Not for Publication Online Appendix For: First Impressions Matter:

advertisement

Not for Publication

Online Appendix For:

First Impressions Matter:

Signalling as a Source of Policy Dynamics

Stephen Hansen∗

Michael McMahon†

July 5, 2015

∗

†

Universitat Pompeu Fabra and Barcelona GSE.

University of Warwick, CEPR, CAGE (Warwick), CEP (LSE), CfM (LSE), and CAMA (ANU).

Contents

A Signalling with Many Periods

A.1 Model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A.2 Solution algorithm . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A.3 Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

5

7

B Strategic Voting

B.1 Theoretical effects of strategic voting . . . . . . . . . . . . . . . . . . . .

B.2 Estimation with strategic voting: a two-step methodology . . . . . . . .

B.3 Empirical Results: Strategic Voting and Robustness . . . . . . . . . . . .

10

10

12

14

C Alternative Measures of Inflation Aversion

16

D Ex-ante Differences between Members

17

E Other Sources of Voting Dynamics

E.1 Career Trajectory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E.2 Reappointment driving the results . . . . . . . . . . . . . . . . . . . . . .

E.3 Concerns About The Committee Reputation . . . . . . . . . . . . . . . .

18

18

20

21

F Alternative Structural Specifications

23

1

A

Signalling with Many Periods

The model presented in the main paper features policymakers serving for two periods,

which makes analyzing the signalling incentive particularly clean. In this section, we

consider whether our key theoretical predictions are robust to a model with T > 2

periods.

A.1

Model

For simplicity, we focus on a single policymaker with one of two types—θ = L or θ = H

where H > L. θ is drawn from a Bernoulli distribution with Pr [ θ = H ] = r and privately

observed by the banker at the beginning of the game. Then, in each period t = 1, . . . , T ,

the banker and public play the following subgame (identical to that in the main paper):

1. qt is observed by the banker and public.

2. ωt is drawn but not observed by any player.

3. The public forms πtE .

4. The banker draws a signal st ∼ N (ωt , σt2 ).

5. The banker chooses rt ∈ {0, 1}, which the public observes.

6. πt is observed by all players.

The equilibrium concept we use to solve the game is Perfect Bayesian Equilibrium.

θ̂t (rt−1 | ωt−1 , qt−1 , θ̂t−1 ) is the public’s belief that the banker is of type θ = H in

period t. In general, this depends on the additional information contained in rt−1 given

ωt−1 , qt−1 , and the prior belief θ̂t−1 (let θ̂0 = r). Moreover, let Vt (θ, θ̂t ) be the expected

continuation value for banker type θ from playing the game from period t onwards given

θ̂t , and ∆t+1 (θ, qt , θ̂t | ωt ) ≡ Vt+1 [θ, θ̂t+1 (0 | ωt , qt , θ̂t )] − Vt+1 [θ, θ̂t+1 (1 | ωt , qt , θ̂t )] be the

change in the period t + 1 continuation value from voting 0 rather than 1 in period t. As

in the main paper, bankers adopt cutoff voting rules each period that satisfy

Ct (θ, qt , θ̂t ) =

µ0 + θ[π(0, 0) − π(1, 0)] + δ∆t+1 (θ, qt , θ̂t | 0)

µ1 − θ[π(1, 1) − π(0, 1)] − δ∆t+1 (θ, qt , θ̂t | 1)

.

(A.1)

The first two terms in the numerator and denominator reflect the impact of rt on period

t policy while the last term reflects the impact on future expected utility from signalling.

The key then is to understand the behavior of the ∆t+1 terms since they determine how

the cutoff evolves over time.

As a first step, the following result is helpful in understanding signalling incentives.

2

Lemma 1 Given qt , period t expected utility for type H with reputation θ̂t is

ut (H, qt , θ̂t ) =

n

h

i

o

qt −l[π(1, 1)] − Pr rt = 0 θ = H, θ̂t , qt , ωt = 1 µ1 + (1 − θ̂t )Hyt (θ̂t , qt , 1) +

n

h

i

o

(1 − qt ) −l[π(1, 0)] + Pr rt = 0 θ = H, θ̂t , qt , ωt = 0 µ0 + (1 − θ̂t )Hyt (θ̂t , qt , 0)

(A.2)

and for type L is

ut (L, qt , θ̂t ) =

n

h

i

o

qt −l[π(1, 1)] − Pr rt = 0 θ = L, θ̂t , qt , ωt = 1 µ1 − θ̂t Lyt (θ̂t , qt , 1) +

n

h

i

o

(1 − qt ) −l[π(1, 0)] + Pr rt = 0 θ = L, θ̂t , qt , ωt = 0 µ0 − θ̂t Lyt (θ̂t , qt , 0)

(A.3)

where yt (θ̂t , qt , ωt ) is

io

i

h

n h

.

[π(0, ωt ) − π(1, ωt )] Pr rt = 0 θ = H, θ̂t , qt , ωt − Pr rt = 0 θ = L, θ̂t , qt , ωt

h i

Proof. Let Pr rt θ, θ̂t , qt , ωt be the probability that type θ with reputation θ̂t given

qt and ωt chooses rt . Expected utility is then

h

i

Pr rt = 0 θ, θ̂t , qt , 1 {−l[π(0, 1)] + θπ(0, 1)} −

n h

i

h

i

o

θπ(0, 1) Pr rt = 0 H, θ̂t , qt , 1 θ̂t + Pr rt = 0 L, θ̂t , qt , 1 (1 − θ̂t ) +

+

h

i

qt

Pr rt = 1 θ, θ̂t , qt , 1 {−l[π(1, 1)] + θπ(1, 1)} −

n h

i

h

i

o

θπ(1, 1) Pr rt = 1 H, θ̂t , qt , 1 θ̂t + Pr rt = 1 L, θ̂t , qt , 1 (1 − θ̂t )

h

i

Pr rt = 0 θ, θ̂t , qt , 0 {−l[π(0, 1)] + θπ(0, 1)} −

n h

i

h

i

o

θπ(0, 1) Pr rt = 0 H, θ̂t , qt , 0 θ̂t + Pr rt = 0 L, θ̂t , qt , 0 (1 − θ̂t ) +

h

i

(1 − qt )

Pr rt = 1 θ, θ̂t , qt , 0 {−l[π(1, 1)] + θπ(1, 1)} −

n h

i

h

i

o

θπ(1, 1) Pr rt = 1 H, θ̂t , qt , 0 θ̂t + Pr rt = 1 L, θ̂t , qt , 0 (1 − θ̂t )

3

This expression can be simplified. First consider a type θ = H. Conditional on state

