“The Dynamics of Trade and Competition” Contents Results Available Upon Request for

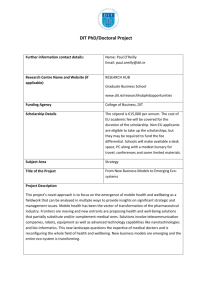

advertisement

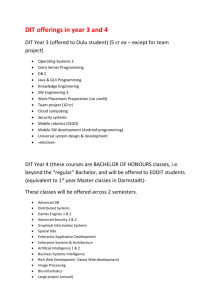

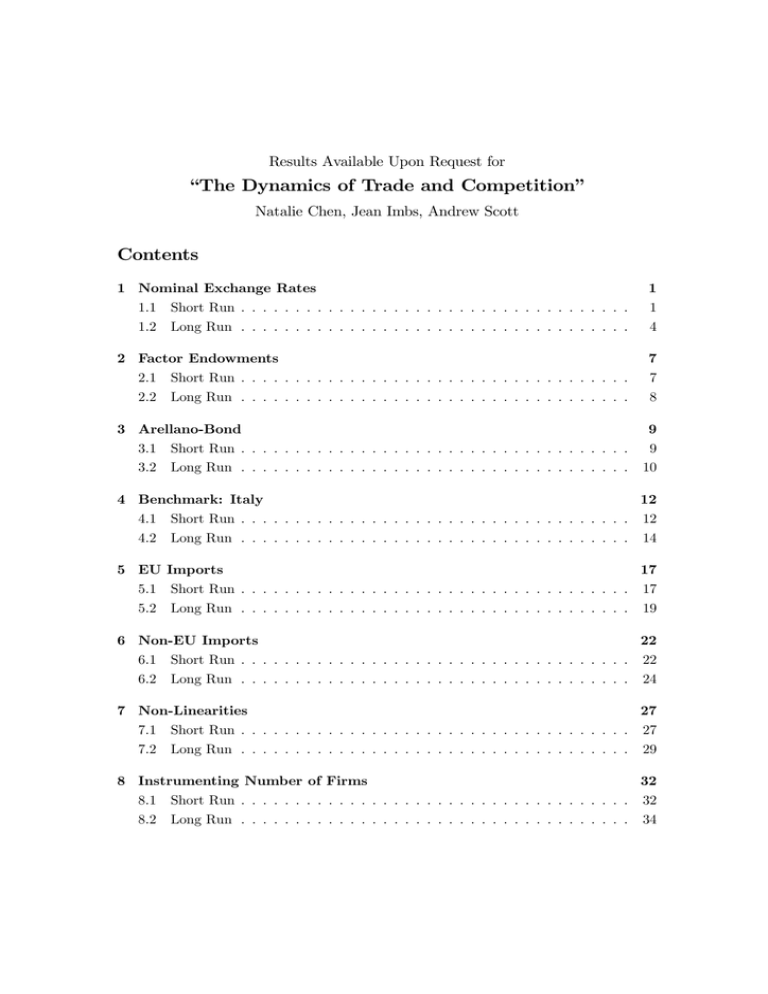

Results Available Upon Request for “The Dynamics of Trade and Competition” Natalie Chen, Jean Imbs, Andrew Scott Contents 1 Nominal Exchange Rates 1.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 4 2 Factor Endowments 2.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 7 8 3 Arellano-Bond 3.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 9 10 4 Benchmark: Italy 12 4.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 4.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 5 EU Imports 17 5.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 5.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 6 Non-EU Imports 22 6.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 6.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 7 Non-Linearities 27 7.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 7.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 8 Instrumenting Number of Firms 32 8.1 Short Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 8.2 Long Run . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 1 Nominal Exchange Rates 1.1 Short Run Table 1: Prices (Short Run), all country pairs, sector-specific nominal exchange rates Method ∆ ln pit−1 p∗ it−1 ∆ ln θit (1) (2) (3) (4) (5) (6) (7) OLS OLS OLS OLS IV IV IV — — −0.013 (−2.002) (−1.202) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit ∗ ∆ ln Dit 0.009 −0.022 0.019 (1.963) (1.978) 0.066 — — −0.035 — — — — 0.025 — — — — (−4.231) −0.029 (−4.473) −0.177 (−4.553) −0.176 (−4.060) −0.014 (−2.569) −0.043 (−2.635) −0.044 (−2.842) 0.066 (−3.400) (0.989) (1.995) (2.701) — — — 0.007 (0.637) 0.000 (−0.107) ∆ ln Pt — ∆ ln Pt∗ — N 800 −0.008 (−0.720) 0.002 (1.413) 0.449 0.089 (1.842) −0.016 (−1.474) 0.002 (1.584) 0.518 (−1.329) 0.003 0.013 (1.839) (4.437) 0.521 — (5.542) (6.518) (6.576) −0.424 −0.584 (−6.865) −0.577 — (−5.029) (−6.825) 800 720 720 800 0.012 (3.803) 0.357 −0.207 −0.051 0.013 (3.625) 0.391 (3.349) (3.289) (−3.256) −0.354 (−3.101) 800 720 −0.404 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (5) to (7) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Industryspecific bilateral nominal exchange rates (not reported) are included in all regressions. 1 Table 2: Productivity (Short Run), all country pairs, sector-specific nominal exchange rates Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit ∗ ∆ ln Dit N (1) OLS — 0.000 (−0.007) 0.024 (2) OLS (3) OLS (4) IV −0.156 −0.101 — (−5.330) (−2.805) 0.008 — — — 0.024 — — — (0.264) (0.911) (0.854) — — 0.049 0.074 (2.900) 0.067 0.168 (1.565) (2.145) (−0.298) −0.001 (−0.060) 800 720 0.000 (5) IV −0.140 (−2.409) 0.676 (4.852) 0.287 0.871 (4.153) 0.340 (4.598) (4.889) (4.647) (−7.419) −0.040 (−6.903) −0.073 (−5.905) 720 800 720 −0.084 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. We cannot reject the hypothesis that the coefficients on domestic and foreign openness are equal but we can reject it for the coefficients on the number of domestic and foreign firms. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Industry-specific bilateral nominal exchange rates (not reported) are included in all regressions. 2 Table 3: Markups (Short Run), all country pairs, sector-specific nominal exchange rates Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS — −0.017 (−1.346) ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit 0.014 N (3) OLS (4) IV −0.224 −0.226 — (−5.900) (−6.009) −0.024 — — — 0.030 — — — (−2.918) −0.025 (−2.898) −0.109 (−3.100) −0.050 (−3.811) −0.061 (−4.358) (2.575) — — −0.038 0.004 (5) IV −0.223 (−5.021) (−1.829) (1.223) (−2.834) ∗ ∆ ln Dit (2) OLS −0.050 (−3.796) 0.005 (−4.072) 0.005 0.010 −0.161 −0.078 0.013 (1.760) (2.581) (2.908) (3.472) (3.615) 800 720 720 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. We cannot reject the hypothesis that the coefficients on domestic and foreign openness are equal but we can reject it for the coefficients on the number of domestic and foreign firms. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Industry-specific bilateral nominal exchange rates (not reported) are included in all regressions. 3 1.2 Long Run Table 4: Prices (Long Run), all country pairs, sector-specific nominal exchange rates Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV — — — (4) IV −0.012 (−0.230) −0.007 — — — 0.003 — — — (−0.923) −0.006 (−1.474) −0.039 (−1.209) −0.001 (−1.435) −0.016 (−1.179) (−0.814) ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit ∆ ln Pt ∆ ln Pt∗ ln pit−1 p∗ it−1 ln θit−1 ln θ∗it−1 ln θ it−1 θ∗ it−1 ln Lt−1 (0.406) — 0.005 (0.557) (−0.105) −0.001 (0.706) (−0.837) 0.721 0.001 0.641 0.004 (2.019) 0.722 −0.044 −0.015 0.005 (1.938) 0.604 (5.386) (6.592) (5.682) (3.470) −0.624 (−6.843) −0.853 (−5.034) −0.768 (−3.843) (−17.465) −0.484 (−18.419) −0.451 (−9.036) −0.379 (−7.381) 0.011 — — — −0.003 — — — (−4.072) (1.628) −0.737 −0.341 (−0.410) — 0.012 0.063 0.082 (2.423) (2.401) (2.794) −0.101 — — — 0.054 — — — −0.069 (−6.161) −0.074 (−4.897) (−2.952) ln L∗t−1 L ln Lt−1 ∗ t−1 ln Pt−1 ∗ ln Pt−1 N (1.664) — (−6.687) 0.310 0.301 (6.486) (9.951) (−5.469) −0.283 (−10.100) 800 800 −0.352 0.265 −0.075 0.214 (7.276) (3.091) (−7.546) −0.319 (−3.841) 800 720 −0.295 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. Industry-specific bilateral exchange rates (not reported) are included in all regressions. Industry-specific bilateral nominal exchange rates (not reported) are included in all regressions. 