Topic 4: Financial markets and the macroeconomy: portfolio model with money

advertisement

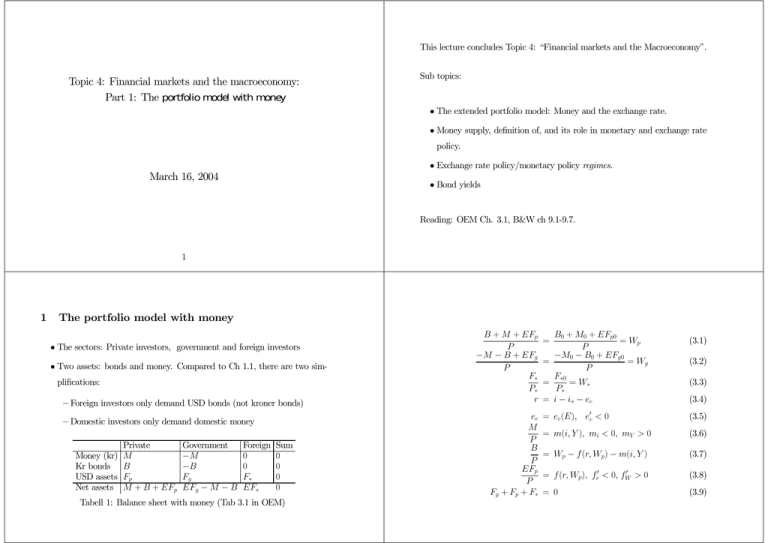

This lecture concludes Topic 4: “Financial markets and the Macroeconomy”. Topic 4: Financial markets and the macroeconomy: Part 1: The portfolio model with money Sub topics: • The extended portfolio model: Money and the exchange rate. • Money supply, definition of, and its role in monetary and exchange rate policy. • Exchange rate policy/monetary policy regimes. March 16, 2004 • Bond yields Reading: OEM Ch. 3.1, B&W ch 9.1-9.7. 1 1 The portfolio model with money • The sectors: Private investors, government and foreign investors • Two assets: bonds and money. Compared to Ch 1.1, there are two simplifications: — Foreign investors only demand USD bonds (not kroner bonds) — Domestic investors only demand domestic money Private Money (kr) M Kr bonds B USD assets Fp Net assets M + B + EFp Government −M −B Fg EFg − M − B Foreign 0 0 F∗ EF∗ Sum 0 0 0 0 Tabell 1: Balance sheet with money (Tab 3.1 in OEM) B + M + EFp P −M − B + EFg P F∗ P∗ r ee M P B P EFp P Fg + Fp + F∗ B0 + M0 + EFp0 = Wp P −M0 − B0 + EFg0 = = Wg P F∗0 = = W∗ P∗ = i − i∗ − ee = = ee(E), e0e <0 (3.1) (3.2) (3.3) (3.4) (3.5) = m(i, Y ), mi < 0, mY > 0 (3.6) = Wp − f (r, Wp) − m(i, Y ) (3.7) 0 >0 = f (r, Wp), fr0 < 0, fW (3.8) = 0 (3.9) Endogenous: Wg , Wp, W∗, F∗,Fp, r, ee + 3 depending on regime. (note: 10 endogenous variables, not 12, since only 10 independent equation, explained on page 65 in OEM). Exogenous: i∗, Y, P, P∗, M0, B0, Fp0, Fgo,F∗ Regime Fixed exchange rate I Fixed interest rate II No sterilization III Full sterilization Floating exchange rate IV Fixed interest rate V No sterilization VI Full sterilization Exogenous Endogenous E, i E, B, E, M Fg , M, B Fg , i, M Fg , i, B Fg , i Fg , B Fg , M E, M, B E, i, M E, i, B Tabell 2: Policy regimes (Tab 3.2) We interpret the exogenous variables in the table as either targets of monetary policy, or instruments which are “set aside” to attain other target variables, which are not specified in the portfolio model. We will not analyse in detail all 6 regimes, leave that to ECON 4330. Will instead spend some time on regime III, and then concentrate on the float Money supply and sterilization Money demand is represented in the model by a separate equation. regimes. But first, need to clarify money supply and sterilization What about the supply of money? Being a stock variable, total money supply is unaffected by e.g., the government surplus/deficit (flow) in the short run. The portfolio model is a short run model, still some of the regimes in table 2 has M as endogenous? Is this an inconsistency? The answer is no, since money supply is linked to other stock variables. Definition: Sterilization Consider (3.2): −M − B + EFg −M0 − B0 + EFg0 = = Wg P P Assuming a fixed exchange rate regime, and noting that P and Wg are constants within the short period of the model, we derive form (3.2): (3.10) dM = E dFg − dB where dM = M − M0, dFg = Fg − Fg0 and dB = B − Bg0. The degree of sterilization in monetary policy denotes how much B is changed (by market operations) when there is a change in Fg . Formally, dB EdF g s = 1: Full sterilization. s = 0: No sterilization. s= Regime II (fixed): The link dFg → dM is not sterilized by increased bonds sales, i.e., (3.10) is the fundamental money-supply function of an open economy: It links money supply to changes in other stocks. In particular: if the supply dB =0 EdFg of domestic bonds is fixed (dB = 0), there is a direct link to from foreign Regime III (fixed): The link is broken (dFg 9 dM), i.e., domestic money currency reserves to the money supply. supply is “insulated” from the market for exchange rate. dB =1 EdFg Regime V and VI, (float) are equivalent as long the there is a “clean float”. What kind of money? As long as dFg = 0, constant M is only possible with B constant (and vice versa). Economists use several definitions of money. M in the portfolio model can be interpreted in two ways: However, for a managed float, with interventions i) As the stock of base money, M0, notes and coins issued by the central bank, or • Regime V: dM = EdFg • Regime VII: dM = 0 and dB = EdFg (s = 1). ii) since one function of private bank is to create