Potential Impact Sugar-Sweetened Beverage

advertisement

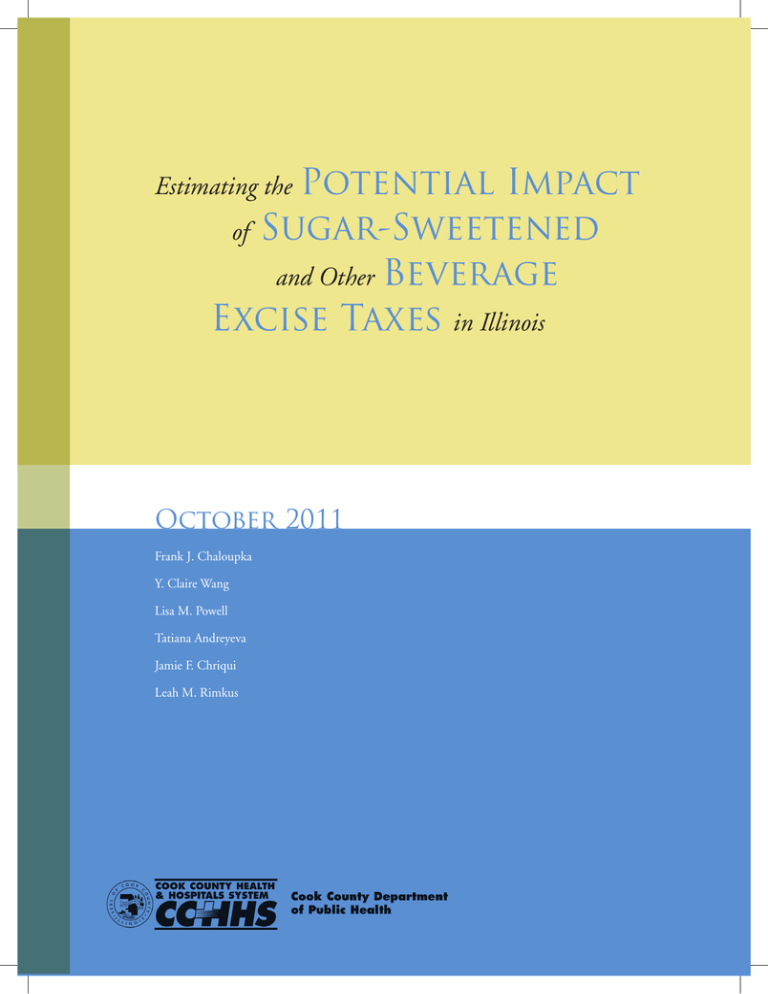

Potential Impact of Sugar-Sweetened and Other Beverage Excise Taxes in Illinois Estimating the October 2011 Frank J. Chaloupka Y. Claire Wang Lisa M. Powell Tatiana Andreyeva Jamie F. Chriqui Leah M. Rimkus October 2011 Frank J. Chaloupka 1 Y. Claire Wang 2 Lisa M. Powell 1 Tatiana Andreyeva 3 Jamie F. Chriqui 1 Leah M. Rimkus 1 1 Health Policy Center, Institute for Health Research and Policy, University of Illinois at Chicago. 2 Department of Health Policy & Management, Mailman School of Public Health, Columbia University 3 Rudd Center for Food Policy & Obesity, Yale University. Executive Summary Over the past few decades, obesity rates in the United States have risen rapidly, with recent estimates indicating that more than one-third of adults are obese, up from less than one in seven in the early 1960s, with another one-third overweight. Recent estimates for children and adolescents show that more than one in six is obese, more than triple the rate of the early 1970s. Illinois is experiencing the same rise in obesity. Between 1995 and 2009, the prevalence of obesity among Illinois adults rose by nearly 65 percent, from 16.7 percent to 27.4 percent, with another 37.1 percent overweight in 2009. Similarly, more than one in five Illinois youth ages 10 through 17 were obese in 2007, and more than one in three were overweight or obese. The sharp rise in obesity has resulted from a change in the ‘energy balance’ – more calories being taken in than expended. Many factors have contributed to this imbalance, from increased caloric intake following reductions in the prices of energy dense foods and beverages to fewer calories expended as technological changes reduced physical activity. Among these, the parallel rise in calories consumed from sugar sweetened beverages (SSBs) has drawn particular attention. SSBs include carbonated soft drinks, sports drinks, fruit drinks, flavored waters, sweetened teas, ready-to-drink coffees, and other non-alcoholic drinks containing added sugars. One recent study concludes that SSBs account for at least twenty percent of the increases in weight in the United States from 1977 through 2007. The increasing recognition of the role of SSBs in contributing to the growing obesity epidemic has spurred interest in policy and other interventions that aim to reduce SSB consumption. Given the demonstrated effectiveness of increased tobacco taxes in reducing cigarette smoking and other tobacco product use, many have proposed SSB taxes that would lead to sizable increases in prices as a promising policy option for curbing obesity and its health and economic consequences. To date, however, existing taxes are mostly small sales taxes that are applied to both sugar-sweetened and diet beverages. In Illinois, the state’s 6.25 percent sales tax is applied to many beverages, including: regular and diet sodas; juice drinks containing 50 percent or less real juice; sweetened, ready-to-drink teas; and sports drinks and other isotonic beverages. Research assessing the impact of the small taxes applied in many states generally finds that they have modest effects on beverage consumption and a limited impact on weight. At the same time, estimates from these studies suggest that sizable taxes that result in large price increases would, by sharply reducing SSB consumption, have a substantial impact on the prevalence of obesity at the population level. This report was made possible by funding through the Department of Health and Human Services: Communities Putting Prevention to Work (CPPW) grant. CPPW is a joint project of the Cook County Department of Public Health and the Public Health Institute of Metropolitan Chicago. 1 Given the potential for SSB taxes to reduce obesity, we use the best available data and research-based evidence to estimate the impact of alternative beverage taxes in Illinois. Specifically, we consider four alternative beverage taxes – a one cent per ounce excise tax on SSBs and their diet versions (‘all beverages’); a one cent per ounce excise tax on SSBs only; a two cent per ounce excise tax on all beverages; and a two cent per ounce excise tax on SSBs only. Using recent data, we predict their impact on overall beverage consumption, tax revenues, age and gender-specific frequency of SSB consumption, average daily caloric intake, body weight, body mass index (BMI), obesity prevalence, diabetes incidence, and health care costs of diabetes and obesity. The table below summarizes our estimates. Table 1 Estimated Impact of Alternative Beverage Excise Taxes, Illinois, 2011 Reduction in Health Care Costs of Diabetes Reduction in Number of Obese Youth (2-17) Reduction in Number of Obese Adults (18+) Reduction in Number of Obese Illinoisans Reduction in Diabetes Incidence 1 Cent - All 6.2% 3.5% 123,418 2,294 $13.8 $100.5 $876.1 1 Cent SSBs Only 9.3% 5.2% 185,127 3,442 $20.7 $150.8 $606.7 2 Cents - All 12.3% 7.0% 246,836 4,591 $27.6 $201.0 $1,419.6 2 Cents SSBs Only 18.5% 10.5% 370,253 6,885 $41.3 $301.6 $839.3 (millions) Reduction New Tax in Obesity- Revenues Related (millions) Health Care Costs (millions) In 2011, we estimate that Illinoisans will consume more than 620 million gallons of SSBs, and almost 200 million gallons of diet alternatives. We estimate that a one-cent per ounce tax on SSBs only would lead to about a 23.5 percent drop in SSB consumption, while generating more than$600 million in new revenues. A higher tax would lead to even larger declines in consumption and increases in revenues; a broader based tax on all beverages would have a smaller impact on SSB consumption while generating more revenue. Similarly, the reductions in SSB consumption that would result from a tax on SSBs will lead to reductions in weight. Using the relatively conservative assumption that half of the reduction in caloric intake from SSBs following an SSB tax is offset by increases in caloric intake from other sources, we estimate that a one-cent per ounce tax on SSBs only will reduce average weight among Illinoisans by about 1.7 pounds, with larger reductions in the younger and male populations that are heavier consumers. We estimate that these reductions in weight will lead to reductions in the prevalence of obesity in Illinois. For example, we estimate that a one-cent per ounce tax on SSBs only will reduce obesity prevalence among Illinoisans two years and older from 25.2 percent to 23.7 percent – a drop of over 185,000 in the number of obese persons in the state. Almost one-quarter of the drop – more than 45,000 – would be among children ages 2 through 17 years. Again, a higher tax on SSBs would lead to a larger decline in weight and obesity, while a broader based tax on all beverages would have a smaller impact. Additionally, given the significant costs of treating the diseases caused by obesity, we estimate that the reductions in the number of obese Illinoisans following a tax on SSBs would lead to reduced health care spending in the state. For example, we estimate that a one-cent per ounce tax on SSBs only would reduce obesity-related health care costs by more than $150 million in the first year. Given that a sizable share of the obesity-related health care costs in Illinois are paid for by publicly funded insurance programs, an SSB tax will not only raise new revenues for the state, but it also will reduce state Medicaid spending. Given the continued reduction in SSB consumption following the alternative beverage taxes, the impact of the tax will grow over time as additional new diabetes cases will be prevented and as the long term costs resulting from childhood obesity are averted. To the extent that a portion of the new revenues generated by the tax are used to support obesity prevention and reduction programs in Illinois, the future declines in obesity prevalence and the resulting disease and costs will be even larger. In summary, sizable new SSB taxes would be a win-win for Illinois – they would generate considerable new revenues, and lead to reductions in SSB consumption, obesity, and the resulting disease burden and health care costs. As seen with tobacco tax increases that earmarked a portion of new revenues for comprehensive tobacco prevention and cessation programs that further reduced tobacco use and its consequences, using the same approach with SSB tax revenues would lead to further reductions in obesity while at the same time increasing public support for such taxes. The increased prices that result from SSB taxes will reduce SSB consumption and its consequences. Given the research demonstrating that increased SSB consumption leads to an increased risk of type 2 diabetes, we estimate the impact of alternative beverage taxes on the incidence of diabetes and related costs. For example, we estimate that a one-cent per ounce tax on SSBs only would prevent nearly 3,500 new cases of type 2 diabetes in 2011, reducing health care costs by more than $20 million. Higher taxes would lead to larger reductions in the incidence of type 2 diabetes and the resulting costs of treating it, while a broader based tax would have a smaller impact. 2 3 Section I Introduction U.S. obesity rates have risen rapidly over the past several decades. By 2007-08, more than one-third of adults 20 and older were obese (body mass index (BMI) ≥ 30), compared with fewer than one in seven in 1960-62; an additional one-third of adults were overweight (BMI ≥25) (Flegal, et al., 2010; National Center for Health Statistics (NCHS), 2008). Among children and adolescents ages 2-19, more than one in six were obese (≥ 95th percentile) in 2007-08, more than triple the five percent obesity rate in the early 1970s (Ogden and Carroll, 2010). There are considerable disparities in the prevalence of obesity, with rates varying by gender, race/ ethnicity, and socio-economic status. In 2009 in Illinois, for example, 72.6 percent of adult men were either overweight or obese (44.0 and 28.6 percent, respectively), while 56.5 percent of women were overweight or obese (26.2 percent and 30.4 percent, respectively). Similarly, 14.7 percent of high school boys in Illinois were obese in 2009, compared to 9.0 percent of high school girls. Obesity prevalence among Illinois adults generally rises from adolescence and young adulthood through middle age, before declining among older adults (see Figure 2). Racial/ethnic differences are similarly large, with the highest obesity prevalence among youth and adult Blacks and the lowest among non-Hispanic Whites (see Figure 3). Finally, there are striking differences in obesity prevalence across different socioeconomic groups, with considerably lower rates among the most educated and highest income Illinoisans than among their less educated and lower income counterparts (see Figure 4). Figure 2 Prevalence of Obesity by Age, Illinois, 2009 Illinois has experienced the same upward trend in obesity rates. From 1995 through 2009, the prevalence of obesity among adults in Illinois rose by nearly 65 percent, from 16.7 percent in 1995 to 27.4 percent in 2009 (see Figure 1). An additional 37.1 percent of Illinois adults were overweight in 2009. Among youth ages 10-17 in 2007, more than one in five (20.8 percent) were obese while more than one in three (34.9 percent) were overweight or obese (≥ 85th percentile) (Singh, et al., 2010). Note: 12-17 year old rate reflects prevalence among high school students. Sources: Youth Risk Behavior Surveillance System, http://apps.nccd.cdc.gov/youthonline/App/ Default.aspx, and Behavioral Risk Factor Surveillance System, http://apps.nccd.cdc.gov/brfss/ 36.2 Figure 1 35 Prevalence of Obesity in Adults, Illinois 1995-2009 31.3 Source: Behavioral Risk Factor Surveillance System, http://apps.nccd.cdc.gov/brfss/ 30 27.4 20 24.7 25 Percent Obese 25 Percent Obese 30.5 24.7 20 14.8 15 11.9 16.7 10 15 5 10 0 12 -17 18 -24 25 -34 35 -44 45 -54 55 -64 65+ 5 0 4 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 5 Figure 3 Figure 5 Prevalence of Obesity by Race/Ethnicity, Illinois, 2009 Soda Consumption and Adult Obesity Prevalence, California Counties, 2005 Note: Youth rates reflect prevalence among high school students. Youth Adults 40 65 Percent of Adults Who Are Overweight of Obese 36.5 35 30 30 Percent Obese Source: Babey, et al., 2009 and authors’ calculations. 70 Sources: Youth Risk Behavior Surveillance System, http://apps.nccd.cdc.gov/youthonline/App/Default. aspx, and Behavioral Risk Factor Surveillance System, http://apps.nccd.cdc.gov/brfss/ 26.5 25 18.4 20 15 12.9 9.8 10 60 55 50 5 0 45 White Black Hispanic y = 16.44ln(x) + 6.1142 R² = 0.6656 40 Figure 4 10 Prevalence of Obesity by Education and Income, Adults, Illinois, 2009 40 Percent Obese 35 30 25 20 15 10 5 l oo gh i <H h Sc gh Hi l oo h Sc ED me So l oo G or igh Po H st- h Sc C ol e leg a Gr tes a du < 0 ,00 5 $1 9 ,99 4 -$2 0 ,00 5 $1 9 0 ,00 5 $2 9 ,99 ,99 4 -$3 0 ,00 5 $3 9 -$4 $ + 00 ,0 50 The public health and economic consequences of the rise in obesity are enormous. Obesity increases the risks of coronary heart disease, hypertension, stroke, type 2 diabetes, various cancers, osteoarthritis, sleep apnea, other respiratory problems, and other health ailments (National Heart, Lung and Blood Institute (NHLBI), 1998). In 2008, the nation spent as much as $147 billion to treat the consequences of obesity – nearly ten percent of overall health care spending, and with about a half of costs paid by Medicaid and Medicare (Finkelstein, et al., 2009). In the state of Illinois, obesity-attributable health care costs were almost $4.4 billion per year with Medicaid and Medicare funds covering about 54 percent of the burden (Finkelstein, et al., 2004). 6 20 25 30 35 40 % Adults Drinking One or More Sodas per Day Source: Behavioral Risk Factor Surveillance System, http://apps.nccd.cdc.gov/brfss/ 0 15 The sharp rise in obesity has resulted from a change in the ‘energy balance’ – more calories being taken in than expended. Many factors have contributed to this imbalance, from increased caloric intake following reductions in the prices of energy dense foods and beverages to fewer calories expended as technological changes reduced physical activity (Lakdawalla and Philipson, 2009). Among these, the parallel rise in calories consumed from SSBs has drawn particular attention. SSBs include carbonated soft drinks, sports drinks, fruit drinks, flavored waters, sweetened teas, ready-to-drink coffees, and other non-alcoholic drinks containing added sugars. Nielsen and Popkin (2004) found that caloric intake from SSBs accounted for 3.9 percent of total intake in 1977-78, increasing to 9.2 percent by 1999-2001 – a rise of more than 120 calories per day. Similarly, cross-sectional comparisons for California adults (see Figure 5; comparable data not available for Illinois) suggest that SSB consumption is positively associated with the prevalence of obesity. Recent evidence on the metabolism of “liquid calories” suggests that caloric consumption from beverages does not lead to offsetting reductions in reduced caloric intake from food, providing additional evidence on the link between higher SSB consumption and increased obesity (Popkin and Duffey, 2010). One recent study concludes that SSBs account for at least 20 percent of the increases in weight in the United States from 1977 through 2007 (Woodward-Lopez, et al., 2011). The simple associations observed in the trend and cross-sectional data are confirmed by epidemiologic and experimental analyses. While there is considerable variation in study designs and estimated effects sizes, recent comprehensive reviews by Malik and colleagues (2006) and Vartanian and colleagues (2007) conclude that, based on evidence from a number of cross-sectional studies, increased SSB consumption is associated with higher caloric intake, poorer diet quality, and increased likelihood of obesity. Both reviews conclude that increased SSB consumption results in weight gain among children and adults based on evidence from longitudinal and experimental studies. 7 Both Vartanian and colleagues (2007) and Gortmaker and colleagues (2009) note that studies funded by the food and beverage industry are more likely to find smaller or less consistent associations between SSB consumption and weight. In addition, SSB consumption is linked to numerous adverse health and nutrition consequences. Vartanian and colleagues’ (2007) review highlights the negative impact of SSB consumption on calcium intake – largely from lower milk consumption among those consuming more SSBs – and on other nutrient intake (including fiber, protein, and riboflavin), as well as various health outcomes. Similarly, Gortmaker and colleagues (2009) summarize the evidence relating SSB consumption to type 2 diabetes, lower bone density, dental problems, headaches, anxiety, and sleep loss. SSB consumption and its contribution to caloric intake are most pronounced among young people (see Figure 6). Using data from the 1999-2004 National Health and Nutrition Examination Survey (NHANES), Wang and colleagues (2008) estimated that youth ages 12-19 consumed about 16 percent of total caloric intake – or 356 calories per day – from SSBs; among children ages 2-5 and 6-11, SSB consumption accounted for about 11 percent of intake (176 and 229 calories per day, respectively). Using the same data, Bleich and colleagues (2009) estimated that SSBs accounted for about 12 percent of total caloric intake among 20-44 year olds (289 calories per day), before falling to 6 percent and 5 percent among those 45-64 and 65 and older, respectively. Rates of SSB consumption rise from 70 percent among 2-5 year olds in 1999-2004, peaking at 84 percent for ages 12-19, falling to 72 percent for 20-44 year olds, and decline among older ages (Wang, et al., 2008; Bleich, et al., 2009). Numerous studies demonstrate the persistence of body weight over the life cycle, showing that obese children are likely to become obese adults (McTigue, et al., 2002). Contributions of SSB consumption to high rates of obesity among children and adolescents will most likely lead to greater prevalence of adult obesity in the future. The habitual nature of SSB consumption is also well known, suggesting that higher caloric intake from SSBs among younger populations can persist into adulthood, further increasing the risk for obesity (Popkin and Duffey, 2010). Obesity among adolescents and young adults is of particular concern given its links to severe obesity at older ages. For example, using National Longitudinal Study of Adolescent Health data, The and colleagues (2010) found that obese youth at baseline (ages 12-21) were significantly more likely to be severely obese twelve years later. Figure 6 Per Capita Daily Consumption of Calories from SSBs, by Type, 1999-2004 Source: Adapted from Wang, et al. (2008) and Bleich, et al., (2009). 