Cognitive Science 33 (2009) 105–113

Copyright 2009 Cognitive Science Society, Inc. All rights reserved.

ISSN: 0364-0213 print / 1551-6709 online

DOI: 10.1111/j.1551-6709.2008.01005.x

Sunk-Cost Effects on Purely Behavioral Investments

Marcus Cunha, Jr, Fabio Caldieraro

Michael G. Foster School of Business, University of Washington, Seattle

Received 26 January 2008; received in revised form 8 May 2008; accepted 13 May 2008

Abstract

Although the sunk-cost effect is a well-documented psychological phenomenon in monetary

investments, existing literature investigating behavioral investments (e.g., time, effort) has not replicated this effect except when such investments relate to monetary values. The current explanation for

this discrepancy proposes that purely behavioral sunk-cost effects are unlikely to be observed

because they are difficult to book, track, and balance in a mental account. Conversely, we argue that,

through an effort-justification mechanism, people account for the amount of behavioral resources

invested when selecting an alternative, in which case they may fall prey to purely behavioral sunkcost effects. The results of two experiments support this prediction. Because many decisions involve

behavioral investments, behavioral sunk-cost effects should be pervasive psychological phenomena.

Keywords: Sunk costs; Cognitive psychology; Behavioral decision making; Effort and decision

1. Introduction

Mary recently changed jobs and is deciding among the available health care plans. After

putting some effort into learning about the plans, she finally sets her mind on a given option.

Right before she calls Human Resources to communicate her choice, she receives a letter

from another plan, offering a better deal than the one she is about to choose. Will Mary

switch to this new option or stick with her initial choice (i.e., the interim choice)?

A vast body of literature reports that people frequently violate rationality by allowing

nonrecoverable investments (sunk costs) to influence their decisions (Garland, 1990;

Karlsson, Juliusson, Grankvist, & Gär, 2002; Rubin & Brockner, 1975; Staw, 1976, 1981;

Thaler, 1980; Thaler & Johnson, 1990; Whyte, 1986), a phenomenon known as the

sunk-cost effect (Arkes & Blumer, 1985). Although sunk-cost effects have been well

Correspondence should be sent to Marcus Cunha, Jr, 329 Mackenzie Hall, P.O. Box 353200, Seattle, WA

98195. E-mail: cunhamv@u.washington.edu

106

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

documented for monetary investments, they have been demonstrated for behavioral

investments only when those investments are linked to a monetary equivalent (Devoe &

Pfeffer, 2007a; Heath, 1995; Soman, 2001; Zeelenberg & van Dijk, 1997). According to

this finding, Mary would stick to her interim choice of health plans only if she translated

the effort she put into her decision into a monetary equivalent (e.g., hourly wages). Otherwise, she would behave according to the rational model. This conclusion is intriguing

because research into behavioral-resources allocation documents that people recognize

time costs invested in cognitive tasks (Gray, Sims, Fu, & Schoelles, 2006), and because,

according to the definition of sunk-cost effects, nonrecoverable behavioral investments

should be treated as sunk costs as well (Arkes & Blumer, 1985). In this paper, we demonstrate how an effort-justification mechanism can predict purely behavioral sunk-cost

effects.

2. Theoretical background

2.1. Current perspective on behavioral sunk-cost effects

Recent attempts to demonstrate sunk-cost effects for behavioral resources rely on principles of mental accounting (Thaler, 1985, 1999) and predict that sunk investments set a mental account ‘‘in the red,’’ which causes people to escalate their commitment to the current

course of action in an attempt to close the account ‘‘in the black.’’ Because behavioral

investments are harder to book and track, a person may not perceive the mental account as

‘‘in the red,’’ and sunk-cost effects are less likely to be observed (see Soman, 2001; cf.

