Document 11015737

advertisement

The Stock Market

Student Investment Management

November 30, 2010

EQUITY RESEARCH

2010

Energy | Integrated Oil and Gas | 30 December

CHEVRON CORPORATION

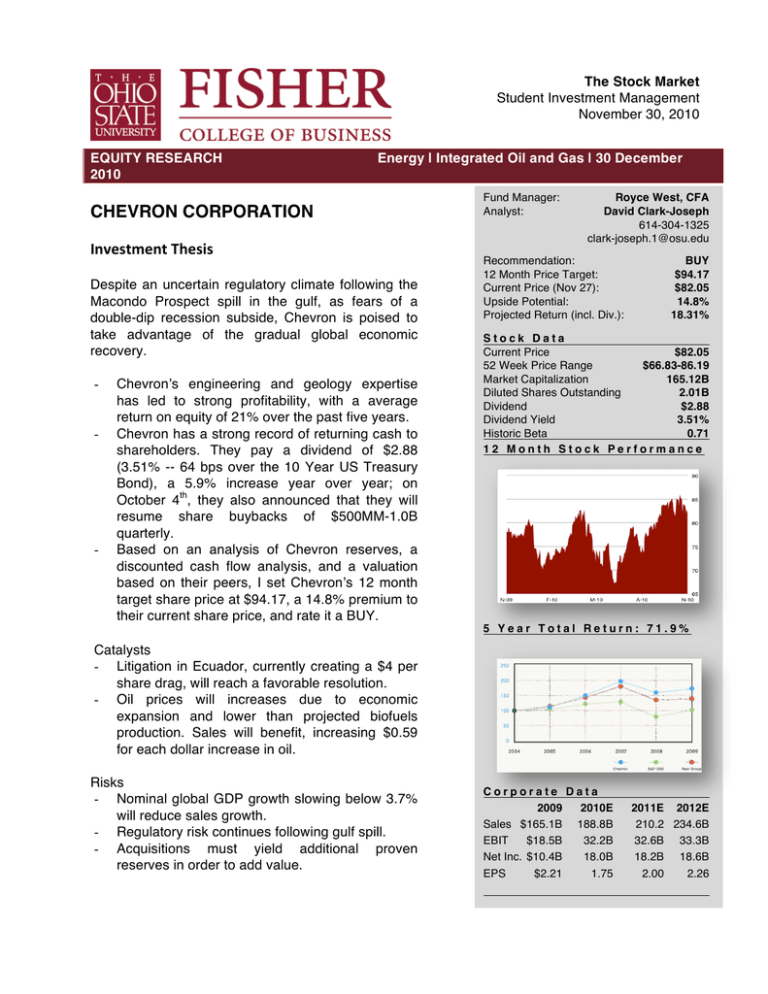

Investment Thesis Despite an uncertain regulatory climate following the

Macondo Prospect spill in the gulf, as fears of a

double-dip recession subside, Chevron is poised to

take advantage of the gradual global economic

recovery.

-

-

-

Chevronʼs engineering and geology expertise

has led to strong profitability, with a average

return on equity of 21% over the past five years.

Chevron has a strong record of returning cash to

shareholders. They pay a dividend of $2.88

(3.51% -- 64 bps over the 10 Year US Treasury

Bond), a 5.9% increase year over year; on

October 4th, they also announced that they will

resume share buybacks of $500MM-1.0B

quarterly.

Based on an analysis of Chevron reserves, a

discounted cash flow analysis, and a valuation

based on their peers, I set Chevronʼs 12 month

target share price at $94.17, a 14.8% premium to

their current share price, and rate it a BUY.

Fund Manager:

Analyst:

Royce West, CFA

David Clark-Joseph

614-304-1325

clark-joseph.1@osu.edu

Recommendation:

12 Month Price Target:

Current Price (Nov 27):

Upside Potential:

Projected Return (incl. Div.):

BUY

$94.17

$82.05

14.8%

18.31%

Stock Data

Current Price

$82.05

52 Week Price Range

$66.83-86.19

Market Capitalization

165.12B

Diluted Shares Outstanding

2.01B

Dividend

$2.88

Dividend Yield

3.51%

Historic Beta

0.71

12 Month Stock Performance

5 Year Total Return: 71.9%

Catalysts

- Litigation in Ecuador, currently creating a $4 per

share drag, will reach a favorable resolution.

- Oil prices will increases due to economic

expansion and lower than projected biofuels

production. Sales will benefit, increasing $0.59

for each dollar increase in oil.

Risks

- Nominal global GDP growth slowing below 3.7%

will reduce sales growth.

- Regulatory risk continues following gulf spill.

- Acquisitions must yield additional proven

reserves in order to add value.

Corporate Data

2009

2010E

Sales $165.1B 188.8B

EBIT

$18.5B

32.2B

Net Inc. $10.4B

18.0B

EPS

$2.21

1.75

2011E 2012E

210.2 234.6B

32.6B 33.3B

18.2B 18.6B

2.00

2.26

Table of Contents

Company Overview and Description ........................................................................... 3

Segments ...................................................................................................................................... 4

Upstream .................................................................................................................................. 4

Downstream .............................................................................................................................. 4

Chemicals ................................................................................................................................. 5

Segment Mix ................................................................................................................................. 5

Geographic Diversification Exposure ............................................................................................ 5

Strategy ........................................................................................................................................ 6

Growth Outlook ............................................................................................................................. 6

Pending Litigation ......................................................................................................................... 7

Investment Thesis .......................................................................................................... 8

Strong fundamental and competitive position and a pessimistic market ...................................... 8

Economic Analysis ........................................................................................................................ 9

Financial Analysis ........................................................................................................ 11

Profitability Analysis .................................................................................................................... 11

Peer Comparison ........................................................................................................................ 11

DuPont Analysis – Efficiency, Asset Management and Growth Prospects ................................ 12

