Quantitative Trading Sachsen LB Europe plc High Performace Computing Seminar Dublin, 17.10.07

advertisement

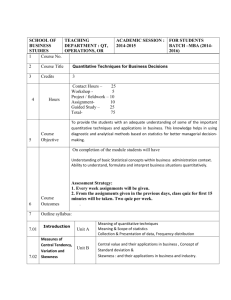

Dublin, 17.10.07 Sachsen LB Europe plc Quantitative Trading Presentation to: High Performace Computing Seminar Table of Contents 1. From Usury to Physics and the Information revolution 2. Banking, Maths & Computers – odd bedfellows? 3. An example – Derivative Risk 4. CDOs 5. Quantitative Trading – Hypothetical Example 6. Food for though 1. From Usury to Physics and the Information revolution A birds eye overview of why you get a student credit card • Usury is the practice of charging interest on a loan, seems reasonable? • Most religions at on stage banned it as immoral • • • • "And what do you think of usury?" ­ "What do you think of murder?“ – Cato • Islamic law still forbids it – “Sharia Law” • Modern Banking and the Rothschild Empire • Where does money come from? Money as Debt! Isn’t not rockets science! Well really it is … Enter Derivatives • Genesis of modern quantitative finance begin with Louis Bachelier (1900) • Incorporated Brownian Motion into a theory of speculation (martingales) • Itō calculus (40s) – useful in modelling the trajectory of rockets (random perturbation) • BlackScholesMerton Equation (70s) De­facto parlance The Information revolution …. Liquidity, speed and transparency for algorithmic trading • Claude Shannon describes information (entropy) for the first time (40s) • Alan Turing lays the foundations of modern computers and AI around the same time • Milton Friedman and the freemarket. Globalisation and Deregulation My credit card? ­­­ Deregulated Usury, Quantitative Risk (Fico Scoring) and Money as Debt = $$$’all 3 2. Banking, Maths & Computers – odd bedfellows? Great Bedfellows! • Hopefully now I’ve articulated the progression of finance to quantitative finance! So just how big a presence is technology in today’s investment banks? • Banks are undoubtedly one of the largest buyer & sponsor of Technological Progress. • Personal experience of DB Unix Engineering • Advised on the development roadpath for Solaris, AIX and Suse Linux (big shareholder in Suse) • Datacenters absolutely massive probably rivalled only by telcos and google • Actual majority of staff support front office functions (IT, Ops etc) • Big next steps for quantitative banking and IT • Grid virtualisation (utility computing … commoditise like electricity) • Bloated and burgeoning derivative markets require ever more complex pricing and risk monitoring. • Can moore’s law sustain investment banking’s greed for speed? 4 3. An example – Derivative Risk Something concrete – Why Trade Derivatives? • Efficient markets service the needs of many perspectives (Hedgers, Speculators, Corporates etc) • For instance an airline industry corporation may want to protect its balance sheet from negative weather. Insurance companies, who prefer tail risk, wont cover this. In steps the freemarket to offload that risk at a ‘fair’ market price. • Oil trading at record highs $88 a barrel (still only 50c a litre, compare with water). How do companies protect their balance sheets using forwards. Enter Backwardation and Contango. • How is this price calculated? Mathematical models circumscribe reality but don’t define it! All sorts of auxiliary risk. •Uncertainty and Risk • Retracing our steps back to Shannon. Information entropy is a measure of uncertainty. • Uncertainty in one dimension is variance (volatility square root of var with same units as original variable) • Uncertainty in two dimensions is covariance (correlation is the square root of covar) • Lets looks at Credit Risk. Company A loans to Company B generated a credit risk to Company A. • Credit derivatives are like and insurance premium over the risk free rate on this risk. • Collateralised Debt Obligations (CDOs) are portfolios of credit derivates (Similar approach for any derivative) 5 4. CDOs Getting more complicated • Correlation is obviously very complicated to quantify. Market has agreed/fabricated an liquid standard in Europe for the implicit derivation of correlation using a standard model. Remember correlation is backed out of this model – it doesn’t exist in reality under any simplistic (or prob even computable) delineation. • Allows market participants to speculate/hedge on correlation and also map to bespoke portfolios •Market has also developed a quite liquid market for Credit Options … which also allow us to back out implied volatility from observable market quotes 6 using a standard model (Black’s Model) 5. Quantitative Trading – Hypothetical Example The Juicy Stuff • Identify market risk factors from historical prices (PCA) • Valuation model (Static correlation Gaussian Copula). Further developments around stochastic correlation & spreads • Optimisation methods using desired constraints (highest return for least risk). Genetic Algorithms etc • Execution algorithms. Executing in liquidity markets with ‘dark pools’ and optimised batch trading (recent liquidity crunch) 7 Thank you very much for your attention! Food For Thought