money, we can also reason as if M corresponds to a broader definition of money, M 1, M2 or M3. The second, and more interesting, interpretation builds on the money (and credit) multiplier: The basic intuition is that each time a bank issues a loan, reserve requirements also creates a deposit (which goes into the wider money measures). B&W’s chapter 9, makes for interesting, cursory reading on this subject. Solving the model: A two step procedure Step 1: Determining the interest rate 1. Find out how the interest rate is determined. Regime I and IV: i is exogenous. Either it is a target variable on its own, 2. Given the solution for the interest rate, find the solu- or it is determined outside the model, for example it is used as an instrument tion for E or Fg from the equilibrium condition in the to attain some other target variable, not specified in the portfolio model. market for foreign exchange. Regime III, V and VI (clean float): i is determined in the money market M = P m(i, Y ) (3.12) with M exogenous. Cf Figure 3.2. (See appendix for Regime II, fixed without sterilization) Step 2: The market for foreign exchange (and overall equilibrium). For a given equilibrium level (or exogenous as in R I and IV), Fg , or E,is determined by the equilibrium condition (3.14) Fg = −F∗0 − P B0 + M0 + EFp0 f (i − i∗ − ee(E), ) E P (we have used F∗ = F∗0). Note that ∂Fg >0 ∂E under the same set of condition as in the simplest model (OEM Ch. 1). Note also that P ∂Fg = − fr > 0, relevant for fix-regimes ∂i E P fr ∂E = < 0, relevant for float ∂i (1 − fW )Fp0 + P e0efr ∂E/∂i is achieved by implicit derivation of (3.14), and is the slope of the Ei-curve introduced in the lecture on the model without model (see appendix B for derivation in the present version of the model) . 2 Examples of monetary policy analysis Hence, in order to increase M by 1bill, the CB needs to buy bonds for more than 1bill, since reserves are worn down (dFg /dM < 0) when the S-curve of Regime III foreign currency is shifted leftwards: Assume that the government wants monetary expansion (e.g., to stimulate (3.21) the real economy). In this regime: Uses market operations to achieve an increase in the targeted dFg dFp dF∗ P di 1 fr <0 = −[ + ] = − fr =− dM dM dM E dM E mi Role of capital mobility: From (3.21) dFg 1 fr =− dM E mi money supply (consistent with this, M is exogenous, while B, the instrument is endogenous). → −fr0 →∞ −∞ implying that full sterilization is a logical impossibility when capital mobility Effect on i from money market equilibrium (3.12) is perfect: The central bank cannot control the money supply. di 1 < 0. = dM P mi Effect on B: Money supply function implies dB = EdFg − dM, and If there is full capital mobility: monetary policy becomes ineffective. (3.19) (3.20) dB dFg =E − 1 < −1 dM dM Regime V/VII, clean float An important “left out” regime dM > 0 is achieved by market operations dB = −dM . The book does not cover one of the regimes that characterized both Sweden Effect: i & (money market) and E % (market for foreign exchange). of both Fg and E exogenous with i endogenous and M endogenous. Effect on E depend on degree of capital mobility (how?) and Norway in the 1990s (as well as many other countries): namely the case This allows maintaining fixed E as target, while freezing Fg at a certain level. In the model, i is determined by the equilibrium condition for the market for An appendix provides a cursory analysis of “dirty float” regimes. foreign exchange. Graphically, the regime can be analysed using the Ei-curve along with a the money-market graph. (Short-run) interest rates can become high during periods of speculative attack (cf graphs of Swedish and Norwegian interest rates in 1992). Model formulation with perfect capital mobility 3 No rationale for separate asset demand functions. The models reduces to In the portfolio model, the interest bearing asset is labelled “bonds”. However M = m(i, Y ), mi < 0, mY > 0 P r = i − i∗ − ee(E) = 0 Short-term and long-term interest rates little “bond specificity” in the formal model. Bonds are like ordinary (short) (3.22) bank deposits. (3.23) with i and M endogenous in a fixed exch rate regimes, and i and E endogenous in a float regime. Which regimes can be operational in this case? 1. Using the interest rate to target E (requires e0e 6= 0) 2. Clean float, with M−targeting 3. Dirty float with interventions (see an appendix). 