SOBOBA SPRINGS: William Henry Johnson University of California at Berkeley

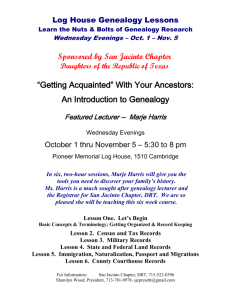

advertisement