Heath, 1995; for an alternative mental account perspective). However, when behavioral

resources are linked to a monetary equivalent (e.g., hourly wages) prior to the investment of

behavioral resources, people more easily book and track investments, perceive the account

as being ‘‘in the red,’’ and tend to escalate commitment hoping to close the account ‘‘in the

black.’’ When this sequence of events occurs, sunk-cost effects tend to be observed for

behavioral investments (Heath, 1995; Soman, 2001; Zeelenberg & van Dijk, 1997). In

addition, that the accounting of behavioral investments is affected by the salience of the

relationship between time and money, Devoe and Pfeffer (2007a) found that workers that

are paid hourly wages, which increases the salience of the time–money relationship, use different mental accounting standards when compared with those that are salaried. In addition,

these authors also found that people paid hourly spent about 36% less time volunteering

than salaried people (Devoe & Pfeffer, 2007b). Soman (2001) further argues that without

the link to monetary values, booking and tracking processes for mental accounting become

impaired, and sunk-cost effects will not be observed. Thus, he proposes that ‘‘this ‘pseudorationality’ is due to the fact that individuals lack the ability to account for time in the same

way as they account for money’’ (Soman, 2001, p. 169).

The fact that purely behavioral sunk costs were not observed in previous research could

imply that mental accounting as an underlying process of sunk-cost effects is more likely to

be activated if contextual cues help individuals explicitly link behavioral investments to a

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

107

mental account, book them as costs, and verify the ‘‘balance’’ of the account with respect to

a given reference point. In many other situations, such as in Mary’s health plan case, the

linking of behavioral investments to a mental account may not be activated because contextual cues facilitating the booking, tracking, and accounting of investments are not available.

In the absence of such cues, research relying on a mental accounting perspective has not

been successful in providing evidence for purely behavioral sunk-cost effects.

Furthermore, the predictions of a mental accounting perspective for the case of behavioral investments could even imply a smaller likelihood of experiencing sunk-cost effects

when making larger investments. To illustrate, assume that people somehow book behavioral investments even when they are not linked to monetary equivalents. In this case,

given that cognitive effort is undesirable and therefore accounted for as a cost, people

who face greater effort would book higher costs than people who face lesser effort; thus,

once people make an interim choice, those who invested larger effort would be more

likely to have their mental account ‘‘in the red’’ than those who invested low effort.

When given the opportunity to switch to an alternative option of better value (with negligible uncertainty associated with this value), the likelihood of switching to this option

should increase as a function of the magnitude of effort. This is expected because, for

those investing greater effort, an option of better value not only has a larger utility but

also presents a higher likelihood of changing the balance of the account from ‘‘in the

red’’ to ‘‘in the black.’’ Consequently, according to a mental accounting perspective,

individuals who invest greater effort should be more likely to switch to the better alternative option than those who invest smaller effort.

2.2. Effort justification and purely behavioral sunk-cost effects

In contrast, we propose the effort-justification mechanism (Aronson & Mills, 1959;

Axsom, 1989) as an alternative underlying mechanism of purely behavioral sunk-cost

effects. Because cognitively demanding tasks are undesirable, dissonance arises whenever

people engage in effortful tasks. However, people can reduce dissonance through a compensation process in which they exaggerate the desirability of the decision outcome by adding

consonant cognitions to it, such that the magnitude of desirability represents an increasing

function of the amount of effort. Therefore, the same outcome should be perceived as more

desirable by people who invest more effort than by those who invest less into making a

choice. We refer to this effort-related increment in the perceived utility of an interim choice

as the behavioral investment sunk cost (BISC) value and propose that people enjoy the positive value of effort invested in making an interim decision only if they stick with this decision. If a new option is available, the decision to switch from the interim choice to the new

opportunity depends not only on the incentive involved in switching, defined as the difference in utility between the interim choice and the new option (hereafter, opportunity cost)

but also on the utility derived from the exaggerated value of the interim choice owing to the

effort-justification process (i.e., magnitude of the BISC value). Thus, purely behavioral

sunk-cost effects should be more likely to occur when the opportunity cost is insufficient to

offset the positive BISC value. Alternatively, purely behavioral sunk-cost effects should be

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

108

less likely when the opportunity cost is large enough to offset the positive BISC value. We

test these predictions next.

3. Experiment 1

Experiment 1 was designed to test whether an effortful process leads to an exaggeration

of the value of the interim choice (the BISC value) and whether purely behavioral sunk-cost

effects depend on the relationship between the BISC value and the magnitude of the opportunity cost posed by a new option.