Liquidity ....................................................................................................................................... 12

Financial Statement Projections ................................................................................................. 12

Valuation ....................................................................................................................... 13

Valuation through Comparables ................................................................................................. 13

Valuation – Discounted Cash Flow ............................................................................................. 14

Sum of Parts Valuation – Asset Value and Peer Composite ...................................................... 15

Sum of Parts Valuation – Valuation of Chevron Business Segments ..................................... 15

Sum of Parts Valuation – Peer Composite ............................................................................. 15

Valuation Composite of Scenarios .............................................................................................. 16

Conclusion .................................................................................................................... 16

Appendix ....................................................................................................................... 17

Appendix A - Selected Financials ............................................................................................... 17

Appendix B - Works Cited ........................................................................................................... 17

Appendix C - Sum of Parts – Valuation of Chevron Reserves .................................................... 18

Appendix D - Discounted Cash Flow ......................................................................................... 19

Analyst Bio .................................................................................................................................. 20

11/29/10

2

Company Overview

Company Overview and Description

Chevron, an integrated oil and gas producer, - A company engaged in all aspects of the energy

industry: Chevron is the third largest energy company in the world with a market cap of

$165.15B, behind Exxon Mobil (XOM) and Royal Dutch Shell (RDS.A), and the eighth largest

company in the S&P. Chevron has significant petroleum reserves and worldwide operations.

Their upstream activities include significant oil and gas exploration and production; their

downstream activities include major refining operations throughout the world. Chevronʼs 5 year

average annual revenues are above $200B, though, as a cyclical play, their revenues declined

37% in 2009 to $171B.

2010 has also been a challenging year for Chevron, both because of the continued concerns

about the state of the global economy, and because of one the worst environmental incidents in

ever in the oil and gas industry – the oil spill in the Macondo Prospect.

In addition to significant environmental damage, the spill has created a significant risk of

increased regulatory burdens and even a company such as Chevron, with an industry leading

safety record, will face an additional burden of proof when demonstrating that their operations

and equipment are safe and technically sound. Fortunately, technology and engineering

capabilities are two of Chevronʼs greatest competitive advantages. Their expertise combined

with their continuing shift towards the more profitable upstream, positions Chevron to grow sales

by 10.15% annually for the next decade with gradually increasing margins as oil prices gradually

increase.

11/29/10

3

Company Overview: Strategy and Growth

Segments

Upstream

Figure 1 2009 CVX Annual Report

Chevronʼs upstream operations include natural

gas and crude oil exploration and production.

Their consolidated worldwide reserves at the

end of 2009 reached 8.3B barrels, and their

production operations average 2.7MM barrels

per day. They have broad global diversification,

and control significant production in Angola,

Australia, Azerbaijan, Bangladesh, Brazil,

Canada, Denmark, Indonesia, Kazakhstan,

Nigeria, the Partitioned Zone between Kuwait

and Saudi Arabia, Thailand, the United

Kingdom, the United States, and Venezuela.

Additionally, Chevronʼs exploration activities

extend to the Gulf of Mexico, offshore Australia,

western Africa, Thailand, Canada, the UK,

Norway and Brazil.

Additionally, Chevron has developed

significant natural gas operations in Australia,

western Africa, Bangladesh, China, Indonesia,

Kazakhstan, North America, the Philippines,

South America, Thailand, the UK and Vietnam.

Downstream

Chevronʼs downstream activities include refining,

fuels marketing, supply and trading and

transportation and distribution of petroleum

products at 21,750 affiliated retail stations

marketed under Chevron, Texaco and Caltex

brands. Downstream operations include refining,

fuels and lubricants marketing, supply and trading,

and transportation. In 2009, they processed

1.9MM barrels of crude oil per day into

approximately 1.995MM barrels of distillates

representing a 5% gain from the refinery cracking

processes.

Last year, Chevron sales averaged 3.3MM

barrels per day of refined product sales worldwide.

Chevron operates 15 refineries, recently having

divested part of the Caribbean refineries in a

transaction with RUBIS, a French firm. Significant

downstream activities include the west coast of

North America, the U.S. Gulf Coast into Latin

America, SE Asia, South Korea, southern Africa

and the UK.

11/29/10

Figure 2 CVX Annual Report

4

Company Overview: Strategy and Growth

+

Chemicals

Chevronʼs chemical business consists of production of commodity compounds derived from

petroleum including aromatics for the production of adhesives and plastics, and olefins, used in

packaging, pipes, tires, and detergents. Chevron subsidiary Oronite produces lubricants and

fuel additives; additionally, Chevron owns a 50 percent stake in Chevron Phillips Chemical

Company. As a producer of commodity products, Chevronʼs chemicals business is a price

taker, but revenues are strongly correlated with global demand and crude oil prices. The

chemicals business made up just 0.9% of sales

in 2009, but 3.9%% of revenue, indicating the

segmentʼs profit potential.

Segment Mix

Chevron has gradually shifted their business

mix towards greater upstream exposure over

the past 5 years (2004-2009), increasing

upstream revenue as a percentage of total

revenue from 22.3% to 26%, and increasing

upstream profit as a percentage of total profit

significantly (79.3% to 91.5%, albeit related to

poor downstream margins related to economy).

Figure 3 shows the revenue mix, heavily tilted

Figure 3 Chevron Revenue Mix by Segment

towards downstream revenue, while Figure

4 shows that profit mix, increasingly more

tilted towards the considerably more

profitable upstream. Chevron capital

expenditure upstream now outpaces

downstream by 4:1.

+

Geographic+Diversification+

+

Chevron has significant macroeconomic Figure 4 Chevron Net Income Mix by Segment

exposure, and is exposed to foreign exchange

risk and political risk from their diverse global operations. This

risk is largely diversified, but their profitability is largely

dependent on their ability to manage these risks, as evidenced

by Q3 2010 foreign exchange losses of $400MM due to

increased volatility in global currencies.

Chevron hedges significant amounts of currency risk,

using project finance and credit derivatives to hedge against

specific market and credit risks. In 2009, Chevron reducing

foreign exchange impact to 1% ($114 MM on NI of $10,563MM).

11/29/10

5

Company Overview: Strategy and Growth

Strategy

Chevron primarily pursues a low-cost strategy in order to produce commodity products. In order

to create shareholder value, they must continually seek to increase their operating margins,

stemming from commodity prices that they cannot control and their cost structure, which they

can control. This pursuit of a higher margin structure has led them to reduce their downstream

assets while increasing upstream assets. By investing in upstream assets, they are able to

create reserves at a fixed cost, providing extraction at a low variable cost. This strategy is

executed through upstream weighted investment and acquisitions, as well as reduced

downstream investment and strategic downstream divestitures. Upstream expansion has sought

to increase deepwater activities and develop an extensive natural gas resource base.

This strategic transformation also utilizes their extensive technical capabilities, from

geology and engineering, allowing them to add value to acquisitions by reducing operating risk,

and appraising possible reserves. In November, Chevron announced the $4.3B acquisition of

Atlas Energy, a natural gas firm with significant Appalachian gas reserves. Chevron acquires

896.7 BCF of proven natural gas reserves, as well as 18,000 BCF of potential reserves. As

896.7 BCF of gas at spot price are worth nearly $1.18B, this suggests that Chevronʼs

knowledge base examined the

likelihood of potential reserves, and

valued them well in excess of 3.12B.

Chevron has also actively

divested downstream assets, aiming

to retain highly flexible refining

operations in key markets. Recent

divestitures include the recent sale

of Caribbean fuel and refinery

assets to RUBIS, a French firm.

Chevronʼs upstream profits as

a percentage of total profits were

86.3% Q3 2010, leading their peers

whose upstream percentage in 2010

are approximately 80%.

Figure 5 Long Term Historical Earnings Mix of Integrateds

Growth Outlook

With decreasing quantities of easily accessible petroleum resources, and increased demand

from BRIC countries, traditional organic growth is becoming increasingly difficult for Chevron

and their integrated peers. Chevron has embraced the changing dynamics of oil and gas

exploration, and is focusing efforts on their core competencies, geological and technical

expertise, pursuing deepwater exploration including recent September 2010 acquisition of

deepwater interests in Liberia, Turkey and China, and entering shale-natural gas exploration

through acquisitions such as Atlas Energy.

Chevron conducts deep-water exploration in resource rich areas in the Gulf of Mexico,

Western Africa, Australia and Thailand. Deepwater exploration carries with it considerable

operational risk both in performance risk of each well drilled and in technology risk involved in

engineering extraction.

11/29/10

6

Company Overview: Strategy and Growth

Management has issued capital expenditure guidance indicating their intention to spend

$21.6B in 2010, and has reaffirmed its previously stated full-year net production guidance for

2010 of 2,750 MBOED based on the first nine months' 2010 average WTI price of $78. This

represents a two percent increase from 2009 actual net production. I estimate that resulting

sales growth will reach high single digits until 2013 based on the start-up years of Chevronʼs

project backlog. From 2013-2020, I anticipate sales growth steadily increasing as Australian and

Canadian projects come online, converging to 10.15%, the growth rate implied by their trailing

12 month return on equity and historic reinvestment rate.

Pending Litigation

Chevron is the target of high profile litigation in Ecuador alleging

environmental contamination relating to Texacoʼs operations over 23 years, from 1967-1990.

The 48 plaintiffs now ask for damages of $113B, a significant upward revision from the courtappointed expertʼs estimate of $27B. I estimate that the market is incorporating these damages

at a 25% probability, reducing share price by $4 per share.

Chevron is challenging the legitimacy of the Ecuadorian proceedings, and alleging fraud

and misconduct by the Plaintiffs. Chevron has successfully petitioned the United States

Southern District of New York, to provide extensive discovery from the Ecuadorian Plaintiffs

Attorneys and other parties with video evidence pertaining to the Plaintiffs. These requests have

been granted under 28 U.S.C 1782, which permits discovery, among other reasons, to

challenge the fairness and impartiality of a foreign judgment.

In a November 11, 2010 opinion, Judge Kaplan writes:

The outtakes contain substantial evidence that [agents of the plaintiffs] were involved in

ex parte contacts with the court to obtain appointment of the expert; met secretly with the

supposedly neutral and impartial expert prior to his appointment and outlined a detailed

work plan for the plaintiffsʼ own consultants; and wrote some or all of the expertʼs final

report that was submitted to the Lago Agrio court and the Prosecutor Generalʼs Office,

supposedly as the neutral and independent product of the expert.

This evidence greatly increases the likelihood that any judgment obtained in Ecuador through

this litigation, regardless of the size of the judgment, will be unenforceable against Chevron

assets as enforceability of a foreign judgment under the Uniform Enforcement of Judgments Act

is predicated on proof that the judgment was issued through an impartial tribunal. I have

incorporated a 1% chance of an enforceable $113B judgment into the valuation. Any significant

drop market cap greater than 1% upon news of a judgment represents a strong buying

opportunity.

11/29/10

7

Investment Thesis

!"#$%&'$"&+()$%*%++

Strong fundamental and competitive position and a pessimistic market

The market assigns a high probability of a declining future oil price, based on moderate

probabilities of a slow recovery or a double dip recession, where as I predict that oil prices will

rise 3-5% annually for the next decade on emerging market demand, OECD economic recovery,

moderate inflation, and lower than anticipated biofuel output due to lower than projected

investment. Commodity prices will be further strengthened by any Dollar weakness, and by any

ongoing political uncertainty in North Korea. Additionally, the market assigns a higher value to a

potential judgment in the Ecuador litigation, where as I predict that any judgment will be

unenforceable under the US Uniform Enforcement of Foreign Judgments Act.

My investment thesis is also shaped partially by strong signals from management. By

raising the quarterly dividend in April by 5.9%, management demonstrates their conviction that

the economy is in recovery, and that Chevron is in a strong cyclical position. Additionally, the

announcement of share buybacks in the range of $500MM to $1B quarterly suggests that

management perceives a meaningful discount to current market prices. These buybacks alone

will produce modest accretion in share price of approximately 1% annually.

Chevronʼs strategy of moving upstream has resulted in the greatest net profit margin of

their peers. As they continue this strategy through careful acquisitions such as their purchase of

Atlas Energy providing access to the Marcellus Shale play, and their divestiture of downstream

assets as they pursue an efficient and flexible downstream segment.

Through three valuation techniques, a sum of parts analysis of Chevron reserves at spot

price, a assumption driven discounted cash flow, and a relative valuation, I have shown that

Chevron sells for lower than the fair value of its assets, Chevron sells at a discount relative to

conservative projections of its future cash flows, and Chevron is undervalued by the market

compared to its peersʼ multiples and its past multiples. Over the next 12 months, I project that

the market price will converge on my estimate of Chevronʼs fair value of $94.17 per share based

on catalysts surrounding the oil prices and the resolution of litigation.

+

+

+

+

11/29/10

8

Investment Thesis - Economic Analysis

Economic Analysis

Figure 6 Gross Domestic Product through 2030, OECD

This will provide a strong basis for

volume growth for Chevron. Sales growth

will be a function of this increased demand

and oil prices.

The Economist Intelligence Unit

also projects that oil prices will steadily

decline for the next 5 years reaching, $71

per barrel by 2015. This estimate

resembles the Low Oil Price case

projected by the U.S. Energy Information

Administration in the 2010 International

Energy Outlook.

The USEIAʼs Low Price Oil case

relies on several assumptions: significantly

greater access to non-OPEC regions

The price of oil over the next 25 years will

primarily be a product of global aggregate

demand, energy demand, and the supply of

oil alternatives. The Economist Intelligence

Unit forecasts that World gross domestic

product growth will double in the next 20

years, with 80% of the GDP growth coming

from Non-OECD countries.

Strong growth by BRIC and other NonOECD countries will drive strong global

GDP growth, and consequently energy

consumption is expected to rise significantly

from 495 quadrillion BTU in 2007 to 739

quadrillion BTU in 2035, a compound

annual growth rate of 1.4%.

Figure 7 World marketed energy consumption

(quadrillion Btu), USEIA

coupled with more attractive fiscal regimes in

those countries, and increased production

from OPEC, leaving most production in

conventional reserves. In contrast, the USEIA

High Oil Price case assumes greater

restriction or additional financial burdens

resulting in reduced access to non-OPEC

reserves, as well as OPEC members reducing

their production substantially below todayʼs

levels, as can be seen in Figure 9.

Figure 8 Three Oil Price Scenarios, USEIA

11/29/10

9

Investment Thesis - Economic Analysis

As oil prices rise, expensive

unconventional oil resources such as

heavy crude reserves and oil sands

become increasingly attractive.

Figure 9 Production: Reference v. High Oil Price, USEIA

Low oil is predicated on significant growth in

renewable. Both the Economist Intelligence

Unit and the USEIA Low Oil Price case rely in

part on significant increases in biofuels. The

EIU projects significant rises in Brazil and

Kazakhstan; the USEIA also projects the mix

of energy production in the Low Price Oil case

in 2035 would require renewables production

Figure 10 World marketed energy use by fuel type, USEIA

to double between 2007 and 2010. However,

doubling renewables production by 2030 requires significant investment in alternative energy,

an activity that, while popular until 2008 during record nominal oil prices, has been cut back

Figure 11 and 12 Historical and projected investment in sustainable energy, Bloomberg New Energy Finance

significantly as oil has recovered from highs and as countries embrace austerity measures.

Absent a significant uptick in new investment in sustainable energy, I project renewables

will increase at a slower rate of .5%-.7% annually. Accordingly, I project oil prices will most

closely resemble the USEIAʼs Base Case Oil price with prices reaching $110 by 2010.

11/29/10

10

Investment Thesis – Financial Analysis

Financial Analysis

Profitability Analysis

Profitability

2006

2007

2008

2009

TTM

Gross

Margin

31.4%

31.4%

29.2%

41.9%

42.4%

Operating

Margin

20.0%

19.3%

15.8%

10.8%

14.6%

8.1%

8.4%

8.7%

6.1%

8.4%

Return on

Assets

13.2%

13.2%

15.4%

6.4%

9.9%

Return on

Equity

26.0%

25.6%

29.2%

11.7%

17.4%

Free Cash

Flow /

Sales

5.0%

3.7%

3.6%

-0.3%

5.34%

Net

Margin

Despite gross margin and operating margin

steadily decreasing over the past five years

due to steady depletion of the most

accessible petroleum, Chevronʼs profitability

profile is strong. Over the same five year

period, their net margins have averaged in

the high single digits, indicating a level of

profitability in line with 2006-2008, and

achieved

despite

lower

oil

prices.

Additionally, Chevron generates a high level

of free cash flow beyond their dividend

payments, and over the past 12 months, it

has generated $5.34 per $100 of sales, a

level in line with pre-recession levels.

!

Peer Comparison

Chevronʼs profitability profile compares

strongly to their integrated peers,

displaying the highest Net Margin, the

second highest return on assets, and

4th highest return on equity. Their lead

position in Net Margin is indicative of

their success at focusing on upstream

operations. While Exxon Mobile is also

highly profitable, it also expensive on a

relative basis, trading at 12.2 times

current earnings.

