January Commentary

advertisement

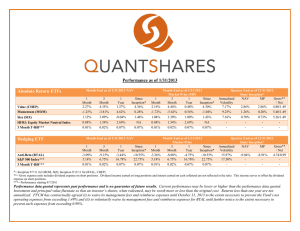

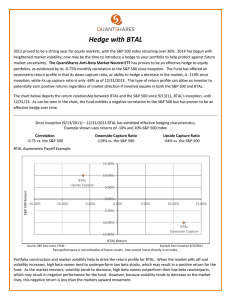

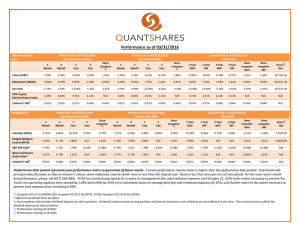

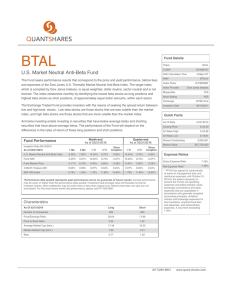

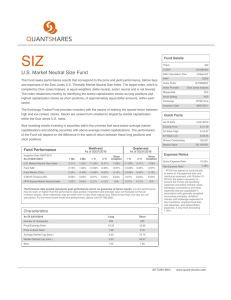

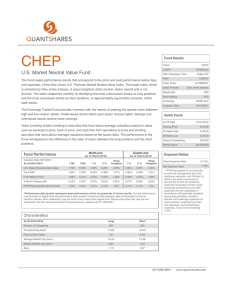

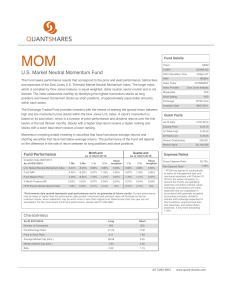

January Commentary The January Effect held true in 2012, with low-quality and high-risk assets performing well. Both high beta names and small caps were rewarded as the market shook off some of the concerns that took hold in 2011, when the global macro environment soured. The market leadership from high beta and small cap comes as a complete reversal from 2011, where high beta and small caps were both victims of a downturn in the global economy. QuantShares Market Neutral High Beta Fund (BTAH) performed well up 8.31% for the month of January, driven largely by performance in the long holdings. QuantShares Market Neutral Size Fund (SIZ) continued to show consistent performance, up in every time period since inception, as small caps rebounded during the outset of 2012. The QuantShares Market Neutral Value Fund (CHEP) continues to show consistent positive returns with low volatility. The Fund was up 1.11% in January and is up 4.76% since inception (9/13/2011) with annualized volatility of 8.28%. The Fund has had positive returns in each of the five months it has been open. The quality trade, the best performing investment style of 2011, fell victim to an increasing appetite for risk and continues to trail as the broader market advances. Low beta names, which were adopted for their risk mitigating characteristics in 2011, were shunned in January as investors adjusted their portfolios for higher beta securities. Both the QuantShares Market Neutral Quality Fund (QLT) and Anti-Beta (BTAL) posted monthly losses, which are consistent with this reversal in trends from 2011 to 2012. Momentum, a long driver of market performance, has yet to adopt its leadership position as we continue to see new names propel the market higher. Consistent with this theme, the QuantShares Market Neutral Momentum Fund (MOM) has lagged (-1.97%), as last year’s underperforming stocks rallied in January, while its mirror, the QuantShares Market Neutral Anti-Momentum Fund (NOMO), was up 1.77% for the month. 2012 Outlook 2012 promises to be another volatile year both domestically and abroad. The United States faces a presidential election, so governing amid that backdrop will prove challenging even for the most seasoned politicians. Europe has unfinished business in addressing their ongoing debt crisis which has pit the northern European vs. the southern European economies. Emerging market economies continue to grow and have begun the transition from export driven to more consumer driven economies. Only time will tell if the transition will happen smoothly or if we will see another wave of uprising closely resembling the “Arab Spring” that took hold in 2011. The QuantShares line-up of Market Neutral ETFs is positioned to perform even in the face of an ever changing global landscape, due to their uncorrelated return profile to the broader market and their ability to capture persistent market premiums with lower volatility. January 2012 Performance Strategic ETFs Month-End as of 01/31/2012 NAV 1-Mo 3-Mo Value (CHEP) Quality (QLT) 1.11% -0.83% Size (SIZ) Russell 1000 Index** 3 Month T-Bill** Tactical ETFs 1-Mo 3-Mo 1.24% -2.54% Since Inception 4.76% -3.20% 1.78% 0.21% 0.64% 1.45% 2.10% 4.87% 0.00% 5.47% 0.00% 13.62% 0.00% 3-Mo 