4 Table 5: Productivity (Long Run), all country pairs, sector-specific nominal exchange rates Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit ∗ ∆ ln Dit z ln zit−1 ∗ it−1 ln θit−1 (1) OLS (2) OLS (3) IV — — — (4) IV (5) IV (6) IV (−2.000) −0.153 (−1.609) −0.099 (−2.038) −0.139 0.016 — — — — — 0.022 — — — — — (0.559) (0.825) — 0.042 (1.384) 0.001 (0.132) −0.354 0.062 (2.625) 0.117 0.491 (4.493) 0.255 0.512 (3.555) 0.254 0.564 (4.113) 0.243 0.594 (4.108) 0.232 (3.533) (4.647) (4.034) (4.374) (1.741) (−6.877) −0.035 (−6.365) −0.055 (−5.654) −0.058 (−5.294) −0.063 (−5.407) −0.089 (−11.790) (−9.713) −0.307 (−6.165) −0.307 (−4.345) −0.290 (−4.028) −0.295 (−3.077) −0.216 −0.002 — — — — — 0.046 — — — — — (−2.085) −0.045 (−2.502) −0.343 (−2.494) −0.479 (−1.484) −0.206 (−1.288) 0.187 — — — — — −0.248 — — — — — (−0.090) ln θ∗it−1 ln θ it−1 θ∗ it−1 ln Lt−1 ln L∗t−1 ln Lt−1 L∗ t−1 ln wit−1 (1.783) — (2.589) −0.184 (−3.052) — 0.244 0.484 0.565 0.344 0.214 (5.807) (5.079) (4.298) (2.173) (1.577) −0.040 — — — — — 0.096 — — — — — (−3.654) −0.085 (−3.961) −0.368 (−3.467) −0.430 (−1.174) −0.189 (−0.173) 800 800 720 720 720 (−1.361) ∗ ln wit−1 w (3.742) ln wit−1 ∗ — N 800 it−1 −0.023 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. We cannot reject the hypothesis that the coefficients on domestic and foreign variables are equal except for the coefficients on the number of domestic and foreign firms in (1) to (5). In (3) to (6) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (5) wages are instrumented by the average income tax rate for married individuals and in (6) the number of firms is further instrumented by its own lags. Lt denotes (real) GDP. Industry-specific bilateral nominal exchange rates (not reported) are included in all regressions. 5 Table 6: Markups (Long Run), all country pairs, sector-specific nominal exchange rates Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV (4) IV — — — −0.025 — — — 0.013 — — — (−1.515) −0.011 (−0.732) −0.019 (−0.776) −0.036 (−3.021) −0.037 (−3.054) 0.045 (1.052) (−2.190) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit (1.235) — −0.037 (−3.226) ∗ ∆ ln Dit ln μit−1 μ∗ it−1 ln θit−1 0.005 (2.525) −0.627 (−3.424) 0.004 (2.650) −0.566 0.006 (2.618) −0.554 −0.023 −0.040 0.006 (2.483) −0.622 (−17.297) (−16.345) (−15.378) (−12.806) −0.019 — — — 0.000 — — — (−2.200) ln θ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 (−0.021) — 0.004 0.030 0.031 (0.740) (1.842) (1.599) −0.046 — — — 0.075 — — — (−2.109) −0.016 (−2.678) −0.028 (−2.225) 800 800 720 (−1.807) ln L∗t−1 ln N Lt−1 L∗ t−1 (2.534) — 800 −0.028 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. We cannot reject the hypothesis that the coefficients on domestic and foreign variables are equal except for the coefficients on the number of domestic and foreign firms. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. Industry-specific bilateral nominal exchange rates (not reported) are included in all regressions. 6 2 Factor Endowments 2.1 Short Run Table 7: Productivity (Short Run), all country pairs, controlling for factor endowments Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit ∗ ∆ ln Dit ∆ ln αit (1) OLS — 0.039 (3) OLS (4) IV −0.083 −0.083 — (−2.211) (−2.228) 0.055 — — — −0.071 — — — (1.080) (1.424) (−1.844) −0.060 (−2.045) — — 0.145 0.170 0.177 −0.115 (−1.922) 0.665 (4.508) 0.299 0.874 (3.840) 0.351 (4.274) (4.705) (4.936) (4.575) (−5.871) −0.033 (−5.892) −0.034 (−6.054) −0.033 (−6.091) −0.065 (−5.184) −0.641 −0.657 — — — (−1.587) 1.088 — — — (−2.376) −0.819 (−0.834) −0.383 (−0.397) 720 800 720 0.912 (1.925) (2.121) it ∆ ln α α∗ — — N 800 it 0.064 (2.460) (5) IV (3.802) (−1.626) ∆ ln α∗it (2) OLS 720 −0.075 −0.227 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. αit denotes an interaction term between aggregate capital stock and sectoral capital shares. 7 2.2 Long Run Table 8: Productivity (Long Run), all country pairs, controlling for factor endowments Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit ∆ ln αit (1) OLS (2) OLS (3) IV — — — (4) IV (5) IV (6) IV (−0.302) −0.017 (−0.946) −0.059 (−1.028) −0.066 0.044 — — — — — −0.049 — — — — — (1.265) (−1.509) — 0.107 0.049 (2.054) 0.108 0.385 (4.161) 0.219 0.417 (3.607) 0.215 0.585 (3.964) 0.214 0.551 (3.843) 0.143 (2.923) (3.196) (4.553) (4.287) (3.672) (1.078) (−5.263) −0.028 (−5.640) −0.028 (−6.158) −0.043 (−5.815) −0.044 (−5.423) −0.062 (−4.898) −0.764 — — — — — 0.888 — — — — — (−2.467) −0.841 (−0.666) −0.340 (−0.506) −0.269 (−1.323) −0.815 (−1.091) −0.322 −0.079 (−1.846) ∆ ln α∗it it ∆ ln α α∗ it ln zit−1 ∗ zit−1 ln θit−1 (1.708) — −0.324 −0.666 (−10.061) (−10.127) (−6.798) −0.320 (−6.404) −0.347 (−3.949) −0.268 (−4.122) −0.268 −0.022 — — — — — 0.035 — — — — — (−1.198) −0.027 (−1.251) −0.152 (−0.927) −0.133 (−0.009) −0.001 (0.751) 0.247 — — — — — −0.237 — — — — — (−0.744) ln θ∗it−1 ln θ it−1 θ∗ it−1 ln Lt−1 ln L∗t−1 ln Lt−1 L∗ t−1 ln wit−1 (1.208) — (4.700) 0.098 (−4.374) — 0.242 0.331 0.332 0.108 0.145 (5.593) (4.778) (3.906) (0.845) (1.292) −0.035 — — — — — 0.071 — — — — — (−2.347) −0.058 (−2.552) −0.226 (−2.119) −0.201 (0.673) (−0.264) 0.179 — — — — — −0.271 — — — — — (−1.083) ∗ ln wit−1 ln wit−1 ∗ wit−1 ln αit−1 ln α∗it−1 α (2.303) — (1.285) −0.039 (−2.151) ln αit−1 ∗ — N 800 it−1 0.103 (2.383) 0.251 (−0.601) −0.132 (−0.477) −0.092 (0.928) 0.227 (1.072) 0.262 800 800 720 720 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) to (6) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (5) wages are instrumented by the average income tax rate for married individuals and in (6) the number of firms is further instrumented by its own lags. Lt denotes (real) GDP. αit denotes an interaction term between aggregate capital stock and sectoral capital shares. 