350 300 kcal 250 200 150 Other 100 Sport Drinks 50 Fruit Punch 0 8 Taxation as Public Health Policy Section II Increased awareness of the obesity epidemic and its health and economic consequences has spurred policy makers, public health practitioners, advocates, and others to look for interventions to promote healthier eating and increased physical activity (Institute of Medicine (IOM), 2005). Some of the proposed policy solutions have explicitly targeted SSB consumption by limiting access to SSBs in public facilities (schools, government worksites, and recreation centers); increasing access to drinking water and encouraging water as an alternative to SSBs; restricting marketing of SSBs to children; and adopting policies that alter relative prices of SSBs and healthier alternatives (Centers for Disease Control and Prevention (CDC), 2009; IOM, 2009). These strategies have, at least in part, been identified as having potential to curb obesity based on successful experiences with similar approaches to reducing other unhealthy behaviors, notably tobacco use and harmful drinking. In The Wealth of Nations, Adam Smith (1776) wrote “Sugar, rum, and tobacco are commodities which are nowhere necessaries of life, which are become objects of almost universal consumption, and which are therefore extremely proper subjects of taxation.” Since Smith focused on the revenue generating potential of these taxes, nearly every government worldwide has taxed tobacco products and alcoholic beverages to raise revenues. In recent years, the beneficial public health impact of tobacco and alcohol taxes has become clear as extensive research has demonstrated the effectiveness of higher taxes in reducing tobacco and alcohol use and their consequences (International Agency for Research on Cancer (IARC), in press; Wagenaar, et al., 2009, 2010). Reduced use is a result of preventing uptake in youth, promoting cessation among current users or reducing their frequency and intensity of consumption, and deterring relapse among former users (IARC, in press; Wagenaar, et al., 2009). This improves public health by reducing the disease burden of tobacco and alcohol use, and lowering accidents, violence, and other consequences of harmful drinking (IARC, in press; Wagenaar, et al., 2010). In the United States, evidence on the effectiveness of higher taxes in reducing tobacco use and its consequences has led to sharp increases in tobacco taxes and prices. This significantly reduced tobacco use among youth and adults, while generating considerable new revenues that some states have used to support other prevention and cessation activities, leading to reductions in tobacco use beyond those that result from the tax increase alone (Chaloupka, 2010) (see Figure 7 for trends in cigarette taxes and cigarette sales). In contrast, despite similarly strong evidence on the impact of higher alcohol taxes and prices, the real value of alcohol taxes has been eroded over time by inflation, contributing to falling alcohol prices and higher rates of drinking and its consequences than would exist had these taxes kept pace with inflation over time (Xu and Chaloupka, in press) (see Figure 8 for trends in beer taxes and beer sales). Soda Age 2-5 Age 6-11 Age 12-19 Age 20-44 Age 45-65 Age 65+ 9 Figure 7 In Illinois, the 6.25 percent state sales tax is applied to many beverages, including: regular and diet carbonated soft drinks; juice drinks containing 50 percent or less juice; sweetened, ready-to-drink teas; and sports drinks and other isotonic beverages. This is more than two percentage points higher than the average sales tax applied to these beverages across all states. Juice drinks containing more than 50 percent juice, bottled waters, and other beverages are subject to the 1.00 percent sales tax that applies to most foods and beverages. Cigarette Taxes and Cigarette Sales, US, 1973-2010 Source: Orzechowski and Walker (2011) and authors’ calculations. Cigarette Sales Cigarette Tax 28.5 $2.05 26.5 $1.85 $1.65 24.5 $1.45 22.5 $1.25 20.5 $1.05 18.5 Tax Per Pack (Feb 2011 Dollars) Billion Packs $2.25 The success with significant tobacco excise tax increases in reducing tobacco use and health consequences has led to calls for sizable new taxes on SSBs (e.g. Brownell and Frieden, 2009). Many state and local governments have debated such taxes in recent years, with proposed taxes varying widely. Some proposals call for significantly higher sales taxes on SSBs than those that already exist, while others propose ad valorem (value-based) or specific (volume or weight-based) excise taxes (see Figure 10 for states with recent legislative proposals for SSB taxes). Figure 9 $0.85 16.5 $0.65 14.5 $0.45 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 Sales Tax Rates on Carbonated Beverages, July 1, 2010 MT ME ND VT MN OR ID SD NY WI Figure 8 UT Beer Taxes and Beer Sales, US, 1973-2009 IL CO KS CA AZ NM KY 205.0 $1.15 195.0 $1.05 185.0 $0.95 175.0 $0.85 165.0 $0.75 155.0 $0.65 145.0 $0.55 > 1 to < 3% (n=5 States) FL 0% (n=16 States Plus DC) AK HI Figure 10 Legislative Proposals for SSB Taxes, March 2011 WA ME ND VT MN OR ID SD NY WI $0.45 UT CO CA Governments have yet to heed Smith’s call for sugar taxes, with some taking the opposite approach and subsidizing sugar and other high calorie sweeteners. In the United States, SSB taxation is largely limited to subjecting SSBs and other select beverages to sales taxes that add a few percent to prices (in contrast to cigarette taxes which account for nearly half of cigarette prices), and a few states adopting small excise taxes or fees on carbonated and other beverages (Chriqui, et al., 2008; Bridging the Gap Research Program, 2010) (see Figure 9). AZ IL KS NM WV VA KY NC TN AR AL NJ DE CT Source: Yale University, Rudd Center for Food Policy & Obesity (2011); http://www.yaleruddcenter.org/what_ we_do.aspx?id=272 Map Legend Excise Tax Sales Tax SC MS TX MD OH IN MO OK RI PA IA NE NV NH MA MI WY 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 > 3 to < 5% (n=5 States) LA TX MT 135.0 > 5% to < 7% (n=19 States) SC GA AL Map Legend > 7% (n=5 States) NC AR MS $1.25 CT DE VA TN Beer Tax 215.0 WV Tax Per 6-Pack (Feb 2011 Dollars) Million Barrels Beer Sales IN NJ MD OH MO OK RI PA IA NE NV NH MA MI WY Source: Brewers’ Almanac, 2010, and authors’ calculations. Source: Bridging the Gap Research Program, University of Illinois at Chicago; http://www.bridgingthegapresearch.org WA GA Excise and Sales LA FL AK HI 10 11 Figure 11 Experiences with excise and other taxes on tobacco products provide some insights concerning alternative types of SSB taxes. As described by the World Health Organization (WHO, 2010) in its Technical Manual for Tobacco Tax Administration, uniform specific taxes on all tobacco products will have the greatest public health impact, while also generating significant tax revenues that are relatively stable over time. A uniform specific excise tax sends the message that all tobacco products are equally harmful, in contrast to tiered-specific or ad valorem taxes which apply different taxes to similar products based on their characteristics (e.g., cigarette length or presence/absence of a filter) or prices. Moreover, a uniform specific excise tax minimizes the price gap between higher and lower-priced products, reducing opportunities for consumers to avoid at least some of the tax by substituting to cheaper products. Given the parallel trends in SSB consumption and obesity, a growing number of researchers have recently assessed the impact of beverage taxes and prices on beverage consumption. This research clearly demonstrates that higher beverage prices significantly reduce consumption, with one recent comprehensive review concluding that a 10 percent price increase could reduce soft drink consumption by about eight percent (Andreyeva, et al., 2010). Estimates from studies that have focused on the demand for SSBs find even larger reductions in consumption for a 10 percent price increase. Lin and colleagues (2010) estimate that a ten percent increase in SSB prices would reduce consumption by 9.5 to 12.6 percent. Less clear is the impact of SSB taxes on weight outcomes. Existing research finds little or no impact of existing low taxes on BMI or obesity rates, noting that this is likely due to the low current tax rates and that the point estimates imply that sizable taxes would significantly reduce obesity in at least some populations (Finkelstein, et al., 2010; Sturm, et al., 2010; Powell et al., 2009). Others conclude that even large SSB taxes would have little impact on weight outcomes suggesting that reductions in caloric intake from SSBs would be largely offset by increased calories from other beverages such as whole milk (Fletcher, et al., 2010). Still others find only partial substitution in response to changes in relative prices of SSBs and other beverages, concluding that sizable SSB taxes could significantly reduce net caloric intake, body weight, and obesity among children and adults (Smith, et al., 2010). Further, these studies find that price responsiveness is greater among young people, those on lower incomes, and those already at higher weight (Powell and Chriqui, in press). 