ωt = ω utility is

h

i

− Pr rt = 0 H, θ̂t , qt , ω l[π(0, ω)]+

n h

i

h

io

θπ(0, ω)(1 − θ̂t ) Pr rt = 0 H, θ̂t , qt , ω − Pr rt = 0 L, θ̂t , qt , ω

−

h

i

Pr rt = 1 H, θ̂t , qt , ω l[π(1, ω)]+

n h

i

h

io

θπ(1, ω)(1 − θ̂t ) Pr rt = 1 H, θ̂t , qt , ω − Pr rt = 1 L, θ̂t , qt , ω

=

h

i

− Pr rt = 0 H, θ̂t , qt , ω l[π(0, ω)]+

n h

i

h

io

θπ(0, ω)(1 − θ̂t ) Pr rt = 0 H, θ̂t , qt , ω − Pr rt = 0 L, θ̂t , qt , ω

−

h

i

Pr rt = 1 H, θ̂t , qt , ω l[π(1, ω)]+

n

h

i

h

io

θπ(1, ω)(1 − θ̂t ) 1 − Pr rt = 0 H, θ̂t , qt , ω − 1 + Pr rt = 0 L, θ̂t , qt , ω

Further simplification gives type θ = H utility as

h

i

h

i

− Pr rt = 0 θ = H, θ̂t , qt , ω l[π(0, ω)] − Pr rt = 1 θ = H, θ̂t , qt , ω l[π(1, ω)]+

io

i

h

n h

(1 − θ̂t )H[π(0, ω) − π(1, ω)] Pr rt = 0 θ = H, θ̂t , qt , ω − Pr rt = 0 θ = L, θ̂t , qt , ω

Similarly the utility for a type θ = L is

i

h

i

− Pr rt = 0 θ = L, θ̂t , qt , ω l[π(0, ω)] − Pr rt = 1 θ = L, θ̂t , qt , ω l[π(1, ω)]−

n h

i

h

io

θ̂t L[π(0, ω) − π(1, ω)] Pr rt = 0 θ = H, θ̂t , qt , ω − Pr rt = 0 θ = L, θ̂t , qt , ω

h

i

i

h

The result follows by plugging in Pr rt = 1 θ, θ̂t , qt , ω = 1 − Pr rt = 0 θ, θ̂t , qt , ω .

h

For ease of interpretation, the proposition expresses expected utility in terms of the

probabilities that different types vote for low rates. The first two terms in the curly

brackets of the above expressions relate to the expected loss from deviations of inflation

from target, while the third term (that in yt ) relates to the expected output gap. When

the inflation-tolerant type chooses low rates more often in equilibrium, yt is positive, which

means the inflation-tolerant (inflation-averse) type faces a positive (negative) expected

output gap. The logic is that the public forms rational expectations on period t inflation

by averaging the behavior of each type, which underestimates true inflation when the

actual type is θ = H and overestimates it when θ = L.

Our interest lies in the effect of θ̂t on utility since this will determine whether a banker

in period t−1 wants to increase or decrease his reputation for inflation tolerance in period

4

t. First, it appears directly as a linear term with coefficient −θyt (θ̂t , qt , ωt ) which decreases

utility as θ̂t increases. The interpretation is that as the weight the public puts on the

type’s being θ = H increases, the higher its inflation expectations and the lower is the

output gap, which is precisely the effect we emphasize in the main paper.

Second, θ̂t also appears indirectly in the probability the banker chooses rt = 0, an

effect that arises whenever Ct (θ, qt , θ̂t ) is not constant in θ̂t . This effect is subtle. Different

values of θ̂t influence by how much rt will affect θ̂t+1 . For example, when θ̂t is near 0

or 1, rt will have little impact on θ̂t+1 , while

if θ̂t is near 0.5 the iimpact will be larger.

h

If Ct (θ, qt , θ̂t ) increases in θ̂t —so that Pr rt = 0 θ = H, θ̂t , qt , ωt increases—there are

several effects on utility. In state 1 the expected loss of deviation of inflation from target

increases since the probability of the wrong decision goes up, while the reverse is true

in state 0. Moreover, when Ct (θ, qt , θ̂t ) changes at different rates for the two types, the

value of yt also changes.

In the two-period model of the main paper, these secondary effects are not present.

The reason is that in the last period T , types θ = H and θ = L use the cutoffs

CT (H) =

µ0 + L[π(0, 0) − π(1, 0)]

µ0 + H[π(0, 0) − π(1, 0)]

and CT (L) =

,

µ1 − H[π(1, 1) − π(0, 1)]

µ1 − L[π(1, 1) − π(0, 1)]

(A.4)

which do not depend on θ̂T . Thus one can unambiguously (negatively) sign the effect on

welfare of an increase in θ̂T , and in period T − 1 there is always an incentive to signal a

more inflation-averse type. In contrast, in all periods t = 1, . . . , T − 2 the banker must

consider the indirect effects of reputation as well. In general, Ct (θ, qt , θ̂t ) is not monotonic

in θ̂t as explained in the preceding, so unambiguously signing how welfare changes with

the indirect effects is not straightforward. The key question is whether these indirect

effects might ever provide an incentive to signal the inflation-tolerant type that is strong

enough to overturn the direct effect to signal the inflation-averse type.

A.2

Solution algorithm

Given the ambiguity of the indirect effects, we choose to solve the equilibrium computationally, and then examine its properties. To do so, we use the following backwardinduction algorithm. We assume qt is drawn uniformly from some discrete set Q.

1. For each type, compute CT (θ) from (A.4) and VT (θ, θ̂T ) by averaging uT (θ, qT , θ̂T )

over qT ∈ Q.1

2. For each period t = T − 1, . . . , 1:

(a) For each θ̂t = 0.01, 0.03, . . . , 0.99:

1

Since the game ends after period T , the continuation value is equivalent to the period T utility.

5

i. For each qt ∈ Q:

A. Solve for Ct (L, qt , θ̂t ) and Ct (H, qt , θ̂t ) from (A.1) given Vt+1 (θ, θ̂t+1 ).

B. Compute ut (θ, qt , θ̂t ).

C. Compute the expected value of Vt+1 (θ, θ̂t+1 ) with respect to θ̂t+1 given

Ct (θ, qt , θ̂t ) and the fact that beliefs must evolve according to Bayes’

rule. Denote the result V t+1 (θ, qt , θ̂t ).

D. Compute Vt (θ, qt , θ̂t ) = ut (θ, qt , θ̂t ) + δV t+1 (θ, qt , θ̂t ).

(b) Approximate Ct (L, qt , θ̂t ) and Ct (H, qt , θ̂t ) for all values θ̂t ∈ [0, 1] by fitting a

five-degree polynomial through the points computed in point A above.

(c) Compute Vt (θ, θ̂t ) by averaging over Vt (θ, qt , θ̂t ) from step D above. Then

approximate Vt (θ, θ̂t ) for all values θ̂t ∈ [0, 1] by fitting a five-degree polynomial

through the computed values.

We approximate the equilibrium cutoffs and value functions due to the following. Given

Ct (θ, qt , θ̂t ), one can compute the exact values for θ̂t+1 at which to compute the value

function Vt+1 . But because Ct (θ, qt , θ̂t ) depends on Vt+1 their values are determined

jointly in equilibrium. For this reason, we approximate Vt+1 at all values of θ̂t+1 in order

to facilitate computation of Ct (θ, qt , θ̂t ).

We compute the equilibrium at the following values:2

1. T = 36. This corresponds to the number of meetings in the average term on the

MPC. In the below we refer to a time period as a month.

2. δ = 0.998. This corresponds to the discount factor given a real annual interest rate

of 0.03, the typical value in our sample.

3. Realized inflation. This is consistent with hitting the inflation target when matching

the interest rate to the state, and symmetric deviations otherwise.

(a) π(0, 0) = 2

(b) π(1, 0) = 1.9

(c) π(1, 1) = 2

(d) π(0, 1) = 2.1

4. Loss function. This is consistent with treating upside and downside misses equivalently. It is larger than that implied by a quadratic loss in order to ensure both

banker types wish to match the decision to the state.

2

We use R for the exercise, in particular its nleqslv package. We achieve convergence at point A in

the algorithm above in every loop.

6

(a) µ0 = 0.06

(b) µ1 = 0.06

5. Types L = 0.3 and H = 0.5. These ensure that the more inflation-averse type

places less weight on the output gap. The levels, though higher than the weight for

the Federal Reserve used in Woodford (2003), are within the range in Debortoli,

Kim, Linde, and Nunes (2015) for the estimated (0.25) and the optimal (1) weight

placed on the output gap.

6. σt = 0.4 in every period. This is the value we estimate in the data.

7. Q is the set of 137 fitted values for qt from the main paper.

A.3

Results

Our primary question of interest is whether our theoretical results on the evolution of

equilibrium cutoffs hold period-by-period. In order to focus on the extent to which time

alone is responsible for changing signalling incentives, we explore how Ct (θ, qt , θ̂t ) behaves

holding fixed qt and θ̂t . In other words, we ask whether for all qt+1 = qt ∈ Q, θ̂t+1 = θ̂t ∈

[0, 1] we have that

1. Ct+1 (θ, qt , θ̂t ) > Ct (θ, qt , θ̂t ) for each type.

h

i h

i

2. Ct+1 (H, qt , θ̂t ) − Ct (H, qt , θ̂t ) − Ct+1 (L, qt , θ̂t ) − Ct (L, qt , θ̂t ) > 0.

To get an idea of why one might expect this to hold, recall that the shape of the value

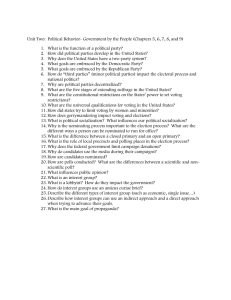

function determines the direction and strength of the signalling incentive. Figures A.1a

and A.1b plot the value function for each type at 36 months (the last period of the game)

and at 18 months (the middle of the game). In both periods, the continuation value of

the game is declining in reputation (recall this is the belief the public puts on the banker’s

having type θ = H). This means that in periods 35 and 17 both types have an incentive

to signal type θ = L. But the rate at which the continuation value changes in period

18 is substantially higher than the rate in period 36. Figures A.1c and A.1d plot the

marginal valuations of signalling the more inflation-averse type (decreasing θ̂t ) at 36 and

18 months. Clearly, the marginal value is substantially higher in the middle of the game

than at the end. Finally, in each period the inflation tolerant type θ = H has a higher

marginal valuation of improving its reputation. As in the main paper, the intuition is it

cares more about building a reputation since it weights the output gap more.

To further illustrate these features of the equilibrium, table A.1 provides the estimated

coefficients of the constant and linear term of the polynomial approximation for the value

functions at different points in time. Focusing on the linear term, again one finds the

7

0.44

0.36

0.016

0.38

0.018

0.40

0.020

0.42

0.022

0.024

Type L

Type H

0.0

0.2

0.4

0.6

0.8

1.0

0.0

0.2

Reputation

0.4

0.6

0.8

1.0

Reputation

(b) Continuation Value at 18 Months

0.25

0.006

(a) Continuation Value at 36 Months

Type L

Type H

0.00

0.000

0.001

0.05

0.002

0.10

0.003

0.15

0.004

0.20

0.005

Type L

Type H

0.0

0.2

0.4

0.6

0.8

1.0

0.0

Reputation

0.2

0.4

0.6

0.8

1.0

Reputation

(c) Marginal Absolute Value at 36 Months

(d) Marginal Absolute Value at 18 Months

Figure A.1: Continuation Values over Time for Two Types

Notes: The top row of this figure plots approximated values of the value functions V36 (θ, θ̂36 )

and V18 (θ, θ̂18 ) for each type. The bottom row plots the absolute value of the derivatives

of these functions with respect to θ̂t . Note that each subfigure is drawn on a different scale

on the vertical axis.

8

same basic pattern. In each period it is negative, its absolute value decreases over time,

and its absolute value is higher for the inflation-tolerant type.

Table A.1: Approximations of Value Functions at Different Periods

T

36 Months

30 Months

24 Months

18 Months

12 Months

6 Months

Constant

θ=L θ=H

0.02

0.02

0.16

0.16

0.29

0.30

0.43

0.44

0.56

0.58

0.69

0.71

Linear

θ=L

-0.002

-0.016

-0.030

-0.047

-0.067

-0.088

Term

θ=H

-0.004

-0.032

-0.068

-0.108

-0.150

-0.193

Given this evidence, it should be unsurprising that we find that the two inequalities

above indeed hold for all Q and for every value of reputation θ̂t we have examined, 0.01

through 0.99 in increments of 0.01. In this sense, we are confident that our basic logic

from the two-period model is robust to the introduction of multiple periods. Another

way of interpreting this result is that the indirect effects in the T -period model are less

quantitatively important than the direct effect we focus on in the main paper.

We should also note that the main effect of signalling comes in the initial periods of the

game since this is when changes in θ̂t have the highest marginal impact on continuation

values. The marginal impact then declines steadily over time before becoming relatively

small in the later stages of the game. For example, the linear term at 36 months in table

A.1 induces a signalling incentive in period 35 that is many times smaller than the linear

term at 6 months induces in period 5. In this sense, the equilibrium does not feature

notable end-game effects in which there is some discontinuous shift in behavior in moving

to the last period.

9

B

Strategic Voting

In the main text, both the model and the empirical analysis were based on the assumption

of sincere voting behavior. This section explores the theoretical effects and empirical

implications of strategic, i.e. pivotal, voting.

