Document 10607681

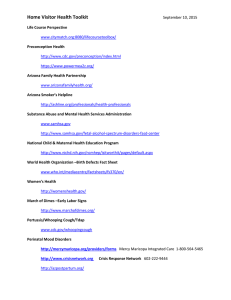

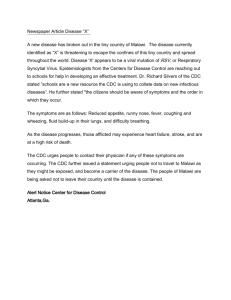

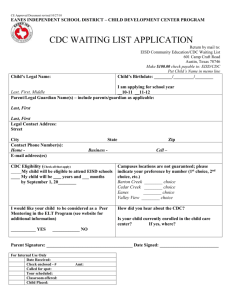

advertisement