Chevronʼs Net Margins will likely

increase as future investments are

made favoring upstream activity and

downstream assets are sold. In the

short run, over 2010 and 2011, oil

prices and stronger refining margins

should contribute to higher profitability

even as production costs rise from their

2009 levels.

!

!

!

!

!

!

11/29/10

Figure 13 Profitability in peer group

11

Investment Thesis – Financial Analysis

DuPont Analysis – Efficiency, Asset Management and Growth Prospects

+

DuPont Analysis

5Y Average

Profit Margin (Net Income / Revenue)

0.08

Total Asset Turnover (Revenue/ Assets)

1.34

Return on Investment

0.11

Profit Margin * Total Asset Turnover

Equity Multiplier (Avg Total assets/ Avg

Total Equity)

1.87

Average Total Assets / Average Total Equity

Return on Equity (ROI*Equity Multiplier)

0.210

2010E

0.08

1.13

0.10

2009

0.06

1.00

0.06

2008

0.09

1.63

0.15

2007

0.09

1.42

0.13

2006

0.08

1.53

0.13

1.75

1.81

1.89

1.92

1.96

0.17

0.12

0.28

0.24

0.25

+

The DuPont analysis describes the relation between Chevronʼs profit margins, asset utilization,

and leverage to describe operating management. Chevronʼs profit margins, as mentioned earlier

are high single digits, an area of financial leadership among its peers. Looking to Chevronʼs

asset turnover, they have been making progress since 2009, but still trail their 5 year average

following a strong 2006-2009 period. When viewed in conjunction with Chevronʼs asset turnover,

we can see how Chevronʼs return on investment stems from their profit margin per asset turn, to

produce a 9.89% Return on Investment, a 40% increase from 2009, and only 10% off of their 5

year average.

By evaluation Chevronʼs leverage, I arrived at their equity multiplier, a ratio describing

the amount of assets available per equity dollar. This number has lowered over the past 5 years,

and is below their 5 year average, an indication that they have reduced their overall leverage.

By dividing the return per dollar of assets by the equity multiplier, I calculated the return per

dollar of equity at 17.4%, a 45% increase from 2009. I project that their long term Return on

Equity will converge on their 5 year average of 21.0. I also used the return on equity to derive

the expected growth rate, as the amount of net income reinvested (61%), expected to earn the

2010 return on equity (16%) producing an implied growth rate of 10.15%.

,*-.*/*&0+1"/+,$#$213$+

2006

Current Ratio

1.28

Quick Ratio

1.02

Debt

PV of Operating Leases

+

2007

1.17

.9

2008

1.14

.79

Liquidity

+

2009

1.42

1.01

Adjusted Debt

Adjusted Debt to

Assets

3Q10

1.66

1.21

10,473

2,312

12,785

7.2%

Chevron has adjusted their liquidity to

provide for greater flexibility following

the credit crisis of 2008. Their current

ratio and quick ratio both provide

sufficient

liquidity,

particularly

considering their low total leverage,

even after taking into account the

present value of operating lease

obligations.

Financial Statement Projections

Appendix A presents selected financial statement data with projections for the next

three years.

11/29/10

12

Valuation

Valuation

Valuation through Comparables

10 Year

P/Forward E

P/S

P/B

P/EBITDA

P/CF

High

24.1

1.5

3.2

5.34

10.9

Low

5.6

0.4

1.4

2.37

3.8

Median

10.6

0.8

2.4

4.42

7

Current

Target

E/S/B/

Multiple EBITDA/CF

8.6

10.6

18,860

0.8

0.8

199.577

1.6

2.4

102,243

4.26

4.26

41,955

5.5

7

30,122

Weighted Target Equity Value

Shares outstanding

Price per Share

Predicted

EV

199,919

159,662

245,383

178,728

210,854

$203,815

2080

$97.99

Weight

22.5%

10.0%

22.5%

22.5%

22.5%

Through analyzing Chevronʼs historic valuation multiples, it becomes apparent that relative to

historic multiples, Chevron is trading at a significant discount, except on a Price to Sales basis.

However, as Chevron moves towards higher profitability upstream earnings, and away from

lower profitability downstream earnings, Price to Sales is the useful historic ratio. On each other

multiple examined, Chevron trades at a discount to the 10 year median, and significant discount

to 10 year highs. In considering weights, Price to Sales was reduced because of the incongruity

between upstream and downstream earnings and sales.

Also noteworthy is that Chevron is trading

at significantly lower multiples than the

S&P 500 and industry peers, despite

having the 2nd highest net margins, and

the highest return on assets over the past

12 months. This suggests that the

markets are undervaluing Chevron compared to its peers, despite Chevronʼs superior financial

performance. While multiples best provide historical context to overall valuation, they support

my discounted cash flow and sum of parts valuations.

Current Multiples

Price/Earnings

Price/Book

Price/Sales

Price/Cash Flow

Dividend Yield %

11/29/10

Chevron

9.80

1.60

0.80

5.50

3.50

Industry

14.70

1.80

0.80

6.70

3.40

S&P 500

15.10

2.00

1.30

7.60

1.90

13

Valuation

Valuation – Discounted Cash Flow

Appendix D presents my full discounted cash flow analysis, with which I arrive at an equity

value of $203.7B, $101.47 per share, a 23% upside from current levels. To generate my

discounted cash flow, I relied on the following assumptions.

Assumption

Description

Source

Market Assumptions

Cost of Debt

4.97%

Market Factor

6.00%; β =1.21

Size Factor

Book to Market Factor

Risk Free Rate

Debt to Assets

Final Cost of Equity

Adjustments

Operating Leases

Underfunded Pension

Operating Assumptions

Terminal Growth Rate

Sales Growth Rate

0.41%; β = .21

-1.46%, β = .73

4.22%

0.068

11.26%

Marginal Cost at S&P AA spread of .75 bps

over 30 Year

Implied Equity Risk Premium, 11/1/10,

Industry Average β

Kenneth French, 11/26/10

Kenneth French, 11/26/10

30 Year US Bond, 11/26/10

Lease Adjusted Debt

Fama-French Three Factor

1130

2496

Treated as Debt

Pension shortfall from Notes

Depletion, Depreciation, Amortization

3.7%

Increasing to 10.15% after 10

years

0.694% of CapEx

CapEx

21.6B, CAGR at 3.7%

Operating Margin

Increasing moderately to 11%

after 10 years

Moves to 48%

Reduced by $2B over 4 years

Projected GDP Growth - EIU

Implied by reinvestment rate (0.61) * return

on equity (16.6%)

Weighted (4:1) historic 10 year average of

Upstream CapEx:DDA 1.4x (80%) and

Downstream CapEx:DDA 1.6x (20%).

CVX Guidance, increase at terminal growth

rate

Reflecting shift towards Upstream

Tax Rate

Shares Outstanding

Reversion to company 5 year mean of 44%

Share buybacks.

I also analyzed my DCFʼs sensitivity to changes in discount rate and in terminal growth rate.

Note that using a higher discount rate or a slower growth rate, one could arrive very close to the

current stock price under my set of assumptions.

Discounted Cash Flow: Sensitivity Analysis

$101.47

Terminal

Growth

11/29/10

1.0%

1.5%

2.0%

2.5%

3.0%

3.7%

4.0%

4.5%

8.50%

124.39

130.29

137.09

145.03

154.41

170.82

179.42

196.61

9.00%

115.01

119.96

125.62

132.14

139.76

152.83

159.56

172.75

9.50%

106.77

110.96

115.71

121.14

127.40

137.99

143.35

153.71

Discount Rate

10.0%

10.5%

11.0%

99.48

93.00

87.19

103.06

96.07

89.85

107.08

99.50

92.79

111.64

103.36

96.09

116.85

107.74

99.80

125.53

114.95 105.84

129.88

118.51 108.80

138.17

125.25 114.34

11.27%

84.30

86.76

89.49

92.52

95.92

101.44

104.13

109.14

12%

77.24

79.26

81.47

83.92

86.64

91.00

93.10

96.98

12.50%

72.95

74.72

76.65

78.78

81.13

84.88

86.67

89.95

14

Valuation

Sum of Parts Valuation – Asset Value and Peer Composite

4.'+56+712&%+819.1&*5"+:+819.1&*5"+56+;)$#25"+<.%*"$%%+4$3'$"&%+

I performed a sum of parts valuation on Chevron reserves. The detailed valuation is provided in

Appendix C. This valuation was performed using available data from the SEC, and information

courtesy of JP Morgan. For upstream operations, I analyzed proven, probable and possible

reserves, including the recent Atlas Energy acquisition.

For the downstream valuation, I

assessed refining operations by region, regional capacities and average flow; I assessed

marketing by multiplying regional sites through JP Morgan estimates for valuation per site.

Chemical valuation was assessed by a multiple of peak earnings weighted for Chevronʼs equity

stake in Chevron Philips.

I then adjusted the value of gross operating assets by lease-adjusted net debt,

underfunded pension liabilities, and an expected value of Ecuadorian litigation at a probability of

1%. Through my sum of parts valuation, I assess Chevronʼs equity value at $187,640MM, or

$93.45 per share.

4.'+56+712&%+819.1&*5"+:+7$$2+;5'=5%*&$+

Sum of Parts Analysis

Segments

Petroleum Upstream

Petroleum Downstream

TOTAL

Sales per

Segment

P/S

Ratio

51328

142854

194182

Competitors P/S ratios

VQ

MWE

SD

NBR

3.0

2.6

2.4

1.7

SUN

0.14

0.882

HES

0.69

FTO

0.31

MUR

0.57

Target

P/S

Multiple

Current Stock

Price

# of diluted

shares

Target Price

% return to target

Value

2.43

124,727

0.4275

6,1070

0.957

Target Market Cap

Date of price

Segment

185,797

11/26/10

$82.05

2008

$92.53

13%

For the sum of parts peer composite, I divided Chevron sales by segment. For each segment, I

identified four pure play competitors, and calculated their Price to Sales ratios. These Price to

Sales ratios were averaged, and then multiplied by Chevron segment sales to estimate

expected segment market capitalization. The sum of the segment market capitalizations

indicates the segment-weighted expected market capitalization based on segment competitors

P/S ratios. This indicates that on a sales basis, Chevron is undervalued by 13%, even when

considering lower margin downstream sales.

11/29/10

15

Valuation

Valuation Composite of Scenarios

Valuation Ranges

52-week Trading Range

$66.83

$86.19

Multiples Analysis

$76.76

$117.97

Sum of Parts Assets and

Segment Comparables

Discounted Cash Flow

Analysis

$92.53

$72.95

11/26/10 Trading Range

$60.00

$93.45

$81.70

$70.00

$80.00

$82.60

$90.00

$100.00

$110.00

$120.00

Illustrative WMT Price per Share

min

$ 66.83

$ 76.76

$ 92.53

$ 72.95

$ 81.70

52-week Trading Range

Multiples Analysis

Sum of Parts Assets and Segment Comparables

Discounted Cash Flow Analysis

11/26/10 Trading Range

Valuation Composite

Value

Weight

DCF

SOP-Asset

SOP-Comp

Multiples

203,754

187,640

185,797

203,815

40%

40%

8%

12%

Composite

Shares

$ per share

Current Price

Upside

Upside %

19.36

41.21

0.92

123.66

0.90

max

$

86.19

$

117.97

$

93.45

$

196.61

$

82.60

Weighted $

81502

75056

14864

24458

$195,879

2080

$94.17

$82.05

$12.12

14.8%

Conclusion

Chevron is currently the inexpensive to their integrated peers, and offers a tremendous value

proposition. After reviewing pending litigation in Ecuador, an item currently creating a drag of $4

per share, my analysis indicates that any judgment that may result would be unenforceable in

the US under the Uniform Enforcement of Judgments Act. Combined with my oil price

projections tracking the US Energy Information Administrationʼs base case, and assessing the

spot value of Chevron reserves, I assign Chevron my a composite 12 month price target of

$94.17. Accordingly, I recommend Chevron (CVX) as a BUY with a 14.8% upside from its close

on November 26, 2010.