B.1

Theoretical effects of strategic voting

In line with Duggan and Martinelli (2001), we focus on responsive equilibria in which all

members have a positive probability of voting for high and low rates. The main difference

with the sincere case is that members now condition their votes on changing the outcome,

or being pivotal. Let E { Pr [ PIVit | ωt ] | p−it } be the expected probability that member

i’s vote is pivotal in period t given ωt and his colleagues’ reputations p−it (the expectation

is taken with respect to other members’ types). This is the expected probability of all

the events in which exactly N2−1 of his colleagues vote for high rates, and N2−1 vote for

low rates. In responsive equilibria, these probabilities are all non-zero. We modify the

definition of cutoff voting rules slightly to be those in which member i chooses vit = 1 if

and only if

ω

bit E { Pr [ PIVit | 1 ] | p−it }

≥ CitST R ,

1−ω

bit E { Pr [ PIVit | 0 ] | p−it }

where CitST R is i’s period t cutoff under strategic voting. In line with lemma 1 in the main

R

text, member i equivalently chooses vit = 1 if and only if sit ≥ sST

CitST R , σit , qt , p−it

it

where

qt

E

{ Pr [ PIVit | 1 ] | p−it }

1

2

ST R

ST R

+ ln

(B.1)

sit (·) ≡ − σit ln

2

1 − qt

E{ Pr [ PIVit | 0 ] | p−it } − ln Cit

is the threshold i’s signal must reach to induce him to vote high. An equilibrium of the

model is a set of N thresholds such that (B.1) holds for each member i.

An important difference with the sincere case is that voting behavior now depends on

colleagues’ reputations. This is because the probability of being pivotal depends on the

probability that colleagues vote high, which in turn depends on their preference types

about which i has beliefs p−it . Hence rookie votes now indirectly affect others’ future

voting behavior, so strategic voting introduces an additional signalling channel absent in

the sincere model.

This new effect is difficult to characterize outside of special cases because of the large

number of pivotal events and general distribution of types. For this reason, we view the

question of whether and how voting depends on colleagues’ reputations as an empirical

question. To explore it, for each member i in each meeting t, we generate an index

of the voting behavior of his veteran colleagues when they were rookies. The variable

10

ColleaguePit is defined as the fraction of votes that all veterans on the period t MPC cast

when rookies that were high (excluding member i in the case he is a veteran). We then

estimate the regression

vit = µi + δt + λColleaguePit + it ,

(B.2)

with results reported in table B.2. We find no evidence that a member is any more or

less likely to vote for high rates when his veteran colleagues have established a reputation

for inflation aversion. This might be because members simply do not vote strategically,

or because pivot probabilities do not change markedly with p−it . The rest of this section

makes the latter assumption, and ignores the dependence of pivot probabilities on p−it .

Table B.2: Effect of inflation-averse colleagues on own voting behavior

(1)

vit

Main Regressors

ColleaguePit

-0.0049

[0.658]

1.07***

[0.003]

Constant

Number of mem num

R-squared

Model

Member effects?

Time effects?

Sample?

Obs?

26

0.674

Panel LPM

YES

YES

12/98-03/09

1106

Notes: This regression presents OLS estimates of equation B.2. Standard errors clustered

by member. The dependent variable, vit , is our measure of whether member i votes for the

high interest rate in period t. The results show that, controlling for member and time fixed

effects, whether other existing members have voted for high rates more in the past has no

effect on the probability that a given member votes for high rates.

The analogue of veterans’ utility from choosing vit expressed in the proof of proposition

1 is3

UV (vit , θi ) = ω

bit {−l [π(vit , 1)] + θi π(vit , 1)} Pr [ PIVit | 1 ]+

(1 − ω

bit ) {−l [π(vit , 0)] + θi π(vit , 0)} Pr [ PIVit | 0 ] − θi πtE .

from which one obtains the voting rule of choosing vit = 1 if and only if

ω

bit Pr [ PIVit | 1 ]

µ0 + θi [π(0, 0) − π(1, 0)]

≥

≡ CVST R (θi ),

1−ω

bit Pr [ PIVit | 0 ]

µ1 − θi [π(0, 1) − π(1, 1)]

3

(B.3)

For the rest of this section, we drop the expectations with respect to p−it in the pivot probabilities

in line with the empirical finding in table B.2.

11

where CVST R (θi ) is the veteran’s cutoff under strategic voting.

For rookies, the expected utility from choosing vit is

UR (vit , θi ) = ω

bit {−l [π(vit , 1)] + θi π(vit , 1)} Pr [ PIVit | 1 ] +

(1 − ω

bit ) {−l [π(vit , 0)] + θi π(vit , 0)} Pr [ PIVit | 0 ] − θi πtE −

R

R

+ vit , qt , NtR , qt+1 , Nt+1

, ωt+1

.

δθi E π E∗ p V−it

Re-writing this expression gives a cutoff voting rule with cutoff

CRST R θi , qt , NtR ≡

µ0 + θi [π(0, 0) − π(1, 0)] − ∆(qt , NtR | 0)/ Pr [ PIVit | 0 ]

.

µ1 − θi {[π(0, 1) − π(1, 1)] − ∆(qt , NtR | 1)/ Pr [ PIVit | 1 ]}

(B.4)

where ∆(qt , NtR | ωt ) is as defined in the main text.

As in the sincere model discussed in the main text, the probability that veterans and

rookies vote low is increasing in type, so a low vote by rookie i in period t leads the public

to associate i with a higher θi and to increase its belief on the probability i will vote low

in period t + 1 when a veteran (for formal details see the proof of proposition 2). So ∆

continues to be positive and the two empirical predictions in the main text hold.

B.2

Estimation with strategic voting: a two-step methodology

In this section we describe how to estimate the model under strategic voting using the

two-step estimator of Iaryczower and Shum (2012). For convenience, we begin by rewriting the likelihood function from the main text:

#

"

Y

t

qt

Y

(κ1it )vit (1 − κ1it )1−vit + (1 − qt )

i

Y

(κ0it )vit (1 − κ0it )1−vit ,

(B.5)

i

where

κ1it ≡ 1 − Φ

s∗it (·) − 1

σi

and κ0it ≡ 1 − Φ

s∗it (·)

σi

.

(B.6)

κ0it (κ1it ) is the probability member i in meeting t votes high conditional on ωt = 0

(ωt = 1), and qt and (1 − qt ) are the prior probabilities that the economy is in the high

and low inflation states, respectively. Under strategic voting, s∗it (·) is a function of all

other members’ thresholds since these enter the probability of being pivotal by equation

(B.1).4 For this reason, directly maximizing (B.5) with respect to cutoffs and expertise

is no longer feasible.