12 Sources: Bureau of Labor Statistics, Youth Risk Behavior Surveillance System on-line, and authors’ calculations. Carb. Bev. 155 % Obese, Youth 12.9 Inflation Adjusted Carbonated Beverage Price Index 153 12.4 151 11.9 149 11.4 147 10.9 145 143 Percent Obese With respect to SSB taxes, a uniform specific tax based on volume (e.g., per ounce) or sugar-content (e.g., per gram of added sugar) should have a greater impact on consumption than a comparable ad valorem excise tax or a sales tax, given the potential for consumers to purchase larger volumes that are less expensive per ounce (e.g., a two-liter bottle rather than a 12-ounce can) or cheaper brands in response to the price increases resulting from the tax (Chriqui, et al., in progress; Powell and Chriqui, in press). Likewise, specific excise taxes are easier administratively and reduce opportunities for tax avoidance and evasion as they do not require valuation of a product. The main disadvantage of a specific excise tax is that it needs to be regularly adjusted for inflation over time in order to maintain its public health and revenue impact. Finally, excise taxes are likely to have a greater impact on consumption than sales taxes given that excise taxes are reflected in the shelfprices of SSBs while sales taxes are imposed at the checkout after purchase decisions have largely been made (Chriqui, et al., in progress; Powell and Chriqui, in press). Carbonated Soft Drink Prices and Prevalence of Obesity among Youth, 1999-2009 1998 2000 2002 2004 2006 2008 10.4 Despite this mixed evidence that likely reflects very low existing taxes on SSBs, the weight of the evidence suggests that taxes on the order of a cent or two per ounce will raise prices enough to reduce net caloric intake and obesity. Indeed, recent increases in SSB prices have been accompanied by reductions in obesity prevalence among adolescents although other factors are also likely contributing to the decline (see Figure 11). More research is needed to understand the impact of large changes in relative prices of SSBs on weight outcomes. At the very least, such taxes would have little impact on overall caloric intake, while promoting substitution of healthier beverages for the empty calories contained in SSBs, reducing some of the health consequences associated with SSB consumption. Significant SSB taxes can generate substantial new revenues; one recent estimate suggests that a national penny per ounce SSB tax could raise nearly $15 billion in the first year (Brownell, et al., 2009). These revenues could support other costly components of a comprehensive obesity prevention strategy, including mass-media public education campaigns, subsidies that lower the relative prices of healthier foods and beverages, and programs to make safe, free drinking water more widely available. As seen with tobacco tax increases that earmark revenues for tobacco control efforts, there is considerable public support for SSB taxes when the revenues generated are used to support activities to reduce obesity among children and adults (Yale Rudd Center, 2009). 13 Potential Impact of Sugar-Sweetened and Other Beverage Excise Taxes in Illinois Section III We estimate the potential impact of an excise tax on SSBs in Illinois drawing from the presented science on the impact of SSB consumption on weight outcomes and the effects of beverage prices on beverage consumption, as well as published research on the impact of SSB consumption on diabetes risk, and recent national and state-level data on beverage consumption, prices, obesity prevalence, diabetes incidence, and health care costs of diabetes and obesity. Figure 12 illustrates the analytic framework of our estimation. Figure 12 Analytic Framework Excise Tax on SSB Net Increase Tax Revenue Increase in Price Specifically, we estimate the impact of four alternative excise taxes: a one-cent per ounce excise tax on SSBs only; a one-cent per ounce excise tax on SSBs and their diet/low-calorie versions (i.e., all beverages); a two-cent per ounce excise tax on SSBs only; and a two-cent per ounce excise tax on all beverages. The outcomes assessed are beverage consumption; tax revenues; frequency of SSB consumption; diabetes incidence; health care costs of diabetes; obesity prevalence; and obesity-related health care costs. Impact on Price Recent studies estimate that the average price for carbonated soft drinks (CSDs) in the United States is about 4.5 cents per ounce (Andreyeva, et al., in press; Hahn 2009). Based on an assessment of prices from a variety of vendors, Andreyeva and colleagues (in press) estimated that the average prices per ounce of other beverages are: 7 cents for fruit drinks; 5 cents for sports drinks, 9 cents for ready-to-drink (RTD) teas; 5.5 cents for flavored waters; 17.5 cents for energy drinks; and 20 cents for RTD coffees. Based on market shares of different beverages, the weighted average price for all beverages in 2010 is 5.3 cents per ounce. Future prices, exclusive of taxes, are assumed to rise with the average rate of CSD inflation over the period from 1978 through 2010 (Andreyeva, et al., in press), producing an estimated average price of all beverages in 2011 of 5.45 cents per ounce. Given this, a one-cent per ounce tax will result in about an average 18.3 percent increase in price, if fully passed on to consumers. Similarly, a two-cent per ounce tax will result in about an average 36.7 percent increase in price, if fully passed on to consumers. At least one study suggests that beverage sales taxes lead to larger increases in prices than accounted for by the tax alone, with prices rising by about 129 percent of the amount of the tax (Besley and Rosen, 1999). However, in order to produce conservative estimates of the impact of the tax on obesity, diabetes, and related health care costs, we assume that the tax results in a comparable increase in the retail prices of the taxed beverages. A greater pass through of the tax to price would result in greater reductions in SSB consumption, obesity, and related consequences/costs, but somewhat lower tax revenues. A less than full pass through of the tax to price (partial absorbing of the tax by beverage companies, distributors, and/or retailers) would lead to smaller reductions in beverage consumption, obesity, and related public health consequences and economic costs, but somewhat higher tax revenues. When modeling the impact of a SSB-only tax, we assume that the prices of diet beverages do not change following the imposition of the tax. In practice, however, the beverage industry may spread the tax across all beverages, but modeling such strategic behavior is beyond the scope of our paper. Reduced SSB Consumption 14 Lower Incident Type 2 Diabetes Lower Daily Caloric Intake Lower Medical Cost Lower Obesity 15 Figure 13 Impact on Overall Consumption Illinois-specific data on beverage consumption are not available; however, comparable data are available nationally and regionally and we use these to estimate consumption levels in Illinois, using the approach described by Andreyeva and colleagues (in press). Specifically, we used 2008 regional sales volume data for the consumption of carbonated soft drinks (CSDs), fruit beverages and ready-to-drink (RTD) teas from the Beverage Marketing Corporation (2009a,b,c) and 2008 national sales volume data for sports drinks, flavored/enhanced waters, energy drinks, and RTD coffees from the Beverage World (2009). We estimated beverage consumption in Illinois based on the state’s share of population in the total U.S. population, adjusting for variability in per capita beverage consumption in the East Central region (consisting of Illinois, Indiana, Kentucky, Michigan, Ohio, West Virginia and Wisconsin) for CSDs and fruit drinks, and in the Midwest region (consisting of Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, Wisconsin) for RTD teas. This approach does not account for possible variation in beverage consumption within regions that could be due to differences in demographic characteristics, consumer tastes, and other factors. It is nevertheless preferable to assuming constant per capita beverage consumption across the nation and is the best option available given existing data. Following Andreyeva and colleagues (in press), we estimate future SSB and diet beverage consumption based on beverage specific historic trends in consumption. Given available data and perceived stability of trends in consumption, average annual rates of change over the period of 2000-2009 are used for CSDs, 2005-2009 for fruit beverages, 2006-2009 for sports drinks, 2007-2009 for RTD teas, 20082009 for flavored/enhanced water, 2008-2009 for energy drinks, and 2007-2009 for RTD coffee (Beverage Marketing Corporation, 2009a,b,c; Beverage World 2007-2010). Based on this approach, for example, we assumed that CSD consumption (the largest category of consumption) would fall by 0.7 percent annually between 2010 and 2015. The share of diet varieties in CSDs in 2008 was 30.85 percent for the United States, but varied across regions, with a share of 29 percent in the East Central region that includes Illinois (Beverage Marketing Corporation, 2009a). Given the lack of available data, we assumed the same share of diet varieties in RTD teas as for CSDs and that only non-diet varieties of other beverages are available. Based on the increasing market share of diet CSDs, we assumed that the share of diet varieties in CSDs and RTD teas will increase by 0.5 percentage points annually. Based on this approach, we estimate that Illinoisans will consume more than 814 million gallons of refreshment beverages in 2011. Most of this will come in the form of carbonated soft drinks, with most of these sugar-sweetened carbonated soft drinks. SSBs will account for more than 80 percent of total consumption – an estimated 620.12 million gallons. Figure 13 shows the estimated distribution of beverage consumption across beverage types. In estimating the reductions that would result from alternative excise taxes on SSBs and their diet versions, we assumed that all beverage purchases would be subject to the excise tax being modeled. Specifically, we did not exempt purchases made by participants in the Supplemental Nutritional Assistance Program (SNAP) (as is currently done with the sales tax on beverages bought with SNAP benefits). If the excise tax is not collected on purchases made by SNAP participants, the impact of the tax on revenues, obesity and its consequences/costs will be smaller than estimated below. 