8 3 3.1 Arellano-Bond Short Run Table 9: Prices (Short Run), Arellano-Bond estimations, all country pairs (1) ∆ ln pit−1 p∗ it−1 (2) 0.384 ∆ ln θθit ∗ it ∆ ln Dit 0.372 (13.560) (13.012) (−8.045) −0.076 (−7.763) −0.039 (−3.315) −0.077 −0.033 (−4.015) ∗ ∆ ln Dit 0.007 0.009 (4.427) ∆ ln Pt (5.645) 0.471 0.467 (8.633) ∆ ln Pt∗ (8.557) −0.622 N −0.551 (−11.820) (−9.931) 720 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. The number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. In (2), industry-specific bilateral nominal exchange rates (not reported) are included. Table 10: Productivity and Markups (Short Run), Arellano-Bond estimations, all country pairs Productivity ∆ ln zit−1 ∗ zit−1 ∆ ln θ it θ∗ it ∆ ln Dit ∗ ∆ ln Dit (1) 0.394 (9.190) 0.087 (2.460) 0.211 (5.778) −0.032 (−6.132) it ∆ ln α α∗ — N 720 it (2) Markups 0.397 (9.265) 0.090 (2.534) (3) ∆ ln μit−1 μ∗ it−1 (4.770) ∆ ln θ it θ∗ it (−5.051) 0.196 −0.060 0.212 ∆ ln Dit −0.032 ∗ ∆ ln Dit 0.402 — — 720 N 720 (5.771) (−6.151) (1.168) −0.070 (−6.482) 0.008 (4.553) Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. The number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. In (2), αit denotes an interaction term between aggregate capital stock and sectoral capital shares. 9 3.2 Long Run Table 11: Prices (Long Run), Arellano-Bond estimations, all country pairs Prices (1) (2) ∆ ln pit−1 p∗ it−1 (11.534) (11.012) ∆ ln θ it θ∗ it (−3.212) −0.027 (−2.076) −0.006 (0.631) ∆ ln Dit 0.299 (−0.656) ∗ ∆ ln Dit ∆ ln Pt ∆ ln Pt∗ it ∆ ln α α∗ p it ln pit−1 ∗ it−1 θ ln θit−1 ∗ it−1 ln Lt−1 L∗ t−1 ln Pt−1 ∗ ln Pt−1 N 0.003 (2.464) 0.458 0.287 −0.018 0.006 0.004 (2.919) 0.515 (4.987) (5.522) (−5.439) −0.619 (−4.648) — — −0.289 (−16.833) 0.010 −0.541 −0.312 (−16.634) 0.010 (2.884) (2.648) −0.049 (−5.806) (−5.692) 0.159 −0.054 0.173 (4.858) (5.168) (−4.975) −0.188 (−4.824) 720 720 −0.186 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. The number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. Lt denotes (real) GDP. In (2), industry-specific bilateral nominal exchange rates (not reported) are included. 10 Table 12: Productivity and Markups (Long Run), Arellano-Bond estimations, all country pairs Productivity ∆ ln zit−1 ∗ zit−1 ∆ ln θ it θ∗ it ∆ ln Dit ∗ ∆ ln Dit it ∆ ln α α∗ it ln zit−1 ∗ zit−1 ln θ it−1 θ∗ it−1 L ln Lt−1 ∗ t−1 ln wit−1 ∗ wit−1 α (1) 0.278 (8.734) −0.013 (−0.428) 0.096 (2.893) −0.025 (−5.246) — Markups (3) ∆ ln μit−1 μ∗ it−1 (7.279) −0.009 ∆ ln θ it θ∗ it (−6.838) 0.082 ∆ ln Dit −0.024 ∗ ∆ ln Dit −0.751 — 0.270 (8.426) (−0.314) (2.435) (−4.979) 0.262 −0.067 −0.079 (−8.130) 0.006 (4.028) — (−2.189) −0.256 (−11.751) −0.044 (−2.699) 0.142 ln (−11.546) μit−1 μ∗ it−1 (−15.733) −0.033 ln θ it−1 θ∗ it−1 (−2.738) 0.137 ln Lt−1 ∗ (−0.821) −0.027 — — 0.107 — — 720 N 720 −0.263 (−1.956) (4.770) (3.915) −0.041 (−1.519) (−2.366) ln αit−1 ∗ — N 720 it−1 (2) (1.267) L t−1 −0.460 −0.011 −0.004 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. The number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. Lt denotes (real) GDP. In (2), αit denotes an interaction term between aggregate capital stock and sectoral capital shares. 11 4 Benchmark: Italy 4.1 Short Run Table 13: Prices (Short Run), Benchmark is Italy Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS — — −0.033 (−1.721) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit 0.050 0.044 (4) OLS (5) IV (6) IV −0.058 −0.056 — — (−0.873) (−0.844) −0.037 — — 0.029 — (−2.311) −0.033 −0.027 (−3.034) (2.374) (1.469) — — — −0.042 0.013 (3.680) ∆ ln Pt — ∆ ln Pt∗ — N 260 −0.025 (−1.480) 0.010 (2.993) 0.567 (7) IV 0.184 (8) GMM 0.324 (1.628) (5.374) — — — — — — — (−4.883) −0.211 (−4.593) −0.187 (−3.991) −0.231 (−2.582) −0.065 (−2.331) −0.048 (−2.167) −0.051 (−2.230) (−1.963) (2.630) (−2.403) ∗ ∆ ln Dit −0.030 (−1.631) (3) OLS −0.028 (−1.653) 0.007 (2.050) 0.685 (−1.637) 0.008 0.020 (2.389) (4.420) 0.691 — (4.189) (4.541) (4.628) −0.635 −0.886 (−5.935) −0.880 — (−5.018) (−5.957) 260 234 234 260 0.017 (3.917) 0.516 0.019 (3.501) 0.466 −0.048 −0.033 0.010 (3.022) 0.486 (3.099) (2.150) (4.445) (−3.423) −0.540 (−2.109) −0.489 (−6.273) 260 234 234 −0.723 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (5) to (8) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (8), the number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. 