Assignment: Accounts Name:

advertisement

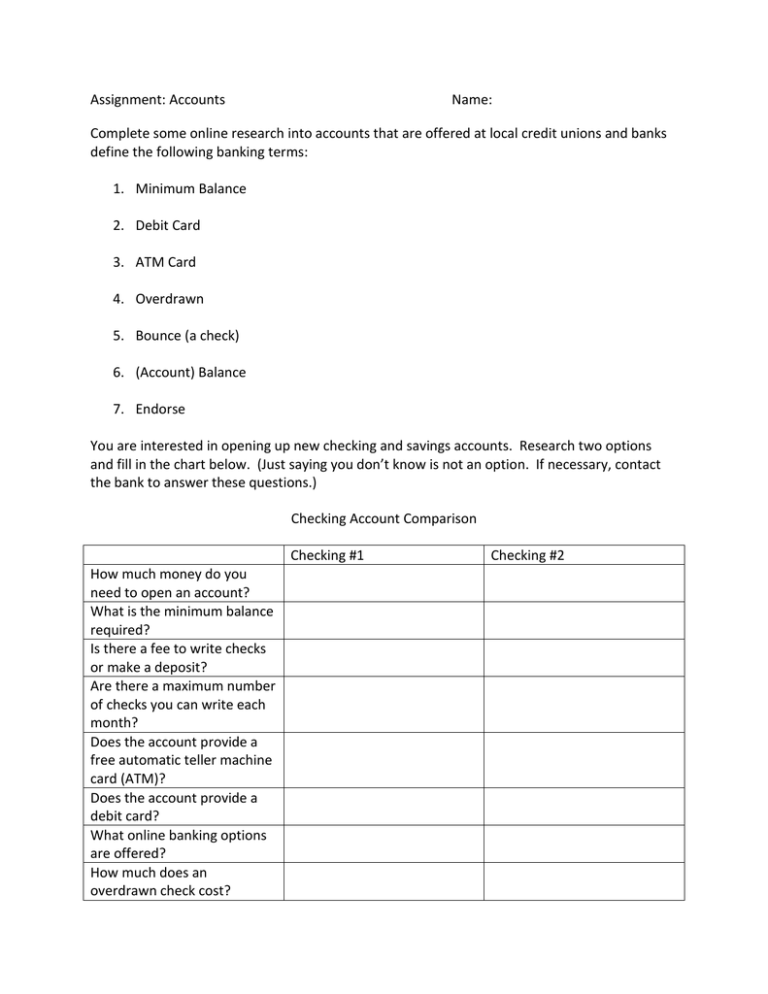

Assignment: Accounts Name: Complete some online research into accounts that are offered at local credit unions and banks define the following banking terms: 1. Minimum Balance 2. Debit Card 3. ATM Card 4. Overdrawn 5. Bounce (a check) 6. (Account) Balance 7. Endorse You are interested in opening up new checking and savings accounts. Research two options and fill in the chart below. (Just saying you don’t know is not an option. If necessary, contact the bank to answer these questions.) Checking Account Comparison Checking #1 How much money do you need to open an account? What is the minimum balance required? Is there a fee to write checks or make a deposit? Are there a maximum number of checks you can write each month? Does the account provide a free automatic teller machine card (ATM)? Does the account provide a debit card? What online banking options are offered? How much does an overdrawn check cost? Checking #2 How much does it cost to stop payment on a check? 8. Briefly explain which of the two checking accounts would be better for you. 9. It's the beginning of the month. Create a blank register, similar to the one you saw in your unit and record the transactions for the month. You have $43.18 to start in your checking account. On October 1 your paycheck for $468.78 was deposited into your checking account. On October 1 you made payments to ACME Electricity for $45.85 on check #1092. On October 2 you paid DirecTV $60.00 with check #1093. On October 4th, you bought groceries at Food Town Mart. The groceries cost $24.32. You swiped the amount with your check debt card. On October 11 you made a payment to Farmers Insurance $115.00 on check #1094. On October 15 your paycheck for $468.78 was deposited into your checking account. On October 15th, you bought groceries at Food Town Mart with your debt card for $88.72. Also on October 15th, you bought a new pair of shoes on sale at Fit Well Shoe Store for $19.95. You paid for the shoes with check No. 1095. On October 18th, you received a check for $15.00 from Aunt Mable for your birthday. You deposited the check at the bank the next day. On October 25 you pulled check #1096 and put it into your wallet. You plan on going garage sale shopping this weekend and might need to write a check for what you buy. On October 28th you received your telephone bill from C & P Telephone Company for $23.20 and paid with check #1097. On October 28th you write your check for your share of next month's rent. Check #1098 for $425. 10. When you have finished the transaction records for the month answer the following question: What is the most you can spend at the garage sale this weekend? Explain: