RFID ROI

by

John Dirk Kinley

MBA

Kellogg School of Management, Northwestern University, 2000

Submitted to the MIT Engineering Systems Division in

Partial Fulfillment of the Requirements for the Degree of

Master of Engineering in Logistics

at the

MASSACHUSETTS INSTITUTE.

OF TECHNOLOGY

Massachusetts Institute of Technology

JL2RA 004

June 2004

LIBRARIES

@ 2004 John Dirk Kinley. All rights reserved.

The author hereby grants to MIT permission to reproduce and to distribute

publicly paper and electronic copies of this thesis document in whole or in part.

Signature of

Author

Engineerifg Sy tems Division

.}ay

10th, 2004

Certified by

Director, MIT Integrate SuMI'

cs

Acting Director, Affiliates Program in Lo

James B. Rice, Jr.

ain Management (ICSM) Program

enter for Transportation & Logistics

Thesiyjupervisor

Accepted by

//

Yossi Sheffi

Professor, Engffeering Systems Division

Civil

and

Environmental Engineering Department

Professor,

Director, MIT Center for Transportation and Logistics

5/5/2004

I

BARKER

RFID ROI

by

John Dirk Kinley

MBA

Kellogg School of Management, Northwestern University, 2000

Submitted to the MIT Engineering Systems Division in

Partial Fulfillment of the Requirements for the Degree of

Master of Engineering in Logistics

ABSTRACT

This thesis investigates financial results from RFID integration at product level in semiconductor

manufacturing. The thesis explores how the technology might act in concert with other

significant logistics tools to create return on investment. In this case, the use of RFID, along with

postponement and Kanban practices, may help a manufacturer better align supply with central

processing unit (CPU) demand. The resulting economic benefits are explored through yield

scenarios.

It is important to note that the thesis explores this topic without the benefit of empirical data.

Consequently, a number of assumptions were made; these assumptions may affect the validity of

the observations. Nonetheless, the study demonstrates an innovative approach that may

contribute to new models of creative problem solving.

Thesis Supervisor: James B. Rice, Jr.

Title: Director, MIT Integrated Supply Chain Management (ICSM) Program

Acting Director, Affiliates Program in Logistics, Center for Transportation & Logistics

2

ACKNOWLEDGEMENTS

I would like to thank all those who contributed to my understanding of this topic and to the

creation of this document:

James B. Rice for his time, feedback, and guidance.

My classmates; in particular David Cassett, Dennis Duckworth, and Christopher Hopeman, who

worked on similar projects and gave valuable input at various points.

Lastly, my fianc6e, for her support; in particular, her repeated proof reading of a topic that could

not lie further from her true interests.

3

TABLE OF CONTENTS

ABSTRACT .......................................................................................................................................

2

ACKNOW LEDGEMENTS..................................................................................................................

TABLE OF CONTENTS.....................................................................................................................

INTRODUCTION ...............................................................................................................................

3

4

Background and M otivation .......................................................................................

Research Question ....................................................................................................

Literature Review ............................................................................................................

5

5

6

7

Postponem ent Literature ..........................................................................................

Kanban Literature ..................................................................................................

Tracking & Tracing Goods .......................................................................................

RFID Literature.........................................................................................................

7

8

10

11

RFID System : In Brief..................................................................................................

16

Sem iconductor M anufacturing: In Brief....................................................................

M ethodology .................................................................................................................

18

19

DATA ANALYSIS ...........................................................................................................................

Current Process w ith Requirem ents...........................................................................

Proposed Process w ith Requirem ents ........................................................................

22

22

24

YIELD AND ROI M ODELS............................................................................................................

OBSERVATIONS ............................................................................................................................

28

37

Changes in Y ield...........................................................................................................

37

Other Contributors and Risk Factors ........................................................................

Effects on Cycle Tim e .........................................................................................

Effects on Quality ..................................................................................................

Shortage Effect..........................................................................................................

Labor Costs ...............................................................................................................

Inventory Holding Costs.......................................................................................

CPU A ssociated Costs ..............................................................................................

M anagem ent and Operational Risks ......................................................................

38

38

39

39

40

41

41

42

BIBLIOGRAPHY.............................................................................................................................

46

APPENDIX A - CPU SORTING CAPITAL EQUIPMENT............................................................

48

4

INTRODUCTION

Background and Motivation

In 1888 Heinrich Hertz proved the existence of electromagnetic radiation. Key to his proof was a

radio frequency (RF) device he built which transmitted radio waves. In 1942, the Allied Forces

used large RF systems in England to identify (ID) returning Allied bombers and distinguish them

from raiding German warplanes. Thus, RFID technology has been in existence for several years.

However, it was not until recently that it attracted significant attention. In the past there were

significant adoption barriers, including overly large and expensive tags and readers, and

inadequate back end data management systems. However, recent advances have decreased costs,

improved form factors, and introduced functional data management systems. Recently, the

consumer packaged goods companies Gillette and Rockport have committed to RFID pilots.

Moreover, TESCO, Wal-Mart and other firms have committed to specific timelines for more

comprehensive pallet/case level integration with supply chain partners. These organizations and

others are trying to understand how best to leverage the technology for economic gain.

The anticipated benefits of utilizing this technology are numerous and include: non-line of sight

(NLOS) functionality, product or unit level traceability (ULT), and location based asset tracking.

RFID provides NLOS tracking by virtue of radio frequency transmission. For example, in this

transmission a warehouse manager could track various packages stacked together without having

to move packages around to look for the important bar codes. Additionally, by providing an

extensive numbering format, RFID offers the possibility of identifying each item or unit with

unique numbering which makes ULT possible. ULT could become important in tracking

individual products through a supply chain to perform reverse logistics, or with material sourcing

issues such as tracking poor quality raw materials by associating units with their production

batches. Another potential benefit is asset tracking. Generally, RFID achieves asset tracking

through use of source association. With this method, distinct radio wave emitting sources are set

5

up at various points in a supply chain where they consistently monitor an asset's movements

through various areas. These areas are generally confined spaces, thus providing for fairly

accurate asset location information. RFID has attracted attention outside the arena of consumer

packaged goods for asset tracking. The Department of Defense (DOD) has begun field use of

RFID for ULT tracking of specific equipment and resources. In an example referred to later, the

DOD is using RFID to track fuel containers through their internal supply chain, from purchase to

use.

The semiconductor industry stands to gain from RFID use on the unit level considering the high

value-to-size ratio of the product (chips), the complicated nature of the manufacturing process,

and the need for product information while maintaining high process speed (velocity). With this

in mind, the study will consider a section of the semiconductor manufacturing process, focusing

first on one key benefit of ULT use; second, briefly considering other potential effects within

manufacturing; and, finally, highlighting some potential concerns. The hope is that this study

will provide a foundation of analysis for others to learn from, and build upon.

Research Question

The specific research question on which this study focuses is: "What is the return on

investment from implementing RFID in concert with postponement and Kanban practices

to better align output with demand in a semiconductor manufacturingfacility?"

This question is of particular interest because it presents REID as an enabling technology in an

environment, manufacturing, where this has not previously been a focus. When considering who

will benefit from RFID, the focus has been on distribution centers (DCs) and retailers. Research

in this area often implies that the manufacturer will assume the majority of costs, such as tags and

6

tagging labor, while accruing less benefit from its investment in this technology than its supply

chain partners.'

Literature Review

Postponement Literature

Moving the customization point closer to customers, or postponement, can be a powerful logistics

strategy. Research in this field has studied diverse postponement strategies involving labeling,

packaging, assembly, and manufacturing. This research has demonstrated that postponement

strategies are useful when inventory carry costs exist, and manufacturing postponement is likely

to reduce product obsolescence risk. Other factors to consider with a postponement strategy

include end demand, modularity of manufacturing, product value and product life cycle.

Postponement typically offers greater advantages when end demand has some degree of

variability; manufacturing is somewhat modular; product values are higher; and life cycles are

shorter. These conditions exist in semiconductor manufacturing.

Researchers have given considerable attention to the use of information systems (IS) to enable

postponement strategies.2 At any given point in a product pipeline there are a number of dynamic

forces inside and outside the firm that need to be accounted for in order to make an optimal

decision. For manufacturing, use of IS to enable postponement is a method that can respond to

one of the most dynamic forces-- demand. In the world of technology manufacturing, Dell is the

oft-cited example of postponement through use of IS. Dell combines direct sales with real time

inventory information and a make-to-order systems to achieve effective postponement. Dell's

' Byrnes J. Who Will Profit From Auto-ID? Harvard Business School: Working Knowledge. September 1,

2003.

2 Anand K, Mendelson H. Postponement and Information Systems in a Supply

Chain. NYU WISE 1998.

December, 1998.

7

success has transformed the personal computer industry and literally forced competitors, such as

IBM and Gateway, to adapt.

Successful postponement requires supply chain visibility to match supply with demand. For

example, material and product flow visibility become very critical as more processes, such as

manufacturing and assembly, are postponed until customer demand is known. Understanding the

nature of material and product flow from the supplier to the customer is a key potential benefit of

RFID. When consumer demand is initiated, the internal supply chain could ideally be instantly

queried through RFID systems to understand total work in progress (WIP) and inventory levels,

locations. The query would offer insight to the company supply chain expert, allowing him/her

assess the most efficient fulfillment route through directing manufacturing, assembly and

inventory operations. The more accurate and efficient the query, the better the postponement

results. It is better to know exact WIP and inventory than rough estimates. The potential benefit

RFID brings is greater accuracy and velocity. The end goal for an internal RFID system is to use

radio frequency transmission to perform more comprehensive and immediate queries.

Kanban Literature

Kanban means "signal". Kanban signals a cycle of replenishment for production and materials.

It maintains an orderly and efficient flow of materials throughout the entire manufacturing

process. It is usually a printed card that contains specific information such as part name,

description, and quantity.3 Leading companies around the world have considered and in some

cases, adopted Kanban practices. The industries using Kanban are quite diverse including high

tech (Sun Microsystems), steel manufacturing (Northeast Mfg.), and automotive production

3 Six Sigma. Definition of Kanban. Available online: http://www.isixsigma.con/dictionary/Kanban-

148.htm

8

(Toyota). Kanban can represent an inexpensive methodology for effectively communicating

demand through a manufacturing process.

Although Kanban has been well researched, new developments in many aspects of the supply

chain have continued to emerge. Kanban has traditionally operated as a manual signal.

Enterprise resource planning (ERP) systems have worked to integrate Kanban into their software.

With ERP Kanban has had an impact throughout organizations, affecting finance, human

resources, and transportation decisions. The emphasis is on systemic effects of Kanban and big

picture implications of integration. Recent literature has also focused on defining and

implementing baseline measurements. Safety stocks, minimums, and order multiples are all

adjusted using baseline measurements as guidance. Accuracy and efficiency of baseline

measurements is an area of considerable interest. In general automated Kanban systems have

been touted for their ability to offer many advantages such as recalculation of lot sizes-- both

intra-company as well as through supply chain-- capacity planning, and staffing levels.

Many companies cannot accurately control order volume. On the most basic level, sudden high

order periods lead to spikes in demand which can create stock-outs. Use of simulation tools

which take into account replenishment lead times, inventory costs, and other inputs can be

exceptionally useful when demand is not linear. Conversely, not all parts can or should be

included on a Kanban system. General qualities of successful products included in a Kanban

system are: linear demand, outstanding quality, not being phased out, and realistic lead times. It

is interesting to note that although semiconductor chips are periodically phased out by speed, the

chips themselves are not being phased out. Furthermore the demand for chips is fairly linear;

they are generally of high quality; and they have realistic lead times. Interestingly, Kanban is

also a great tool to use with RFID since Kanban uses real time inventory data, and RFID provides

real time inventory data.

9

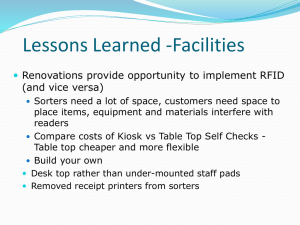

Tracking & Tracing Goods

Tracking is defined as the observing of the progress of goods through a supply chain. Tracing is

following the course which goods take through a supply chain. Although these terms have

similar definitions they are in fact different functions. The evolution of tracking and tracing

goods has progressed from the laborious markings of engraving of valuables, to bar codes in the

early 1970s, to the advent and current deployment of RFID. With this evolution the

sophistication of tracking and tracing has improved greatly. Since manual labor was no longer

required with the bar code, labor costs dropped on a per item basis, and more and more products

were tracked and traced. The purpose for tracking and tracing also changed from authenticity to

Table 1.

Continous, Data Floa

Humaniesource Efficient

Poin thouificD it

ab

r

urce

ine

ow b

icient

Sheltered Tag Placement Enabled

SiiglenmCode Reading Capabilitiesh

-nvgive,

reading,

Ulisetered C dework polyi

Up

Uniqtue Product' Identifier in Numberinig'

L fitd]

MultipleTag Reading Capabilities

Uninvasive cnntreading

miemg

n

,aufctean*-

Source:,McFarlwane,Shetai, The Impact

iforma

tio.Ictn adtion

toppy

these advantas,t

International

.Journal of Log cs Management(IJLM VoL. 14uNo. (2003 ,20.

supply chain uses, such as inventory management. Although RFID is just now beginning to gain

broader acceptance, expectations are high; researchers are forecasting a $3.1 Billion industry

within five years4 . The growth expectations can be attributed in part to the many significant

advantages over bar codes. These include multiple reads per second, non-line of sight

functionality, read/write tagging, and location information. In addition to these advantages, the

4 Koprowski G. RFID Emerges to Threaten the Bar Code. CRMBuyer. April 12, 2004.

10

introduction of a unit level numbering system by EPCglobal5 enables ULT product identification

for the first time on a global standardized scale.

One of the exciting benefits that REID offers is its breadth of potential application within the

supply chain. Current studies focus on how RFID might benefit product flow from

manufacturing to distributors, from retailers to consumers, and across full supply chains and

industries. This paper considers a specific example, in semiconductor manufacturing, to show

how creative use of RFID to identify CPUs (or chips) at the unit level might increase yield by

changing how manufacturing reacts to demand.

RFID Literature

Companies are facing more and more complex business decisions involving technology adoption.

Some of these are driven by strategic objectives, while others are more operationally driven.

Nonetheless, all seem to be pushing for the common goal of greater efficiency and effectiveness.

A common ground facing many companies is how to measure risk-reward or cost-benefit. Recent

history has made many firms pause before hasty adoption. The past tells us that roughly 90% of

first round Enterprise Resource Planning implementations were not successful in the 1990s.6 In

the late 1990s it was not unusual for traditional dollar based return on investment studies to be

grossly manipulated, or ignored as meaningless in the 'new economy'

.

These abuses led to

exaggerated expectations and over-commitment to new technologies in the 1990s and early

2000s.

EPCglobal Website. Available online: www.epcglobal.com

Donovan RM. Why the Controversy over ROI from ERP? R. Michael Donovan & Co., Inc White Paper.

January 2000.

5

6

7

Mollison, C. ROI: Times Have Changed in the Past Couple Years, and ROI Has Made a Comeback as a

Result. Internet World. March 2002.

11

Literature focusing on RFID began to appear in mass during the late 1990s. Many studies focus

on the cost hurdle associated with hardware and systems integration. Most of these are concerned

with retailers who have been identified as those in the supply chain with the most to gain. In a

typical supply chain the manufacturer might bear both the cost of the tag, as well as the cost of

affixing the tag. Furthermore it has been analytically demonstrated that in many industries the

manufacturer is in the least favorable cost-benefit position in the supply chain.

Other areas of research are concerned with hardware cost and performance trends. This is

important information for determining feasibility of lower cost systems and adoption rates.

According to Forrester Research, after 2007, RFID tags will have dropped to the $.01/tag level.

Some analysis points to

this price point as the

economically viable

Chart1..Analysis

Chr

C - Technology/

Dntinaryi

A -Case studies

B - Economic

Management

Logistics

Case Studies

Logistics

Economics

Logistics

TeclutologylIT

Evolution

2 - Storefront

Ste

Storefron

tefono/t

Stoefiont

security

3 -Security

Cas Studies

Security

Economics

Security

Teclogo/rr

Evolution

SmrMahns

Case Studies

SatMcie

Economics

SmtMcies

mrtahns

5- Telematics

Case Studies

Economics

Technology/IT

(C5)

Evolution

stenc

Sqimn

sy

Case Studies

Systemic

Systemic

6-Systemic

Economics

Technology/IT

1-Logisics

nutywd

point for mass use.9

Interestingly, there

Management

seems to be a catch-22

preventing a steep

4 - mrt

curve from

growth growhMcrvefrone-s

Tednoogy/IT

Evolution

occurring in the next

few years. REID

fe yar.(FIA5)

equipment

(B35)

(D5)

systen-dc

Evolution

manufacturers cite low

Framework by Professor Hau Lee, Stanford University

unit demand as a reason

8

Byrnes J. Who Will Profit From Auto-ID? HarvardBusiness School: Working Knowledge. September 1,

2003.

9 Gupta, P. The future of Radio Frequency Identification. TechRepublic. August 18, 2003.

12

for not reducing tag and reader prices, meanwhile potential adopters cite high costs as a central

reason for not purchasing.

Professor Hau Lee of Stanford University has proposed an effective framework for understanding

RFID literature. His contribution segments writings into general subject matter on the "y" axis

and methodology of study on the "x" axis. The literature reviewed falls primarily in the

Economic Analysis column. The majority of economic analysis articles and work done in this

area is concerned with Storefront Economics (B2) and Systemic Economics (B6) with high level

studies on retailers, such as Walmart, representing the majority. "Measuring the Impact of

Information Technology on Value and Productivity using a Process Based Approach: The Case

for RFID Technology " is a particular interesting introduction of methodology for assessing

economic value of technology. The case study considers RFID in a consumer packaged goods

company. However, the framework can be applied to other areas as well. Security Economics

(B3) literature included inputs such as shrinkage rates, item cost and associated stocking costs to

arrive at potential benefits from comprehensive security efforts. Smart Machines Economics

literature was usually coupled with a case study on a new technology. Common themes were in

consumer goods, for example refrigerators that automatically read food levels and reorder, and

medicine cabinets that check prescriptions to make sure the right drugs are taken at the right

times. Most Telematics literature falls in the Technology/IT (C5) or the Case Study (A5) column.

Systemic Economics, (B6) focusing on the supply chain, work is centered on cutting tangible

costs over more immediate time horizons. If the aforementioned technology downturns have

taught potential adopters anything, it is to be wary of advertised leaner operations with surefire

competitive advantages. Where technology benefits were once overstated and integration costs

understated, the pendulum has now swung the other way. Most work in this area considers RFID

as a standalone technology where intra-company economics do not seem to be particularly

favorable with current RFID hardware costs. This thesis is concerned with the Logistics

13

Economics, (B 1) which is the first row in this column. In the sum of all works on RFID, Logistics

Economics is only a small portion.

Logistics-economics literature includes high-level studies on adoption rates. This literature

generally points to a short-term pilot/trial growth in the first 12-18 months for early adopters and

a long-term mass adoption by five to ten years. 10 These articles often are geared to give

companies strategic pointers on how to benefit the most from RFID adoption. Economics focuses

on quality, timeliness and accuracy of forecasting to provide incremental asset utilization,

revenues and reduced costs. Freight transportation, both land and maritime, have provided case

studies where supply chain stakeholders have garnered significant top line growth and cost of

goods sold (COGS) savings with RFID.""

2

Other Logistics-economics research provides analysis

on which supply chain partners will derive the greatest benefits from adoption.13 This is a

common theme in many articles, with most pointing to the larger retailers as key benefactors and

manufacturers as those who will bare the majority of costs. Beyond Logistics-economics articles,

there are many articles that address the economics of logistics in some form as part of another

focus. Focal points within these various articles vary from: who will benefit and why, specific

returns based analysis, improvements in retailers' ability to measure shrink theft and improve

labor productivity. Most of these articles mention costs and benefits at higher, generalized levels

and are not particularly useful for in depth analysis.' 4

MacDonald, D. RFID Will Bring Great Benefits for Retailers, but Little Return for Some Manufacturers.

AT Kearney White Paper. November 10, 2003.

"1Swamy G, Sarma S. Manufacturing Cost Simulations for Low Cost RFID Systems. MIT AutoID

Whitepaper. February 1, 2003.

12 Alexander K, Gilliam T, Gramling K, Kindy M, Moogimane D, Schultz M, Woods M. Focus on the

Supply Chain: Applying Auto-ID within the Distribution Center. Auto ID Center White Paper. June 2,

2002.

13 Byrnes J. Who Will Profit From Auto-ID? Harvard Business School: Working Knowledge. September 1,

2003.

10

14

Citation to be added.

14

RFID is considered a new technology, and economic approaches vary according to various

perspectives. Those considering RFID a very risky endeavor may use a payback methodology,

where money saved or incrementally earned is measured to determine how long until the

technology and integration costs are paid off. The payback method is a very crude method,

generally employed if project risks are exceptionally high. Return on Asset (ROA) measures tend

to be less popular when a large portion of project costs and benefits are not asset based. With

technology adoption, the integration costs can surpass the cost of the hardware and software, thus

an ROA approach is somewhat inappropriate. Return on Investment (ROI) is more inclusive in

that it takes into consideration tangible and intangible costs and assumes that the project will be

active for a number of periods (i.e. years). This method is often chosen because it is all-cost

encompassing, widely accepted, and relatively simple to perform. The ROI method was chosen

for this study for to these reasons.

The MIT Process Handbook" contains several thousand processes, several pertaining to

manufacturing. This reference gives insight on how to quantitatively breakdown processes for

study purposes, both economic and other. This handbook was consulted for input on how to

economically break down manufacturing into key value-add and non-value-add elements, from

raw material processing to finished goods delivery. Specific key points referenced include cost

(value added productivity), and service/quality (yields, just in time demand flow techniques).

Additionally input from this handbook, in addition to Six Sigma, and other sources, indicated that

Appendix A, "Best Practice Guidelines for Implementation" be added to this study. The use of

'best practices' implies that management and company goals are aligned to make the proposed

changes happen in the most efficient and effective manner possible. There are many diverse

applications to best practices across industries, in various company functions. Many studies have

15 MIT Process Handbook Project. Available online: http://ccs.mit.edulp/

15

shown that these management guidelines can lead to valuable outcomes. For this study these

practices are taken as important high-level assumptions on which integration costs are partially

based.

RFID System: In Brief

The main purpose of RFID is automatic identification, or Auto-ID, where location and

identification information is provided through a system of tags, readers and host computers.

Although RFID systems vary considerably, they generally have the following system parts in

common: tags, antennas, readers and host computers. Tags, also known as transponders, which

are principally made up of an RF integrated circuit (IC) and antenna. The IC takes up a small

space on the tag, less than .5 x .5 mm, when compared to the antenna which is required to receive

and send signals and therefore takes up much larger space. The IC is where the

intelligence/memory of the tag is located.

Chart 2.

Tags

"electronic

Device made up of an

circuit

and an

integrated antenna

" RF used to transfer data

between the tag and the

antenna

" Portable rnemory

Read-only orreadhwite

"Active or passive

" Usual attachedto

c items

Antenna

- Receives and

transmits the

electromagnetic

- Wireless data

transfer

Reader

- Communicates with

the tag via antenna

- Reie

commands from

application solware

-

Intrprets radio

waves into digital

informaton

Host Computer

ReadsAarites data

frnm/to the tags

tthrough the reader

- Stores and evaluates

ebtained data

*

- Lnks the transcever

to an alications,

e.g.

0 Provides power

supply to passive

tags

Source: Tobolski, Joseph, Accenture, RFID JournalLive Conference 2004

The IC can be "read-only," write once ready many times (WORM), or "read-write". With readonly the initial data is coded onto the tag during manufacturing. With WORM the initial users

16

provide the 'permanent' information they want stored on the tag. Read-write provides the

greatest flexibility but is also generally the most expensive. Tags can be built on a variety of

backings such as clear film, product labels, or directly into product packaging. Tags can be

passive, with no battery required, or active, with battery required. Active tags generally have

greater read distances and memory capabilities. The reader, sometimes referred to as an

interrogator, uses power to send an RF signal through one or more antennas to remote tags. The

power sent through the RF signal is used to power a passive tag and/or activate an active tag.

The frequency, interference, antenna size, and power all affect transmission range and speed.

Frequencies range from low (125kHz), to high (13.56MHz) to Ultra High Frequency (UHF of

433MHz to 2.45GHz). The higher the frequency, the higher the read range. Low frequencies can

have maximum read distances of 10 cm, whereas UHF can have up to 10 meters or more.

Although signals can be read through packaging and other barriers, metal and liquids often

introduce interference. As the DOD has found, sometimes preventing inference from tagged

products is as simple as putting a thin layer between the product and tag. The DOD has begun

using weather stripping between tags and metal fuel drums when tracking these resources.

The reader feeds the retrieved data from the tag through an information system. This information

system most likely contains a software layer to intelligently filter and organize the data (Savant).

Other components of the information system include hardware and software for database and

tracking systems. These databases may plug directly into a company's exiting enterprise resource

planning application or may use a middleware application to bring the systems together.

17

Semiconductor Manufacturing: In Brief

Semiconductor manufacturing is a costly and labor-intensive process that is getting increasingly

expensive to perform. The cost for a new semiconductor manufacturing or fabrication plant,

commonly referred to as a 'fab' in 2000 was over $1 Billion. Today, building a fabrication plant

cost between $3 Billion and $4 Billion.16 The complicated nature of semiconductor

manufacturing and the fact that yield loss can occur at any step requires most processes to be

monitored closely. In addition to these pressures, engineers are constantly pushed to think of

ways to get more components on a chip.

Chart 3.

Wafer Processing

Phootlihegraph

Chra

Dia BoB

ng

o

Mn

It

* EncpsultiDeposFitihon

source: www.xandex.com/images/

process.glt

This study is concerned with a particular product, the central processing unit or CPU. At the

beginning of CPU manufacturing, in the fabrication plant, the silicon is first shaped into discs, or

wafers, from raw silicon. Precision equipment is used throughout manufacturing; part of the

early stage process includes applying a thin, roughly ten atom thick layer of gallium arsenide

(GaAs) to the wafers. Through manufacturing, each wafer is sectioned into 100 to 500+

rectangular blocks, or dies. Generally dies are assembled with three basic elements. First the

active components are added. These might include transistors or memory cells. Second an

6

1

SpOOner, J. Samsung Chips to Take on a 'Blue' Hue. CNet News.com. March 5, 2004.

18

insulating layer is added to cover the active components. Finally holes are etched into the

insulation and conductive metal traces are added. The process becomes increasingly complicated

as it is repeated five or six times to add more and more components to each die.' 7 Once

components are added to the dies, the dies have functionality and are referred to as CPUs. It is

important to understand that in semiconductor manufacturing each wafer is unique and each area

of each wafer has different characteristics. The result is that each die is different from the next,

even though they have the same components and have gone through the same manufacturing

steps. Due to this fact the dies need to be tested and understood for their individual performance

properties.

Although testing occurs at multiple different points, the "final test" step is where the ultimate

performance determination is made and the CPUs are usually "locked and marked" into a specific

performance. This step occurs in a separate facility from the fab called "Assembly -Test". After

lock and mark and final test in the Assembly-Test, the CPUs are delivered to a finished goods

inventory (FGI) warehouse. They are held at the FGI warehouse and shipped to meet demand.

Methodology

This study entailed using a methodology that had six (6) steps:

1.

Literature review. This provided a foundation on Semiconductor Manufacturing,

Postponement, Kanban, Tracking & Tracing Goods, and RFID.

2.

Process Selection. This entailed choosing an appropriate process to focus the work on,

and the process of manufacturing inventory yield management was selected based on real

" Dunn, P. Semiconductor Manufacturing Process. FACSNET Science & Technology. September 27,

2000.

19

industry concern. This process spans from the Assembly-Test to the Finished Goods

Warehouse in a typical semiconductor manufacturer and is defined in greater detail later.

3.

Process Definition. This entailed identifying the likely process steps for the new

manufacturing inventory yield management process. This is an estimated flow based on

study of semiconductor manufacturing processes as well as field visits to various

semiconductor manufacturing facilities. The processes do not however represent any one

specific company's process flow.

4.

Yield data. This entailed identifying production yields and inefficiencies created due to

the "lock and mark" processes.

5.

Yield analysis. This entailed applying 'bucket' analysis which is based on the framework

and methods developed by Subirana [describe the process in detail]... resulting in data

that would potentially identify process improvement opportunities.

6.

Proposed process modification. The entailed developing a modified process that would

take advantage of the process improvement opportunities that surfaced in the prior step.

At the highest level, the methodology used begins with understanding the background of key

tools and concepts used. This includes understanding postponement, Kanban, RFID, economic

modeling and semiconductor manufacturing. The steps taken include investigation through

literature into the key tools and concepts; field visits to a semiconductor manufacturing facility

with process observation; and interviews with semiconductor professionals. The field visits

surfaced several issues regarding inventory management in FGI warehouses. Further

investigation and discussion led to considering product flows through Assembly-Test to Finished

Goods Inventory Warehouse. These became the focus of the RFID study with managing

inventory to demand as a desired improvement" or something like this. General understandings

of these steps along with what is believed to be a root issue, inventory management to demand,

led to building a new process.

20

The analysis begins by considering the current process, a series of steps in semiconductor

manufacturing, with their accompanying requirements. The requirements refer to the valueadded at each step.

Chart 4.

Receiv,

rstAssemble

& Othe

Processes

Lock

Hnal

Mark

Test

Trays

Storage

Processing

iPReareFtialxs.Prta

Scaled

Box

FG1

BHes

G

tandling

-Partial Return

Yield data was analyzed considering the proposed and current processes. The yield data was

considered in performance 'buckets', each bucket pertains to different CPU groups based on level

of performance (e.g. 3.0 GHz, 3.2 GHz). Three different hypothetical yield bucket scenarios

were analyzed in addition to the current 6 bucket process. These were 9, 12, and 24 buckets.

Yield analysis results were discussed with various 'bucket' scenarios to show the effects of the

proposed process changes. The method used to understand these processes is in some ways

similar to that used in the recent study by Subirana et al, 2003.

In this study, Subirana and colleagues demonstrate a useful process decomposition approach for

economically assessing technology adoption value. This thesis has adopted the format used by

Subirana and colleagues (2003), which is a process decomposition approach. In process

decomposition, each of the process steps is understood for its 'requirements' or value-add. By

understanding the value add the researcher can then determine at what cost this value add is

achieved at (e.g. how long does it take, or how much output is achieved). Once the value and

cost are determined the researcher can compare multiple scenarios that achieve the same valueadd but at potentially different costs. Since the authors illustrate the approach in a consumer

21

package goods distribution warehouse environment, special consideration was given to

understanding how this process might be amended for high-tech manufacturing. The approach

taken in this paper is different from that described by Subirana et al. in a few key aspects. These

differences include industry, position on supply chain, and RFID use. The last difference

highlights the fact that this case study represents RFID as an enabler of other logistics practices

instead of a stand-alone technology. Like Subirana et al., an ROI model was built, considering

the costs in conjunction with the yield benefits of the most conservative new process scenario.

After the ROI analysis and discussion, additional observations on potential effects of change were

considered such as: cycle time, quality, shortage, labor and inventory. The study concludes with

final remarks on the potential impact of the study on industry practices.

DATA ANALYSIS

Current Process with Requirements

This study observes process steps occurring in semiconductor manufacturing, assembly-test, and

finished goods inventory (FGI) warehousing. The description is based on visits to a

semiconductor manufacturing company, interviews, and literature. It is not meant to represent

process at a specific firm. The documented steps, or current process, covers a hypothetical

semiconductor producer's CPU production facilities.

Chart5.

Receive,

t Assemble

a Other

S Processes

Loack

and

Fnl

Mak Test

Trays

i

Sealed

Box

SoaePoesn

r

ce~iv

Full Boxes

Fciv

...

Boxes

.ata

Partial

.Partial Return

22

Although the current process will have indirect effects on many areas in semiconductor

manufacturing, for purposes of this study only processes from 'lock and mark' in the AssemblyTest locations to finished goods inventory in the FGI warehouses will be considered. Also for the

purpose of this study, several assumptions were made regarding production volumes that may or

may not be consistent to current system capabilities.

The assumptions are:

"

Each fab is assumed to have 10,000 wafer starts per week with 125 dies per wafer.

"

After the initial stages the number of nonperformance dies are assumed to have been

eliminated and the yield per wafer is estimated to be 100 CPUs.

"

The hypothetical semiconductor producer's CPU production facilities produce 150

Million CPUs/year.

The current process requirements are outlined below. The process requirements represent the key

steps which are impacted by the proposed process at the Assembly-Test location and Finished

Goods Warehouse.

Assembly-Test Location

1)

CPU trays representing 2,500 CPUs are received from prior processes in Assembly -Test.

A group of twenty-five wafers is considered a significant volume. Each wafer represents

100 CPUs for a total of 2,500 processed.

2) CPU trays are manually placed into "Lock and Mark" equipment. "Lock" is a process of

adding/setting components to limit the performance of a CPU to a specific level. "Mark"

refers to the process of physically marking the outside casing of the CPU with its

performance related information.

3) CPUs are brought over to the Final Test step in trays.

4) CPU trays representing 2,500 CPUs (a 25 wafer lot, at 100 CPU/wafer) are received

5)

CPUs are loaded into automated test equipment.

23

6) Test equipment run a series of electrical tests to ensure performance.

7) CPUs are sealed in boxes, 10 per tray, 30 trays/box and then leave the fab for Finished

Goods Inventory (FGI) Warehouse.

Finished Goods Inventory Warehouse

1)

CPUs arrive in Receiving operation, and are then shelved in FGI Warehouse.

2) Orders are filled using boxes of 300 CPUs, and partial boxes when necessary.

3) Orders may require partial or mixed groupings of CPUs to be shipped.

Proposed Process with Requirements

The proposed process assumes that the RFID integrated circuit (IC) is inserted early in the

lithography of the wafer. Furthermore, each wafer has multiple ICs, so that each die has a

separate IC. This process is performed with newer, 90 nanometer technology equipment, where

the cost to manufacturing for designing-in the IC may be negligible. For the purposes of this

thesis, the cost assumption is not viewed insignificant, the ROI model which is addressed later,

accounts for RFID IC cost.

24

Chart 6.

Current Process

Storage

Receive

Full Boxes

FGFFGI

Processing

P

Boxes

FGI Warehouse

Partial

Handling

-Partial Return

-

-

Processing

Receive

SFGI Trays

(Kanban)

FGI Trays

& Boxes

Lock and

Mark

*Pick exact

quantity

*No partial

/

return

The proposed process is similar to the existing process with a few exceptions.

First, the "lock and mark" step is moved later in the process and becomes part of the FGI

Warehousing operations. Practically, this entails a significant cost outlay in order to

move the "Lock and Mark" equipment from Assembly-Test operations to an FGI

Warehouse, regardless of the proximity of the two facilities. In Chart 6 this is depicted

by showing the "Lock and Mark" step as postponed from Assembly-Test to FGI

Warehouse. This is potentially the most significant fixed, or nonrecurring, costinvolved,

estimated from interviews to be roughly $60 Million. Although Assembly-Test and FGI

Warehouse locations are generally only a few miles apart, the high cost is incurred from

moving precision capital equipment, set up, and training personnel at the different

locations.

The manufacturer maintains multiple separate locations primarily to insure

uninterrupted production. For this reason these locations are in various countries and

time zones. Each Assembly-Test location has a corresponding FGI Warehouse. The

purpose of the process change is to postpone Lock and Mark, the differentiating step, to

be as close as possible to demand. The process change would most likely occur

sequentially, from one Assembly-Test to FGI Warehouse at a time to prevent system-

25

wide production disruptions. The process change would also require special care to the

Lock and Mark equipment since it is precision machinery. The key to this process change

is that the manufacturer should postpone Lock & Mark in order to take advantage of

serving the specific market demands.

Second, the proposed process entails creating and adding an RFID CPU-sort machine for

each Assembly-Test. This sorter would use RFID to intelligently move CPUs into trays

of like performance. Appendix B shows a simple diagram of how this capital equipment

might work, although this is speculative because this is only a conceptual model and has

not been developed. The cost per machine is estimated to be $1 Million, or $4 Million

for equipping the network of four Assembly-Test facilities. After the CPUs are in likeperformance trays, they are shipped as Semi Finished Goods Inventory (SFGI) to the FGI

Warehouse. This process change allows the firm to get higher yield from the chips on the

wafer because it proposes to use RFID to segment the products into more refined buckets.

Third, the proposed process entails the addition of demand signaling, or Kanban practices to

lower FGI. Kanban allows the manufacturer to pull product through production to react to

customer demand. This allows the manufacturer to have lower safety stock levels, which

translates to lower overall inventory levels. There is much entailed in setting up and managing a

Kanban system. One of the most significant demands Kanban places on a system is quick

response between various steps of manufacturing. The quick response requirement can be of

significant costly. In the proposed process Kanban is used to move CPUs from SFGI to FGI to

rapidly meet customer demand. Furthermore, the proposed process entails maintaining mainly

SFGI which will allow for postponement, with some FGI held as safety stock. Instead of all FGI

at the warehouse, the proposed process allows for majority semi-finished goods inventory (SFGI)

To manage the addition of SFGI in the warehouse, revised process steps, information systems,

26

and physical locations would likely be needed. The proposed process is described below. The

bold print signifies process changes from the current state.

Assembly-Test Location

1)

CPU racks representing 2,500 CPUs (a 25 wafer lot, at 100 CPU/wafer) are received.

2) CPUs are loaded into automated test equipment.

3) CPUs are tested for performance.

4) CPUs are inventoried as SFGI using a new CPU sorter.

CPUs are directly fed from the final test to a new piece of equipment, a CPU sorter. The

sorter is linked to the prior step, the final test, to receive CPU performance characteristics.

The sorter uses RFID to identify individual CPUs and then puts them in one of the 9 (12, or

24) corresponding performance trays. As these trays fill up they are moved to SFGI until the

appropriate demand signal. Appendix B gives more details on the sorter.

FinishedGoods Inventory Warehouse

1)

CPUs arrive, are shelved in SFGI within the FGI warehouse.

2) Kanban signal received.

Although some inventory is kept as buffer stock in FGI to satisfy immediate demand, most is

shifted from FGI to SFGI. As various performance CPUs are shipped to meet demand a

signal, or kanban, is sent to lock and mark more CPUs.

3)

CPUs are retrieved, locked and marked with respect to immediate demand. In the

new process the lock and mark portion of the final step is postponed until demand is signaled

through the Kanban system. As demand is signaled to the fab, the CPUs that are the closest

performance fit are retrieved, locked and marked.

4) Orders are filled to exact quantities using trays

5) Orders may require partial or mixed CPUs to be shipped

27

&

YIELD AND ROI MODELS

When considering yield, several assumptions are made. CPU prices are volatile and can change

on a daily basis. In the study, the process yields are arrived at through examination of historical

production volume,

and market prices at

various

performance levels.

Estimated annual

volume has been

inputted to tables

Chart 7.

CPUs Manufactured - Yield Distribution

30,000,000

25,000,000

m 20,000,000

I 15,000,000

10,000,000

5,000,000

b

p

5

\

rob

GHZ

shown in this section, where pre-lock and mark manufacturing output is followed through to

demand. The numbers in the tables represent annual production and demand numbers from a

leading semiconductor manufacturer. Both the volume and performance numbers are

representative given study of industry data and discussions with manufacturers.

28

Table 2.

Current Manufacturing and Pricing - 6 CPU GHz Buckets

Original

Bucket 1

Bucket 3

GHz

3.55

3.5

3.45

3.4

Original Vol.

300,000

500,000

700,000

900,000

3.15

3.1

3.05

3

6,375,000

10,750,000

22,000,000

25,000,000

2.75

2.7

2.65

2.6

Bucket 5

ITotal

4,500,000~

3,000,000

2,500,000

1,300,000

Lock Lock & Mark

GHz

Vol.

Unit Demand

Price Price/GHz

Yield

3.4

2,400,000

2,160,000

$395

$116

$853,200,000

3

64,125,000

57,712,500

$189

$63

$10,907,662,500

2.6

11,300,000

10,170,000

$160

$62

$1,627,200,000

,,,,$25,174,710,000

The unit prices are based on researched market prices for difference chips at various times. The

price spreads are typical in that a 3.2 GHz CPU would cost around $395/CPU when it represents

peak performance. Once the 3.4 GHz CPU is introduced the cost for the 3.2 GHz CPU drops to

around $273/CPU. The common price spreads for the six buckets of CPUs of the studied

semiconductor manufacturing firm are, from high performance to low: $395, $273, $189, $165,

$160, and $153. Pricing structure can also be understood on a Price/GHz where peak

performance chips command a higher Price/GHz when compared to lower end, more commodity

CPUs. A 3.2 GHz CPU is priced at $273 per CPU or $85/GHz. The lower end 2.4 GHz CPU is

priced at $153 per CPU or $64/GHz. This is shown below in manufacturing and pricing tables.

For comparative purposes, each table considers the same production and demand volume with

different pricing buckets. The pricing buckets considered include the current standard of 6

29

buckets which is referred to in this study as the 'baseline', and the three hypothetical scenarios of

9, 12, and 24 buckets.

There are several necessary assumptions to allow for a quantitative comparison in simplified

format. The first assumption is that the original GHz speeds are continuously normally

distributed as they were when studied. This distribution is depicted in the below graph. This

distribution may change over time and factors leading to variance are not fully understood.

Although it has not been studied, the act of increasing buckets may still increase revenues even

with non-normal distributions. Benefits may be greater with increased volatility in manufacturing

yield.

A second assumption is that unit demand is consistently 90% of manufactured volume, across

both time and CPUs. This assumption is based on discussions with manufacturers regarding

several months of historical CPU sales. Although demand is not linear and varies dramatically at

times (new CPU launches, product pricing changes), over time with anomalies aside, 90% is a

reasonable estimation. From the 6 CPU buckets table we can see that overall annual yield is

$25.174 Billion. This number is slightly high, but realistic. When considering the manufacturer,

actual total SEC stated annual revenues frequently surpass $30 Billion, with 80% derived from

processor sales. This equates to roughly $24 Billion in revenue derived from processing units.

The assumption is that the majority of these processors are central processing units. The

takeaway is that the $25 Billion yield number appears to be a fairly accurate estimation with

consideration to publicly disclosed financial data.

The proposed process segments the products, or CPUs, into finer groups. The result of this

increased segmentation is that the manufacturer will have more products at a higher performance

levels. The first hypothetical scenario divides the CPUs into 9 bucketsThis scenario, like all the

30

Table 3.

Proposed Manufacturing and Pricing - 9 CPU GHz Buckets

Original

GHz

Original Vol.

3.55

3.5

3.45

3.4

Bucket 1

Lock Lock & Mark

GHz

Vol.

Unit Demand

Price Price/GHz

Yield

300,000

500,000

700,000

900,000

3.4

2,400,000

3

2,160,000

$395

$116

$853,200,000

7

6,375,000

Bucket 3

3.15

3.1

150,000

3.1

17,125,000

15,412,500

$195

$63

$3,010,061,250

Bucket 5

3

25,000,000

3

25,000,000

22,500,000

$189

$63

$4,252,500,000

a

2.85

28

27

10,750,0O0

6,375,000

2.8

17,125,000

15,412500

$165

$59

$2,543,062,500

-.

27

Bucket a

Bucket 9

2.55

900,000

2.5

750,000

2.45

2.4

Total

L

600,000

500,000

150,000,000

%BCanekrom6tucet

2.4

2,750,000

2,475,000

135,000,000

$153

$64

Yield Incr.