3.1. Method

Sixty-nine undergraduate students received extra credit to participate in a computerbased experiment, in which they were randomly assigned to one of the four betweensubjects experimental conditions (effort · opportunity cost). We used a purchase scenario

pertaining to a product generically described as an ‘‘electronic gadget.’’ As stimuli, we

employed a set of five products with four hypothetical attributes (see Table 1). We

manipulated the opportunity cost by varying the overall rating of the new option so that

it was slightly or significantly better than the target interim option. To manipulate

amount of effort, we presented attribute ratings in the form of either fractions (e.g.,

14 ⁄ 2, 18 ⁄ 2, 32 ⁄ 4, 14 ⁄ 2) in the greater-effort condition or integers (e.g., 7, 9, 8, 7) in the

lesser-effort condition.

We told participants that the four attributes were equally important and that they could

reach an overall evaluation of the product by adding the four attribute ratings. Participants

viewed the list of products and attribute ratings and made their selection in a text box on the

bottom of the computer screen after they had finished evaluating the products. The target

interim choice had an overall rating of 31. We unobtrusively recorded the amount of time

each participant spent evaluating the products to measure cognitive effort. Following the

evaluation task, participants rated how satisfied they were with their interim choice (from 1

‘‘not satisfied at all’’ to 7 ‘‘very satisfied’’), which we used to capture the hypothesized

positive BISC value.

Table 1

Experiments’ stimulia

Product 1

Product 2

Product 3

Product 4

Product 5

a

Attribute (a)

Attribute (b)

Attribute (c)

Attribute (d)

6 [18 ⁄ 3]

8 [32 ⁄ 4]

7 [14 ⁄ 2]

6 [18 ⁄ 3]

9 [18 ⁄ 2]

8 [32 ⁄ 4]

3 [9 ⁄ 3]

9 [18 ⁄ 2]

8 [32 ⁄ 4]

5 [25 ⁄ 5]

8 [32 ⁄ 4]

9 [18 ⁄ 2]

8 [32 ⁄ 4]

5 [25 ⁄ 5]

7 [14 ⁄ 2]

7 [14 ⁄ 2]

4 [16 ⁄ 4]

7 [14 ⁄ 2]

9 [18 ⁄ 2]

6 [18 ⁄ 3]

Stimuli used in the greater-effort condition in Experiment 1 appear in brackets.

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

109

We then told participants that before they headed to the store to buy the product, they

learned that one more product had become available in the market and that they could

consider switching to this new product. The new product was either slightly better (overall

rating of 32) in the small, or significantly better (overall rating of 37) in the large opportunity-cost condition. Participants then rated the likelihood that they would switch to this

new product (from 1 ‘‘definitely keep my initial choice’’ to 7 ‘‘definitely switch to the new

product’’).

3.2. Results and discussion

Overall, 91.3% of the participants correctly chose the target interim gadget, and this

proportion did not vary significantly across levels of effort.

3.2.1. Manipulation check and BISC value

An analysis of the decision times and satisfaction measure shows that participants in the

greater-effort condition spent more time (M = 85.63, SE = 6.97) evaluating the options than

did those in the lesser-effort condition (M = 60.43, SE = 3.66; t(67) = 3.37, p < .01,

d = .82) and were more satisfied (M = 5.65, SE = .17) with the interim choice than lessereffort participants (M = 4.97, SE = .19; t(67) = 2.68, p < .01, d = .65). These results are

consistent with our prediction that the BISC value, as captured by the measure of satisfaction with the interim choice, increases as a function of effort.