16 Estimated Annual Beverage Consumption by Beverage Type, Illinois, 2011 27.3 13.1 18.3 15.6 Note: Estimates are in millions of gallons; textured slices are for non-SSBs. 2.4 Source: Andreyeva, et al., unpublished data. 47.2 62.3 447.0 181.2 Regular Soft Drinks Diet Soft Drinks Fruit Drinks Sports Drinks RTD Tea - Non-Diet RTD Tea - Diet Flavored Water Energy Drinks RTD Coffee Based on the recent review by Andreyeva and colleagues (2010), we assumed that the price elasticity of demand for beverages was -0.8 for the scenarios which tax all beverages (SSBs and their diet versions). When modeling the impact of taxes on SSBs only, we use a price elasticity of -1.2 (Smith et al., 2010), allowing for greater reductions in consumption of SSBs as some consumers would switch to the nontaxed diet options that would be relatively less expensive under this scenario. Using the estimates of beverage consumption for Illinois in 2011, Table 2 presents estimated consumption of various beverages for five scenarios: no tax; a one cent per ounce tax on all beverages considered (CSDs, fruit drinks, sports drinks, RTD teas and coffees, flavored waters, and energy drinks); a one cent per ounce tax on SSBs only (excludes diet CSDs and RTD teas); a two cent per ounce tax on all beverages; and a two cent per ounce tax on SSBs only. Given estimated price levels, the alternative taxes lead to significant increases in beverage prices and substantial reductions in beverage consumption. The relative declines in consumption are greater for relatively inexpensive beverages (e.g. CSDs) and smaller for more expensive beverages (RTD teas and coffees), and the declines in SSB consumption are greater when taxes are applied to SSBs only, given potential substitution to lower priced, untaxed beverages (see Figure 14). 17 Table 2 Revenue Impact Impact of Alternative Beverage Excise Taxes on Beverage Consumption by Type, Illinois, 2011 Note: Figures reflect estimated annual consumption, in millions of gallons, with no tax increase and following the tax increase specified in first column. Regular CSDs Diet CSDs Fruit Drinks Sports Drinks RTD Tea - Regular RTD Tea - Diet Flavored Water Energy Drinks No Tax 447.0 181.2 62.3 1 Cent - All 369.6 149.8 1 Cent SSBs Only 330.9 2 Cents - All 2 Cents SSBs Only RTD Coffee 47.2 27.3 13.1 18.3 15.6 2.4 814.3 55.4 39.8 25.0 11.9 15.7 14.9 2.3 684.4 181.2 51.9 36.2 23.8 13.1 14.4 14.6 2.2 668.2 292.2 118.4 48.5 32.5 22.6 10.8 13.1 14.2 2.2 554.5 214.8 181.2 41.5 25.1 20.2 13.1 10.5 13.5 2.1 522.1 Total The revenue generating potential of beverage excise taxes is considerable. Using the consumption estimates obtained above under the alternative scenarios and applying the tax modeled in each scenario, we estimate the revenue generated by each option. As expected, broader based taxes (those that include diet as well as SSBs) generate higher revenues, as do higher taxes (although not proportionately given the additional reductions in consumption as the tax rises). We estimate that a one-cent per ounce tax on SSBs only would generate for the government of Illinois about $607 million in 2011, while a two cent per ounce tax on SSBs and diet beverages would generate moer than $1.4 billion in 2011. The excise tax revenues generated under each scenario are illustrated in Figure 15. Figure 15 Estimated Revenues, Alternative Tax Scenarios, Illinois, 2011 Source: Andreyeva, et al., unpublished data. 2 Cents - SSBs Only $839.2 Figure 14 Estimated SSB Consumption, Alternative Tax Scenarios, Illinois, 2011 2 Cents - All $1,419.5 Source: Andreyeva, et al., unpublished data. 620.1 1 Cent - SSBs Only 600 $606.6 522.7 500 473.9 1 Cent - All $876.0 Million Gallons 425.2 400 327.8 300 100 18 $400.0 $800.0 $1,200.0 $1,600.0 Millions Impact on Frequency of SSB Consumption 200 0 $0.0 No Tax 1 Cent - All 1 Cent SSBs Only 2 Cents - All 2 Cents SSBs Only We estimate age- and gender-specific frequency of self-reported SSB consumption for Illinois using data from the 2007-08 National Health and Nutrition Examination Survey (NHANES). Specifically, we estimate the percentage of males and females ages 2-19, 20-44, 45-64, and 65 and older consuming SSBs less than once per week; one or more times per week but less than daily; one to two times per day, and two or more times per day (assuming 12 ounces consumed per occasion). Tax-induced changes in the frequency of SSB consumption are estimated for each tax scenario, assuming the same price elasticities as used in the revenue estimation (-0.8 for a broad based tax and -1.2 for an SSB only tax). Given a lack of age- and gender-specific price elasticities, we assumed it to be constant across subpopulations. Figures 16-20 depict the predicted changes in the frequency of SSB consumption for age groups 2-19, 20-44, 45-64, 65 and older, and 2 and older. 19 Figure 16 Figure 19 Estimated Frequency of Weekly SSB Consumption, Alternative Tax Scenarios, Ages 65 and Older 40.0 35.0 30.0 Male Female 1 Cent - SSBs Only 20.0 2 Cents - All 10.0 Total Male Female 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day 1-2/day 1/wk-<1/d 2 Cents - SSBs Only <1/week 0.0 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day <1/week 1-2/day 2 Cents - SSBs Only 0.0 1 Cent - All 30.0 2+/day 2 Cents - All 1 Cent - SSBs Only Baseline 40.0 1-2/day 10.0 5.0 50.0 1/wk-<1/d 1 Cent - All Baseline 60.0 <1/week 25.0 20.0 15.0 Percent Consuming 70.0 1/wk-<1/d Percent Consuming Estimated Frequency of Weekly SSB Consumption, Alternative Tax Scenarios, Ages 2-19 Total Figure 17 Figure 20 Estimated Frequency of Weekly SSB Consumption, Alternative Tax Scenarios, Ages 2 and Older Male Female Total Estimated Frequency of Weekly SSB Consumption, Alternative Tax Scenarios, Ages 45-64 60.0 Percent Consuming 1 Cent - SSBs Only 10.0 2 Cents - All 50.0 40.0 Baseline 30.0 1 Cent - All 20.0 1 Cent - SSBs Only 10.0 2 Cents - All Female 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day 1-2/day 2 Cents - SSBs Only 1/wk-<1/d 0.0 Male Figure 18 Total As expected, the frequency of heavy SSB consumption (2 or more times per day) falls sharply in response to the imposition of a beverage tax, with larger reductions for a SSB only tax and for a higher tax, while the frequency of occasional SSB consumption (less than once per week) rises sharply. Changes for occasional (less than daily) and moderate users (1-2 times per day) are fairly modest, reflecting the movement of some previously in these categories to less frequent consumption categories and the movement of some from more frequent consumption categories into these categories. Given the more frequent consumption of SSBs among younger populations and males, the greatest reductions occur in youth and young adult males, while relatively smaller reductions are seen in older populations and women. 2 Cents - SSBs Only Male Female Total 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day 1-2/day 1/wk-<1/d <1/week 0.0 20 20.0 <1/week 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day 1-2/day 1/wk-<1/d <1/week 2+/day 1-2/day 1/wk-<1/d 2 Cents - SSBs Only 1 Cent - All 2+/day 2 Cents - All Baseline 30.0 1-2/day 1 Cent - SSBs Only 40.0 1/wk-<1/d 1 Cent - All 50.0 <1/week Baseline Percent Consuming 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 <1/week Percent Consuming Estimated Frequency of Weekly SSB Consumption, Alternative Tax Scenarios, Ages 20-44 21 Impact on the Incidence and Health Care Costs of Diabetes Several studies have demonstrated the role of SSB consumption in development of type 2 diabetes (e.g. Schultze, et al., 2004; Malik, et al., 2010). The CDC estimates that the age-adjusted incidence of diabetes was 8.8 per 1,000 population 18 to 79 years old in 2009 (CDC, 2011). The incidence of type 2 diabetes rises dramatically with age, from 4.6 per 1,000 among 18-44 year olds to 15.2 per 1,000 among 45-64 year olds. While still rare, the incidence of type 2 diabetes among youth (under age 20) is rising; based on data from the SEARCH Writing Group (2007), we estimate that the incidence is 5 per 100,000. The risk differs across adult population subgroups, with somewhat higher risk for men than women (9.2 and 8.4 per 1,000, respectively) and significantly higher risks for Blacks and Hispanics (11.7 and 13.1 per 1,000, respectively) than for Whites (8.5 per 1,000). Using data on these risks and the age, gender, and racial/ethnic composition of the Illinois population, we estimate that approximately 94,500 new cases of diabetes are diagnosed each year in Illinois, with disproportionately higher shares among minority populations. Most of these new cases are preventable, including through tax-induced reductions in SSB consumption. The best clinical evidence on the impact of SSB consumption on diabetes risk comes from the prospective cohort study conducted by Schultze and colleagues (2004). They followed 91,249 women free of diabetes and other chronic diseases at baseline and found 741 cases of type 2 diabetes in these women between 1991 and 1999. Of relevance for our estimates, they found that women who consumed one or more SSBs per day increased their risk of type 2 diabetes by 83 to 98 percent compared to those consuming less than one per week. Using their age adjusted results, we estimate that the relative risks for different frequencies of SSB consumption are 1 (< 1 per week), 1.32 (once or more but less than daily), 1.63 (≥1 but <2 per day), and 2.37 (≥2 per day). Using the population impact fraction framework described by Wang (2010), we estimate the proportion of new diabetes cases that would be prevented in 2011 by the tax-induced reductions in the frequency of SSB consumption described in the previous section, with age- and gender-specific estimates. These estimates are presented in Table 3. The predicted reductions in the incidence of type 2 diabetes vary between 2.4 and 7.3 percent of the new cases estimated to occur in 2011, with relatively larger reductions among younger, male populations given their greater frequency of SSB consumption. Table 3 The estimated tax-induced reductions in the incidence of diabetes in the first year understate the long-run impact of the tax on diabetes. New cases of diabetes will continue to decline in the years to come driven by further reductions in SSB consumption due to the tax. Assuming a constant reduction in the incidence of diabetes each year, we estimate a cumulative reduction of about 23,000 to 69,000 new cases of diabetes in the coming decade, depending on the size and extent of the beverage tax. Reducing the incidence of diabetes would significantly lower the related health care spending. Recent estimates indicated that people with diabetes spend more than twice as much on medical care as they would have in the absence of the disease and that about 10 percent of overall health care expenditures can be attributed to diabetes (American Diabetes Association (ADA), 2008). To estimate the health care costs savings that would result from the tax-induced reductions in diabetes, we use the ADA’s (2008) estimates of diabetes-related costs by age in 2007, updated for inflation using the medical care component of the consumer price index. The average annual cost for diagnosed diabetes is about $6,000 per case. The total savings would be considerably higher given that an average diabetes case is also associated with $3,326 annually in nonmedical costs such as absenteeism, reduced productivity at work, disability that prevents working, reduced non-workforce labor and early mortality (Dall et al., 2010). Figure 21 shows the estimated reductions in health care costs of diabetes for the four alternative beverage tax scenarios. Given the larger reductions in diabetes incidence from higher SSB-only taxes, the avoided costs from these taxes would be most substantial. The long-term cost savings would be considerably higher. Given the greater consumption of SSBs and, as a result, greater incidence of diabetes in low-income populations, a disproportionate share of these cost savings would accrue to the state’s Medicaid program. Figure 21 Reductions in Diabetes-Related Health Care Costs, Alternative Tax Scenarios, Illinois, 2011 Impact on Caloric Intake and Body Weight 2 Cents - SSBs Only $41.3 Reduction in New Cases of Type 2 Diabetes, Alternative Tax Scenarios, Illinois, 2011 Note: Numbers may not add to total given rounding of estimates. 22 2 Cents - All Ages 2-19 Ages 20-44 Ages 45-64 Ages 65+ 1 Cent - All 3 729 1,252 310 2,295 1 Cent SSBs Only 5 1,094 1,878 465 3,443 2 Cents - All 7 1,459 2,505 620 4,590 2 Cents SSBs Only 10 2,188 3,757 930 6,885 $27.6 Total 1 Cent - SSBs Only $20.7 1 Cent - All $13.8 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 Millions 23 Using the estimates above of the age- and gender-specific changes in SSB consumption frequency, we estimate the daily reduction in calories consumed from SSBs for each tax scenario. The estimated reductions are presented by age and gender in Figure 22. Younger men have the largest reductions in calories due to high SSB consumption. For a one cent per ounce tax on SSBs only, we estimate that 2-19 year old males would consume 46 fewer calories from SSBs daily and that 20-44 year old males would consume 55 fewer SSB calories per day, compared to 32 and 16 fewer calories for 45-64 year old and 65 and older males. Among women, the reductions would be 36, 38, 22, and 10 calories from SSBs per day among those ages 2-19, 20-44, 45-64 and 65 and older, respectively. As with SSB consumption, larger reductions in caloric intake result from a tax limited to SSBs only, as do higher taxes regardless of the base on which the tax is applied. Figure 22 Reductions in Average Daily Caloric Intake from SSBs by Age and Gender, Alternative Tax Scenarios, Illinois, 2011 100 Based on these assumptions, we estimate that the alternative beverage taxes would lead to significant reductions in average body weight at the population level, with greater reductions among young males given their greater frequency of SSB consumption. The estimated age- and gender-specific reductions in average body weight are shown in Figure 23. We estimate that a one-cent tax on SSBs only would reduce average body weight among Illinoisans ages two and older by about 1.7 pounds. 80 Figure 23 60 Reductions in Body Weight by Age and Gender, Alternative Tax Scenarios, Illinois, 2011 40 1 Cent - All 6.0 1 Cent - SSBs Only 20 2 Cents - All 0 2-19 20-44 45-64 65+ 2-19 20-44 45-64 Female 65+ 2-19 20 -44 45 -64 65+ 4.7 4.6 4.0 Total We use these estimated reductions in average daily caloric intake to model the impact of alternative beverage taxes on BMI and obesity prevalence. There are two key assumptions in translating reductions - All 1 in Cent - SSBs Only and 2obesity. Cents - AllThe first 2 Cents - SSBs in caloric intake1 Cent to reductions body weight relates to Only the extent to which the taxinduced reduction in calories from SSBs is offset by increases in calories from other sources such as food and non-taxed caloric beverages like juice and milk. Current research is mixed on the extent of substitution in response to changes in relative beverage prices, including those that result from the existing small sales taxes on various beverages. Fletcher and colleagues (2010), for example, conclude that reductions in SSB calories from higher SSB prices are largely offset in children and adolescents by increases in calories from other beverages, particularly whole milk, resulting in little impact on weight. In contrast, Smith and colleagues (2010) find only modest increases in calories from other caloric beverages when SSB calories fall in response to tax-induced SSB price increases. As a result, the authors predict that a 20 percent tax on SSBs would reduce obesity prevalence by 3 percentage points in adults and 2.9 percentage points in children. These are substantial reductions. 5.5 5.0 2 Cents - SSBs Only Male 24 The second key assumption relates to translating a reduction in net caloric intake to weight change (i.e. calories to pounds). There is considerable confusion around the extent to which reduced calories lead to reductions in weight (Katan and Ludwig, 2010). We use the estimates developed by Hall and colleagues (Hall, et al., 2009; Hall and Jordan, 2008) in their models that account for the human physiology of energy regulation. Their models predict that a reduction in caloric intake of about 10 calories per day will reduce weight by about one pound in the steady state. Pounds Reduced Calories Per Day 120 Research findings on the impact of existing small taxes on weight outcomes are generally consistent with Smith et al., (2010) and suggest limited BMI effects of small taxes, but that point estimates imply that large taxes could lead to sizable reductions in weight and obesity, particularly in higher risk populations (Powell and Chriqui, in press). To be conservative, we assume that half of the tax-induced reductions in calories consumed from SSBs will be offset by increases in calories from other sources. If there is less compensation, then the impact of the alternative taxes on obesity prevalence and related health care costs will be greater. 3.2 3.0 4.1 3.8 3.6 2.7 2.3 2.0 1.6 1.8 1.9 2.1 1.1 0.8 1.0 0.0 1.6 2.2 2.7 2.3 1.3 1.0 1.3 0.6 0.5 1 Cent - All 1 Cent - SSBs Only 2 Cents - All 2 Cents - SSBs Only 2-19 20-44 45-64 65+ Male 2-19 20-44 45-64 65+ 2-19 Female 1 Cent - All 1 Cent - SSBs Only 20-44 45-64 65+ Total 2 Cents - All 2 Cents - SSBs Only 25 Impact on Obesity and Obesity-Related Health Care Costs Using the estimated reductions in weight described above, we further estimate the impact of alternative beverage taxes on the prevalence of obesity in Illinois and obesity-related health care costs. Data on adult obesity rates by age and gender come from the 2009 Behavioral Risk Factor Surveillance System data for Illinois, with the age-specific rates adjusted in proportion to the gender-specific rates to produce estimates for males and females ages 18-44, 45-64, and 65 and older. Gender specific estimates of obesity prevalence for children ages 2-17 are obtained using data from the 2007 National Survey of Children’s Health (Singh, et al., 2010; for gender specific rates for youth ages 10-17), and the 20072008 NHANES (assuming that the relative rates for 2-9 year olds and 10-17 year olds nationally apply to Illinois children). Using this approach, we estimate that 25.2 percent of the Illinois population ages two and older is obese, with age specific prevalence rates of 17.5, 24.5, 33.0, and 24.7 percent among those ages 2-17, 18-44, 45-64, and 65 and older, respectively. Obesity rates among males in each age group are about 10 percent higher than among females. We use age- and gender-specific average height data from NHANES to translate the predicted reductions in weight into reductions in age- and gender-specific