% Change from 6 Buckets

$378,675,000

$25,551,625,179

$376,915,179

1.5%

following variations is identical to the baseline study of 6 buckets with the exception of additional

buckets and a linear projection of demand and chip pricing. All manufacturing GHz speeds and

volumes are assumed to be the same as the baseline 6 buckets. As noted above, demand is

assumed to be 90% of manufactured volume. Chip pricing is based on Price/GHz numbers

discussed above. The pricing for new buckets was determined by using similar CPU Price/GHz

and multiplying by the GHz. For example, the new 3.1 GHz bucket #3 price of $195 per CPU

was determined by assuming that the Price/GHz was $63, then multiplying this by the

performance of 3.1 GHz. Note that the $63 Price/GHz was taken from the lower 3.0GHz found in

the baseline table. The new buckets were placed to capture optimal revenue. The new buckets

are concentrated around the highest volume CPUs, with consideration of CPU price. Although

there may be slightly more optimal bucket placements given the distribution, the point of this

study is to show order of magnitude yield change given realistic performance and price

31

placement, not to show exact optimal buckets without consideration of existing performance and

price points. The noticeable outcome of adding 3 more buckets is an increase in yield of roughly

1.5% or $377 Million. This is a substantial improvement. The cost of this particular 9 bucket

system is detailed at the end of this section in the ROI study.

Table 4.

Proposed Manufacturing and Pricing - 12 CPU GHz Buckets

Original

GHz

Original Vol.

3.55

300,000

500,000

3.5

3.45

700,000

1A

ann nnn

Bucket 1

2.75

2.7

Bucket 11

1

I

2.65

1

I

9A

Lock

GHz

Lock & Mark

Vol.

A

Ann nnn

Q

Unit Demand

o 1 an nnn 020r

4,500,000

3,000,000

2,500,000

1

Ann nnn

9 r,

11 qnn nnn

Price Price/GHz

in

17n

nnn ti an

Yield

e1roc',nnAnn

e

eao

ct r-,37 onn nnn

Yield Incr.

% Change from 6Buckets

$488,463,750

1.9%

The impact of increased yield sorting is explored further with a 12 bucket scenario. Note that this

represents half the possible 24 yield distributions considered. The overall improvement in yield

from 6 buckets to 12 buckets is 1.9% or $488 Million. This is a .4% or $111 Million

improvement from the previously considered 9 bucket scenario. This indicates that with

32

increased price-performance buckets, and no increase in manufacturing volume or change in

original GHz performance the semiconductor manufacturer is able to garner greater revenues.

It is important to note that use of increased number of performance-price buckets relies more on

the company's ability to create and adapt to process change. The costs associated with doing this

are very hard to estimate. The ROI model at the end of this section uses the 9 bucket scenario to

consider these costs.

Table 5.

Proposed Manufacturing and Pricing - 24 CPU GHz Buckets

Bucket 1

Bucket 2

Bucket 3

Bucket 4

Bucket 5

Bucket 6

Bucket 7

Bucket 8

Bucket 9

Bucket 10

Bucket 11

Bucket 12

Bucket 13

Bucket 14

Bucket 15

Bucket 16

Bucket 17

Bucket 18

Bucket 19

Bucket 20

Bucket 21

Bucket 22

Bucket 23

Bucket 24

Original

Lock

GHz

Original Vol. GHz

3.55

300,000 3.55

3.5

500,000

3.5

3.45

700,000 3.45

3.4

900,000

3.4

3.35

1,300,000 3.35

3.3

2,500,000

3.3

3.25

3,000,000 3.25

3.2

4,500,000

3.2

3.15

6,375,000 3.15

3.1

10,750,000

3.1

3.05

22,000,000 3.05

3

25,000,000

3

2.95

24,500,000 2.95

2.9

16,500,000

2.9

2.85

10,750,000 2.85

2.8

6,375,000

2.8

2.75

4,500,000 2.75

2.7

3,000,000

2.7

2.65

2,500,000 2.65

2.6

1,300,000

2.6

2.55

900,000 2.55

2.5

750,000

2.5

2.45

600,000 2.45

500,000

2.4

2.4

Total

150,000,000

Lock & Mark

Vol.

300,000

500,000

700,000

900,000

1,300,000

2,500,000

3,000,000

4,500,000

6,375,000

10,750,000

22,000,000

25,000,000

24,500,000

16,500,000

10,750,000

6,375,000

4,500,000

3,000,000

2,500,000

1,300,000

900,000

750,000

600,000

500,000

Unit Demand

270,000

450,000

630,000

810,000

1,170,000

2,250,000

2,700,000

4,050,000

5,737,500

9,675,000

19,800,000

22,500,000

22,050,000

14,850,000

9,675,000

5,737,500

4,050,000

2,700,000

2,250,000

1,170,000

810,000

675,000

540,000

450,000

134,730,000

Price Price/GHz

$412

$116

$407

$116

$401

$116

$395

$116

$286

$85

$282

$85

$277

$85

$273

$85

$198

$63

$195

$63

$192

$63

$189

$63

$174

$59

$171

$59

$168

$59

$165

$59

$169

$62

$166

$62

$163

$62

$160

$62

$163

$64

$159

$64

$156

$64

$153

$64

Yield Incr.

% Change from 6 Buckets

Yield

$111,355,147

$182,977,941

$252,509,559

$319,950,000

$334,382,344

$633,445,313

$748,617,188

$1,105,650,000

$1,138,606,875

$1,889,527,500

$3,804,570,000

$4,252,500,000

$3,833,156,250

$2,537,758,929

$1,624,881,696

$946,687,500

$685,384,615

$448,615,385

$366,923,077

$187,200,000

$131,675,625

$107,578,125

$84,341,250

$68,850,000

$25,797,144,318

$622,434,318

2.5%

The 24 bucket scenario assumes radical performance-price change and therefore may be

increasingly difficult to implement in the current state of semiconductor manufacturing. This is

expected to be the case because the more dramatic the change from the current process, the

greater the strains on management. These strains include requiring significant management of

inventory response and other management capabilities coupled with new marketing and sales

33

initiatives to offer each of these perfromance-price points to customers.

Even given the fact

that a move from 6 buckets to 24 buckets would probably occur in stages, it still represents a

fourfold increase. This increase would put tremendous strains on management and require

significant inventory response and management capabilities coupled with new marketing and

sales initiatives. The purpose of including this scenario is not to propose its usefulness in today's

semiconductor manufacturing. The scenario serves academic purpose by providing a means for

further understanding the effects of performance-price on yield.

The outcome of this scenario is similar to the previous scenario in which buckets were added.

Yield continues to increase as

additional buckets are added. In this

Table 6.

scenario yield increases 2.5% over

rT

the current 6 bucket scenario. This

Sources of Gains

Yield Benefit for 9 Bucket*

represents a dramatic $622 Million

Sources of Costs

revenue increase. Although this is

DieRFIC*

very much a hypothetical scenario, it

RFID Systemfor FinalTest

follows suit with the prior scenarios

by confirming potential yield gains

.

that may result from better alignment

of manufacturing output with

demand.