The basic idea of the two-step estimator is the following:

4

This is true even without any dependence of the pivot probabilities on p−it .

12

1. Specify κ0it and κ1it with flexible functional forms that depend on observed covariates. These functions are not linked to any particular economic model. This yields

the estimated values for voting probabilities κ

b0it and κ

b1it .

2. The second step links to the economic model by backing structural parameters

out of the equilibrium equations that generate κ

b0it and κ

b1it . Here one can assume

either sincere or strategic voting for the equilibrium equations. For completeness,

we present both sincere and strategic results, thus providing a robustness check on

the sincere estimates in the main text from the direct approach.

Specifically, the model for the prior is:

exp α0 + α1 qtR + α2 qtM

,

qt =

1 + exp (α0 + α1 qtR + α2 qtM )

(B.7)

where qtR and qtM are proxy variables used in the main text. The models for the κ terms

are:

exp (β · Xit )

κ0it + exp (γ · Xit )

κ0it =

and κ1it =

(B.8)

1 + exp (β · Xit )

1 + exp (γ · Xit )

where Xit is a vector of covariates. For the baseline specification, we use

Xit = 1, qtR , qtM , D(Int)i , D(Vet)it , D(N R )t , D(Hike)t , D(Int)i · qtR , D(Int)i · qtM .

These are the same covariates as used in the main text with the addition of the interactions

between D(Int)i and the proxies for the prior, which control for members’ with different

signal precisions reacting differently to changes in the prior. To test the difference-indifferences prediction, we use

Xit =

1, qtR , qtM , D(Int)i , D(Vet)it , D(N R )t , D(Hike)t , D(Int)i · qtR ,

D(Int)i · qtM , D(θP CT Exp )i , D(θP CT Exp )i · D(Vet)it

!

,

where D(θP CT Exp )i is defined as in the main text.5

The dependence of κ1 on κ0 ensures that κ1 ≥ κ0 , which is implied by the model and

necessary for identifying the first stage parameters β and γ. Without the restriction that

κ1 ≥ κ0 , assigning individual votes to the cluster corresponding to the correct inflationary

state is not possible. We estimate the α, β, and γ via maximum likelihood applied to

(B.5), and obtain fitted values qbt , κ

b0it , and κ

b1it .

For the second step, with either sincere or strategic voting, one can use (B.6) to

5

We present results for just D(θP CT Exp )i to save on space, results for D(θP CT )i are similar.

13

recover estimates of sb∗it and σit with the following equations:

sb∗it

1

Φ−1 (1 − κ

b0it )

and σ

bit = −1

.

= −1

−1

Φ (1 − κ

b0it ) + Φ (b

κ1it )

Φ (1 − κ

b0it ) − Φ−1 (1 − κ

b1it )

(B.9)

Obtaining estimates for the cutoff Cit requires specifying the sincere or strategic model.

bit can be obtained by plugging qbt , σ

Under the former, C

bit , and sb∗it into the equation (2)

in the main text and solving directly.

[ PIVit | 1 ]

Under strategic voting, for each member i we first compute an estimate of Pr

Pr [ PIVit | 0 ]

in the following way. From the estimates of κ

b0jt and κ

b1jt for j 6= i, one can compute the

probability that exactly N2−1 of i’s colleagues vote high in states 0 and 1, respectively.

(Note that conditional on the state ωt , the probability that members vote high is iid).

bitST R as

We then use the empirical analogue of (B.1) to back out C

∗

sit − 1

bST R = exp 2b

C

+ ln

it

2b

σit2

qbt

1 − qbt

i

d

Pr PIVit 1

i .

+ ln h

d

Pr PIVit 0

h

bit and

By construction, the two-step approach delivers separate estimates of σ

bit , C

bitST R for each meeting (or more precisely, for each value of qbt , which is different for every

C

meeting). Testing our empirical predictions therefore requires comparing distributions of

estimated parameters. To test empirical prediction 1 using the baseline specification, we

bit and C

bST R by rookie and veteran

report the median of the estimated values of σ

bit , C

it

separately. We prefer the median to the mean to avoid having the results driven by tail

values of the estimated parameters. To test empirical prediction 2 using the expanded

set of covariates, we report the median separately by rookie and veteran, and by inflation

averse and inflation tolerant.6

B.3

Empirical Results: Strategic Voting and Robustness

Table B.3 provides the results for empirical prediction 1. These are equivalent to the

results which are presented in table 2 in main text, and the evolution of cutoffs from

that table is replicated on the first line of table B.3. The second line, marked “C 2step Sincere”, shows the evolution of the cutoffs if we continue to assume members vote

6

Confidence intervals are constructed using the same approach in Hansen, McMahon, and Velasco

(2014). This involves a Monte-Carlo approach that is similar in spirit to boot-strapping. We make

1,000 draws of first-stage coefficients from a multivariate normal distribution centered on the vector of

estimated coefficients with variance-covariance matrix that is the inverse of the negative Hessian matrix.

For each draw, we generate an estimate for the value of the expertise and cutoff parameters exactly as

in the second stage of estimation (by computing different values for each meeting from the equilibrium

equations, and then taking the median value across meetings). This generates a simulated distribution

of structural parameter estimates (and their differences) that we use to construct confidence intervals.

14

sincerely but use the two-step methodology. Then the third line reports the results

assuming members vote strategically (“C 2-step Strategic”). The qualitative results are

unchanged in each case, though the average level of the C tends to be lower under

the assumption of strategic voting. Using the two-step methodology, expertise changes

modestly with tenure. However, rather than learning through their tenure, the average

member appears to become less expert with tenure.

Table B.3: Baseline Results: Robustness to strategic voting

C(θ) Baseline (Sincere, direct)

C(θ) 2-step Sincere

C(θ) 2-step Strategic

σ 2-step

Baseline

Rookie Veteran Difference

0.87

3.17

2.30

[0.003]

0.29

1.42

1.13

[0.000]

0.15

0.56

0.41

[0.000]

0.38

0.42

0.04

[0.097]

Notes: This table reports the estimated cutoffs for the average MPC member. As in the

main text, the final column compares the effect of experience on the increase in the cutoff

between the two groups. The terms reported in brackets are p-values, calculated using a

bootstrapped distribution of estimates, for a one-sided test of difference from zero.

Table B.4 provides the results for empirical prediction 2 (table 3 in main text). The

difference-in-differences results are also qualitatively unaffected by the two-step methodology or the assumption of strategic voting.

