File

advertisement

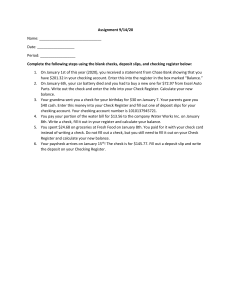

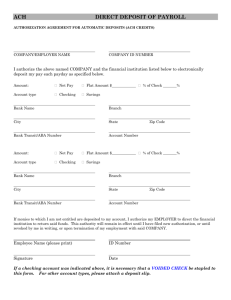

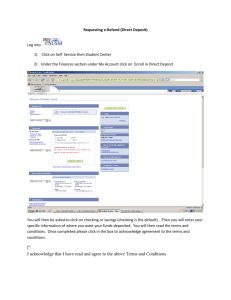

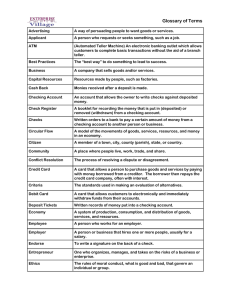

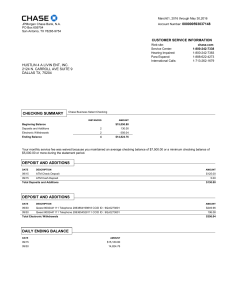

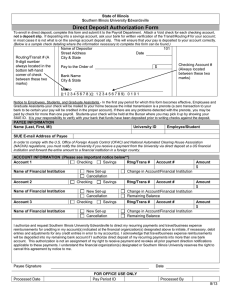

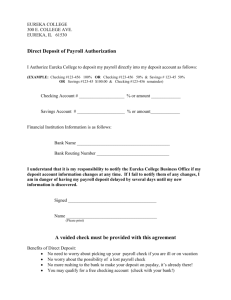

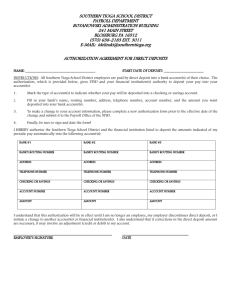

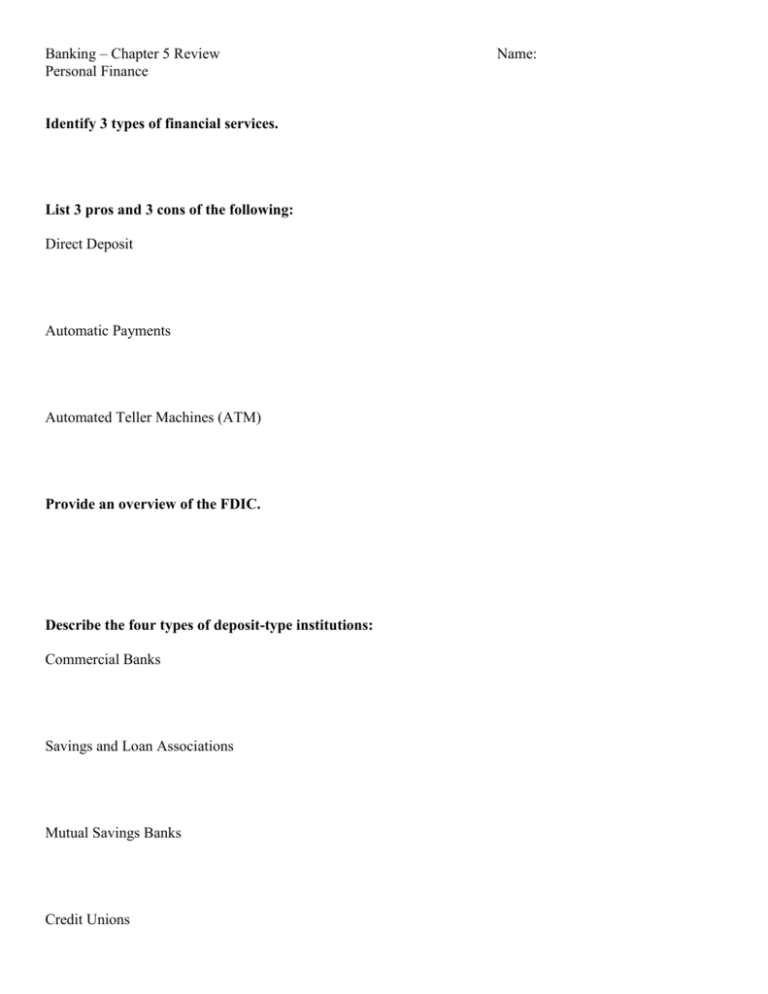

Banking – Chapter 5 Review Personal Finance Identify 3 types of financial services. List 3 pros and 3 cons of the following: Direct Deposit Automatic Payments Automated Teller Machines (ATM) Provide an overview of the FDIC. Describe the four types of deposit-type institutions: Commercial Banks Savings and Loan Associations Mutual Savings Banks Credit Unions Name: Describe the four types of nondeposit-type institutions: Life Insurance Companies Investment Companies Finance Companies Mortgage Companies Complete the following table in regards to the benefits and draw backs of savings plans: Type of Account Regular Savings Accounts Certificates of Deposit (CD) Money Market Accounts US Savings Bonds Define the following terms: Rate of Return Compounding Annual Percentage Yield Benefits Drawbacks Compare and contrast the three types of checking accounts: Regular Checking Accounts Activity Accounts Interest-Earning Accounts Identify and describe four elements that affect checking accounts: 1. 2. 3. 4. List the 6 steps in correctly writing a check and write check #101 to Abbotsford School District for $106.23. 1. 2. 3. 4. 5. 6. Provide 5 tips when making deposits into your checking account: 1. 2. 3. 4. 5. Define the following terms: Stop-Payment Order Endorsement Bank Reconciliation List the 4 steps involved in reconciling your checking account: 1. 2. 3. 4. Describe how a Certificate of Deposit works: