Stay at Work Program A Financial Incentive for Washington Employers

advertisement

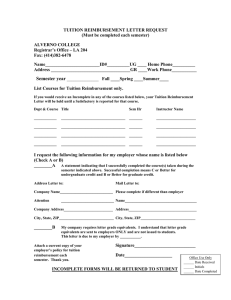

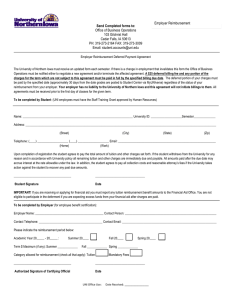

Stay at Work Program A Financial Incentive for Washington Employers Payroll Personnel Management System (PPMS) Tuyen Manikhoth, Outreach Specialist Stay at Work Program 360-902-5875 tuyen.manikhoth@lni.wa.gov 2 Stay at Work – It’s the Right Thing to Do! What is “Stay at Work?” A legislatively mandated (EHB 2123) program providing financial incentives for State Fund Employers providing light duty or transitional work to employees recovering from on-the-job injuries. RCW: 51.32.090 WAC: 296-16A 3 It is a Strategy to help get your employee back to work as soon as possible Work Shorter Hours A Different Type of Job Perform “Light Duty” What is Included in a RTW Program? Written Policy Statement – Signed by President/CEO/Management Written Procedures – Who, What, Where, When, Why & How Ongoing Education – Eliminates surprises & misunderstanding Communication 5 FileFast Order Educational Materials – www.FileFast.Lni.wa.gov/about 6 Communication is the To Claim Management & Return to Work Injured worker Health Care Provider Employer Labor & Industries 7 Allows Employee to Maintain Contact with Co-Workers Keeps Employee Active May Reduce Re-Injury Shifts: “Dis-ability” To “Ability” Employee Feels Their Contributions are Valued Speeds Medical Recovery Provides Sense of Job Security May Reduce Risk of Re-Injury Reduces Time Loss Costs Lowers costs: Hiring & Training Replacements Shows Commitment to Employees Loss of Productivity Minimized Maintains Employer Employee Relationship Maintains Skills of Injured Worker Health effects of “worklessness”: • 2-3 times the risk of poor health • 2-3 times the risk of mental illness • Significant increased risk of depression • Significant increase in overall mortality rate Long term “worklessness” carries more risk to health than many “killer diseases” and more risk than most dangerous jobs. (e.g. construction, working on an oil rig) Source: Journal of Insurance Medicine 11 12 • Injured workers who are off longer than 6 months have only a 50% chance of ever returning to their job.* • Compensable claims on average cost 37x more than non-compensable claims. ** • Nationally, compensable claims on average cost 44x more than non-compensable claims. *** Source: *Defense Civilian Personnel Advisory Service **WA State Department of Labor & Industries. ***National Council for Compensation Insurance 13 Premiums Paid by Employer Uninsured Costs Lost Production Failure to fill or meet order deadlines Overhead costs while work was disrupted Time lost from work by injured employee Training costs for replacement workers What is “light duty?” Work activity designed to return a recovering worker to the workplace in a meaningful and productive job. Work activity that conforms with the Healthcare Providers guidance. Focus on Worker’s Abilities “Light Duty/Transitional Duty” A rose by any other name.. 15 Where is Light Duty found? What tasks are not being performed now? What tasks are performed occasionally? What tasks, if done by injured worker, would free other employees to do their jobs more efficiently? INCLUDE EMPLOYEES IN DEVELOPMENT! Job Accommodation Network www.askjan.org 16 17 18 Job Description Employer & Worker Information Essential Task Duties Physical Demands Attending Healthcare Provider Approval 19 RCW 51.32.090(4)(b) Process for a Light Duty Job to qualify: The worker is certified by the provider as able to work at a job other than their usual work The employer furnishes a statement describing the work available The provider determines whether the worker is physically able to perform the work described The worker begins the work with the employer. L&I will use the date the employer submits the job description to the provider as the first date considered for Stay at Work reimbursements. The medical provider must still approve the job for reimbursements to be paid. 20 Employer’s Job Description • • • • The job description must be in writing. The light duty or transitional work must be approved by the attending health care provider to qualify for reimbursement. The attending health care provider can indicate on the completed activity prescription form that they approve or deny the written light duty job description sent to them by the employer. The employer will need to provide a copy to the injured worker. 