BMI. We further assume that reductions in BMI that result from the alternative taxes will move a fraction (1/5th) of people with BMI in the obese range (≥ 30) to the non-obese range. Given these assumptions, we estimate age and gender specific reductions in obesity prevalence that would result from the alternative beverage taxes. These estimates are shown in Figure 24. The alternative beverage taxes would lead to significant reductions in obesity prevalence. For example, we estimate that a one-cent tax on SSBs only would reduce obesity prevalence among 12-17 year olds to 15.9 percent, implying 45,000 fewer obese children in Illinois. Similarly, this tax would reduce obesity prevalence among 18-44 year olds to 22.7 percent and among 45-64 year olds to 31.6 percent, reducing the number of obese adults in these age groups by about 85,000 and 45,000, respectively. The overall obesity rate in Illinois would fall from 25.2 percent to 23.7 percent, reflecting a more than 185,000 reduction in the number of obese Illinoisans. Again, SSB only taxes produce larger reductions in obesity prevalence than broader based taxes that include diet beverages, and higher taxes lead to more substantial declines in obesity rates. Finally, given the considerable health care costs estimated to result from obesity, we use these reductions in obesity prevalence to estimate the impact of alternative beverage taxes on health care costs attributable to obesity in Illinois. A growing literature demonstrates that obese individuals spend significantly more on health care to treat the consequences of their obesity (Finkelstein, et al., 2009; Wee et al., 2005). To estimate the impact of the tax induced reductions in obesity prevalence on health care spending, we use age and gender specific adult cost estimates from Wee and colleagues (2005), updated for inflation using the Medical Care Price Index. They estimate that obesity-related health care costs are higher for women than for men and that these costs rise with age for both genders. Based on the recent study by Skinner and colleagues (2008) that found no excessive health care costs for overweight children relative to normal weight peers, we assume no reduction in health care costs for the youngest age group (ages 2-17). As a result, our estimates will be conservative with respect to the long term cost savings that result from the tax induced declines in SSB consumption and obesity. That is, the reductions in obesity among young people will lead to significant reductions in future health care costs caused by obesity. The estimated health care cost savings in Illinois in 2011 from tax-induced reductions in obesity are shown in Figure 25. We estimate that a one-cent tax on SSBs only, for example, would reduce health care spending attributable to obesity by more than $150 million in the first year alone. Over time, 26 the cumulative effects of savings in health care spending will grow; assuming that the annual cost savings are constant over time a one-cent SSB only tax would save more than $1.5 billion in health care spending in Illinois over the next decade. Given the higher prevalence of obesity in lower-income populations, a disproportionate reduction in obesity-related health care spending would be seen in the state’s Medicaid program. As with the reductions in diabetes, the total benefits for the Illinois economy would be substantially higher and include reductions in other costs associated with obesity, including reduced productivity, absenteeism, and disability. Figure 24 Obesity Prevalence Rates by Age and Gender, Alternative Tax Scenarios, Illinois, 2011 Note: the percentages shown on the bar graphs reflect the estimated obesity prevalence rate that would result from a one-cent per ounce tax on SSBs only. 35.0% 32.8% 30.0% 25.2% 23.5% 25.0% 20.0% 31.6% 30.4% 23.2% 21.9% 16.8% 15.9% 15.0% 15.0% 24.0% 22.7% Baseline 10.0% 1 Cent - All 1 Cent - SSBs Only 5.0% 0.0% 2 Cents - All 2 Cents - SSBs Only 2-17 18-44 45-64 65+ 2-17 18-44 45-64 Male 65+ 2-17 18-44 45-64 Female 65+ Total Figure 25 Reductions in- Obesity-Related Health Baseline 1 Cent All 1 Cent - SSBs Only Care Costs, Scenarios, Illinois, 2011 2 Cents - AllAlternative 2 Cents Tax - SSBs Only $301.6 2 Cents - SSBs Only $201.0 2 Cents - All $150.8 1 Cent - SSBs Only 1 Cent - All $100.5 $0.0 $50.0 $100.0 $150.0 Millions $200.0 $250.0 $300.0 27 Table 4 Section IV Estimated Impact of Alternative Beverage Excise Taxes, Illinois, 2011 Discussion The increasing recognition of the role of sugar-sweetened beverages (SSBs) in contributing to the growing obesity epidemic has spurred interest in policy and other interventions that aim to reduce SSB consumption. Given the demonstrated effectiveness of increased tobacco taxes in reducing cigarette smoking and other tobacco product use, many have proposed SSB taxes that would lead to sizable increases in prices as a promising policy option for curbing obesity and its health and economic consequences. To date, however, existing SSB taxes are mostly small sales taxes that are applied to both sugar-sweetened and diet beverages. Research assessing the impact of these small taxes generally finds that they have modest effects on beverage consumption and a limited impact on weight. At the same time, estimates from these studies suggest that larger taxes would have a substantial impact on the prevalence of obesity at the population level. Reduction in Health Care Costs of Diabetes Reduction in Number of Obese Youth (2-17) Reduction in Number of Obese Adults (18+) Reduction in Number of Obese Illinoisans Reduction in Diabetes Incidence 1 Cent - All 6.2% 3.5% 123,418 2,294 $13.8 $100.5 $876.1 1 Cent SSBs Only 9.3% 5.2% 185,127 3,442 $20.7 $150.8 $606.7 2 Cents - All 12.3% 7.0% 246,836 4,591 $27.6 $201.0 $1,419.6 2 Cents SSBs Only 18.5% 10.5% 370,253 6,885 $41.3 $301.6 $839.3 (millions) Reduction New Tax in Obesity- Revenues Related (millions) Health Care Costs (millions) Given the potential for SSB taxes to reduce obesity, we use the best available data and research-based evidence to estimate the impact of alternative beverage taxes in Illinois. Specifically, we consider four alternative beverage taxes – a one cent per ounce excise tax on SSBs and their diet versions (i.e., all beverages); a one cent per ounce excise tax on SSBs only; a two cent per ounce excise tax on all beverages; and a two cent per ounce excise tax on SSBs only. Using recent data, we predict their impact on overall beverage consumption, tax revenues, age and gender-specific frequency of SSB consumption, average daily caloric intake, body weight, body mass index (BMI), obesity prevalence diabetes incidence, and health care costs of diabetes and obesity. Table 3 below summarizes our estimates. Given the continued reduction in SSB consumption following the alternative beverage taxes, the impact of the tax will grow over time as additional new diabetes cases will be prevented and as the long-term costs resulting from childhood obesity are averted. To the extent that a portion of the new revenues generated by the tax are used to support obesity prevention and reduction programs in Illinois, the future declines in obesity prevalence and the resulting disease and costs will be even larger. In summary, sizable new SSB taxes would be a win-win for Illinois – they would generate considerable new revenues, and lead to reductions in SSB consumption, obesity, and the resulting disease burden and health care costs. As seen with tobacco tax increases that earmarked a portion of new revenues for comprehensive tobacco prevention and cessation programs that further reduced tobacco use and its consequences, using the same approach with SSB tax revenues would lead to further reductions in obesity while at the same time increasing public support for such taxes. 28 29 Literature Cited American Diabetes Association (2008). Economic costs of diabetes in the U.S. in 2007. Diabetes Care 31(3):596-615. Andreyeva T, Chaloupka FJ, Brownell KD (in press). Estimating the beverage tax potential to reduce beverage consumption and generate revenue. Preventive Medicine. Andreyeva T, Long M, Brownell KD (2010). The impact of food prices on consumption: a systematic review of research on price elasticity of demand for food. American Journal of Public Health 100: 216-222. Babey SH, Jones M, Yu H, Goldstein H (2009). Bubbling Over: Soda Consumption and Its Link to Obesity in California. Los Angeles: California Center for Public Health Advocacy & UCLA Center for Health Policy Research, 2009. Beer Institute (2011). Brewers Almanac, 2010. Washington DC: Beer Institute. Besley TJ, Rosen HS (1999). Sales taxes and prices: an empirical analysis. National Tax Journal 52(2):157. Beverage Marketing Corporation (2009). Carbonated Soft Drinks in the U.S. 2009 Edition, Chapter 3, September 2009. Beverage Marketing Corporation of New York. Beverage Marketing Corporation. (2009) Fruit Beverages in the U.S. 2008 Edition, Chapter 2, July 2009. Beverage Marketing Corporation of New York. Beverage Marketing Corporation. (2009) RTD Tea in the U.S. 2009 Edition, Chapter 3, September 2009. Beverage Marketing Corporation of New York. Beverage World. (2009) State of the Industry ’09. Chicago: Beverage World. Beverage World. (2010) State of the Industry 2010. Liquid Refreshment Beverages. Chicago: Beverage World. Beverage World. (2008) State of the Industry ’08. Chicago: Beverage World. Beverage World. (2007) State of the Industry ’07. Chicago: Beverage World. 