2014 Southeast Hay Convention Fertilization Outlook for Hay Producers Fertilization Outlook for

advertisement

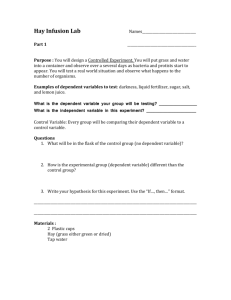

2014 Southeast Hay Convention Fertilization Outlook for Hay Producers Fertilization Outlook for Hay Producers Over the next few minutes… • Projected Production Costs • The False Economy of Shortcuts • Fertilizer Value of Different Forage Crops • Fertilizer Industry Trends - Supply/Demand - Changes in Capacity - Imports and Consolidation - Price stability/decline? Dr. Dennis Hancock Extension Forage Specialist Crop and Soil Sciences – UGA Bermudagrass Hay Production – 2014 Breakdown of Projected Costs per Acre $16 (g) (a) (b) $140 (c) (f) (d) $262 $12 (f) (g) (e) $36 (e) (d) (a) (c) $70 (b) $87 Fertilizer Fuel and Maintenance Pesticides Interest on Var. Costs Labor Fixed & Mgmt Costs Lime $652/acre or $109/ton The False Economy of Shortcuts Cost of Production Yield (t/ac) Forage Cost ($/lb) = $522 $587 $652 $717 $782 70% 80% 90% 100% 110% 120% ----------------------------- $/ton of DM ----------------------------- Total Cost ($/Acre) Forage Yield (lbs/Acre) Dr. Dennis Hancock Extension Forage Agronomist $456 8 7 6 5 4 3 1 $57 $65 $76 $91 $114 $152 $65 $75 $87 $104 $130 $174 $73 $84 $98 $117 $147 $196 $82 $93 $109 $130 $163 $217 $90 $102 $120 $143 $179 $239 $98 $112 $130 $156 $196 $261 2014 Southeast Hay Convention Fertilization Outlook for Hay Producers Annual Nutrient Removal by the Primary Hay Crops in the South Soil Test and Follow Fertility Recommendations Alfalfa Bermudagrass Orchardgrass Perennial Peanut Tall Fescue Nutrients Removed (lbs of Nutrient/Acre/Year) 300 250 200 150 100 50 Sample hayfields every year and 1/3 of your pastures each year. 0 Nitrogen Phosphate Potash Calcium Mag Adapted from Southern Forages, 2007 and Myer et al, 2010. Fertilizer Prices 0.80 Urea 45-46% nitrogen Price ($/lb of N, P2O5, or K2O) Diammonium phosphate (18-46-0), figured for P value only 0.60 Potassium chloride (60%) 0.40 0.20 19 9 19 5 9 19 6 9 19 7 9 19 8 9 20 9 0 20 0 0 20 1 0 20 2 0 20 3 0 20 4 0 20 5 0 20 6 0 20 7 0 20 8 0 20 9 1 20 0 1 20 1 12 20 1 20 3 14 0.00 Source: USDA-ERS, Jan. 2014 with industry forecasts Fertilizer Prices: A New Plateau? 0.80 $90.00 2004 $80.00 2014 Urea 45-46% nitrogen Diammonium phosphate (18-46-0), figured for P value only ($/lb of N, P2O5, or K2O) $70.00 Price $60.00 $50.00 $40.00 0.60 Potassium chloride (60%) 0.40 0.20 $30.00 $20.00 0.00 $10.00 $0.00 19 9 19 5 9 19 6 9 19 7 9 19 8 9 20 9 0 20 0 0 20 1 0 20 2 0 20 3 0 20 4 0 20 5 0 20 6 0 20 7 0 20 8 0 20 9 1 20 0 1 20 1 12 20 1 20 3 14 Value of Fertilizer (N, P2O5, or K2O) per Ton of DM Tracking Fertilizer Value in Your Hay has Also Never Been More Important Alfalfa Bermudagrass Corn silage Fescue Dr. Dennis Hancock Extension Forage Agronomist Orchardgrass Peanut Source: USDA-ERS, Jan. 2014 with industry forecasts 2 2014 Southeast Hay Convention Fertilization Outlook for Hay Producers (% of Total NPK Demand) World N Supply/Demand Balance Total NPK Use in the U.S. Demand is Driven by Corn 180.0 Demand 170.0 Capacity +12.6% 160.0 Corn Wheat Soybean 140.0 130.0 110.0 Cotton 100.0 High Value Crops 90.0 Other 4,000,000 6,000,000 4,000,000 3,500,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 1960 1970 1980 1990 2000 - 2010 1960 Source: USDA Economic Research Service (http://www.ers.usda.gov/Data/FertilizerUse/). Import Million tons of Nitrogen 1980 1990 Domestic 12% 7% 6% 35% Middle East Canada 50.8% China 10 11% 8 Egypt 6 Trinidad 4 Other 2 2003 2004 2005 2006 2007 2008 2009 2010 28% 2011 Source: Glen Buckley, NPK Fertilizer & Advisory Service, Nov. 2011. Adapted from USDA Economic Research Service (http://www.ers.usda.gov/Data/FertilizerUse/). Dr. Dennis Hancock Extension Forage Agronomist 2010 Urea Imports by Country 16 0 2002 2000 (% of Total Urea Imports) 18 27.2% 1970 Adapted from USDA Economic Research Service (http://www.ers.usda.gov/Data/FertilizerUse/). U.S. N Use is Dependent Upon Imports 20 12 16 3,000,000 2,000,000 14 Anh. Amm. Amm. Nit. N Solns. Urea 4,500,000 Tons of Actual N Tons of Product Actual N Applied 5,000,000 8,000,000 22 20 N Fertilizer Products Sold in the U.S. Anh. Amm. Amm. Nit. N Solns Urea 10,000,000 15 Source: UN FAO, 2012. Current world fertilizer trends and outlook to 2016. Actual