A t a glance Your RRSP:

advertisement

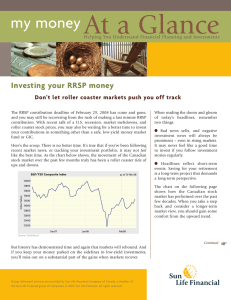

A t a glance Helping You Understand Financial Planning and Investments Your RRSP: Top seven questions for 2007 You’ve likely heard the benefits of contributing to a RRSP before, but this is one strategy that’s worth repeating – the benefits of contributing to a Registered Retirement Savings Plan (RRSP) are tough to beat. Here are two key reasons why everyone keeps talking about RRSPs: ● All contributions up to your contribution limit are fully tax-deductible. ● Your RRSP investment earnings grow tax-free until you withdraw the money. If you have unused contribution room remaining for the 2006 tax year, we hope that the questions and answers below help you see the advantage of putting some of that contribution room to work for your future. 1. How can I make a RRSP contribution when I have no money to do so? The easy answer is to commit now to making regular contributions in small amounts. You will hardly notice a small deduction from each pay cheque, and by year-end, you’ll have contributed a sizeable amount. If you have a Group RRSP at work, you can arrange to make regular contributions in a matter of minutes. So avoid the last minute RRSP savings frenzy and get regular with your contributions. 2. I have a Group Savings Plan at work. Isn’t that enough for my retirement? Your group savings or pension plan at work can form a key foundation for your retirement savings. But few workplace plans are designed to provide all of the retirement income you’ll need. Each Group plan varies significantly. Let’s assume your plan provides 40% of your needed retirement income (a reasonable projection in many cases), with government programs such as the Canada/Quebec Pension Plan and Old Age Security providing 30%. Depending on your retirement goals, you will need to replace your working income by 60-80%. That’s why saving through your RRSP can be so important. Continued ☛ A 3. t a glance Helping You Understand Financial Planning and Investments Don’t be scared by the million dollar headlines. Most people need far less. Just focus each year on maximizing your RRSP contributions as much as possible, investing wisely, and patiently growing your savings. You’ll be amazed at how much you’ll save over time. 4. • Permanent loss of contribution room. When you withdraw funds from an RRSP, you permanently lose the contribution room that you originally used to make your deposit. While you can continue making your maximum contribution to your RRSP in the future, you are not allowed to re-contribute the amount you withdrew. How do I know how much I need to save – I keep hearing it’s a million dollars or more! I’m busy with a mortgage and raising a family – can’t I catch up later? 6. What’s the big deal about RRSPs and tax savings? 7. How much can I contribute this year? Yes, you can catch up to some extent, but time can be the biggest factor in how your investment grows. The sooner you get your money in your RRSP, the more time your investments will have to compound, or earn interest on the interest. This can make a big difference to your retirement savings. And of course, catching up on your RRSP contributions only gets more difficult over time. The longer you delay, the larger your contribution carry-forward becomes, and the more difficult it becomes to reach your maximum contribution and achieve your financial goals. If you’re torn between making a mortgage pre-payment and contributing to your RRSP, consider splitting the difference and doing both. You could make a lump sum RRSP contribution and then use the tax refund to pay down your mortgage. 5. Will my retirement savings really take a hit if I use a little of my RRSP savings now for other purposes? The short answer is yes. Here’s why: • Loss of tax-sheltered earnings. Early withdrawals of RRSP savings can cost you big time. For example, if you withdraw $6,000 from your RRSP – and your remaining RRSP assets earn a seven per cent return each year for the next 25 years – your RRSP could be worth $32,000 less than if you hadn’t made the withdrawal. • Immediate tax liability. Any withdrawals from your RRSP are immediately subject to withholding tax – from 10 per cent to 30 per cent depending on the amount of the withdrawal. And if your marginal tax rate is higher than the withholding tax rate, you’ll have to pay additional tax at year-end on the funds you’ve withdrawn. The taxes you save with RRSP contributions are both real and significant. Here’s an example: Let’s say your marginal tax rate is 35 per cent (in many provinces that means you’re making between $40,000 to $60,000 a year). Every dollar invested in your RRSP will save you about 35 cents. That means a $9,000 contribution will reduce your tax bill by $3,150. You still have the $9,000 invested in your RRSP, earning tax-free income, and you’ve got $3,150 in your pocket that you otherwise wouldn’t have. As the pre-retirement youth of today might say – that’s sweet. For the 2007 tax year, you can contribute 18 per cent of your 2006 earned income, to a maximum of $19,000, less any pension adjustment. The contribution limit will increase $1,000 each year, from $19,000 in 2007 to $22,000 in 2010. Make your move to a brighter retirement If you’ve got RRSP contribution room still available, it pays to use it as soon as you can. Remember, unlike depreciable assets such as cars or household goods, your RRSP is an asset that appreciates over time. An RRSP contribution is an investment in your future financial security – and it’s an asset you’ll appreciate more and more as you approach retirement. i If you have a general question or suggestion about this newsletter, please send an e-mail to can_pencontrol@sunlife.com or write to At a Glance Newsletter, Group Retirement Services Marketing, Sun Life Financial, 225 King Street West, 14th floor, Toronto, ON M5V 3C5. Group retirement services are provided by Sun Life Assurance Company of Canada, a member of the Sun Life Financial group of companies. © 2006, Sun Life Financial. All rights reserved.