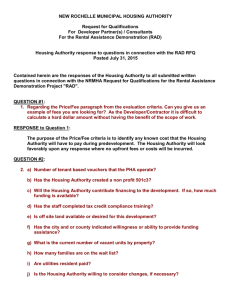

NOTICE OF PROTECTION PROVIDED BY

advertisement