12 Table 14: Productivity (Short Run), Benchmark is Italy (1) OLS Method z ∆ ln zit−1 ∗ — it−1 ∆ ln θit 0.036 ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit N (3) OLS (4) IV −0.046 −0.059 — (−0.726) (−0.939) 0.061 — −0.243 — (0.499) (0.790) (−3.579) −0.254 (−3.193) — — 0.144 ∗ ∆ ln Dit (2) OLS 0.153 (6) GMM (−0.089) −0.010 (5.917) — — — — — — 1.217 (2.655) 0.175 (5) IV (5.760) 0.219 0.315 1.285 (5.445) 0.320 0.348 0.294 (4.123) 0.137 (2.193) (2.455) (3.248) (2.981) (2.750) (2.126) (−6.596) −0.088 (−6.272) −0.088 (−6.009) −0.078 (−5.654) −0.127 (−5.402) −0.132 (−6.703) 260 234 234 260 234 234 −0.088 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) to (6) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (6), the number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. Table 15: Markups (Short Run), Benchmark is Italy Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS — −0.006 (−0.390) ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit 0.034 N (3) OLS (4) IV −0.236 −0.243 — (−3.568) (−3.695) −0.010 — 0.032 (1.958) — — −0.016 0.008 (5) IV (6) GMM (−3.620) −0.241 (3.733) — — — — — — — (−1.732) −0.021 (−2.128) −0.062 (−1.652) −0.049 (−2.200) −0.030 (−1.862) −0.027 (−2.236) −0.032 (−2.543) 0.276 (−0.625) (2.129) (−1.107) ∗ ∆ ln Dit (2) OLS −0.025 (−1.663) 0.008 (−2.110) 0.007 0.009 0.008 −0.035 −0.034 0.005 (2.775) (2.618) (2.422) (2.832) (2.605) (1.609) 260 234 234 260 234 234 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) to (6) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (6), the number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. 13 4.2 Long Run Table 16: Prices (Long Run), Benchmark is Italy Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV — — — −0.029 — 0.019 (4) IV 0.048 (5) GMM 0.296 (0.342) (4.912) — — — — — — — (−1.959) −0.024 (−1.584) −0.088 (−1.486) −0.112 (−2.016) −0.022 (−1.664) −0.038 (−1.484) −0.035 (−1.350) (−1.750) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit (1.087) — −0.024 (−1.718) ∗ ∆ ln Dit ∆ ln Pt ∆ ln Pt∗ p ln pit−1 ∗ it−1 ln θit−1 ln θ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 0.004 (1.118) 0.645 (−1.648) 0.005 (1.548) 0.664 0.013 (2.337) 0.777 0.012 (2.036) 0.638 −0.034 −0.018 0.007 (2.211) 0.746 (3.563) (3.797) (2.438) (1.635) (4.610) (−5.183) −1.230 (−5.184) −1.178 (−1.850) −0.735 (−2.567) −1.080 (−3.308) (−9.431) −0.475 (−9.891) −0.480 (−5.693) −0.468 (−5.058) −0.590 (−8.804) 0.010 — — — — −0.012 — — — — (0.812) −0.846 −0.369 (−0.928) — 0.013 0.164 0.140 0.003 (1.335) (2.007) (1.307) (0.363) −0.052 — — — — 0.034 — — — — −0.043 (−2.852) −0.096 (−1.910) −0.075 (−1.018) (−2.349) ln L∗t−1 ln Lt−1 L∗ t−1 ln Pt−1 ∗ ln Pt−1 N (1.547) — (−2.447) 0.424 0.436 0.574 0.732 −0.020 0.382 (5.717) (6.169) (3.178) (2.512) (4.814) (−6.288) −0.535 (−6.514) −0.540 (−3.289) −0.730 (−2.630) −0.944 (−4.167) 260 260 260 234 234 −0.400 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) to (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. In (5), the number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. 14 Table 17: Productivity (Long Run), Benchmark is Italy Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit z ln zit−1 ∗ it−1 ln θit−1 (1) OLS (2) OLS (3) IV — — — (4) IV 0.169 (5) IV 0.143 (6) IV (7) GMM (1.280) (1.037) (−0.269) −0.043 (5.768) 0.322 0.093 — — — — — — −0.208 — — — — — — (1.374) (−2.932) — 0.182 0.166 (3.203) 0.190 1.070 (5.831) 0.342 1.083 (5.039) 0.317 1.145 (5.090) 0.292 0.859 (3.343) 0.403 0.152 (2.264) 0.087 (2.992) (3.280) (3.652) (3.245) (2.789) (1.488) (1.477) (−5.311) −0.068 (−5.449) −0.064 (−4.983) −0.098 (−4.612) −0.097 (−4.547) −0.117 (−2.915) −0.134 (−4.595) (−5.477) −0.375 (−5.519) −0.367 (−4.873) −0.517 (−4.642) −0.595 (−3.044) −0.484 (−2.520) −0.402 (−6.304) −0.018 — — — — — — 0.008 — — — — — — (−0.588) −0.028 (−0.016) −0.004 (0.213) (0.773) (−0.421) −0.138 (0.871) 0.418 — — — — — — −0.205 — — — — — — −0.059 −0.309 (−0.313) ln θ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 ln L∗t−1 ln Lt−1 L∗ t−1 ln wit−1 (0.120) — (4.041) 0.072 0.254 0.036 (−1.757) — 0.306 0.538 0.578 0.239 0.544 0.136 (3.282) (1.939) (1.695) (0.624) (1.631) (1.822) −0.104 — — — — — — 0.150 — — — — — — (−2.634) −0.143 (−1.433) −0.303 (−1.068) −0.283 (0.225) (−0.591) −0.165 (−0.674) 260 260 234 234 234 234 (−1.697) ∗ ln wit−1 ln N wit−1 ∗ wit−1 (2.196) — 260 0.074 −0.030 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) to (7) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (5) wages are instrumented by the average income tax rate for married individuals and in (6) the number of firms is further instrumented by its own lags. Lt denotes (real) GDP. In (7), the number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. 15 Table 18: Markups (Long Run), Benchmark is Italy Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV — — — (4) IV (5) GMM (−0.277) −0.024 (4.092) 0.252 −0.009 — — — — 0.017 — — — — (−1.457) −0.016 (−1.269) −0.037 (−1.090) −0.037 (−3.068) −0.026 (−1.511) −0.022 (−0.972) −0.017 (−3.063) (−0.649) ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit (1.155) — −0.027 (−2.119) ∗ ∆ ln Dit ln μit−1 μ∗ it−1 ln θit−1 ln θ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 0.006 (−2.156) 0.006 0.010 0.010 −0.044 −0.036 0.003 (2.442) (2.616) (3.191) (2.957) (1.200) (−8.492) −0.501 (−9.036) −0.520 (−8.199) −0.555 (−6.571) −0.635 (−8.455) 0.014 — — — — −0.008 — — — — (1.544) −0.409 (−0.791) — 0.013 0.067 0.085 0.002 (1.873) (3.541) (3.318) (0.382) −0.029 — — — — −0.013 — — — — (−0.829) −0.007 (−3.142) −0.058 (−2.970) −0.067 (1.167) 260 260 234 234 (−2.071) ln L∗t−1 L (−0.946) ln Lt−1 ∗ — N 260 t−1 0.008 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) to (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. In (5), the number of lagged dependent variables (one) is chosen in order to reject autocorrelation of order 2. 16 5 EU Imports 5.1 Short Run Table 19: Prices (Short Run), EU Imports, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS — — −0.023 (−1.893) (−2.325) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit 0.026 0.021 — −0.029 — — — — 0.027 — — — — (−4.507) −0.028 (−3.712) −0.226 (−3.785) −0.239 (−2.705) −0.015 (−2.567) −0.056 (−2.623) −0.059 (−2.328) — 0.005 ∆ ln Pt — ∆ ln Pt∗ — N 800 0.003 (1.443) 0.443 0.170 (2.209) (−3.219) — (2.814) (7) IV — — −0.008 (6) IV 0.070 (3.280) (−0.740) (5) IV (2.090) 0.070 (2.422) −0.008 (4) OLS (2.084) (2.836) (−0.697) ∗ ∆ ln Dit −0.018 (3) OLS −0.015 (−1.482) 0.003 (1.661) 0.507 (−1.483) 0.003 (1.807) 0.508 0.018 0.020 (3.453) (3.922) 0.194 — (5.458) (6.348) (6.373) (1.352) −0.445 −0.591 (−6.980) −0.590 (−6.986) −0.204 — (−5.346) (−1.397) 800 720 720 800 800 −0.288 −0.068 0.023 (2.628) 0.094 (0.412) −0.103 (−0.399) 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (5) to (7) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 17 Table 20: Productivity (Short Run), EU Imports, all country pairs Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit N (1) OLS — (2) OLS (3) OLS (4) IV −0.072 −0.074 — (−1.924) (−1.971) 0.009 — — — −0.084 — — — (−0.105) −0.003 (0.256) (−2.459) −0.073 (−2.680) — — 0.132 0.050 (2.112) 0.157 0.172 (5) IV −0.063 (−0.628) 1.002 (3.922) 0.373 1.535 (3.043) 0.482 (3.544) (4.050) (4.561) (4.115) (3.310) (−6.157) −0.036 (−6.173) −0.037 (−5.958) −0.033 (−4.872) −0.100 (−3.604) 800 720 720 800 720 −0.136 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Table 21: Markups (Short Run), EU Imports, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS — −0.011 (−0.995) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit 0.016 N (3) OLS (4) IV −0.223 −0.224 — (−5.921) (−5.937) −0.016 — — — 0.023 — — — (−2.570) −0.020 (0.188) (0.403) −0.050 (−2.100) −0.034 (−2.260) (2.223) — — −0.038 0.005 (5) IV −0.223 (−5.772) (−1.440) (1.589) (−3.041) ∗ ∆ ln Dit (2) OLS −0.049 (−3.896) (−4.118) 0.006 0.006 0.009 0.004 0.025 −0.041 0.003 (2.756) (3.138) (3.175) (0.985) (0.568) 800 720 720 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 18 5.2 Long Run Table 22: Prices (Long Run), EU Imports, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV (4) IV — — — −0.009 — — — 0.007 — — — (−1.322) −0.008 (−1.322) −0.008 (−0.705) −0.026 (−0.450) −0.007 (−0.724) −0.006 (−1.964) −0.025 (−1.464) 0.026 (0.535) (−1.102) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit (0.826) (−0.772) ∗ ∆ ln Dit ∆ ln Pt ∆ ln Pt∗ p ln pit−1 ∗ it−1 ln θit−1 ln θ ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 0.001 (0.542) 0.621 0.001 (0.699) 0.618 0.004 (1.298) 0.645 −0.025 −0.020 0.005 (1.037) 0.480 (6.142) (6.271) (4.514) (2.075) −0.927 (−7.311) −0.925 (−4.705) −0.926 (−3.302) −0.424 (−7.251) −0.886 (−17.986) −0.424 (−18.007) (−7.683) −0.333 (−6.637) 0.013 — — — −0.009 — — — (2.150) −0.321 (−1.681) — 0.010 0.075 0.085 (2.430) (2.825) (3.172) −0.059 — — — 0.060 — — — −0.060 (−2.935) −0.043 (−2.391) (−4.898) ln L∗t−1 ln Lt−1 L∗ t−1 ln Pt−1 ∗ ln Pt−1 N (5.132) — (−5.937) 0.291 (9.466) −0.360 0.290 (9.575) −0.355 0.226 −0.041 0.193 (5.371) (2.197) (−10.160) (−10.171) (−6.940) −0.334 (−3.371) −0.329 800 800 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 19 Table 23: Productivity (Long Run), EU Imports, all country pairs Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV — — — (4) IV (5) IV (−0.104) −0.007 (0.071) (−0.233) 0.005 (6) IV −0.018 −0.014 — — — — — −0.062 — — — — — (−0.441) ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit ln zit−1 ∗ zit−1 ln θit−1 (−2.069) — 0.110 0.029 0.548 (1.336) (3.835) 0.121 0.292 0.605 (3.402) 0.273 0.708 (3.516) 0.274 0.736 (4.003) 0.287 (3.109) (3.595) (4.520) (4.095) (4.009) (1.818) −0.031 (−5.679) −0.029 (−5.424) −0.063 (−5.150) −0.067 (−4.382) −0.076 (−4.704) −0.317 (−5.683) −0.321 −0.101 (−10.337) (−10.218) (−6.924) −0.370 (−6.382) −0.411 (−4.445) −0.381 (−4.169) −0.338 −0.067 — — — — — 0.088 — — — — — (−3.831) −0.069 (−3.344) −0.338 (−2.131) −0.273 (−1.337) −0.153 (−1.353) 0.256 — — — — — −0.265 — — — — — (−3.075) ln θ∗it−1 ln θ it−1 θ∗ it−1 ln Lt−1 ln L∗t−1 ln Lt−1 L∗ t−1 ln wit−1 (3.495) — (5.396) −0.145 (−5.757) — 0.259 0.448 0.455 0.349 0.293 (6.562) (6.072) (5.311) (2.483) (2.606) −0.060 — — — — — 0.145 — — — — — (−4.550) −0.104 (−5.006) −0.416 (−3.910) −0.355 (−1.168) −0.193 (−0.823) 800 800 720 720 720 (−2.046) ∗ ln wit−1 ln N wit−1 ∗ wit−1 (4.992) — 800 −0.097 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) to (6) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (5) wages are instrumented by the average income tax rate for married individuals and in (6) the number of firms is further instrumented by its own lags. Lt denotes (real) GDP. 20 Table 24: Markups (Long Run), EU Imports, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV (4) IV — — — −0.008 — — — 0.006 — — — (−1.195) −0.008 (1.352) (1.420) −0.037 (−2.038) −0.026 (−1.902) 0.046 (1.061) (−0.847) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit (0.623) — −0.040 (−3.653) ∗ ∆ ln Dit ln μit−1 μ∗ it−1 ln θit−1 ln θ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 0.005 (2.787) (−3.526) 0.005 (3.277) 0.002 (0.915) −0.540 0.051 −0.026 0.002 (0.636) (−15.895) −0.544 (−16.070) (−15.336) (−12.630) 0.008 — — — −0.016 — — — (1.274) −0.545 0.040 −0.602 (−2.618) — 0.012 0.022 0.027 (2.551) (1.663) (1.603) −0.028 — — — 0.015 — — — (−3.410) −0.022 (−3.449) −0.024 (−2.680) 800 800 720 (−2.931) ln L∗t−1 ln N Lt−1 L∗ t−1 (1.616) — 800 −0.023 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 21 6 Non-EU Imports 6.1 Short Run Table 25: Prices (Short Run), Non-EU Imports, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS — — −0.015 (−2.164) (−1.822) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit 0.012 0.007 — −0.024 — — — — 0.013 — — — — (−3.203) −0.018 (−4.964) −0.117 (−4.704) −0.111 (−4.851) −0.014 (−2.340) −0.034 (−2.298) −0.033 (−2.747) — 0.003 ∆ ln Pt — ∆ ln Pt∗ — N 800 0.001 (0.613) 0.457 0.036 (0.833) (−3.036) — (2.065) (7) IV — — −0.010 (6) IV 0.057 (1.593) (−0.865) (5) IV (1.667) 0.056 (0.878) −0.007 (4) OLS (1.642) (1.389) (−0.639) ∗ ∆ ln Dit −0.018 (3) OLS −0.016 (−1.512) 0.001 (0.496) 0.542 (−1.322) 0.001 (0.599) 0.546 0.003 0.005 (1.637) (2.703) 0.412 — (5.641) (6.784) (6.843) (4.237) −0.485 −0.650 (−7.598) −0.635 (−7.527) −0.464 — (−5.710) (−4.669) 800 720 720 800 800 −0.133 −0.040 0.003 (1.490) 0.502 (4.901) −0.587 (−5.410) 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (5) to (7) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 22 Table 26: Productivity (Short Run), Non-EU Imports, all country pairs (1) OLS Method z ∆ ln zit−1 ∗ — it−1 ∆ ln θit 0.055 ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit N (3) OLS (4) IV −0.082 −0.080 — (−2.178) (−2.141) 0.069 — — — −0.025 — — — (2.024) (2.296) (−0.635) −0.017 (−0.851) — — 0.159 ∗ ∆ ln Dit (2) OLS 0.047 (2.140) 0.184 0.173 (5) IV −0.139 (−2.785) 0.405 (4.992) 0.247 0.489 (4.566) 0.280 (4.203) (4.700) (4.579) (5.078) (5.131) (−5.645) −0.030 (−5.589) −0.030 (−5.708) −0.031 (−5.675) −0.037 (−5.294) 800 720 720 800 720 −0.037 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Table 27: Markups (Short Run), Non-EU Imports, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS — −0.020 (−2.224) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit 0.017 N (3) OLS (4) IV −0.226 −0.226 — (−6.024) (−6.016) −0.019 — — — 0.028 — — — (−3.368) −0.024 (−4.012) −0.098 (−4.235) −0.051 (−4.241) −0.062 (−4.823) (2.909) — — −0.042 0.005 (5) IV −0.237 (−5.364) (−2.010) (1.833) (−3.313) ∗ ∆ ln Dit (2) OLS −0.049 (−3.906) (−4.239) 0.005 0.005 0.006 −0.132 −0.076 0.006 (2.542) (2.798) (2.753) (3.044) (3.100) 800 720 720 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 23 6.2 Long Run Table 28: Prices (Long Run), Non-EU Imports, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV (4) IV — — — −0.006 — — — −0.006 — — — 0.006 (0.136) (−0.827) ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit (−0.861) — −0.006 (−0.683) ∗ ∆ ln Dit ∆ ln Pt ∆ ln Pt∗ ln pit−1 p∗ it−1 ln θit−1 ln θ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 0.000 (0.316) 0.715 (0.006) 0.000 (−2.153) −0.037 (−1.845) −0.003 (−1.268) −0.013 (−1.159) (−0.376) 0.001 (0.408) 0.697 0.002 (1.105) 0.708 −0.045 −0.013 0.003 (1.584) 0.713 (7.022) (7.070) (5.524) (4.097) −0.890 (−7.008) −0.877 (−5.558) −0.789 (−4.232) (−7.086) (−18.279) −0.422 (−18.349) (−14.397) (−11.018) 0.019 — — — −0.017 — — — (3.721) −0.423 −0.417 −0.666 −0.377 (−3.039) — 0.018 0.018 0.042 (4.310) (0.948) (1.856) −0.073 — — — 0.070 — — — −0.071 (−5.547) −0.075 (−5.470) (−6.089) ln L∗t−1 ln Lt−1 L∗ t−1 ln Pt−1 ∗ ln Pt−1 N (5.738) — (−7.030) 0.316 (10.420) −0.359 0.312 (10.412) −0.358 0.302 −0.090 0.277 (8.883) (4.062) (−10.301) (−10.327) (−8.871) −0.333 (−4.502) −0.297 800 800 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 24 Table 29: Productivity (Long Run), Non-EU Imports, all country pairs Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit ∆ ln θ∗it ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit z ln zit−1 ∗ it−1 ln θit−1 (1) OLS (2) OLS (3) IV — — — (4) IV (5) IV (6) IV (−0.971) −0.057 (−1.164) −0.071 (−1.270) −0.072 0.057 — — — — — −0.018 — — — — — (2.082) (−0.660) — 0.132 0.040 (1.998) 0.115 0.279 (4.124) 0.185 0.357 (4.142) 0.200 0.379 (4.045) 0.199 0.314 (3.364) 0.081 (3.663) (3.383) (4.358) (4.057) (3.982) (0.710) (−5.047) −0.026 (−5.374) −0.027 (−5.103) −0.029 (−4.418) −0.028 (−3.876) −0.032 (−3.355) (−9.779) −0.320 (−10.111) −0.318 (−8.178) −0.324 (−6.538) −0.333 (−4.540) −0.301 (−4.569) −0.009 — — — — — 0.005 — — — — — (−0.506) −0.008 (−0.763) −0.056 (−0.969) −0.102 (−0.817) −0.088 (−0.564) 0.256 — — — — — −0.219 — — — — — −0.050 −0.252 (−0.396) ln θ∗it−1 θ ln θit−1 ∗ it−1 ln Lt−1 ln L∗t−1 ln Lt−1 L∗ t−1 ln wit−1 (0.212) — (5.207) −0.061 (−4.222) — 0.242 0.309 0.349 0.282 0.162 (5.843) (4.345) (3.478) (1.943) (1.229) −0.039 — — — — — 0.062 — — — — — (−2.791) −0.057 (−3.325) −0.125 (−2.692) −0.142 (−0.628) −0.073 (0.736) 800 800 720 720 720 (−1.206) ∗ ln wit−1 ln N wit−1 ∗ wit−1 (2.665) — 800 0.074 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) to (6) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (5) wages are instrumented by the average income tax rate for married individuals and in (6) the number of firms is further instrumented by its own lags. Lt denotes (real) GDP. 25 Table 30: Markups (Long Run), Non-EU Imports, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV (4) IV — — — −0.013 — — — 0.015 — — — (−2.306) −0.014 (−1.769) −0.034 (−2.077) −0.039 (−3.378) −0.042 (−3.181) 0.007 (0.155) (−1.493) ∆ ln θ∗it ∆ ln θ it θ∗ it ∆ ln Dit (1.758) — −0.040 (−3.631) ∗ ∆ ln Dit ln μit−1 μ∗ it−1 ln θit−1 ln θ∗it−1 ln θ it−1 θ∗ it−1 ln Lt−1 0.004 (2.691) (−3.690) 0.004 (2.748) 0.006 (3.118) (−15.882) (−13.226) (−9.869) 0.000 — — — — — — (−0.761) −0.004 (1.724) (1.805) −0.028 — — — 0.007 — — — (−2.307) −0.018 (−2.882) −0.044 (−2.675) 800 800 720 (−0.089) 0.008 (1.184) — −0.508 −0.045 −0.543 (−15.743) −0.545 0.005 (3.237) −0.051 0.028 −0.534 0.036 (−2.616) ln L∗t−1 ln N Lt−1 L∗ t−1 (0.642) — 800 −0.051 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 26 7 Non-Linearities 7.1 Short Run Table 31: Prices (Short Run), Non-Linearities, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS — — −0.022 (−1.843) (−1.737) ∆ ln θ∗it 0.024 2 (∆ ln θit ) (∆ ln θ∗it )2 θ it θ∗ it ∆ ln 2 ∆ ln θθit ∗ it ∆ ln Dit 0.020 — −0.044 — — — — 0.028 — — — — 0.055 — — — — −0.083 — — — — (−3.825) −0.027 (−4.456) −0.195 (−4.316) −0.194 (−3.654) (−0.874) −0.023 (1.647) (1.667) (1.880) −0.016 (−2.521) −0.046 (−2.417) −0.044 (−2.645) (−0.112) −0.006 (1.052) (−2.126) −0.097 (−1.818) −0.081 (−2.043) — — — 0.006 (3.132) ∆ ln Pt — ∆ ln Pt∗ — N 800 −0.010 0.003 (1.685) 0.447 0.083 (1.336) (−3.519) −0.019 (−0.910) (7) IV — (−0.350) −0.008 (6) IV 0.065 (2.972) — (5) IV (1.940) 0.070 (2.038) — (4) OLS (2.074) (2.460) (−0.734) ∗ ∆ ln Dit −0.023 (3) OLS — −0.019 (−1.819) 0.003 (1.892) 0.518 (−1.521) 0.003 (1.631) 0.524 0.386 0.006 0.419 0.007 (1.200) (1.523) 0.428 — (5.526) (6.515) (6.583) (3.467) −0.451 −0.601 (−7.083) −0.607 (−7.195) −0.449 — (−5.385) (−3.600) 800 720 720 800 800 −0.286 0.571 −0.063 0.007 (1.341) 0.468 (2.921) −0.493 (−2.857) 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (5) to (7) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 27 Table 32: Productivity (Short Run), Non-Linearities, all country pairs (1) OLS Method z ∆ ln zit−1 ∗ — it−1 ∆ ln θit 0.048 ∆ ln θ∗it (∆ ln θit )2 it ∆ ln Dit N −0.076 −0.076 — (−2.034) (−2.027) 0.060 — — — −0.073 — — — 0.008 — — — 0.011 — — — (−1.910) −0.063 (−2.075) −0.039 (0.038) (0.342) (0.074) — — — — 0.148 ∗ ∆ ln Dit (4) IV (1.251) 0.052 ∆ ln θθit ∗ it 2 ∆ ln θθit ∗ (3) OLS (1.164) (−0.215) (∆ ln θ∗it )2 (2) OLS 0.064 (2.328) 0.042 (0.411) 0.173 0.176 (5) IV −0.274 (−2.221) 0.823 1.601 (4.003) (3.379) −3.569 (−2.701) (−3.098) 0.292 −5.450 0.437 (3.873) (4.357) (4.658) (3.487) (3.100) (−5.582) −0.034 (−5.485) −0.034 (−6.013) −0.034 (−0.906) −0.019 (−0.923) 800 720 720 800 720 −0.029 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Table 33: Markups (Short Run), Non-Linearities, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS — −0.009 (−0.652) ∆ ln θ∗it 0.013 (∆ ln θit )2 ∆ ln θθit ∗ it 2 ∆ ln θθit ∗ it ∆ ln Dit N (4) IV −0.241 −0.225 — (−6.435) (−5.969) −0.005 — — — 0.023 — — — −0.144 — — — 0.151 — — — −0.029 (−0.740) −0.056 (0.355) −0.111 (−2.239) 0.120 (2.383) (3.030) — — (−3.289) — −0.040 0.003 (5) IV −0.063 (−0.608) (−0.302) (2.077) (−3.110) ∗ ∆ ln Dit (3) OLS (1.222) (−1.813) (∆ ln θ∗it )2 (2) OLS — 0.016 −0.048 (−3.789) (0.492) (−3.553) −1.502 (−2.970) −0.052 (−2.218) −0.068 (−1.731) (−4.270) 0.004 0.045 0.006 0.030 −1.725 −0.063 0.028 (1.688) (1.905) (3.109) (3.861) (3.297) 800 720 720 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (4) and (5) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 28 7.2 Long Run Table 34: Prices (Long Run), Non-Linearities, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV (4) IV — — — −0.015 — — — 0.003 — — — 0.037 — — — −0.065 — — — (−0.563) −0.004 (−1.430) −0.053 (−1.654) (−1.036) −0.024 (0.968) (1.485) −0.005 (−1.683) −0.021 (−1.545) 0.018 (0.256) (−1.453) ∆ ln θ∗it (0.314) 2 (∆ ln θit ) (0.846) (∆ ln θ∗it )2 θ it θ∗ it ∆ ln 2 ∆ ln θθit ∗ it ∆ ln Dit (−1.799) — — −0.009 (−0.963) ∗ ∆ ln Dit 0.001 (0.958) ∆ ln Pt 0.664 ∆ ln Pt∗ ln ln θit−1 0.641 0.003 (0.852) 0.723 −0.027 0.003 (0.827) 0.481 (6.494) (5.024) (1.989) −0.916 (−7.235) −0.911 (−4.753) −0.809 (−2.541) (−17.434) −0.416 (−17.657) −0.418 (−6.674) −0.352 (−5.029) 0.017 — — — −0.010 — — — −0.001 — — — 0.004 — — — (2.198) ln θ∗it−1 0.001 (0.765) 0.409 (6.473) (−7.208) pit−1 p∗ it−1 (−0.600) 0.177 −0.139 −0.668 −0.289 (−1.467) 2 (ln θit−1 ) (−0.380) (ln θ∗it−1 )2 θ it−1 θ∗ it−1 ln 2 θ ln θit−1 ∗ it−1 ln Lt−1 (1.134) — — 0.014 (2.925) 0.000 0.051 0.057 (1.444) (1.141) (−0.093) (−0.799) −0.014 (0.330) 0.006 −0.061 — — — 0.062 — — — −0.063 (−5.044) −0.073 (−3.433) (−5.074) ln L∗t−1 ln Lt−1 L∗ t−1 ln Pt−1 ∗ ln Pt−1 N (5.233) — (−6.294) 0.298 (9.700) −0.361 0.292 (9.683) −0.353 0.250 −0.078 0.109 (5.810) (0.973) (−10.223) (−10.032) (−4.672) −0.287 (−1.372) −0.191 800 800 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 29 Table 35: Productivity (Long Run), Non-Linearities, all country pairs Method z ∆ ln zit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV — — — (5) IV (6) IV (−1.455) −0.237 (−1.059) −0.145 (−1.344) −0.219 0.052 — — — — — −0.053 — — — — — −0.048 — — — — — 0.047 — — — — — (1.309) ∆ ln θ∗it (4) IV (−1.612) (∆ ln θit )2 (−0.279) (∆ ln θ∗it )2 ∆ ln θθit ∗ it 2 ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit ln zit−1 ∗ zit−1 ln θit−1 (0.333) — — 0.125 0.051 (2.058) 0.020 (0.220) 0.120 0.424 1.138 1.287 1.305 (2.202) (2.470) (2.999) (2.700) −2.035 (−2.495) −4.576 (−2.712) −4.900 (−2.443) (−2.069) 0.281 0.385 0.382 −4.971 0.643 (3.457) (3.521) (3.549) (2.966) (2.977) (1.744) (−5.091) −0.029 (−5.643) −0.029 (−1.073) −0.018 (−0.471) −0.011 (−0.324) −0.009 (−0.123) (−9.954) −0.315 (−9.961) −0.312 (−3.513) −0.269 (−2.988) −0.432 (−2.984) −0.498 (−2.715) −0.055 — — — — — 0.046 — — — — — −0.001 — — — — — −0.020 — — — — — (−2.778) −0.058 (−2.748) −0.580 (−1.049) −0.418 (−0.519) −0.144 (−0.596) (−0.526) −0.003 (1.585) (1.105) (0.705) (1.270) 0.271 — — — — — −0.262 — — — — — −0.006 −0.459 (−1.803) ln θ∗it−1 (1.534) 2 (ln θit−1 ) (−0.045) (ln θ∗it−1 )2 θ it−1 θ∗ it−1 ln 2 θ ln θit−1 ∗ it−1 ln Lt−1 ln L∗t−1 ln Lt−1 L∗ t−1 ln wit−1 (−1.559) — — (5.481) 0.120 0.129 0.077 −0.186 0.182 (−5.328) — 0.264 0.558 0.666 0.559 0.556 (6.568) (4.822) (3.038) (1.984) (2.084) −0.065 — — — — — 0.112 — — — — — (−4.050) −0.093 (−3.887) −0.527 (−2.166) −0.508 (−1.219) −0.368 (−1.301) 800 800 720 720 720 (−2.031) ∗ ln wit−1 w (3.971) ln