun-14 Jul-15 Jul-14 May-14 Jun-15 250 Apr-14 300 Apr-16 Mar-16 Feb-16 Jan-16 Dec-15 Nov-15 Oct-15 Oct-15 Sep-15 Aug-15 200 May-15 (INR) Feb-14 - 350 Mar-14 149 Jan-14 (INR) 594 Zee Entertainment Enterprise 18 Edelweiss Securities Limited Zee Entertainment Enterprises DISCLAIMER Edelweiss Securities Limited (“ESL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is licensed to carry on the business of broking, depository services and related activities. The business of ESL and its Associates (list available on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing and SME Finance, Commodities, Financial Markets, Asset Management and Life Insurance. This Report has been prepared by Edelweiss Securities Limited in the capacity of a Research Analyst having SEBI Registration No.INH200000121 and distributed as per SEBI (Research Analysts) Regulations 2014. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Securities as defined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 includes Financial Instruments and Currency Derivatives. The information contained herein is from publicly available data or other sources believed to be reliable. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in Securities referred to in this document (including the merits and risks involved), and should consult his own advisors to determine the merits and risks of such investment. The investment discussed or views expressed may not be suitable for all investors. This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ESL and associates / group companies to any registration or licensing requirements within such jurisdiction. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. This information is subject to change without any prior notice. ESL reserves the right to make modifications and alterations to this statement as may be required from time to time. ESL or any of its associates / group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. ESL is committed to providing independent and transparent recommendation to its clients. Neither ESL nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Past performance is not necessarily a guide to future performance .The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. The information provided in these reports remains, unless otherwise stated, the copyright of ESL. All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and copyright of ESL and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders. ESL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including network (Internet) reasons or snags in the system, break down of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the ESL to present the data. In no event shall ESL be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data presented by the ESL through this report. We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at the same time. We will not treat recipients as customers by virtue of their receiving this report. ESL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the Securities, mentioned herein or (b) be engaged in any other transaction involving such Securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. ESL may have proprietary long/short position in the above mentioned scrip(s) and therefore should be considered as interested. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. This should not be construed as invitation or solicitation to do business with ESL. 19 Edelweiss Securities Limited Media ESL or its associates may have received compensation from the subject company in the past 12 months. ESL or its associates may have managed or co-managed public offering of securities for the subject company in the past 12 months. ESL or its associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months. ESL or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. ESL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Research analyst or his/her relative or ESL’s associates may have financial interest in the subject company. ESL and/or its Group Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise in the Securities/Currencies and other investment products mentioned in this report. ESL, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange rates can be volatile and are subject to large fluctuations; ( ii) the value of currencies may be affected by numerous market factors, including world and national economic, political and regulatory events, events in equity and debt markets and changes in interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect the value of the currency. Investors in securities such as ADRs and Currency Derivatives, whose values are affected by the currency of an underlying security, effectively assume currency risk. Research analyst has served as an officer, director or employee of subject Company: No ESL has financial interest in the subject companies: No ESL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report. Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No ESL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No Subject company may have been client during twelve months preceding the date of distribution of the research report. There were no instances of non-compliance by ESL on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years except that ESL had submitted an offer of settlement with Securities and Exchange commission, USA (SEC) and the same has been accepted by SEC without admitting or denying the findings in relation to their charges of non registration as a broker dealer. A graph of daily closing prices of the securities is also available at www.nseindia.com Analyst Certification: The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Additional Disclaimers Disclaimer for U.S. Persons This research report is a product of Edelweiss Securities Limited, which is the employer of the research analyst(s) who has prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States (U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst account. This report is intended for distribution by Edelweiss Securities Limited only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor. 20 Edelweiss Securities Limited Zee Entertainment Enterprises In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with Major Institutional Investors, Edelweiss Securities Limited has entered into an agreement with a U.S. registered broker-dealer, Edelweiss Financial Services Inc. ("EFSI"). Transactions in securities discussed in this research report should be effected through Edelweiss Financial Services Inc. Disclaimer for U.K. Persons The contents of this research report have not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 ("FSMA"). In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(5) of the FSMA (Financial Promotion) Order 2005 (the “Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and unincorporated associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such persons together being referred to as “relevant persons”). This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this research report relates is available only to relevant persons and will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents. This research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person. Disclaimer for Canadian Persons This research report is a product of Edelweiss Securities Limited ("ESL"), which is the employer of the research analysts who have prepared the research report. The research analysts preparing the research report are resident outside the Canada and are not associated persons of any Canadian registered adviser and/or dealer and, therefore, the analysts are not subject to supervision by a Canadian registered adviser and/or dealer, and are not required to satisfy the regulatory licensing requirements of the Ontario Securities Commission, other Canadian provincial securities regulators, the Investment Industry Regulatory Organization of Canada and are not required to otherwise comply with Canadian rules or regulations regarding, among other things, the research analysts' business or relationship with a subject company or trading of securities by a research analyst. This report is intended for distribution by ESL only to "Permitted Clients" (as defined in National Instrument 31-103 ("NI 31-103")) who are resident in the Province of Ontario, Canada (an "Ontario Permitted Client"). If the recipient of this report is not an Ontario Permitted Client, as specified above, then the recipient should not act upon this report and should return the report to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any Canadian person. ESL is relying on an exemption from the adviser and/or dealer registration requirements under NI 31-103 available to certain international advisers and/or dealers. Please be advised that (i) ESL is not registered in the Province of Ontario to trade in securities nor is it registered in the Province of Ontario to provide advice with respect to securities; (ii) ESL's head office or principal place of business is located in India; (iii) all or substantially all of ESL's assets may be situated outside of Canada; (iv) there may be difficulty enforcing legal rights against ESL because of the above; and (v) the name and address of the ESL's agent for service of process in the Province of Ontario is: Bamac Services Inc., 181 Bay Street, Suite 2100, Toronto, Ontario M5J 2T3 Canada. Disclaimer for Singapore Persons In Singapore, this report is being distributed by Edelweiss Investment Advisors Private Limited ("EIAPL") (Co. Reg. No. 201016306H) which is a holder of a capital markets services license and an exempt financial adviser in Singapore and (ii) solely to persons who qualify as "institutional investors" or "accredited investors" as defined in section 4A(1) of the Securities and Futures Act, Chapter 289 of Singapore ("the SFA"). Pursuant to regulations 33, 34, 35 and 36 of the Financial Advisers Regulations ("FAR"), sections 25, 27 and 36 of the Financial Advisers Act, Chapter 110 of Singapore shall not apply to EIAPL when providing any financial advisory services to an accredited investor (as defined in regulation 36 of the FAR. Persons in Singapore should contact EIAPL in respect of any matter arising from, or in connection with this publication/communication. This report is not suitable for private investors. Copyright 2009 Edelweiss Research (Edelweiss Securities Ltd). All rights reserved Access the entire repository of Edelweiss Research on www.edelresearch.com 21 Edelweiss Securities Limited