STRATEGIC RISK MANAGEMENT Considering financial asset

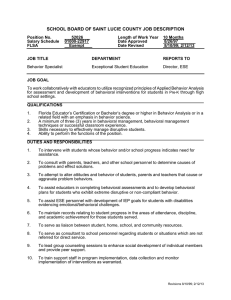

advertisement

STRATEGIC RISK MANAGEMENT Considering financial asset markets we are supposed to distinguish two different sources of riskiness. First, there is the possibility of uncontrollable events (event risk). Second, there is unpredictability of human behavior (behavioral risk). Financial markets are dominated by human behavior. However, the stochastic approach of risk management is ignoring behavioral risk completely, concentrating exclusively on event risk. As a result we observe permanent trouble in banking and financial markets. The reason of this deficiency is the fact that financial risk managers just copy the formulas that are used in natural or “rocket“ science. This is the basic mistake. In order to overcome the deficit we use concepts developed by the theory of behavioral finance. To be more precise, we use basic concepts of game theory. That is what we call strategic risk management. Currently, there is no fully developed concept existing. I hope there are students in class with some practical understanding. That can help to find partial solutions. Timing: december 3 to 6, 2014