3.2.2. Sunk-cost effects

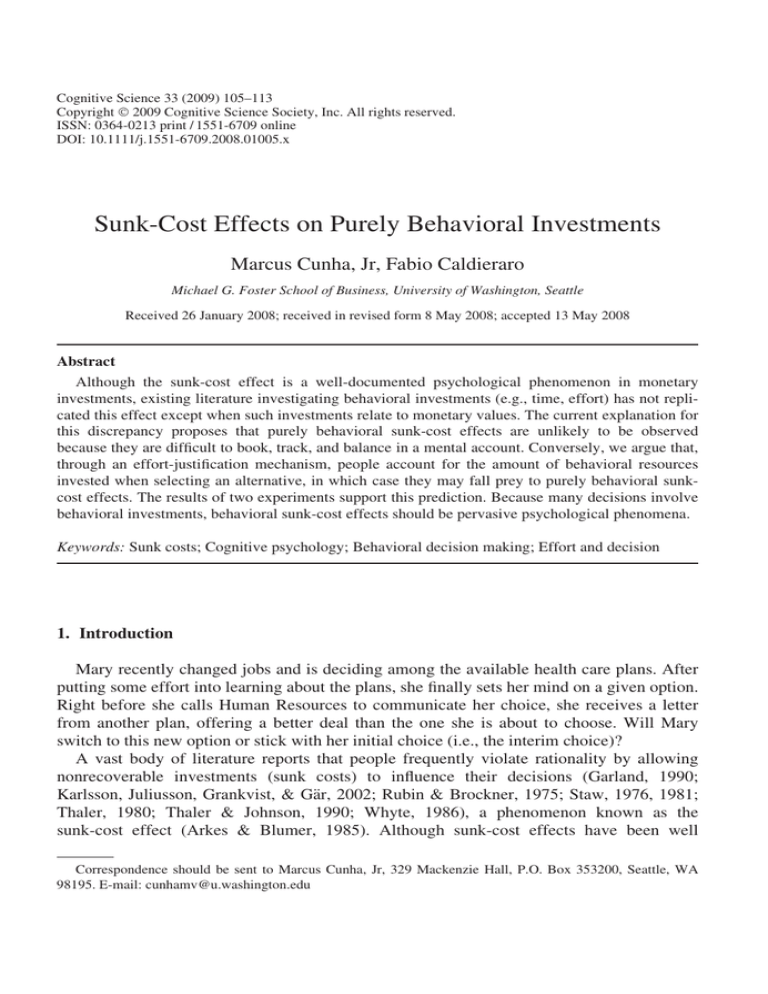

An anova on the likelihood-to-switch estimates shows an interaction between effort and

opportunity cost, F(1,65) = 6.92, p < .05, g2P ¼ :10 (see Fig. 1). We anticipate that a small

opportunity cost will be larger than the BISC value in the lesser-effort condition but smaller

than the BISC value in the greater-effort condition. Therefore, participants should be more

likely to switch to the new option in the lesser- than in the greater-effort condition. Accordingly, when the opportunity cost was small, participants who expended less effort were more

Fig. 1. Estimates of the likelihood that participants will purchase a new product with a greater overall value.

110

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

likely to switch to the new option (M = 5.75, SE = .28) than were those who confronted

greater levels of effort (M = 4.50, SE = .28), F(1,65) = 9.80, p < .01, g2P ¼ :13. Conversely,

we expect a large opportunity cost to be larger than the BISC value in both effort conditions,

so participants should be equally likely to switch to the new option. Accordingly, we find no

differences in willingness to switch between the lesser- (M = 6.14, SE = .24) and greatereffort conditions (M = 6.33, SE = .29), F(1,65) < 1, ns. These results are consistent with

our prediction that purely behavioral sunk-cost effects are a function of the relative sizes of

opportunity cost and BISC values.

Furthermore, lack of motivation to process information about the new option, as a consequence of the amount of effort put in during the evaluation of the options phase, does not

seem to play a role in our results. If respondents had not processed information about the

new option when the effort was greater, then we should have expected no difference

between the two greater-effort conditions. However, as we observed such a difference

(F(1,65) = 20.39, p < .01, g2P ¼ :24), we must conclude that subjects indeed processed the

information about the new option.

4. Experiment 2

In Experiment 2, we test the robustness of our predictions using a more realistic effort

manipulation and choices with direct implications for participants’ utility. Specifically,

respondents’ final selection of a pen with a higher or lower rating influenced the type of pen

they would receive at the end of the experiment.

4.1. Method

One hundred thirty-seven undergraduate and graduate students volunteered to participate

in this experiment in exchange for a pen of their choice and were randomly assigned to one

of four between-subjects conditions. We manipulated effort by presenting the information

about the pens in a compiled (lesser effort) or scattered (greater effort) form. To manipulate

the opportunity cost factor, we varied the overall rating of the new pen.