4. Clean float with targeting of some variable outside this model (e.g., in- OK simplification for many purposes, e.g., for understanding the relationship between domestic money market and market for foreign exchange. But in practice loans and credits have different maturities (short and long), and the long maturities are important for decisions that affect consumption, employment and investments in real capital. Reference: B&W 19.3.1. flation). i as instrument. Role of bonds in the economy Bonds markets are important to the operation of monetary policy–transforms changes in short interest rates to changes in long interest rates (mortgages, Bonds are stores of wealth (like deposits, money, residential and productive capital). Unlike a bank deposit, bonds are fixed income assets–the return (yield) is variable. Bond yields are therefore responsive to changes in money-market interest rates (the interest rate most directly controlled by economic policy). Market equilibrium in asset markets secures transmission of changes in yields on to other interest rates (not necessary equalization, because of different risk characteristics and market inefficiencies etc.). and business credits). Bond price and yield (3.1) defines P as the present value of all future fixed payments. Bonds can be sold and resold (a market for the stock of outstanding bond If you buy a bond. you hold a piece of paper that gives you the right to receive debt) a cash flows (payments) at specified dates in the future, and for a specified Conversely, if P is determined by supply and demand, (3.1) defines the yield as period of rime. the average rate of return that you get from owing the bond from “today” and The periodic payments are called coupons , C below. In addition you will get to maturity (therefore expressions like “yields to maturity” or “redemption a final payment of the face value, F , in the period when the bond matures. yield” are often heard). If the yield on a bond is y and there are n periods (left) maturity, the price, P , of the bond is defined by: (3.1) C C F C P = + ... + + + 1 + y (1 + y)2 (1 + y)n (1 + y)n where we assume that the fist coupon is paid exactly one year (12 months) P and y are negatively related. The relationship is nonlinear Special case (a consol): F = 0 and long maturity (n → ∞), 1 P = . y from now. y is thus yield per year. (Hint: Use result for infinte sum with geometric weights, and correct for the The yield curve fact that “the first term of the sum” is missing from (3.1). The fact that there are markets for bonds with different years to maturity means that there is a functional relationship between (annualized) yields and years to maturity: yn = f (years to maturity) where yn is the yield of the a bond with maturity n (1 month, 3months, 1 year, ....,90 years). The graphs of of this function is called the yield curve. The markets change rapidly, so it only makes sense to talk about a yield curve on any specific day. They are also reported daily by (business) newspapers, and their shape is given a lot of attention by economics. The reason is that the yield curve is believed to embody the markets response to policy-changes (and other shocks), and even anticipations of future policychanges. Upward sloping yield curve: Expectations of interest rate increases in the Illustrating the expectations theory of the yield curve Current and expected Bond maturity money market interest rate: % today 1 year ahead 3 4 12-months 1-year 2 years ahead 5 2-year 3 years ahead 6 3-year 4 years ahead .... Many years ahead 6 6 4-year ... Long yield 3 (3+4) 2 (3.5+ 4+5 2 ) 2 (3.5+4.5+ 5+6 2 ) 3 (3.5+4.5+5.5+ 6+6 2 ) 4 ... 