21 Early Return to Work Assistance 22 KOS, LEP & Stay at Work The employer can apply for reimbursement ONLY for the hours the employee is ACTUALLY working light duty. You will need to keep track of the hours the worker is working light duty and provide that documentation to us. An injured worker can be entitled to Loss of Earning Power. 23 Stay at Work Program Workers Compensation REFORMS Reimbursements are available for Employers: Wages Training Tools / Equipment Clothing Pays Wage Reimbursement – 50% of base wage – Excluding tips, commissions, bonuses, board, housing, fuel, health care, dental care, vision care, per diem, reimbursement for work-related expenses or any other payments. For – Up to 66 days actually worked (not necessarily consecutive) – Up to $10,000 per claim (whichever comes first.) – 24-month period per claim And – Employer has 1 year to apply from first day of light duty or transitional work – Reimbursements are per claim Training Reimbursement For training necessary for the light duty or transitional work Tuition • Books • Fees • Other necessary materials • $1,000 per claim 26 Clothing Reimbursement Clothing • $400 per claim • Becomes property of the worker 27 Tools/Equipment Reimbursement Tools/Equipment • $2,500 per claim Tools and equipment become the property of the employer 28 Important Reminders • You may offer the worker more than one transitional job within the 66 days if approved by medical provider. • Worker may continue the job beyond the 66 days, but the subsidy can’t continue. • Claim must be allowed. • All applications for reimbursement must be submitted within 1 calendar year of date of light duty. 29 Important Reminders, Cont. • Make sure that the worker and the supervisor are aware of the work restrictions and do not exceed them. • Continue any health care benefits the worker had unless these benefits are inconsistent with the employers current benefit program for their workers. • Job offer must be consistent with terms of collective bargaining agreement currently in force. 30 How do I apply for “Stay at Work” reimbursements? Fill-able forms are online Wage form (if applying for light-duty or transitional work wage reimbursement) Expense form (for related expense reimbursement) You may apply to be reimbursed for wages and expenses dating back to June 15, 2011, the date the legislation was signed by the Governor. The Stay at Work Webpage www.stayatwork.lni.wa.gov 32 Wage Reimbursement Request 33 Expense Reimbursement Request 34 What documents are required for reimbursement? 1. Health care provider’s written certification that the worker is unable to do usual job. 2. A written job description of light duty or transitional work. 3. Approval by the attending health care provider that the worker is physically able to perform the light duty or transitional work described. 4. Payroll records and Time Cards for duration of light-duty or transitional work. 5. Receipts for tools, clothing and instruction purchased that were necessary for the light duty or transitional work. 35 Common Application Problems / Mistakes Requesting reimbursement for ineligible time period Date of injury, KOS No approved Light Duty Job Description Lack of records Payroll records, time sheets/cards, salaried staff information, other employee information not redacted Application not signed by employer Tools/Equipment purchased after worker has returned to Light Duty Not including the daily wage on the reimbursement form 36 The Employer did not provide job title of the job of injury & didn’t give a job title for the light duty job! 37 Daily wages were not provided on this reimbursement form! They only provided week-ending wages. 38 Wages were not provided on this reimbursement form! 39 Stay At Work Cumulative Totals from 01-01-12 through 01-30-15: 40 Stay at Work - Dashboard 41 Have questions about Stay at Work? • Visit our website at: www.stayatwork.lni.wa.gov • E-mail the Stay at Work Unit at: stayatwork@lni.wa.gov • Call the Stay at Work Unit at: 1-866-406-2482 or 360-902-4411 42 Stay at Work Contacts Call or E-mail: Bill Smith, MS, MBA, CRC, CPT - Program Manager smwr235@lni.wa.gov 360.902.4748 Christopher Ver Eecke, M.Ed, CRC, CCM, CDMS Vocational Outreach 360.902.4419 verc235@lni.wa.gov Joyce Allen, BA Employer Outreach 360.902.4978 alls235@lni.wa.gov Tuyen Manikhoth, Employer Outreach 360.902.4978 phat235@lni.wa.gov 43 Company Name Company Logo