Participants evaluated five pens on the basis of four equally important attributes (antismearing, comfort, ink grade, and precision). The attribute ratings remained the same as

those in Experiment 1, except that we consistently presented them in integer form. In the

lesser-effort condition, the attribute ratings for all pens appeared on a single page, whereas

in the greater-effort condition, participants had to gather the attribute rating information

from four different pages of the experimental booklet.

After computing the overall value of each pen (i.e., sum of the four attributes), participants chose the pen they would like to receive at the end of the experiment. The target

interim choice had an overall rating of 31. Participants were then offered the opportunity to

switch to a pen with a better overall value (32 or 37). We also asked participants to rate the

perceived amount of effort they invested in choosing a pen and their satisfaction with their

interim choice.

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

111

4.2. Results and discussion

Overall, 90.8% of the participants correctly selected the target interim choice pen, and

this proportion did not vary significantly across levels of effort.

4.2.1. Manipulation check and BISC value

An analysis of the effort and satisfaction measures shows that participants in the greatereffort condition judged the task of evaluating the five pens as more effortful (M = 3.26,

SE = .20) than did those in the lesser-effort condition (M = 2.52, SE = .14; t(135) = 3.00,

d = .52, p < .01); they also were more satisfied (M = 5.34, SE = .14) with their interim

choice than participants in the lesser-effort condition (M = 4.96, SE = .13; t(135) = 1.99,

d = .34, p < .05).

4.2.2. Sunk-cost effects

A logistic regression on participants’ choices, including the main effect and interaction terms, shows that the model, v2 (3) = 22.17, p < .001, corrected r2 = .20, p < .001

(see Fig. 2), and the interaction term, b = 1.65, SE = .76, Wald v2(1) = 4.69, p < .05

are significant. Consistent with our predictions and the results of Experiment 1, we

observe a greater tendency to switch to the new pen with a better overall rating in the

lesser- (p = 66.7%) than in the greater- (p = 27.0%) effort condition when the opportunity cost is small, v2(1) = 11.04, p < .001. However, we observe no differences across

the lesser- (p = 73.5%) and greater- (p = 72.7%) effort conditions when the opportunity

cost is large (v2(1) = .05, ns).

As there are significant differences in the choice proportions across opportunity cost conditions (v2(1) = 14.58, p < .001) in the greater-effort condition, we do not consider motivation to process information regarding the new pen a concern in Experiment 2 either.

Fig. 2. Percentage of participants who chose the pen with the higher overall value rather than the interim

choice.

112

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

5. General discussion

With this article, we attempt to resolve the issue of whether sunk-cost effects may

occur for behavioral investments. The core definition of sunk-cost effect (Arkes &

Blumer, 1985) and the empirical regularity of this effect among monetary investments

suggest that purely behavioral sunk-cost effects should exist. However, previous literature

has not been able to demonstrate these effects (Heath, 1995; Soman, 2001), unless the

investments link to ex-ante contextual cues that facilitate booking and tracking processes.

Therefore, researchers have proposed ‘‘pseudo-rationality’’ (Soman, 2001, p. 169) in the

contrast between purely behavioral and traditional sunk-cost effects and concluded that

people are unlikely to experience sunk-cost effects as a result of purely behavioral

investments. This lack of evidence may stem from researchers’ reliance on a mentalaccounting mechanism, which could be more easily activated when investment amounts

are made easier to book and track.

We instead propose that an effort-justification mechanism may account for purely behavioral sunk-cost effects and accordingly show that these effects can be observed, depending

on the magnitude of the BISC value relative to the opportunity cost posed by a new option.

Our empirical test has an advantage relative to other research, in that we use an actual effort

manipulation (rather than hypothetical scenarios), which may contribute to the activation of

the effort-justification mechanism. Our findings show that, despite the expected moderating

effect of investment characteristics (Heath, 1995; Soman, 2001), one can observe sunk-cost

effects for resources predicted to be hard to book and track. Additional research would be

necessary to better understand the mechanisms driving the differences observed in process

strategies depending on whether behavioral resources are linked to money or not. It could

be the case that linking behavioral resources to monetary values changes both the context of

the task and how the time and effort invested in tracking investments is perceived. Research

into the impact of the task on processing strategies (Gray et al., 2006) suggests that whether

time is judged to be a soft or a hard constraint might have important implications with

respect to one’s attempt to maximize a cost–benefit cognitive relationship based on conserving time or cognitive resources.

