Nudging Farmers to Use Fertilizer: Theory and Experimental Evidence from Kenya

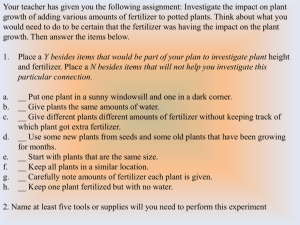

advertisement