8.31% -1.97% -7.59% 1.77% Russell 1000 Index** 3 Month T-Bill** Quarter End as of 12/31/2011 Since Inception* NAV MP 3.11% -1.37% Since Inception 5.50% -2.20% Annualized Volatility 8.28% 7.11% 3.62% -2.40% 3.66% -2.40% 2.50/.99 2.50/.99 0.00% 0.49% 1.01% 9.54% 1.45% 1.01% 2.97/.99 4.87% 0.00% 5.47% 0.00% 13.62% 0.00% 25.25% - - - - Month-End as of 01/31/2012 NAV 1-Mo High Beta (BTAH) Momentum (MOM) Anti-Beta (BTAL) Anti-Momentum (NOMO) Month-End as of 01/31/2012 Market Price (MP) Month-End as of 01/31/2012 Market Price 1-Mo 3-Mo 1.26% -4.69% -2.50% 2.91% Since Inception 7.86% -4.04% -11.27% 1.14% 8.91% -0.08% -6.08% 3.22% 4.87% 5.47% 13.62% 0.00% 0.00% 0.00% Quarter End as of 12/31/2011 Since Inception* NAV MP Gross/Net 2.80% -2.65% -0.63% 3.78% Since Inception 8.02% -1.99% -10.05% 2.33% Annualized Volatility 21.31% 10.30% 22.73% 9.54% Gross/Net -0.41% -2.12% -3.98% -0.62% -0.81% -1.91% -4.23% -0.86% 3.27/.99 2.79/.99 1.92/.99 2.07/.99 4.87% 5.47% 13.62% 25.25% - - - 0.00% 0.00% 0.00% - - - - *= Inception 9/7/11 for (MOM, NOMO, QLT, SIZ); Inception 9/13/11 for (BTAH, BTAL, CHEP) **=Performance starting 9/7/2011 Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment and principal value fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Returns less than one year are not annualized. Since the Funds are new, the Operating expenses are based on first year anticipated Assets Under Management growth. FFCM has contractually agreed to waive fees and expenses to limit net expenses from exceeding.99% until August 31, 2012 Company Overview: QuantShares designs and manages Market Neutral ETFs to provide exposure to well-known equity factors such as Momentum, Value, Quality, Beta and Size. QuantShares Market Neutral ETFs are the first ETFs that have the capability to short physical stocks (as opposed to derivatives) that passively track indexes. Our ETFs offer investors a diversifying asset that is both highly liquid and fully transparent. The ETFs are designed to generate spread returns, diversify risk and reduce volatility. Value, Size and Quality tend to be more strategic in nature and provide strong risk-adjusted returns; Beta and Momentum are more tactical and allows investors to hedge or express short term investment convictions. QuantShares Market Neutral ETFs provide a liquid alternative to help dampen volatility and enhance the risk return profile of an investment portfolio. Disclosures: Before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other information is in the prospectus, a copy of which can be obtained by visiting the Fund’s website at www.quant-shares.com. Please read the prospectus carefully before you invest. Foreside Fund Service, LLC, Distributor. Shares are not individually redeemable and can be redeemed only in Creation Units. The market price of shares can be at, below or above the NAV. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00PM Eastern time (when NAV is normally determined), and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the possible loss of principal amount invested. See prospectus for specific risks regarding each Fund. There is a risk that during a “bull” market, when most equity securities and long only ETFs are increasing in value, the Funds’ short positions will likely cause the Fund to underperform the overall U.S. equity market and such ETFs. The Funds may not be suitable for all investors. Short selling could cause unlimited losses, derivatives could result in losses beyond the amount invested, and the value of an investment in the Fund may fall sharply.