Common Savings Plan

advertisement

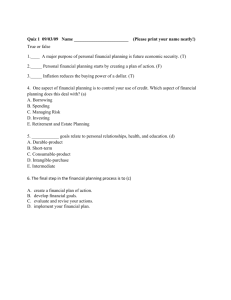

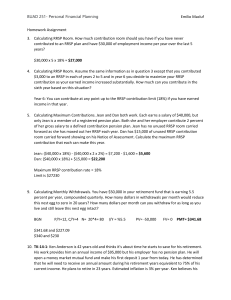

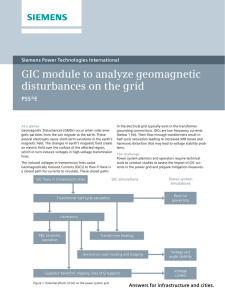

Common Savings Plan Read pages 441-445 & Complete the summaries. How are all the savings plans similar? • Intended for people who don’t plan on withdrawing the money very often • Easy to open • Pay a fixed rate of interest • Protect your money against loss Here are the main types of savings plans: 1. Savings Account • Often require a minimum monthly balance before paying interest • Rate of interest varies • Lowest rate of interest compared with other investments 2. Term Deposits and Guaranteed Investment Certificates (GIC’s) • Deposit a fixed sum of money for a specific length of time (30 days to 5 years) at a certain rate of interest Term Deposits – discuss the length and relationship to interest rates • The shorter the term, the greater the deposit required and the lower the interest rate e.g. 1 year 0.4% 3 years 1.6% 5 years 2.1% a) How are Term Deposits different from GIC’s? •Term deposits can be cashed-in early, GIC’s can’t- Fixed Term 3. Registered Retirement Savings Plan (RRSP) • Encourages people to save for retirement • Don’t have to pay tax on the money you put in an RRSP • You have to pay tax on the money when you withdraw it (hopefully at retirement) Registered Education Savings Plan (RESP) • Encourages saving for a child’s postsecondary education • Income earned grows tax free until child withdraws it • Government contributes $400 for the first $2000 contributed each year Using The Internet; explain the following: • Canada Savings Bond • A loan made by you to the government of Canada, which they pay back with interest • Cash out any time • Corporate Bond • A loan made by you to a corporation, which they pay back with interest. • TFSP – Tax Free Savings Account • Started in 2009, any Canadian resident over the age of 18 can put up to $5000 a year into the TFSP • Money earned on investment in the account will be tax-free meaning you’ll be able to withdraw money WITHOUT paying tax Define the following terms: • Liquidity- The ability to convert an asset or investment into cash quickly and easily • Risk- how safe it is to put money into an investment • Rate of return- Interest expressed as a percent of the original investment, also called yield Liquidity __________________________________________________ Risk: __________________________________________________ Rate of Return: _____________________________________________ Investment Risk? Liquidity? Rate of Return/Yield? Savings Accounts Excellent Excellent Poor Excellent Good Fair Excellent Fair Good to very good Excellent Poor to fair Good to very good Excellent Poor to fair Good CSBs Excellent Good Good Corporate Bonds Excellent Very good Fair to good Term Deposits/ Cashable GICs Non-cashable GICs RRSPs RESPs TFSA Common Stocks Preferred Stocks Mutual Funds Real Estate Collectibles Investing in a Business Good to very good Good Good Fair Good Poor to Excellent Fair to good Good Good to very good Fair to good Good Fair to excellent Fair to Excellent Poor Fair to Excellent Poor to Excellent Fair Poor to Excellent Poor to Excellent Poor Poor to Excellent