3 = 3.5 = 4 = 4.5 = 4.9 ... ≈ 6 Behaviour of bond rates over time future. The theory of the yield curve suggests that, even though the yields curve Downward sloping: Expectations of interest rate cuts. changes from day to day, there will also be a positive relationship between For an example of how expectations about future interest rates are “backed short terms interest rates and average bond yields over a longer period of out” of observed yield curves, see Norwegian National Budget 2004. time. But such procedures hinges on a strong ceteris paribus clause, since yield Such a relationship is what transmits policy motivated changes in short in- curves also depend on other factors than just expectations about short-term terest rates on to interest rates on mortgages and business credit. interest rates. For example inflation, which is not 1-1 with interest rate setting and the possibility that risk is linked to maturity. Regressions on Norwegian data for the period 1990(1)-2001(4) confirm that a relationship exists: 1 pp increase in money market rate increases 6-month average bond yield by 0.34 pp However: Foreign bond yields even more important, see copy of PcGive out- A Interest rate determination in Regime II file. Over the same period, the empirical relationship between bond yield and i is determined in the domestic bonds market: The equilibrium condition average interest on bank loan is very strong, almost 1 to 1. follows from (3.1), (3.4) and (3.5) and (3.7) (3.13) B M0 + B0 + EFp0 M0 + B0 + EFp0 = −f (i−i∗ −ee(E), )−m(i, Y ). P P P The right hand side of (3.12) defines the demand function B d = B(i, E, Y, P, i∗, B0, M0, Fp0), Bi > 0, which is increasing in i: The higher i, the less demand for foreign exchange, and the less demand for money. Formally ∂B d = −P (fr + mi) > 0 ∂i B The slope of the Ei-curve Solving for ∂E/∂i, and noting that Fp = P f (r, WP )/E and setting Fp = Fp0 (since both Fg and F∗ are constant), we obtain P fr ∂E < 0. = ∂i (1 − fW )Fp0 + P e0efr In the basic portfolio model (previous lecture) we derived the partial derivative ∂E/∂i from the derivatives for Si and SE of the supply function of In terms of the model in Chapter 1 of OEM: foreign currency. Here we calculate ∂E/∂i from (3.14). Of course, the two approaches amount to the same thing, as the underlying relationship is the γ = (1 − fW ) market equilibrium condition. Some details: Implicit derivation of (3.14) κ = −fr , gives: 0=− " P f (r, Wp) ∂E ∂i E2 ½ ¾# P Fp0 ∂E 0 ∂E + fr (1 − ee ) + fW E ∂i P ∂i EFp0 , P thus −P κ ∂E = ∂i (1 − fW )Fp0 EP EP − P e0eκ −κ = 1 γ E − e0eκ −1 = γ 0 κE − ee • “minus”, since dM = −dB, from the money demand function (3.10), the same expression as in (1.24). dM > 0 =⇒ dB < 0. C • The market equilibrium glides down along the B d-curve in Figure 3.2 in Monetary policy: Fixed exchange rate without sterilization The money supply is not controlled (M is endogenous). Monetary expansion means that the government succeed in reducing private net stocks of bonds: The central banks buys bonds from the public (“open market operation”). − Assume that the initial increase in M was 1billion (if dB = −1bill). In the new equilibrium: dM mi 1 = P mi = <1 dB P (fr + mi) (f r + mi) since Fg is reduced to restore equilibrium in the market for foreign exchange. (3.17) − dFg dM fr = −[ + 1] = −[ ] < 0. dB dB (fr + mi) (Supply of foreign currency is reduced by i &. In order to keep E constant, The effect on i is found from (3.13) (3.16) OEM. (3.18) di 1 = <0 dB P (fr + mi) − Fg must fall by the same amount). In the analysis of Regime III, full sterilization, we saw that monetary policy D Dirty float regimes had no effect on the interest rate if capital mobility is perfect. How is the regime with no attempt to sterilise affected? From (3.17) − dM mi = dB (fr + mi) → −fr →∞ 0. since −fr → ∞ means that Fg falls by the same amount as Bs. From (3.18): −E This supplements the discussion of the case of a clean float above: dFg fr 1 = −[ ] = −[ ] → −1. dB (fr + mi) (1 + mi/fr ) −fr0 →∞ Intervention without sterilization dM = EdFg > 0 and dB = 0. Leads to i & and E %. Foreign exchange Hence, again as a result of the link between foreign currency reserves and the market: Negative horizontal shift in the S-curve, and demand increases. Both money supply, perfect capital mobility makes monetary policy ineffective also imply higher E (depreciation). The policy work also with high capital mobil- in Regime II. Formally: ity, since i is affected. − di 1 = dB P (fr + mi) → −fr0 →∞ 0 Sterilized intervention dB = EdFg > 0, dM = 0. No change in i. But E % since Fg increases (demand for foreign exchange). Perfect capital mobility takes away the effects of sterilized interventions, the S-curve becomes horizontal..