30 Bleich, S. N., Wang, Y. C., Wang, Y., & Gortmaker, S. L. (2009). Increasing consumption of sugar-sweetened beverages among US adults: 1988-1994 to 1999-2004. American Journal of Clinical Nutrition, 89, 372-381. Brownell KD, Farley T, Willett WC, Popkin B, Chaloupka FJ, et al., (2009). The public health and economic benefits of taxing sugar-sweetened beverages. The New England Journal of Medicine 361(16):1599-1605). Finkelstein EA, Trogdon JG, Cohen JW, Dietz W (2009). Annual medical spending attributable to obesity: payer- and service-specific estimates. Health Affairs 18(5):w822-w831. Finkelstein EA, Zhen C, Nonnemaker J, Todd JE (2010). Impact of targeted beverage taxes on higher- and lower-income households. Archives of Internal Medicine 170(22):2028-2034. Flegal KM, Carroll MD, Ogden CL, Curtin LR (2010). Prevalence and trends in obesity among US adults, 1999-2008. Journal of the American Medical Association 303(3):235-241. Brownell KD, Frieden TR (2009). Ounces of prevention-the public policy case for taxes on sugared beverages. New England Journal of Medicine 360:1805-1808. Fletcher JM, Frisvold DE, Tefft N (2010). The effects of soft drink taxes on child and adolescent consumption and weight outcomes. Journal of Public Economics 94 (11-12): 967-974. Centers for Disease Control and Prevention (2009). Recommended community strategies and measurements to prevent obesity in the United States. Morbidity and Mortality Weekly Report 58(RR-7). Gortmaker S, Long M, Wang YC (2009). The Negative Impact of Sugar-Sweetened Beverages on Children’s Health. Minneapolis: Healthy Eating Research. Centers for Disease Control and Prevention (2011). CDC’s Diabetes Program - Data & Trends, www.cdc.gov/ diabetes/statistics. Chaloupka FJ (2010). Tobacco Control Lessons Learned: The Impact of State and Local Policy. ImpacTeen Research Paper Number 38. Chicago: ImpacTeen, Health Policy Center, Institute for Health Research and Policy, University of Illinois at Chicago. Chriqui JF, Chaloupka FJ, Powell LM (in progress). A typology of sugar-sweetened beverage taxation: multiple approaches for obesity prevention and revenue generation. Chicago: Health Policy Center, Institute for Health Research and Policy, University of Illinois at Chicago. Hahn R (2009). The potential economic impact of a US excise tax on selected beverages: a report to the American Beverage Association, August 31, 2009. Hall KD, Guo J, Dore M, Chow CC (2009). The progressive increase of food waste in America and its environmental impact. PLoS One 4(11):e7940. Lakdawalla D, Philipson T (2009). The growth of obesity and technological change. Economics and Human Biology 7(3):283-293. Lin BH, Smith TA, and JY Lee, 2010, The Effects of a Sugar-Sweetened Beverage Tax: Consumption, Calorie Intake, Obesity, and Tax Burden by Income, Working Paper, US Department of Agriculture. Malik VS, Popkin BM, Bray GA, Després JP, Willett WC, Hu FB (2010). Sugar-sweetened beverages and risk of metabolic syndrome and type 2 diabetes: a metaanalysis. Diabetes Care 33(11):2477-2483. Malik VS, Schulze MB, Hu FB (2006). Intake of sugarsweetened beverages and weight gain: a systematic review. American Journal of Clinical Nutrition 84(2):274288. McTigue KM, Garrett JM, Popkin BM (2002). The natural history of the development of obesity in a cohort of young US adults between 1981 and 1998. Annals of Internal Medicine 136(12):857-864. National Center for Health Statistics (2008). Prevalence of overweight, obesity, and extreme obesity among adults: United States, trends 1976-80 through 200506. On-line at: http://www.cdc.gov/nchs/data/hestat/ overweight/overweight_adult.pdf. Hall KD, Jordan PN (2008). Modeling weight-loss maintenance to help prevent body weight regain. American Journal of Clinical Nutrition 88(6):1495-1503. National Health, Lung, and Blood Institute (1998). Clinical Guidelines on the Identification, Evaluation, and Treatment of Overweight and Obesity in Adults: The Evidence Report. Washington DC: National Heart, Lung, and Blood Institute, National Institutes of Health. Institute of Medicine (2005). Preventing Childhood Obesity: Health in the Balance. Washington DC: The National Academies Press. Nielsen SJ, Popkin BM (2004). Changes in beverage intake between 1977 and 2001. American Journal of Preventive Medicine 27(3):205-210. Institute of Medicine (2009). Local Government Actions to Prevent Childhood Obesity. Washington DC: The National Academies Press. Ogden C, Carroll M (2010). Prevalence of obesity among children and adolescents: United States, trends 19631965 through 2007-2008. National Center for Health Statistics Health E-Stats. On-line at: http://www.cdc. gov/nchs/data/hestat/obesity_child_07_08/obesity_ child_07_08.pdf Chriqui JF, Eidson SS, Bates H, Kowalczyk S, Chaloupka FJ (2008). State sales tax rates for soft drinks and snacks sold through grocery stores and vending machines, 2007. Journal of Public Health Policy 29:226-49. International Agency for Research on Cancer (in press). IARC Handbooks of Cancer Prevention, Tobacco Control, Volume 14: Effectiveness of Tax and Price Policies in Tobacco Control. Lyon, France: International Agency for Research on Cancer. Dall TM, Zhang Y, Chen YJ, Quick WW, Yang WG, Fogli J. (2010). The economic burden of diabetes. Health Affairs 29(2):297-303. Katan MB, Ludwig DS (2010). Extra calories cause weight gain - but how much? Journal of the American Medical Association 303(1):65-66. Orzechowski and Walker (2011). The Tax Burden on Tobacco. Arlington VA: Orzechowski and Walker. Popkin BM, Duffey KJ (2010). Sugar and artificial sweeteners: seeking the sweet truth. In Nutrition and Health: Nutrition Guide for Physicians, T Wilson, et al., editors. New York: Humana Press. 31 Powell LM, Chiriqui J, Chaloupka FJ (2009). Associations between state-level soda taxes and Adolescent Body Mass Index. Journal of Adolescent Health 45:S57-S63. Powell LM, Chriqui JF (in press). Food taxes and subsidies: evidence and policies for obesity prevention. In Handbook of the Social Science of Obesity, J Cawley editor. Oxford: Oxford University Press. Schulze MB, Manson JE, Ludwig DS, et al. (2004). Sugar-sweetened beverages, weight gain, and incidence of type 2 diabetes in young and middle-aged women. Journal of the American Medical Association 292(8):927-934. SEARCH for Diabetes in Youth Study Group Writing Group (2007). Incidence of diabetes in youth in the United States. Journal of the American Medical Association 297(24):2716-2724. Singh GK, Kogan MD, van Dyck PC (2010). Changes in state-specific childhood obesity and overweight prevalence in the United States from 2003 to 2007. Journal of the American Medical Association 164(7):598-607. Skinner AC, Mayer ML, Flower K, Weinberger M (2008). Health status and health care expenditures in a nationally representative sample: how do overweight and healthy-weight children compare? Pediatrics 121:e269-e277. Smith A (1776). An Inquiry into the Nature and Causes of the Wealth of Nations. E. Canaan, editor. London: Methuen & Co., Ltd. Smith, Travis A., Biing-Hwan Lin, and Jonq-Ying Lee. Taxing Caloric Sweetened Beverages: Potential Effects on Beverage Consumption, Calorie Intake, and Obesity, ERR-100, U.S. Department of Agriculture, Economic Research Service, July 2010. Sturm R, Powell LM, Chriqui JF, Chaloupka FJ (2010). Soda taxes, soft drink consumption, and children’s Body Mass Index. Health Affairs 29(5):1052-1058. The NS, Suchindran C, North KE, Popkin BM, GordonLarsen P (2010). Association of adolescent obesity with risk of severe obesity in adulthood. Journal of the American Medical Association 304(18):2042-2047. U.S. Department of Health and Human Services (USDHHS). 2001. The Surgeon General’s Call to Prevent and Decrease Overweight and Obesity. Rockville, Md.: USDHHS, Public Health Service, Office of the Surgeon General. Vartanian LR, Schwartz MB, Brownell KD (2007). Effects of soft drink consumption on nutrition and health: a systematic review and meta-analysis. American Journal of Public Health 97(4):667-675. Wagenaar A.C.; Salois, M.J.; and Komro, K.A. Effects of beverage alcohol price and tax levels on drinking: A meta-analysis of 1003 estimates from 112 studies. Addiction 104:179–90, 2009. Wagenaar, A.C., Tobler, A.L., Komro, K.A. (2010). Effects of Tax and Prices Policies on Mobility and Mortality: A Systematic Review, American Journal of Public Health. Published on-line ahead of print at: http:// ajph.aphapublications.org/cgi/content/abstract/ AJPH.2009.186007v1 Wang YC (2010). The potential impact of sugarsweetened beverage taxes in New York State. A Report to the NYC Department of Health and Mental Hygiene. New York: Department of Health Policy & Management, Mailman School of Public Health, Columbia University. Wang YC, Bleich SN, Gortmaker SL. Increasing Caloric Contribution From Sugar-Sweetened Beverages and 100% Fruit Juices Among US Children and Adolescents, 1988-2004. Pediatrics 2008;121:e1604-e1614. Wee CC, Phillips RS, Legedza AT, et al. (2005). Health care expenditures associated with overweight and obesity among US adults: importance of age and race. American Journal of Public Health 95(1):159-165. Woodward-Lopez G, Kao J, Ritchie L (2011). To what extent have sweetened beverages contributed to the obesity epidemic? Public Health Nutrition 14(3):499509. World Health Organization (2010). WHO Technical Manual for Tobacco Tax Administration. Geneva: World Health Organization. Xu X, Chaloupka FJ (in press). The effects of prices on alcohol Use and its consequences. Alcohol Research & Health. Yale Rudd Center (2009). Soft Drink Taxes: A Policy Brief. New Haven: Rudd Center, Yale University. 32 2