Table B.4: Difference in Differences Results: Robustness to strategic voting using

D(θP CT Exp )i

C(θ) Baseline (Sincere, direct)

C(θ) 2-step Sincere

C(θ) 2-step Strategic

Inflation Averse

Rookie Veteran Difference

0.33

1.58

1.26

[0.007]

0.10

1.20

1.09

[0.000]

0.03

0.17

0.14

[0.040]

Inflation Tolerant

Rookie Veteran Difference

1.52

11.22

9.69

[0.006]

0.62

4.75

4.13

[0.000]

0.03

0.48

0.45

[0.001]

Notes: This table reports the estimated cutoffs for high and low θi types based on the

D(θP CT Exp )i measure. As in the main text, the final column compares the effect of experience on the increase in the cutoff between the two groups. The terms reported in brackets

are p-values, calculated using a bootstrapped distribution of estimates, for a one-sided test

of difference from zero.

15

Diff-in-Diff

-8.43

[0.008]

-3.03

[0.001]

-0.31

[0.018]

C

Alternative Measures of Inflation Aversion

As described in the robustness section in the main paper, we augment the difference-indifferences analysis by using two alternative ways of measuring inflation aversion. The

first alternative comes from Eijffinger, Mahieu, and Raes (2013), which we call EMR

hereafter. They rank members along a policy space of interest rates, and so identify

members that systematically prefer higher or lower rates. We rank members based on

the reported ideal points in EMR, and create an indicator variable D(θEM R )i for inflation

tolerance that roughly splits the sample equally based on this ranking.

We also use the estimated fixed effects from the regression in table 1 in the main paper

to define an indicator variable D(θF E )i . Members with higher fixed effects are assigned

D(θF E )i = 0 and those a lower fixed effects are assigned a 0. We split the sample evenly.

These fixed effects capture average voting tendencies while controlling for common factors

driving voting behavior within a given meeting due to the inclusion of time fixed effects.

Table C.5 presents the structural estimates for all four measures we use in the paper.

The difference-in-differences prediction remains robust to these alternative approaches to

measuring inflation aversion.

Table C.5: Robustness of the structural difference in differences estimates

D(θP CT Exp )

Inflation Averse

Rookie Veteran Difference

0.47

2.87

2.40

[0.000]

Inflation Tolerant

Rookie Veteran Difference

1.88

16.83

14.95

[0.000]

Diff-in-Diff

-12.55

[0.000]

D(θP CT )

0.30

0.68

0.38

[0.048]

2.45

18.28

15.84

[0.000]

-15.46

[0.000]

D(θEM R )

0.27

1.13

0.86

[0.000]

5.02

20.59

15.57

[0.010]

-14.71

[0.015]

D(θF E )

0.10

1.12

1.03

[0.000]

4.94

13.23

8.30

[0.027]

-7.27

[0.042]

Notes: This regression presents structural estimates of cutoff by type of member measured

in four different ways. The results show that our main structural estimates are robust

across other measures of member type.

16

D

Ex-ante Differences between Members

Table D.6 presents the results of table 3 in the main paper separately for internal and

external members. The main difference-in-differences prediction—that all members become more dovish but especially the more inflation-tolerant members—holds conditional

on appointment type. This allays potential concerns that internal and external members

behave very differently in the data.

Table D.6: Dynamic behaviour of different member types conditional on appointment

Baseline

C(θ)

Internal

C(θ)

External C(θ)

Baseline

C(θ)

Internal

C(θ)

External C(θ)

Inflation Averse

D(θ P CT Exp ) = 0

0.47

2.87

2.40

[0.000]

0.11

0.75

0.63

[0.000]

0.89

4.34

3.45

[0.000]

Inflation Averse

D(θ P CT ) = 0

Rookie Veteran Difference

0.30

0.68

0.38

[0.048]

0.11

0.75

0.63

[0.000]

0.89

4.34

3.45

[0.000]

Inflation Tolerant

D(θ P CT Exp ) = 1

1.88

16.83

14.95

[0.000]

0.42

2.11

1.69

[0.000]

1.77

12.69

10.92

[0.000]

Inflation Tolerant

D(θ P CT ) = 1

Rookie Veteran Difference

2.45

18.28

15.84

[0.000]

0.42

2.11

1.69

[0.000]

1.77

12.69

10.92

[0.000]

-12.55

[0.000]

-1.06

[0.012]

-7.47

[0.004]

Diff-in-Diff

-15.46

[0.000]

-1.06

[0.012]

-7.47

[0.004]

Notes: This table reports the results of table 3 in the main paper separately for internal

and external members. The difference-in-differences prediction holds for each appointment

status.

17

E

Other Sources of Voting Dynamics

In this section we further consider three alternative sources of voting dynamics, briefly

mentioned in section 2.3 of the main text, besides the desire to signal one’s preference

type. The first is that members change their cutoffs to pursue particular career paths,

the second is that their behaviour is driven by a desire for reappointment, and the third

is that they care about the reputation of the committee as a whole rather than their

personal reputations.

E.1

Career Trajectory

As an example of how pursuing a particular career path might drive the results, suppose

that MPC members wishing to work in the private sector after leaving the committee

became softer on inflation over time in order to signal to future employers their friendliness

towards business.7 Then our finding of overall increasing cutoffs might be driven solely by

this group becoming softer on inflation over time, while others’ cutoff remained constant.

To analyze this idea, we examine four different splits of the committee. The first

two are whether members came from an academic or private-sector background prior to

joining the MPC, while the last two are whether members went to an academic or privatesector position after leaving the MPC. Table E.7 summarises these career variables for

each member of our sample.

We use the following specifications for the cutoff and expertise:

ln (Cit ) = β0 +β1 ·D(Vet)it +β2 ·D(N R )t +β3 ·D(Int)i +β4 ·D(Hike)t +β5 ·D(Career)i (E.1)

and

ln (σit ) = γ0 + γ1 · D(Vet)it + γ2 · D(Int)i + γ3 · D(Career)i ,

(E.2)

where D(Career)i is one of the four career variables. We then estimate the β and γ

coefficients (along with coefficients for equation (10) that specifies qt ), and back out

values for Cit and σit as described in section 5.1. Their average values by veteran status

and career trajectory are reported in table E.8.

All subgroups have a significant increase in their estimated cutoff. Thus while particular groups might increase more than others, there is a common tendency to become

more dovish that is independent of one’s career trajectory. It is worth pointing out that

whenever one group is estimated as substantially more inflation tolerant than another, as

is the case for all splits except post-MPC academic, that group also has a larger estimated

move in the cutoff. This is consistent with the difference-in-differences prediction, but

7

One fact that already makes this story somewhat less compelling is the absence of an end of term

effect in the data (see section 4 of the main text for details).