wit−1 ∗ — N 800 it−1 −0.379 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) to (6) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (5) wages are instrumented by the average income tax rate for married individuals and in (6) the number of firms is further instrumented by its own lags. Lt denotes (real) GDP. 30 Table 36: Markups (Long Run), Non-Linearities, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θit (1) OLS (2) OLS (3) IV (4) IV — — — −0.007 — — — 0.005 — — — −0.073 — — — 0.091 — — — −0.014 (1.243) (1.900) 0.163 (1.274) (−0.603) ∆ ln θ∗it (0.510) 2 (∆ ln θit ) (−1.388) (∆ ln θ∗it )2 θ it θ∗ it ∆ ln 2 ∆ ln θθit ∗ it ∆ ln Dit (2.083) — (−1.812) — −0.039 (−3.455) ∗ ∆ ln Dit ln 0.003 (1.747) μit−1 μ∗ it−1 ln θit−1 (ln θit−1 ) (ln θ∗it−1 )2 ln 2 θ ln θit−1 ∗ it−1 ln Lt−1 (0.455) (−3.034) −0.995 (−2.632) −0.038 (−1.355) −0.030 (0.082) (−3.558) 0.005 (3.044) −0.543 0.019 −1.785 0.003 0.023 (3.426) (2.602) −0.541 (−15.908) (−6.765) −0.454 (−4.574) −0.605 0.015 — — — −0.012 — — — 0.008 — — — −0.001 — — — (−1.511) 2 θ it−1 θ∗ it−1 0.279 (−15.783) (1.878) ln θ∗it−1 0.013 0.072 (2.063) (−0.369) — — 0.008 (1.460) 0.000 0.086 0.148 (2.134) (1.895) (−0.054) (−0.312) −0.007 (−0.480) −0.019 −0.025 — — — 0.017 — — — (−3.436) −0.024 (−2.895) −0.057 (−2.046) 800 800 720 (−2.414) ln L∗t−1 ln N Lt−1 L∗ t−1 (1.705) — 800 −0.080 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. In (3) and (4) instruments for openness include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 31 8 8.1 Instrumenting Number of Firms Short Run Table 37: Prices (Short Run), IV Number of Firms, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θ it θ∗ it ∆ ln Dit (1) IV (2) IV — — (−3.703) −0.156 (−3.699) −0.157 (−2.939) −0.103 (−2.020) −0.092 (−2.200) (−1.633) ∗ ∆ ln Dit ∆ ln Pt ∆ ln Pt∗ N 0.025 0.028 (4.371) (5.071) 0.268 — −0.186 — 800 800 (2.071) (−1.370) (3) IV 0.108 (2.201) −0.161 −0.129 0.027 (4.824) 0.289 (1.913) −0.174 (−1.188) 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness and the number of firms include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 32 Table 38: Productivity (Short Run), IV Number of Firms, all country pairs Method z ∆ ln zit−1 ∗ it−1 ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit N (1) IV — (2) IV −0.138 (−2.334) 0.597 (3.870) 0.544 0.695 (3.027) 0.677 (3.289) (3.718) (−6.356) −0.126 (−5.942) 800 720 −0.128 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness and the number of firms include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Table 39: Markups (Short Run), IV Number of Firms, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θ it θ∗ it ∆ ln Dit (1) IV — N −0.223 (−5.256) (−2.130) −0.086 (−2.120) −0.148 (−3.185) (−3.421) ∗ ∆ ln Dit (2) IV 0.017 −0.118 −0.136 0.020 (3.347) (3.951) 800 720 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness and the number of firms include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. 33 8.2 Long Run Table 40: Prices (Long Run), IV Number of Firms, all country pairs Method p ∆ ln pit−1 ∗ it−1 ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit ∆ ln Pt ∆ ln Pt∗ p ln pit−1 ∗ it−1 θ ln θit−1 ∗ it−1 ln Lt−1 L∗ t−1 ln Pt−1 ∗ ln Pt−1 N (1) IV — (2) IV −0.037 (−0.543) −0.023 (−0.722) 0.056 (1.033) 0.010 (2.054) 0.659 −0.042 (−0.912) 0.070 (1.176) 0.011 (1.647) 0.456 (4.351) (1.891) (−3.146) −0.687 (−1.849) −0.314 (−4.816) (−5.558) 0.093 −0.594 −0.284 0.116 (2.368) (2.700) −0.079 (−4.346) (−5.273) 0.215 −0.093 0.140 (4.769) (1.527) (−4.842) −0.264 (−1.986) 800 720 −0.212 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness and the number of firms include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 34 Table 41: Productivity (Long Run), IV Number of Firms, all country pairs Method z ∆ ln zit−1 ∗ it−1 ∆ ln θθit ∗ it ∆ ln Dit ∗ ∆ ln Dit ln zit−1 ∗ zit−1 θ ln θit−1 ∗ it−1 (1) IV — (2) IV (3) IV (4) IV −0.198 (−1.808) −0.119 (−1.630) (−1.977) 0.085 0.238 0.425 −0.111 0.530 (0.346) (1.159) (2.821) (−1.595) −0.835 (−0.722) −0.235 (1.976) (1.838) (−0.904) −0.032 (−1.999) −0.050 (−4.329) −0.084 (−4.456) (−1.446) −0.160 (−2.913) −0.248 (−3.402) −0.258 (−3.606) −1.245 (−2.800) −0.871 (−2.423) −0.331 (−2.044) (−2.842) 0.258 (3.559) 0.242 −0.077 −0.246 −0.271 ln Lt−1 L∗ t−1 (3.951) (4.387) (2.575) (2.697) ln wit−1 ∗ wit−1 (−3.166) −0.823 (−3.325) −0.601 (−1.170) −0.198 (−1.026) 800 720 720 720 N 0.751 0.692 0.383 0.302 −0.122 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness and the number of firms include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. In (3) wages are instrumented by the average income tax rate for married individuals and in (4) the number of firms is further instrumented by its own lags. Lt denotes (real) GDP. 35 Table 42: Markups (Long Run), IV Number of Firms, all country pairs Method μ ∆ ln μit−1 ∗ it−1 ∆ ln θ it θ∗ it ∆ ln Dit (1) IV (2) IV — 0.034 (0.737) (−1.004) −0.031 (−0.929) −0.188 (−2.485) (−3.013) ∗ ∆ ln Dit ln μit−1 μ∗ it−1 θ 0.010 (2.499) −0.534 −0.033 −0.153 0.012 (2.914) −0.556 (−13.286) (−10.662) ln θit−1 ∗ it−1 (−0.680) −0.020 (−0.156) Lt−1 L∗ t−1 (−2.208) −0.027 (−2.036) 800 720 ln N −0.005 −0.030 Notes: Country/industry fixed effects are included in all regressions, t-statistics in parenthesis. Instruments for openness and the number of firms include cif/fob, EU directives interacted with NTBs, weighted distance interacted with the elasticity of substitution, weight to value and 1992 and 1999 dummies. Lt denotes (real) GDP. 36