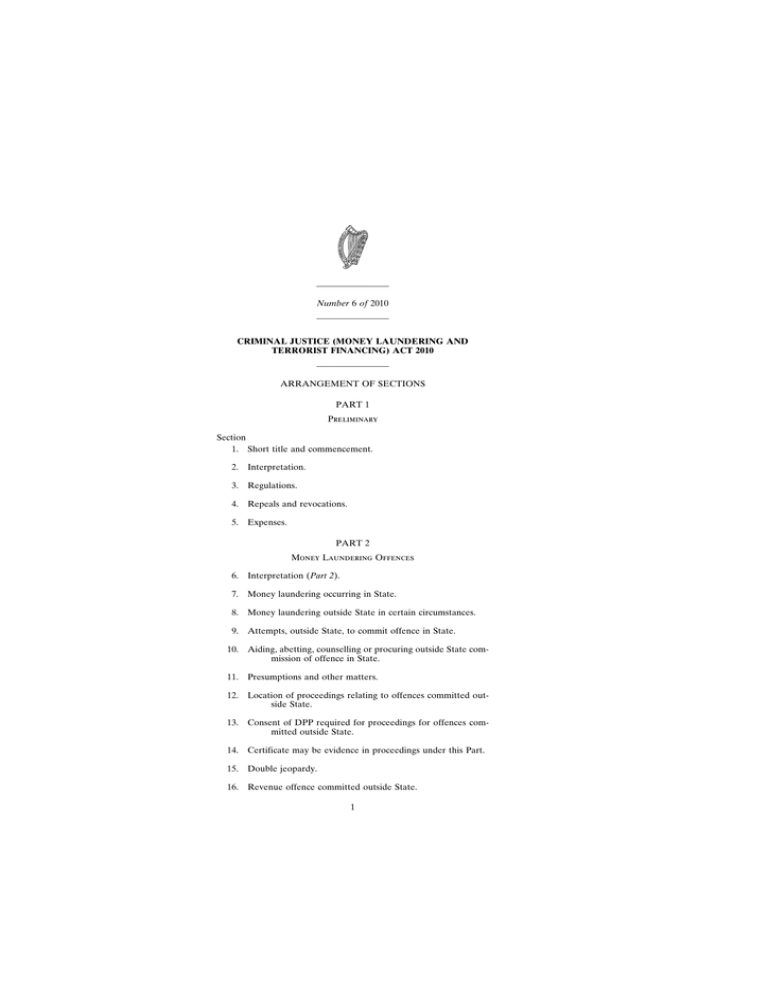

———————— ARRANGEMENT OF SECTIONS PART 1 Preliminary

advertisement