Although existing literature on sunk-cost effects is well developed, behavioral sunk-cost

effects remain largely unexplored. Greater understanding of behavioral sunk-cost effects

has not only theoretical but also substantive practical relevance, because most decisions

people make necessarily involve some degree of cognitive effort.

Acknowledgments

Both authors contributed equally to this paper and are listed in reverse alphabetical order.

The authors acknowledge the helpful comments of Chris Janiszewski, D. Eric Boyd, Edward

F. McQuarrie, Erika Mina Okada, Gary Erickson, Shelby McIntyre, Ying Xie, and the participants of the University of Washington research seminar. The authors also thank Megan

E. Hurley, Michelle M. Gill, and Mark G. Staton for their assistance.

M. Cunha, Jr, F. Caldieraro ⁄ Cognitive Science 33 (2009)

113

References

Arkes, H. R., & Blumer, C. (1985). The psychology of sunk cost. Organizational Behavior and Human Decision

Processes, 35, 124–140.

Aronson, E., & Mills, J. (1959). The effect of severity of initiation on liking for a group. Journal of Abnormal

and Social Psychology, 59, 177–181.

Axsom, D. (1989). Cognitive dissonance and behavior change in psychotherapy. Journal of Experimental Social

Psychology, 25, 234–252.

Devoe, S. E., & Pfeffer, J. (2007a). When time is money: The effect of hourly payment on the evaluation of time.

Organizational Behavior and Human Decision Processes, 104, 1–13.

Devoe, S. E., & Pfeffer, J. (2007b). Hourly payment and volunteering: The effect of organizational practices on

decisions about time use. Academy of Management Journal, 50, 783–798.

Garland, H. (1990). Throwing good money after bad: The effect of sunk costs on decisions to escalate commitment to an ongoing project. Journal of Applied Psychology, 75, 728–731.

Gray, W. D., Sims, C. R., Fu, W.-T., & Schoelles, M. J. (2006). The soft constraints hypothesis: A rational analysis approach to resource allocation for interactive behavior. Psychological Review, 113, 461–482.

Heath, C. (1995). Escalation and de-escalation of commitment in response to sunk costs: The role of budgeting

in mental accounting. Organizational Behavior and Human Decision Processes, 62, 38–54.

Karlsson, N., Juliusson, A., Grankvist, G., & Gär, T. (2002). Impact of decision goal on escalation. Acta Psychologica, 111, 309–322.

Rubin, J. Z., & Brockner, J. (1975). Factors affecting entrapment in waiting situations: The Rosencrantz and

Guildenstern effect. Journal of Personality and Social Psychology, 31, 1054–1063.

Soman, D. (2001). The mental accounting of sunk time costs: Why time is not like money. Journal of Behavioral

Decision Making, 14, 169–185.

Staw, B. M. (1976). Knee-deep in the big muddy: A study of escalating commitment to a chosen course of

action. Organizational Behavior and Human Decision Processes, 16, 27–44.

Staw, B. M. (1981). The escalation of commitment to a course of action. Academy of Management Review, 6,

577–587.

Thaler, R. H. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior and Organization, 1, 39–60.

Thaler, R. H. (1985). Mental accounting and consumer choice. Marketing Science, 4, 199–214.

Thaler, R. H. (1999). Mental accounting matters. Journal of Behavioral Decision Making, 12, 183–206.

Thaler, R. H., & Johnson, E.J. (1990). Gambling with the house money and trying to break even: The effects of

prior outcomes on risky choice. Management Science, 36, 643–660.

Whyte, G. (1986). Escalating commitment to a course of action: A reinterpretation. Academy of Management

Review, 11, 311–321.

Zeelenberg, M., & van Dijk, E. (1997). A reverse sunk cost effect in risky decision making: Sometimes we have

to much invested to gamble. Journal of Economic Psychology, 18, 677–691.