11/29/10

16

Valuation

>==$"/*?+

Appendix A – Selected Financials

Appendix B -Works Cited

1.

2.

3.

4.

5.

6.

7.

8.

Economist Intelligence Unit, Global Forecasting Service, December Update 2010

US Energy Information Administration, 2010 Energy Outlook

International Energy Agency, 2010 World Energy Outlook

Bloomberg New Energy Finance, Global Trends in Sustainable Energy Investment

JP Morgan, Upstream Deepdive 2010

Exxon Mobil 2009 Annual Report

Chevron 2009 Annual Report, 2009 10K, and 2010 Q1-Q3 10-Q

Atlas Energy 2009 Annual Report

11/29/10

17

Appendix

Appendix C – Sum of Parts – Valuation of Chevron Reserves

!"#$%&'"%(%"$%(

!"#$%&'(

'E'F(G

H:I:*6J:K

F7K:I:*6J:K

'E'G!G2

H:I:*6J:K

F7K:I:*6J:K

'E'GQ8)R0

H:I:*6J:K

F7K:I:*6J:K

'E'#5S:8

H:I:*6J:K

F7K:I:*6J:K

'E'T:7U)VRS:I86*)

H:I:*6J:K

F7K:I:*6J:K

'E'#5S:8'GQQ)*)05:1 H:I:*6J:K

F7K:I:*6J:K

'E'&67'R67I:75)670*G5S0D01R0'6)*'107K1

'E'G5*01'%7:8UW

T650*';%'<==>'J86I:7'8:1:8I:1

'E'Y68*K

,&012123

!86D0D*:'":1:8I:1'E'47K:I:*6J:K

!611)D*:'8:1:8I:1'E'47K:I:*6J:K

T650*'ZWK86R08D67'8:1:8I:1

-#%

'''OLX=@L

%486J:

F('/4*Q'26015

F('Y:15'26015

2070K0

G!G2'E':\'20*5:\

GQ8)R0

?IJK*L(KM0K"'%$#

#)*'+,,-.

/01'+-23./01'+-#%.$0*405)67

;%'<==>

';%'<==>'+-23?@AB.# )*'+C?DD*.

@@<<

<L@M

L>> C''''@NAM

<L>

LBM

OO

@OAM

><O

P=O<

BNL

NAP

<MP

<N>B

MB<

NAL

B<=

>NB

@O>

PAO

M<O

<=ML

LP<

PA<

<ON

L=P@

P<O

@=AN

@=P

PP<L

>P<

>A<

@<PO

@BL=

L@O

BA<

O>=

@==L

@NL

NAB

>N

NL

@L

MAB

PM

>>=

@N@

MAP

N<O

@O

BP=

@MN

O>NL

<OB>>

GI:80U:

PP><

@<===

<MPOP

>MBL

<B>OO

LBMMB

,089:5

$0*4:

$

@O

5,118

5,310

5,536

4,047

9,064

10,584

10,741

5,607

526

1,011

11,616

1,181

%&&&&&& !"#$

C''''''''@@=X>NM

<A<P

=A<P

20*5:\

GI:80U:'+[D6JK. C?D6JK

<@=

NAP

LL=

B

@PL

>

PP

N

@<M

P

ON

L

B

LMP

P=]

/'%=&$123

?@&(1A'B#

H$@&%

P=]'6Q'2S:I867'!S)*)J1'2S:[

`7R'2S:I867'#867)5:

!:09

%087)7U1

CDE

@AP

(S08:1 GC?(S

<N= .456788

C,,'J:8'1)5:

=AB

=AM

=AB

=AB

=AP

=AL

=A<

@

=AP

=AM

=A<

,4*5)J*:

<\

<M

@LB=

@M>NO

@PN@

@OPMN

/.,>-+:;<

LB=

LON@

@<@

ON

OMN

<>L

OO

P>@

L@B

P>P

@OP

NOM

B=L

BMB@

?F-/:?.G*

@=NB

_&/

/01'56'_)a4)K1

/*6D0*'!6^:8'/:7:805)67

268J'G11:51

/8611'G11:51

''''201S

''''H:D5

&:5'201S

!:71)67'6^:K

%\J:R5:K'$0*4:'6Q'2675)7U:7R):1

(4['6Q'J0851'%a4)5W'$0*4:

1S08:1

(#!%$?(S

11/29/10

LL>@B

@=<M@

C''''''''@PPX@LM

''''''''''''''LXN@N

C''''''''@PBXBP@

@PNP

<OM=

PM>>

LBP

L@==

LNL

,-9:;:;<

()5:'&4[D:8':\'GF

F('E'6^7:K'?'*:01:K

P=N

F('E'H)158)D45681'?'8:1:**:81

>@NB

2070K0

@O@

%F'E'6^7:K'?'*:01:K

BM

%F'E'K)158)D45681'?'8:1:**:81

@<>L

_G'E'6^7:K'?'*:01:K

>NN

_G'E'K)158)D45681'?'8:1:**:81

MM<

G!G2'E'#^7:K'?'*:01:K

P>@

G!G2'E'K)158)D45681'?'8:1:**:81

OLO

#5S:8'#_

@MBB

#5S:8'H"

@@==

_4D8)R0751

<P=@N

GI)05)67

27,143

13,491

!)J:*)7:1

!)*+,-./

&:5'20J0R)5W'+[D6JK.

<@=

LL=

O@@

PP

O<=

@<M

G1JS0*5

2S:I867'T8071J685

PP===

@OB===

<M>B>>

/01

+C?D6:.

C'''''''@>A@

@BA@

NAP

NAL

PAO

PA<

@@AB

@=A@

@AM

@AL

MAB

MAP

L@==

<MM@

@O<B

>L=

B=>>

C''''''''@>LX=PO

@=X>>P

@<NNL

E@N>=

E<M>O

E@@L=

C''''''''@BNXOM=

<==B

C''''''''''''>LAMP

18

Appendix

Appendix D

Discounted Cash Flow

Chevron (CVX)

Analyst: David Clark-Joseph

Date: 11/30/2010

(MM)

Year

Revenue

% Growth

Operating Income

Operating Margin

Terminal Discount Rate =

Terminal FCF Growth =

2010E

188,880

2011E

2012E

2013E

2014E

11.27%

3.7%

2015E

2016E

2017E

2018E

2019E

2010E

210,272 234,698 255,821 278,845 303,941 334,791 368,772 406,203 447,432 492,847

11.3%

11.6%

9.0%

9.0%

9.0%

10.2%

10.2%

10.2%

10.2%

10.2%

24,892

13.2%

24,370

11.6%

7,388

3.9%

8,390

4.0%

140

0.1%

147

0.1%

155

0.1%

256

0.1%

279

0.1%

304

0.1%

335

0.1%

369

0.1%

406

0.1%

447

0.1%

493

0.1%

Taxes

Tax Rate

14,120

43.8%

14,328

43.8%

14,620

43.8%

11,369

44.0%

12,515

44.0%

13,641

44.0%

15,173

44.0%

17,037

44.0%

19,124

44.0%

21,459

44.0%

23,637

44.0%

Net Income

% Growth

18,020

18,286

1.5%

18,660

2.0%

22,144

18.7%

23,456

5.9%

24,656

5.1%

26,676

8.2%

29,059

8.9%

32,464

11.7%

34,023

4.8%

36,983

8.7%

Add Deprc/Depl/Amort

% of Sales

Plus/(minus) Changes WC

% of Sales

Subtract Cap Ex

Capex % of sales

8,258

4.4%

1,213

0.6%

21,627

11.5%

11,565

5.5%

(632)

-0.3%

22,079

10.5%

11,970

5.1%

(722)

-0.3%

22,962

9.8%

16,583

6.5%

(767)

-0.3%

23,880

9.3%

17,247

6.2%

(837)

-0.3%

24,835

8.9%

17,937

5.9%

(912)

-0.3%

25,829

8.5%

18,654

5.6%

(1,004)

-0.3%

26,862

8.0%

19,400

5.3%

(1,106)

-0.3%

27,936

7.6%

20,176

5.0%

(1,219)

-0.3%

29,054

7.2%

20,983

4.7%

(1,342)

-0.3%

30,216

6.8%

21,823

4.4%

(1,479)

-0.3%

31,425

6.4%

5,864

7,140

21.8%

6,946

-2.7%

14,080

102.7%

15,031

6.8%

15,852

5.5%

17,464

10.2%

19,417

11.2%

22,368

15.2%

23,448

4.8%

25,903

10.5%

Other Income

Other Income % of Sales

Interest and Other

Interest % of Sales

Free Cash Flow

% Growth

NPV of Cash Flows

NPV of terminal value

Value of Operating Assets

Adjustments

Litigation Contingency

Probability of Contingencies

Expected Value

Pension Shortfall

Net Debt

Projected Equity Value

Free Cash Flow Yield

Current P/E

Projected P/E

Current EV/EBITDA

Projected EV/EBITDA

Shares Outstanding

Current Price

Implied equity value/share

Upside/(Downside) to DCF

Operating Lease Adjusted Debt

Cash

Cash/share

11/29/10

87,144

122,026

209,170

23,780

10.1%

26,094

10.2%

28,721

10.3%

31,306

10.3%

34,818

10.4%

39,090

10.6%

43,870

10.8%

49,218

11.0%

54,213

11.0%

9,655 7,674.63 7,528.81 7,294.58 7,365.40 7,375.44 8,124.05 6,711.48 6,899.85

4.1%

3.0%

2.7%

2.4%

2.2%

2.0%

2.0%

1.5%

1.4%

43%

60%

Terminal Value 354,936

Free Cash Yield

(113,000)

1.0%

(1,130)

(2,496)

(1,790)

203,754

7.30%

Terminal P/E

9.6

Terminal EV/EBITDA

4.7

3.56%

9.1

11.3

5.0

6.2

9.0

11.1

4.6

5.7

8.8

10.9

4.7

5.7

2,008

2,003.1

1,998.2

1,993.3

1988.36

1,983.5

1,978.6

1,973.8

101.72

101.97

102.22

102.47

102.73

102.98

103.23

$ 82.05

$ 101.47

23.7%

12,785

10,995

5.48

19

Analyst Bio

Analyst Bio

David Clark-Joseph is full time student pursuing a Masters of Business Administration at The Ohio State

University – Fisher College of Business. At Fisher, he is an active member of the Student Investment

Management program, which combines rigorous academic objectives with the practical demands of

institutional portfolio managers. With his 30 classmates, he manages $20.15 Million for the Ohio State

Endowment.

David is actively pursuing a career in investment management and transaction advisory, and is a

CFA Level I candidate. Before attending Fisher, he received a Juris Doctor from Florida State University,

and performed securitization and secured transaction work with Legal Services of North Florida and

served as a staff member in the Florida Senate Commerce Committee, analyzing corporate taxation and

industrial bonds.

11/29/10

20