Product 12,000,000 20 Source: Glen Buckley, NPK Fertilizer & Advisory Service, Nov. 2011. N Fertilizer Products Sold in the U.S. 14,000,000 20 12 20 11% 5% 14 80.0 3% 20 12% +5.5% 120.0 13 47% 150.0 Million tons 22% 3 2014 Southeast Hay Convention Fertilization Outlook for Hay Producers U.S. UAN 32% Prices Urea Prices (FOB Gulf Barge - $/ton) (Black Sea Urea Prices) High End High End Expected Expected Low End Low End Source: Bryce Knorr, FarmFutures.com (http://farmfutures.com/story-weekly-fertilizer-review-0-30765) Source: Bryce Knorr, FarmFutures.com (http://farmfutures.com/story-weekly-fertilizer-review-0-30765) U.S. Petroleum and Other Liquid Fuels Supply U.S. Energy Production by Fuel Adapted from U.S. Energy Information Administration's Annual Energy Outlook 2014 Adapted from U.S. Energy Information Administration's Annual Energy Outlook 2014 U.S. Natural Gas Imports and Exports (trillion cubic feet) U.S. Electricity Generation (Billion kilowatthours) Adapted from U.S. Energy Information Administration's Annual Energy Outlook 2014 Dr. Dennis Hancock Extension Forage Agronomist Adapted from U.S. Energy Information Administration's Annual Energy Outlook 2014 4 2014 Southeast Hay Convention Fertilization Outlook for Hay Producers Phosphorus Supply U.S. P Use and Exports • Phosphorus over short term appears stable 14 - 500%+ increase in imports in 2010 & 11. - Morocco has 40% of world’s supply of P • Long term supply is questioned. - US has 19% of world’s supply of P - 65% of that comes from one area (Tampa) - Cons. estimates are that this resource will last less than 30 yrs. Export Domestic 12 Million tons of Nitrogen • Price of MAP/DAP may be suppressed by inc. imports from Morocco & Russia. 10 8 42.4% 31.2% 6 4 2 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Adapted from USDA Economic Research Service (http://www.ers.usda.gov/Data/FertilizerUse/). U.S. DAP Price Forecast World P Supply/Demand Balance 55.0 Demand 54.0 Capacity (FOB Tampa - $/metric ton) +12.5% High End Million tons 53.0 52.0 Expected 51.0 Low End 50.0 49.0 48.0 47.0 +8.7% 46.0 16 20 15 20 14 20 13 20 20 12 45.0 Source: UN FAO, 2012. Current world fertilizer trends and outlook to 2016. Source: Bryce Knorr, FarmFutures.com (http://farmfutures.com/story-weekly-fertilizer-review-0-30765) World K Supply/Demand Balance Demand Capacity U.S. K Use and Imports 9 +31.4% Million tons 55.0 50.0 45.0 40.0 35.0 +15.8% 7 6 5 4 3 85.4% 78.0% 2 0 2002 20 16 20 15 20 14 20 13 12 20 Domestic 1 30.0 Source: UN FAO, 2012. Current world fertilizer trends and outlook to 2016. Dr. Dennis Hancock Extension Forage Agronomist Import 8 Million tons of Nitrogen 60.0 2003 2004 2005 2006 2007 2008 2009 2010 Adapted from USDA Economic Research Service (http://www.ers.usda.gov/Data/FertilizerUse/). 5 2011 2014 Southeast Hay Convention Fertilization Outlook for Hay Producers (Million Metric Tons) World Potash Capacity by Country/Company Industry has become Potash Supply by Country/Region 1,485 1,117 Volume 3,750 18,455 Canada East Europe Western Europe China Middle East Latin America USA Other 5,548 5,797 5,895 16,918 PCS Mosaic Agrium 6364 6545 1240 13% 13% 3% } Russia Uralkali Silvinit 3452 3763 7% 8% } combined Belarus Germany Israel Jordan Belaruskali Kali & Salz ICL Fertilizers Arab Potash Major Producers 5465 4250 3600 1452 36,131 13,066 11% 9% 7% 3% 73% 27% Others U.S. Potash Price Forecast highly consolidated. Canada Total Source: Glen Buckley, NPK Fertilizer & Advisory Service, Nov. 2011. % of Total (1000 metric tons of K2O) 49,197 Canpotex Source: Glen Buckley, NPK Fertilizer & Advisory Service, Nov. 2011. Summary (FOB Midwest Wholesale - $/ton) • Soil fertility is an investment. High End § “You get out of it what you put into it.” • Fertilizer prices in 2014 appear to be stabilizing Expected § Increasing capacity/supply in near term may even temper prices. Low End • Long-term prospects appear positive § U.S. Energy policy and LNG exploration? § P supply is dwindling § Industry consolidation and political upheaval? Source: Bryce Knorr, FarmFutures.com (http://farmfutures.com/story-weekly-fertilizer-review-0-30765) Resources Questions? USDA Economic Research Service (http://www.ers.usda.gov/Data/ FertilizerUse/). www.georgiaforages.com Dr. Dennis Hancock Extension Forage Agronomist 6