The ROI model considers the yield

analysis along with costs associated

with implementing the proposed

process. The ROI uses the most

$376,915,179

($1,875,000)

Readers

Middleware

Data Servers

($40,000)

($1,000,000)

($400,000)

RFID CPU Sorter

($4,000,000)

Cost of Design and Build 4 Sorters

Egne*(5000

($520,000)

Engineer*

($152,000)

Technician*

Addition of SFGI

Floor Space Ungrade*

($4000000)

Storage Racks

($150,000)

Insurance*

($40,000)

($400,000)

Security*

Move 'Lock and Mark' to Warehouse

Move four operations

($60,000,000)

*asterisk signifies recurring annual cost/benefit

Total Costs

($72,577,000)

Total Benefit (Cost)

One Year ROI

$304,338,179

319%

34

conservative of the three scenarios, the 9 bucket, to measure costs and benefits. Although other

benefits may exist and are considered in the observations following this section, only the yield

benefit is quantified in the ROI model. Costs considered are many and are incurred from various

changes in process and materials. Die associated costs include RFID IC which is assumed to be

$.01/IC for annual production of $187.5 Million die. Note that 20% of the total die production is

lost through the CPU manufacturing process due to a variety of reasons including poor

performance and damage. This leaves a total salable production of 150 Million CPUs, which is

the amount considered in the yield tables. According to some semiconductor professionals the

production cost per RFID IC of $.01 is a conservative estimate. The actual IC costs may drop

dramatically due to economies of scale and emerging nanometer lithographic technologies. The

Final Test step in the Assembly Test facility requires RFID equipment. The associated costs for

readers, middleware and servers are included and estimated to be a total of $1.44 Million to equip

four final test stations. The cost of $10,000 for a series of 4-6 readers per station, plus installation

costs are accounted for with the $40,000 attributed to readers. A savant software system, free

from MIT, is assumed to provide an initial layer of data filtering, and additional middleware and

overall software implementation from an RFID software vendor is expected to total $1 Million in

software and services. Eight $50,000 data servers are used, where each of the four Final Test

locations has a server and a backup server. The addition of four RFID CPU sorters is also taken

into account. These sorters are described in Appendix B. The cost to design these four machines

and build them is estimated to be $4 Million. Labor costs are increased by one engineer and one

technician at the FGI Warehouse to monitor the new sorting machine and move inventory. A

typical semiconductor manufacturing floor engineer's pay of $62.50/hour including training,

which equates to roughly $130,000/year (52 weeks, 40 hours/day), including employee benefits.

The floor technician's function is significantly less complex, is lower paying and requires less

35

training. An average semiconductor manufacturing floor technician is paid $18/hour, or

$38,000/year (52 weeks, 40 hours/day)18 .

The ROI model also takes into account several costs associated with adding SFGI. Inventory

floor space upgrades to handle SFGI, new storage racks for CPU trays, additional insurance, and

security are also included. Floor space upgrades include creating and maintaining a clean room

environment in the FGI Warehouse. These costs are estimated to be $4 Million and are predicted

to be annually recurring. New storage racks are needed to warehouse the CPUs in trays. These

racks need to be maintained in the clean room environment, near Lock and Mark station.

Additional insurance and security are needed now that the SFGI is stored in open trays in the FGI

Warehouse. These costs have been estimated to be $440,000. The most significant cost would be

incurred with the move of Lock and Mark from Assembly-Test to the FGI Warehouse. The cost,

estimated to be $60 Million, includes the expensive and high risk process of moving clean room

precision equipment from one facility to another. This cost of $60 Million represents roughly

83% of the total system costs of $72.6 Million. Even with all these substantial costs considered,

the return on investment over the course of the first year of operation is over 300%. Separately, if

the costs were doubled, there would still be over a 110% return on investment. If the yield

benefits were cut in half, the return on investment would still be 60%. Additionally, the ROI

model is performed for only on year, although the most significant costs are one time costs and

would not negatively effect a present value of future cash flow analysis. The ROI model notates

recurring annual costs with an asterisk. Lastly, Chart 8 highlights the theoretical performance

improvement in yield as more price-performance buckets are used. The theoretical 9 bucket yield

improvement is the performance improvement that the ROI model attempts to quantify.

18 Swamy G. Manufacturing Cost Simulations for Low Cost RFID Systems. MIT AutolD. February,2003.

36

OBSERVATIONS

Changes in Yield

Chart 8 highlights the theoretical performance improvement in yield as more price-performance

buckets are used. This is theoretical performance improvement that the ROI model attempts to

quantify. Increasing performance-price buckets allows for greater revenue realization. The effect

of buckets on yield percentages is shown in the 'Yield Increase' graph. Yield percentage

increases vary between 1.5% and 2.5%, this equates to between $376 Million and $622 Million

for the semiconductor manufacturer.

The normal distribution characteristics of demand, with higher volume at middle performance

points, creates higher payoffs for more differentiation in pricing with higher volume, middle

performance CPUs. It makes more economic sense to add buckets around the high volume 3.0

GHz performance level than to add them at either the 2.4 or 3.4 GHz levels. This means that

where there is a greater

quantity of CPUs, being

Chart 8.

Locked and Marked to

3.%Yield

lower performance, the

2.5%

payoffs for splitting these

2.0%

into separate buckets is

greatest. In addition to

quantity it is important to

realize that a second

Incre ase

YieldIncrease

2 1.5%

e 1.0%

0.

0.5%

0.0%

6

9 Buckets 12

24

contributing factor is price per GHz paid by the customer. With all else equal, the greater the

price per GHz for any group of CPUs, the more it makes economic sense to differentiate these

CPUs into a separate price-performance bucket. Although optimizing the balance between

37

volume and price to maximize economic payoff might make theoretical sense, this is not a

realistic given the rapid changes in price-performance and manufacturer volume. For the purpose

of this thesis, buckets were lineated in the proposed scenarios in what were felt to be realistic

price-performance points by semiconductor professionals interviewed.

Other Contributors and Risk Factors

This section is a collection of other potential contributors and risk factors. Each point is

discussed as a risk factor, and a potential additional benefit where applicable. The relevance and

perceived likelihood is included to provide better insight to potential impact.

Effects on Cycle Time

Cycle time, or velocity, is an important metric in semiconductor manufacturing. The time needed

to process raw silicon into finished CPUs can be several days to several weeks. The shorter the

manufacturing period, the sooner the CPUs are salable. The shorter the manufacturing to sales

period, the shorter the cash-to-cash cycle, the time from purchasing raw material to sale of

finished goods. All else equal, the shorter the cash-to-cash cycle the more profitable the

company. The proposed process' effect on cycle time is unclear. In the short term, there may be

slower cycle times due to new process requirements. Once these requirements are met and

engineers have familiarized themselves to the new processes, the cycle time may decline. A

possible benefit of the new process would be to lower total WIP and inventory through better

product management. Lowering WIP and inventory requirements translates into moving material

faster from raw material to finished goods. This improved speed, or velocity, might be as little as

a few minutes or as much as a few days.

38

Effects on Quality

Traditionally semiconductor manufacturing has focused on increasing yields by reducing damage

and preventing the use of lower quality materials. Some sources of circuit failure include

particulate matter, mechanical damage, and crystalline defects. Manufacturing aberrations such

as slight fluctuations in doping concentrations, oxide thicknesses, and line widths can lead to

changes in CPU performance characteristics. 19 Given the sensitivity of the manufacturing

process, the proposed change may have an adverse effect on the current process that could alter

product quality performance. It will be critical to move capital equipment carefully and train

employees thoroughly. The potential benefits of the process are an improved understanding of

what factors are contributing to defects and quicker initiation of product recalls. If certain units

exhibit similar problems, it may be easier to identify defect sources. For example, in a situation

where a high percentage of CPUs had defects, these products would be identified quickly and

recalled for testing. With the new RFID process all CPUs are understood as individual units with

location identities, and therefore can be located more quickly.

Shortage Effect