18

Table E.7: Career Covariates for MPC Members in Our Sample

Member

Davies

George

King

Plenderleith

Clementi

Vickers

Bean

Tucker

Large

Lomax

Gieve

Dale

Fisher

D(Int)i

Internal

Internal

Internal

Internal

Internal

Internal

Internal

Internal

Internal

Internal

Internal

Internal

Internal

First

Meeting

Jun 1997

Jun 1997

Jun 1997

Jun 1997

Sep 1997

Jun 1998

Oct 2000

Jun 2002

Oct 2002

Jul 2003

Feb 2006

Jul 2008

Mar 2009

Last

Meeting

Jul 1997

Jun 2003

Pre-MPC Career

Academic Private

0

0

0

0

0

0

May 2002

0

0

Aug 2002

0

1

Sep 2000

1

0

1

0

0

0

Jan 2006

0

0

Jun 2008

0

0

Feb 2009

0

0

0

0

0

0

Buiter

Goodhart

Julius

Budd

Wadhwani

Allsop

Nickell

Barker

Bell

Lambert

Walton

Blanchflower

Besley

Sentence

External

External

External

External

External

External

External

External

External

External

External

External

External

External

Jun 1997

Jun 1997

Sep 1997

Dec 1997

Jun 1999

Jun 2000

Jun 2000

Jun 2001

Jul 2002

Jun 2003

Jul 2005

Jun 2006

Sep 2006

Oct 2006

May

May

May

May

May

May

May

2000

2000

2001

1999

2002

2003

2006

Jun 2005

Mar 2006

Jun 2006

1

1

0

0

0

1

1

0

0

0

0

1

1

0

0

0

1

0

1

0

0

1

1

1

1

0

0

1

Post-MPC Career

Academic Private

0

0

0

0

1

0

0

0

0

1

0

0

1

0

1

0

0

0

0

0

0

0

1

0

0

0

0

1

0

1

0

1

1

0

0

0

0

1

1

0

0

0

1

0

1

0

0

1

0

1

0

0

0

1

Notes: This table provides the career covariates for the MPC members in our sample.

Those with missing values in the “Last Meeting” column were still sitting on the MPC in

March 2009, the month our sample ends. All such members have since left the MPC, so

that there are no missing values for the Post-MPC Career variables.

19

could also be driven by other differences between groups besides the weight put on the

output gap. Overall, the results in the main paper do not appear driven by any particular

group seeking out specific career goals.

Table E.8: Career Effects

Pre-MPC

Non-Private Sector

Rookie Veteran Difference

0.58

2.39

1.81

[0.000]

Private Sector

Rookie Veteran Difference

1.92

7.61

5.69

[0.000]

C(θ)

Post-MPC

Pre-MPC

0.83

2.68

1.86

[0.000]

Non-Academic

Rookie Veteran Difference

0.79

2.39

1.60

[0.000]

1.17

6.86

5.69

[0.000]

Academic

Rookie Veteran Difference

1.13

6.14

5.01

[0.000]

C(θ)

Post-MPC

0.87

3.63

2.77

[0.000]

0.92

3.00

2.08

[0.000]

Notes: This table examines the evolution of cutoffs by different types of career covariate.

All career splits experience a similar increase in cutoff.

E.2

Reappointment driving the results

As discussed in the main text, all members of the committee (both internal and external),

apart from Governor-level positions, serve three-year terms; Governors and Deputy Governors serve five-year terms. However, reappointment is possible. It is therefore feasible

that reappointment incentives drive the behaviour of MPC members. In particular, it

would be worrying for our interpretation of the empirical findings if members became

more dovish toward the end of their first term in order to be reappointed. To do this we

examine the relationship between the type proxies and reappointment, and show that, if

anything, more hawkish (internal) members are more likely to be reappointed to serve a

second term.

To do this, we define a dummy variable for each member, D(Reappointed)i , which is

equal to 1 if member i served a second term (without distinguishing whether the person

wanted to serve a second term or not). We then estimate a linear probability model:

D(Reappointed)i = µ + δ0 D(External)i + δ1 D(θX )i + δ1 D(θX )i × D(Vet)it + it

(E.3)

where D(θX )i is one of our type proxies.

Table E.9 presents the results. They show that, if anything, more hawkish internal

members are more likely to be reappointed (column (1)). Of course, for these regressions

20

Table E.9: Reduced-form evidence on the drivers of reappointment to second term

Main Regressors

D(External)

D(θP CT Exp )

(1)

D(Reappointed)i

(2)

D(Reappointed)i

(3)

D(Reappointed)i

0.042

[0.889]

-0.62*

[0.087]

-0.095

[0.724]

-0.083

[0.753]

D(θP CT )

-0.095

[0.724]

D(θEM R )

D(θP CT Exp ) x D(External)

0.095

[0.727]

0.069

[0.879]

D(θP CT ) x D(External)

-0.11

[0.763]

D(θEM R ) x D(External)

Constant

R-squared

Model

Member effects?

Time effects?

Sample?

Obs?

0.62***

[0.001]

0.43**

[0.026]

-0.18

[0.638]

0.33

[0.105]

0.326

OLS

NO

NO

06/97-03/09

22

0.066

OLS

NO

NO

06/97-03/09

27

0.044

OLS

NO

NO

06/97-03/09

27

Notes: This regression presents OLS estimates of a linear probability model in which the

dependent variable is a dummy equal to 1 if member i was reappointed after the end of

their first term.

there is at most one observation per member, and the D(θP CT Exp )i has only 22 members

with non-missing observations. This means that the statistical power of the regression is

low. So while not conclusive evidence against any changes in behavior driven by a desire

to be reappointed, these findings at least reassure us that a desire to be seen as a dove

to increase chances of reappointment are not the main drivers of the dynamic behavior

we discuss in the main paper.

E.3

Concerns About The Committee Reputation

As we discuss in section 2.3 of the main text, while not entirely straightforward to microfound, members might care about the reputation of the committee as a whole in addition

to their individual reputations. In this section we explore whether such concerns are the

main driver of our results. If members in the sample cared about the reputation of the

MPC for inflation aversion, they should have been particularly motivated to establish its

credibility during its initial meetings when there was the most uncertainty about how it

21

would operate. Moreover, since those serving during the first meetings were by definition

rookies, this group may be responsible for our empirical finding that rookies are tougher

on inflation than veterans.

If this story were true, then removing the rookie votes from the first 18 meetings from

the structural exercise should lead to a much less marked difference in the cutoff between

veterans and rookies. In table E.10, we present results from repeating the structural

estimation of the cutoffs reported in section 5.2 of the main text, but dropping from the

sample any meeting between June 1997 and December 1998 (the first 18 months).8 The

top panel of the table shows that there remains a significant increase in the estimated

cutoff on average. The lower panels show the estimates for different levels of θi (identified

using the D(θP CT Exp )i measure) as well as the difference-in-differences estimate. Again,

the main results of the paper are unaffected; all types have a significant increase in their

cutoffs, but the increase is significantly greater for more inflation-tolerant members.

These results show that individual reputations matter in the sense that even after

the MPC matured as an institution, rookies continued to use significantly higher cutoffs

than veterans overall, and especially when they were more inflation tolerant. This does

not imply that committee reputation concerns are not present in the data, just that they

alone do not appear able to explain the empirical results.

Table E.10: Estimates of cutoffs excluding the first 18 months of the MPC

C(θ)

Baseline

Rookie

1.64

Veteran

5.04

Difference

3.40

[0.000]

Inflation Averse

0.44

2.34

Inflation Tolerant

3.32

19.07

1.90

[0.001]

15.74

[0.000]

-13.84

[0.002]

Diff-in-Diff

Notes: This table shows the structural estimates of the cutoffs (C) for rookies and veteran

members, as well as the difference between them. We report, in brackets below the difference

estimate, the p-value of a one-sided test that the difference is significantly non-zero; the

test is calculated using a bootstrapped distribution of estimates. The first panel shows the

estimates for the overall average on the committee. The second panel reports the estimated

cutoffs for high and low θi types based on the high vote percentage measure. The final panel

reports the difference-in-differences estimate between the high and low θi types.

8

We have also done this for the reduced form analysis in section 4 and the results are unaffected.

22

F

Alternative Structural Specifications

Finally, we conduct a number of checks on the robustness of the specification used for

the structural analysis. In the baseline specification, the three equations estimated in the

structural model are:

qt

= α0 + α1 · qtR + α2 · qtM

(F.1)

ln

1 − qt

ln (Cit ) = β0 + β1 · D(Vet)it + β2 · D(N R )t + β3 · D(Int)i + β4 · D(Hike)t

(F.2)

ln (σit ) = γ0 + γ1 · D(Vet)it + γ2 · D(Int)i

(F.3)

where D(N R )t indicates whether the period t committee composition includes at least

three rookies, D(Int)i indicates whether member i is internal, and D(Hike)t indicates

whether the agenda includes at least one option to raise rates.

Our first robustness check uses a more flexible specification for equation (F.3) in which

we allow the expertise to vary with the agenda by including the D(Hike)t variable:

ln (σit ) = γ0 + γ1 · D(Vet)it + γ2 · D(Int)i + γ3 · D(Hike)t

(F.4)

The baseline results, as well as those under the more flexible specfication for σ, are

shown in Table F.11. The evolution of both C(θ) and σ is very similar.

Table F.11: Estimates of cutoffs under an alternative specification for σ

C(θ)

Baseline

Rookie

0.84

Veteran

3.07

Difference

2.23

[0.000]

Inflation Averse

0.42

2.46

Inflation Tolerant

1.70

15.12

2.04

[0.000]

13.43

[0.000]

-11.39

[0.000]

Diff-in-Diff

σ

0.41

0.41

0.01

[0.385]

Notes: This table shows the structural estimates of the cutoffs (C) for rookies (column 1)

and veteran (column 2) members, as well as the difference between them (column 3). We

report, in brackets below the difference estimate, the p-value of a one-sided test that the

difference is significantly non-zero; the test is calculated using a bootstrapped distribution

of estimates. The first panel shows the estimates for the overall average on the committee.

The second panel reports the estimated cutoffs for high and low θi types based on the high

vote percentage measure. The third panel reports the difference-in-differences estimate

between the high and low θi types. The bottom panel reports the difference between the σ

estimates.

23

Next we include only the terms predicted by our model, D(Int)i and D(N R )t , in

equation (F.2) and otherwise leave the baseline specification as it is.

ln (Cit ) = β0 + β1 · D(Vet)it + β2 · D(N R )t

(F.5)

Again, the results, shown in F.12, support the idea that our results are robust to a

more parsimonious specification.

Table F.12: Estimates of cutoffs using a more parsimonious specification for cutoffs

C(θ)

Baseline

Rookie

2.77

Veteran

4.15

Difference

1.37

[0.080]

Inflation Averse

1.53

3.12

Inflation Tolerant

4.98

19.40

1.59

[0.024]

14.42

[0.005]

-12.83

[0.009]

Diff-in-Diff

Notes: This table shows the structural estimates of the cutoffs (C) for rookies and veteran

members, as well as the difference between them. We report, in brackets below the difference

estimate, the p-value of a one-sided test that the difference is significantly non-zero; the

test is calculated using a bootstrapped distribution of estimates. The first panel shows the

estimates for the overall average on the committee. The second panel reports the estimated

cutoffs for high and low D(θP CT Exp )i types based on the high vote percentage measure.

The final panel reports the difference-in-differences estimate between the high and low

D(θP CT Exp )i types.

Finally, since Mervyn King was present at all the committee meetings in the sample,

he arguably does not truly fit our model’s assumption. We therefore re-estimate the

structural parameters using the same specification as in the main paper, but dropping all

of this votes. F.13 displays the results, which are qualitatively equivalent to those that

include King.

24

Table F.13: Estimates of cutoffs excluding Mervyn King from the sample

C(θ)

Baseline

Rookie

1.13

Veteran

5.50

Difference

4.37

[0.000]

Inflation Averse

0.47

2.87

Inflation Tolerant

1.88

16.83

2.40

[0.000]

14.95

[0.000]

-12.55

[0.000]

Diff-in-Diff

Notes: This table shows the structural estimates of the cutoffs (C) for rookies and veteran

members, as well as the difference between them. We report, in brackets below the difference

estimate, the p-value of a one-sided test that the difference is significantly non-zero; the

test is calculated using a bootstrapped distribution of estimates. The first panel shows the

estimates for the overall average on the committee. The second panel reports the estimated

cutoffs for high and low D(θP CT Exp )i types based on the high vote percentage measure.

The final panel reports the difference-in-differences estimate between the high and low

D(θP CT Exp )i types.

References

Debortoli, D., J. Kim, J. Linde, and R. Nunes (2015): “Designing a simple loss

function for the Fed: does the dual mandate make sense?,” Working Papers 15-3,

Federal Reserve Bank of Boston.

Duggan, J., and C. Martinelli (2001): “A Bayesian Model of Voting in Juries,”

Games and Economic Behavior, 37(2), 259–294.

Eijffinger, S. C. W., R. J. Mahieu, and L. Raes (2013): “Inferring Hawks and

Doves from Voting Records,” Discussion Paper DP9418, CEPR.

Hansen, S., M. McMahon, and C. Velasco (2014): “How Experts Decide: Preferences or Private Assessments on a Monetary Policy Committee?,” Journal of Monetary

Economics, 67(October), 16–32.

Iaryczower, M., and M. Shum (2012): “The Value of Information in the Court: Get

It Right, Keep It Tight,” American Economic Review, 102(1), 202–37.

Woodford, M. (2003): Interest and Prices. Princeton University Press.

25